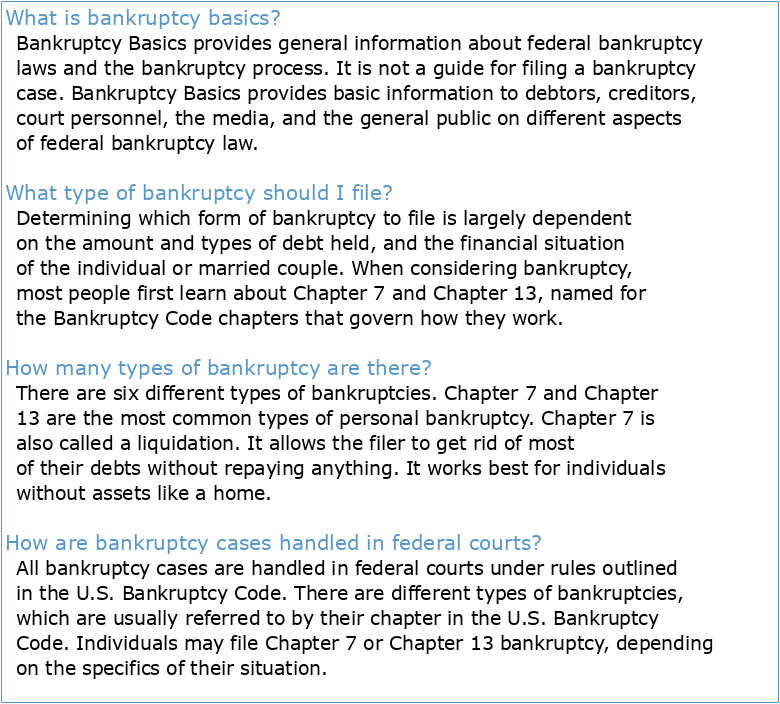

What is bankruptcy basics?

Bankruptcy Basics provides general information about federal bankruptcy laws and the bankruptcy process. It is not a guide for filing a bankruptcy case. Bankruptcy Basics provides basic information to debtors, creditors, court personnel, the media, and the general public on different aspects of federal bankruptcy law.

What type of bankruptcy should I file?

Determining which form of bankruptcy to file is largely dependent on the amount and types of debt held, and the financial situation of the individual or married couple. When considering bankruptcy, most people first learn about Chapter 7 and Chapter 13, named for the Bankruptcy Code chapters that govern how they work.

How many types of bankruptcy are there?

There are six different types of bankruptcies. Chapter 7 and Chapter 13 are the most common types of personal bankruptcy. Chapter 7 is also called a liquidation. It allows the filer to get rid of most of their debts without repaying anything. It works best for individuals without assets like a home.

How are bankruptcy cases handled in federal courts?

All bankruptcy cases are handled in federal courts under rules outlined in the U.S. Bankruptcy Code. There are different types of bankruptcies, which are usually referred to by their chapter in the U.S. Bankruptcy Code. Individuals may file Chapter 7 or Chapter 13 bankruptcy, depending on the specifics of their situation.

What Is Bankruptcy?

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills. The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common. All of the

How Bankruptcy Works

Bankruptcy offers an individual or business a chance to start fresh by forgiving debts that they can't pay. Meanwhile, creditors have a chance to get some repayment based on the individual's or business's assets available for liquidation. In theory, the ability to file for bankruptcy benefits the overall economy by allowing people and companies a s

What Are The Types of Bankruptcy Filings?

Bankruptcy filings in the United States are categorized by which chapter of the Bankruptcy Code applies. For example, Chapter 7 involves the liquidation of assets, Chapter 11 deals with company or individual reorganizations, and Chapter 13arranges for debt repayment with lowered debt covenants or specific payment plans. See full list on investopedia.com

Being Discharged from Bankruptcy

When a debtor receives a discharge order, they are no longer legally required to pay the debts specified in the order. What's more, any creditor listed on the discharge order cannot legally undertake any type of collection activity (such as making phone calls or sending letters) against the debtor once the discharge order is in force. However, not

Advantages and Disadvantages of Bankruptcy

Declaring bankruptcy can help relieve you of your legal obligation to pay your debts and save your home, business, or ability to function financially, depending on which kind of bankruptcy petition you file. But it also will likely lower your credit rating, making it more difficult to get a loan, mortgage, or credit card, buy a home or business, or

Alternatives to Bankruptcy

If you want to avoid bankruptcy, several alternatives may be able to reduce your debt obligations. Negotiating with your creditors without involving the courts can sometimes work to the benefit of both sides. Rather than risk receiving nothing, a creditor might agree to a repayment schedule that reduces your debt or spreads your payments over a lon

The Bottom Line

Bankruptcy can provide the financial benefit of wiping out debt you cannot pay and helping you start fresh, but there are consequences. Having a bankruptcy on your credit history can harm your credit score and make it more difficult to get loans in the future, Before filing for bankruptcy, weigh all your options for resolving your debt, including a

Guide de dépannage et de maintenance

Réparez vous-même vos appareils électroniques : Smartphones

Vocabulaire anglais architecture & construction

An Educator’s Guide to the “Four Cs”

Integrating the 4Cs into EFL Integrated Skills Learning

LESSON 41: ORGANIZING YOUR MATERIALS – THE 4 C’S STRATEGY

Instructions for Form 1041

Deciding About Hormone Therapy Use

Méthode : « Diviser pour régner »

Bankruptcy Basics

Bankruptcy Basics