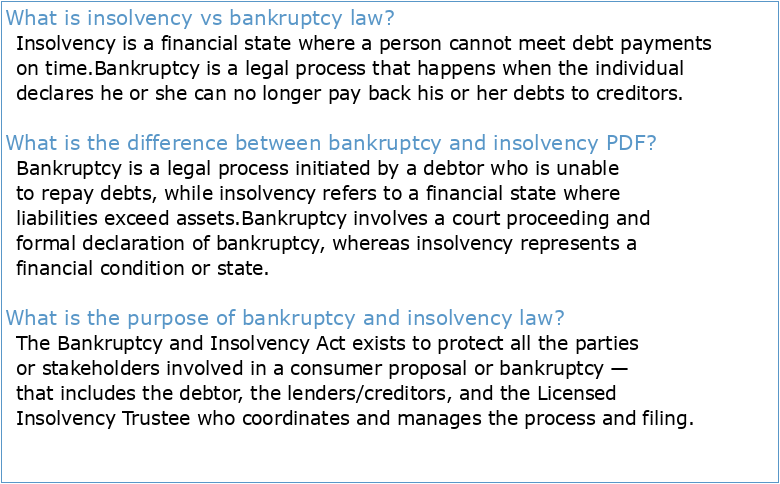

What is insolvency vs bankruptcy law?

Insolvency is a financial state where a person cannot meet debt payments on time.

Bankruptcy is a legal process that happens when the individual declares he or she can no longer pay back his or her debts to creditors.What is the difference between bankruptcy and insolvency PDF?

Bankruptcy is a legal process initiated by a debtor who is unable to repay debts, while insolvency refers to a financial state where liabilities exceed assets.

Bankruptcy involves a court proceeding and formal declaration of bankruptcy, whereas insolvency represents a financial condition or state.What is the purpose of bankruptcy and insolvency law?

The Bankruptcy and Insolvency Act exists to protect all the parties or stakeholders involved in a consumer proposal or bankruptcy — that includes the debtor, the lenders/creditors, and the Licensed Insolvency Trustee who coordinates and manages the process and filing.

- The objective of the Insolvency and Bankruptcy Code is to consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of value of assets of such persons, to promote entrepreneurship, availability of

Bankruptcy- ترجمة

Banque

Banque à distance : avantages inconvénients

Banque à distance Définition

Banque à distance Société Générale

Banque et assurance formation

Banque et Finance matière

Banque et finance pdf

Banque et marché financier PDF