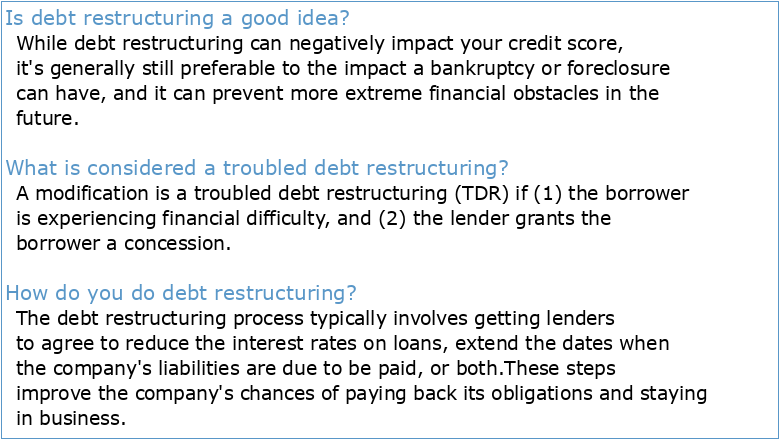

Is debt restructuring a good idea?

While debt restructuring can negatively impact your credit score, it's generally still preferable to the impact a bankruptcy or foreclosure can have, and it can prevent more extreme financial obstacles in the future.

What is considered a troubled debt restructuring?

A modification is a troubled debt restructuring (TDR) if (1) the borrower is experiencing financial difficulty, and (2) the lender grants the borrower a concession.

How do you do debt restructuring?

The debt restructuring process typically involves getting lenders to agree to reduce the interest rates on loans, extend the dates when the company's liabilities are due to be paid, or both.

These steps improve the company's chances of paying back its obligations and staying in business.- It is often achieved by way of negotiation between distressed companies and their creditors, such as banks and other financial institutions, by reducing the total amount of debt the company has, and also by decreasing the interest rate it pays while increasing the period of time it has to pay the obligation back.

How Easy Should Restructuring Be? One of the great paradoxes of banking is that repudiating one's debts makes a borrower more creditworthy. The standard Autres questions

Répertoire des mémoires des étudiantes et étudiants de la

Mémoire de fin d'études Th`eme

Mécanismes de recouvrement des coûts de l'OMS : dépenses d

Meilleures pratiques dans les stratégies de recouvrement

Approaches to Corporate Debt Restructuring in the Wake of

Working Paper 19-8: How to Restructure Sovereign Debt

How to Make Sovereign Debt Restructuring Work Now

Document 2 : analyse de la récupération des coûts des services liés

Synthèse relative à la récupération des coûts des

L'évaluation médico-économique des innovations

Mémoire de fin d'études Th`eme

Mécanismes de recouvrement des coûts de l'OMS : dépenses d

Meilleures pratiques dans les stratégies de recouvrement

Approaches to Corporate Debt Restructuring in the Wake of

Working Paper 19-8: How to Restructure Sovereign Debt

How to Make Sovereign Debt Restructuring Work Now

Document 2 : analyse de la récupération des coûts des services liés

Synthèse relative à la récupération des coûts des

L'évaluation médico-économique des innovations