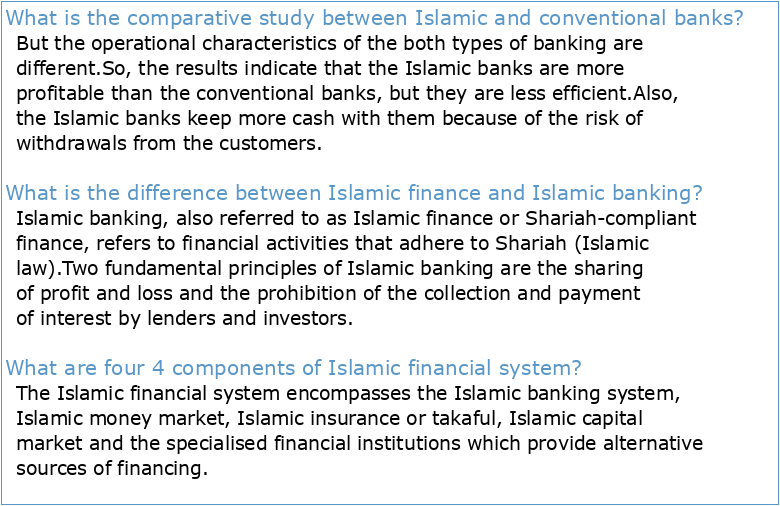

What is the comparative study between Islamic and conventional banks?

But the operational characteristics of the both types of banking are different.

So, the results indicate that the Islamic banks are more profitable than the conventional banks, but they are less efficient.

Also, the Islamic banks keep more cash with them because of the risk of withdrawals from the customers.What is the difference between Islamic finance and Islamic banking?

Islamic banking, also referred to as Islamic finance or Shariah-compliant finance, refers to financial activities that adhere to Shariah (Islamic law).

Two fundamental principles of Islamic banking are the sharing of profit and loss and the prohibition of the collection and payment of interest by lenders and investors.What are four 4 components of Islamic financial system?

The Islamic financial system encompasses the Islamic banking system, Islamic money market, Islamic insurance or takaful, Islamic capital market and the specialised financial institutions which provide alternative sources of financing.

- As already discussed, Islamic banking does not rely on interest payments or interest based activities.

Whilst commercial banks rely on interest as a fundamental component when it comes to lending and borrowing, Islamic banks are more focused on a profit-loss sharing arrangement.

1 ___ /22pts 2

On fait les magasins?

Chapitre 9 intermediaire

Les fiches de lecture (Petit Nuage)

MATH3 LOG 1 fichier pour apprendre à résoudre des problèmes

Appendice: réponses aux exercices

Principles and Guidelines migrants in vulnerable situations

FOREIGNERS AND HUMAN RIGHTS IN MOROCCO

Chap5 – Les dosages colorimétriques