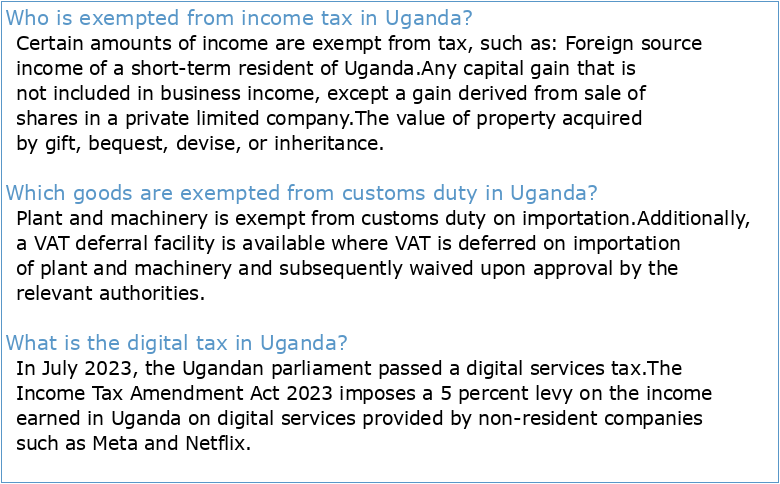

Who is exempted from income tax in Uganda?

Certain amounts of income are exempt from tax, such as: Foreign source income of a short-term resident of Uganda.

Any capital gain that is not included in business income, except a gain derived from sale of shares in a private limited company.

The value of property acquired by gift, bequest, devise, or inheritance.Which goods are exempted from customs duty in Uganda?

Plant and machinery is exempt from customs duty on importation.

Additionally, a VAT deferral facility is available where VAT is deferred on importation of plant and machinery and subsequently waived upon approval by the relevant authorities.What is the digital tax in Uganda?

In July 2023, the Ugandan parliament passed a digital services tax.

The Income Tax Amendment Act 2023 imposes a 5 percent levy on the income earned in Uganda on digital services provided by non-resident companies such as Meta and Netflix.- The general rule is that dividend income is taxable as part of business income at a rate of 30%.

Dividend income is also subject to WHT at the rate of 15%.

The WHT paid in respect of the dividend income is creditable where the income is subject to the corporation tax rate of 30%.

Microorganismes microbes virus au Cycle 3

CORPS HUMAIN ET SANTE

DEROSIER-Avalonepdf

Étude du marketing de contenu et de son influence

Vocabulaire pratique des sciences sociales

Lexique des sciences sociales par Madeleine Grawitz Paris Dalloz

Les microbes

Rattrapage de théorie des jeux

LES THEORIES DU DEVELOPPEMENT ET LEUR IMPACT SUR LE