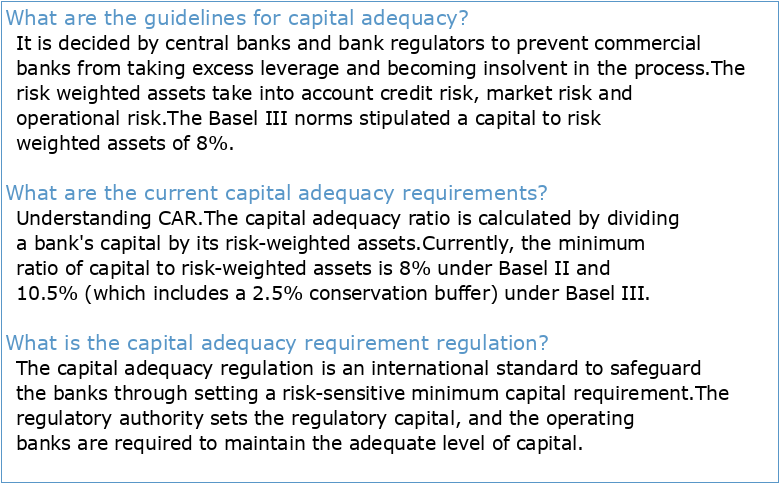

What are the guidelines for capital adequacy?

It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

The risk weighted assets take into account credit risk, market risk and operational risk.

The Basel III norms stipulated a capital to risk weighted assets of 8%.What are the current capital adequacy requirements?

Understanding CAR.

The capital adequacy ratio is calculated by dividing a bank's capital by its risk-weighted assets.

Currently, the minimum ratio of capital to risk-weighted assets is 8% under Basel II and 10.5% (which includes a 2.5% conservation buffer) under Basel III.What is the capital adequacy requirement regulation?

The capital adequacy regulation is an international standard to safeguard the banks through setting a risk-sensitive minimum capital requirement.

The regulatory authority sets the regulatory capital, and the operating banks are required to maintain the adequate level of capital.- OSFI publishes guidelines, which are essentially best or prudent practices, that it expects financial institutions to follow.

Guidelines are used to set standards to govern industry activities and behaviour.

Introduction aux bases de données NoSQL

Les bases de données NoSQL et le Big Data

Nouveaux Cahiers De L Infirmia Re Tome 23 Soins I

RECOMMANDATIONS POUR LA TENUE DU DOSSIER DE SOINS

CS-CJ-Series Manuel de programmation

Manuel de programmation Axial Finance

Manuel d'Installation et de Programmation

1020/1040/1060m

Descriptif de programmation par ingénieur