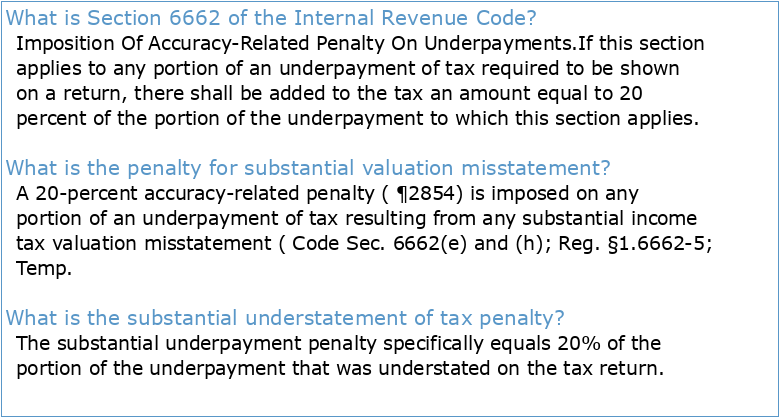

What is Section 6662 of the Internal Revenue Code?

Imposition Of Accuracy-Related Penalty On Underpayments.

If this section applies to any portion of an underpayment of tax required to be shown on a return, there shall be added to the tax an amount equal to 20 percent of the portion of the underpayment to which this section applies.What is the penalty for substantial valuation misstatement?

A 20-percent accuracy-related penalty ( ¶2854) is imposed on any portion of an underpayment of tax resulting from any substantial income tax valuation misstatement ( Code Sec. 6662(e) and (h); Reg. §1.6662-5; Temp.

What is the substantial understatement of tax penalty?

The substantial underpayment penalty specifically equals 20% of the portion of the underpayment that was understated on the tax return.

- The net adjustment penalty applies when an underpayment is caused by an understatement of tax attributable to a net IRC §482 transfer price adjustment for the tax year that exceeds the lesser of $5 million or 10 percent of the taxpayer's gross receipts.

' 6662(h) increases the accuracy-related penalty to. 40% under certain circumstances, including gross valuations misstatements, which include some adjustments Autres questions

La vie sur Terre Chapitre 3 : L'Histoire de la vie et son évolution

Activité 2 : Comprendre l'histoire de la Terre

Processus métiers et Système d'Information

NATIONALE DE LA MÉTALLURGIE EN FICHES

Convention collective nationale de la métallurgie

RAPPORT DE STAGE ST02-P2012

ST02 : Stage Professionnel de fin d'Études

Physique-pcsipdf

Temporary and Circular Migration in Portugal

MIGRATION AND DEVELOPMENT IN PORTUGAL

Activité 2 : Comprendre l'histoire de la Terre

Processus métiers et Système d'Information

NATIONALE DE LA MÉTALLURGIE EN FICHES

Convention collective nationale de la métallurgie

RAPPORT DE STAGE ST02-P2012

ST02 : Stage Professionnel de fin d'Études

Physique-pcsipdf

Temporary and Circular Migration in Portugal

MIGRATION AND DEVELOPMENT IN PORTUGAL