Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

Table 4 - Present value interest factors for an annuity. Formula: PV = [1 - 1/(1 + k)^n] / k. Period. (n) / per cent (k). 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10

Present Value Table

Present Value Table

Present value of an annuity of 1 i.e.. 1 − (1 + r)-". Where r = discount rate n = number of periods. Annuity Table. Discount rate (r). Periods. (n). 1%. 2%. 3%.

Requirements on the Annuity Payment Table

Requirements on the Annuity Payment Table

25 Sept 2019 “Below is a table illustrating the amounts of projected [monthly] annuity payments starting from [the Nth policy year] / [Policy Year N] and ...

2024 Nevada Workers Compensation Actuarial Table and Notice of

2024 Nevada Workers Compensation Actuarial Table and Notice of

A copy of the Actuarial Annuity Table as adopted is attached hereto. DATED this 16th day of June 2023. DIVISION OF INDUSTRIAL RELATIONS. VICTORIA CARREÓN

2023 Nevada Workers Compensation Actuarial Table and Notice of

2023 Nevada Workers Compensation Actuarial Table and Notice of

1 Jul 2022 495(6). /. NOTICE OF ADOPTION OF ACTUARIAL ANNUITY TABLE. The Division of Industrial Relations of the Department of Business and ...

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods. (n). 1%. 2%. 3%. 4%. 5%. 6%. 7%.

1994 Group Annuity Reserving Table

1994 Group Annuity Reserving Table

each of these tables represents the following standard table names are used: 1. The 1994 Group Annuity Mortality Basic (or GAM-94 Basic) Table

On the Law of Mortality and the Construction of Annuity Tables

On the Law of Mortality and the Construction of Annuity Tables

INSTITUTE OF ACTUARIES. On the Law of Mortality and the Construction of Annuity Tables. By William Matthew Makeham Esq.

1995-96 Reports - Annuity 2000 Mortality Tables* - TSR9510

1995-96 Reports - Annuity 2000 Mortality Tables* - TSR9510

Appendix B develops seven blended tables based on these tables. Page 3. TABEE 1. ANNUITY 2000 BASIC TABLE. Age Nearest. Birthday

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( Present value of an annuity of £1 per annum receivable or payable for n years

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( Present value of an annuity of £1 per annum receivable or payable for n years

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

KNOWLEDGEQUITY® 2016. Table 4 - Present value interest factors for an annuity. Formula: PV = [1 - 1/(1 + k)^n] / k. Period. (n) / per cent (k).

Present Value and Future Value Tables

Present Value and Future Value Tables

Table A-2 Future Value Interest Factors for a One-Dollar Annuity Compouned at k Percent for n Periods: FVIFA kn = [(1 + k) n - 1 ] / k.

The American Academy of Actuaries is a 17000-member

The American Academy of Actuaries is a 17000-member

28 Sept 2011 VII - The 2012 Individual Annuity Reserve Table and Projection Factors . ... (LATF) was to produce a new annuity valuation mortality table

WCS Actuarial Annuity Table 7.1.21 - 6.30.22

WCS Actuarial Annuity Table 7.1.21 - 6.30.22

IN THE MATTER OF THE ADOPTION. OF THE ACTUARIAL ANNUITY TABLE. ADOPTED PURSUANT TO NRS 616C.495(5). /. NOTICE OF ADOPTION OF ACTUARIAL ANNUITY TABLE. The

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods.

On the Law of Mortality and the Construction of Annuity Tables

On the Law of Mortality and the Construction of Annuity Tables

INSTITUTE OF ACTUARIES. On the Law of Mortality and the Construction of Annuity Tables. By William Matthew Makeham Esq.

DIVISION OF INDUSTRIAL RELATIONS IN THE MATTER OF THE

DIVISION OF INDUSTRIAL RELATIONS IN THE MATTER OF THE

adopts the Actuarial Annuity Table pursuant to NRS 616C.495(5)

1994 Group Annuity Reserving Table

1994 Group Annuity Reserving Table

The Society of Actuaries Group Annuity Valuation Table Task Force has completed its research and has developed a table that it recommends as.

Present Value of Bonds Computing the Selling Price

Present Value of Bonds Computing the Selling Price

Annuity (PVIFA) PVIFA is taken from the table ? Present Value of an Ordinary Annuity Interest Payment = (stated rate x face value) (number of interest payments per year) Find PVIFA on the table using same periods and interest rate from #1 3 Add the PV of Face Value and PV of Interest Payments This is the Bonds' selling price or cash received

Bond Valuation - Case Western Reserve University

Bond Valuation - Case Western Reserve University

PVIFA: present value interest factor for annuity (A 2) PVIF: present value interest factor for a lump sum (A 1) Example:A 10 coupon bond has ten years to maturity and $1000 face value If the required rate of return for this bond is 10 how much does this bond sell for? Method 1: Use tables A 1 and A 2 PV=100×6 1446+1000×0 3855=$1000

Present value and Future value tables Table 1 - Future value

Present value and Future value tables Table 1 - Future value

Present value and Future value tables Table 1 - Future value interest factors for single cash flows Formula: FV = (1 + k)^n Present value and Future value tables Visit KnowledgEquity com au for practice questions videos case studies and support for your CPA studies © KNOWLEDGEQUITY® 2016

Time Value of Money and Its Applications In Corporate - ed

Time Value of Money and Its Applications In Corporate - ed

Many finance and accounting textbooks put PVIFAin table in the appendix The numbers in table are made based on equation (3) 3 1 1 Present Value (PV) of Ordinary Annuity PV of ordinary annuity means the PV of same PMT (PMT > $0) occurred at end of each period for a finite number of periods

Table 4 Present Value Interest Factor of Annuity

Table 4 Present Value Interest Factor of Annuity

Table 4 Present Value Interest Factor of Annuity PVIFA 050 067 075 100 150 200 250 300 350 400 450 500 600 700 800 900 1000 11

PRESENT VALUE TABLES - Texas A&M University-Commerce

PRESENT VALUE TABLES - Texas A&M University-Commerce

Table of Present Value Annuity Factor Number of periods 1 2 3 4 5 6 7 8 9 10 1 0 9901 0 9804 0 9709 0 9615 0 9524 0 9434 0 9346 0 9259 0 9174 0 9091

Searches related to pvifa table filetype:pdf

Searches related to pvifa table filetype:pdf

The PVIFA is 2 7232 so the present value of the $100 annuity is $272 32: PVA n PMT(PVIFA in) PVA 3 $100(PVIFA 5 3) $100(2 7232) $272 32 SOLVING FOR THEPRESENT VALUE OF ANANNUITY DUE WITH INTEREST TABLES In an annuity due each payment is discounted for one less period Since its payments

2012 Individual Annuity Reserving Table

Presented to the National Association of Insurance CLife Actuarial Task Force

September 2011

en-GB Table of ContentsI - Background and Scope

II - Table Development and ApproachIII - Graduation

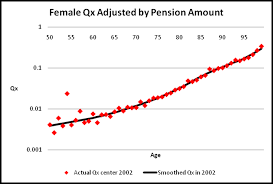

Figure 1. Graduated Male Mortality Adjusted by Amount of Annual Income Figure 2. Graduated Female Mortality Adjusted by Amount of Annual IncomeIV - Younger and Older Age Adjustments

IV.A - Younger Ages

Table 1 - Comparison of Mortality Rates (1000qx) at Low Attained AgesAge 20 Age 35 Age 50

Table Male Female Male Female Male Female

Table 2 - Development of Mortality Rates for

2012 IAM Basic Table Male Risks - Select Younger Ages

MaleAge 1994

GAM Basic1000 QX Projection

Scale AA 1994

GAMProjected

to 2002 GraduatedData Graded

Mortality

Table 3 - Development of Mortality Rates for

2012 IAM Basic Table Female Risks - Select Younger Ages

Female

Age 1994

GAM Basic1000 QX Projection

Scale AA GAM

Projected

to 2002 GraduatedData Graded

Mortality

IV.B - Older Ages

Table 4 - Comparison of Annualized Improvement Rates in U.S Population, the a1983 and a2000 Tables for Select Higher AgesMale Age Female Age

Basis/Time Period 82 87 92 97 82 87 92 97

Table 5 - Comparison of Mortality Rates (1000qx) At High Attained AgesAge 90 Age 95 Age 99

Table Male Female Male Female Male Female

Table 6 - 2000-04 Experience for Ages 95 to 99

Male Female

A/E by A/E by # of A/E by A/E by # of

Age Amount Count Deaths Amount Count Deaths

Table 7 - Results of Kannisto Extrapolation at Older Ages Male Ratio: Increase Female Ratio: Increase Ratio: Qx Qx Kannisto/ Kannisto Qx Qx Kannisto/ Kannisto Female/ Age Actual Kannisto Actual Qx Actual Kannisto Actual Qx Male Table 8 - Comparison of Mortality Rates (1000qx) At High Attained AgesAge 90 Age 95 Age 99

Table Male Female Male Female Male Female

V - The 2012 Individual Annuity Mortality Basic Table Male Actual Actual Actual Forecast Average SSA Scale CIA Age 1990-2000 2000-2006 1990-2006 2010-2030 2002-2006AAScale G Proposal Social Security Improvement Rates - 2010 Trustees Report Female Actual Actual Actual Forecast Average SSA Scale50%CIA Age 1990-2000 2000-2006 1990-2006 2010-2030 2002-2006AAScale G ProposalSocial Security Improvement Rates - 2010 Trustees ReportTable 10 - Comparison of Mortality Improvement for Various Sources - Female Risks

Table 9 - Comparison of Mortality Improvement for Various Sources - Male RisksTable 11 - Scale G2

G2 Improvement

Age Male Female

Table 12 - Annualized Annual Improvement

Scale G2 Compared to U.S. Life Tables

Male Female

Year 62 72 82 92 62 72 82 92

Table 13 - Scale G2 versus Population Improvement and Resulting IAM 2012 Basic Table, Male RisksSSA SSA SSA 2002 2012SSA SSA SSA 2002 2012

1990 2002 2012Scale Exp. IAM 1990 2002 2012Scale Exp. IAM

Age -2006 -2006 -2022G2Table Table Age -2006 -2006 -2022G2Table Table0 2.1% 0.7% 1.9%1.0%2.1681.783612.0% 1.7% 1.5%1.5%7.3066.237

1 3.2% 3.3% 1.9%1.0%0.5420.446622.0% 1.8% 1.5%1.5%8.0846.854

2 3.1% 2.9% 1.8%1.0%0.3660.306632.0% 2.1% 1.4%1.5%8.9467.510

3 3.1% 2.9% 1.8%1.0%0.3040.254642.1% 2.4% 1.3%1.5%9.9008.220

4 3.5% 3.5% 1.9%1.0%0.2370.193652.1% 2.6% 1.2%1.5%10.9559.007

5 3.2% 2.3% 1.8%1.0%0.2170.186662.1% 2.8% 1.2%1.5%11.6399.497

6 3.1% 1.5% 1.7%1.0%0.2080.184672.1% 2.9% 1.1%1.5%12.42810.085

7 3.1% 1.5% 1.7%1.0%0.1990.177682.1% 3.0% 1.1%1.5%13.34410.787

8 3.2% 2.1% 1.9%1.0%0.1840.159692.1% 3.1% 1.1%1.5%14.41111.625

9 3.5% 3.8% 2.2%1.0%0.1780.143702.0% 3.1% 1.1%1.5%15.66112.619

104.1% 7.2% 2.6%1.0%0.1800.126712.0% 3.1% 1.1%1.5%17.12813.798

114.2% 8.9% 2.7%1.0%0.1900.123722.0% 3.1% 1.1%1.5%18.83715.195

123.6% 6.8% 2.1%1.0%0.2070.147731.9% 3.0% 1.1%1.5%20.81416.834

133.0% 3.9% 1.6%1.0%0.2340.188741.9% 2.9% 1.1%1.5%23.08118.733

142.7% 2.2% 1.3%1.0%0.2740.236751.9% 2.8% 1.1%1.5%25.66420.905

152.6% 1.5% 1.2%1.0%0.3180.282761.8% 2.7% 1.0%1.5%28.58623.367

162.5% 1.1% 1.1%1.0%0.3610.325771.7% 2.6% 1.0%1.5%31.88626.155

172.3% 0.6% 1.1%1.0%0.3970.364781.7% 2.6% 1.0%1.5%35.60729.306

181.9% 0.0% 1.0%1.0%0.4250.399791.6% 2.5% 1.1%1.5%39.79632.858

191.4% -0.6% 0.9%1.0%0.4470.430801.5% 2.4% 1.1%1.5%44.50536.927

200.9% -1.1% 0.9%1.0%0.4670.459811.4% 2.3% 1.1%1.4%49.79041.703

210.6% -1.5% 0.8%1.0%0.4930.492821.3% 2.2% 1.0%1.3%55.72246.957

220.5% -1.7% 0.8%1.0%0.5210.526831.2% 2.3% 0.9%1.3%62.38252.713

230.6% -1.9% 0.8%1.0%0.5610.569841.1% 2.4% 0.8%1.2%69.86359.148

240.8% -2.0% 0.9%1.0%0.6040.616851.0% 2.4% 0.7%1.1%78.26966.505

251.0% -2.0% 0.9%1.0%0.6560.669860.8% 2.3% 0.6%1.0%87.70275.015

261.3% -2.0% 1.0%1.0%0.7140.728870.7% 2.2% 0.5%0.9%98.20684.823

271.5% -2.0% 1.0%1.0%0.7510.764880.5% 2.0% 0.5%0.9%109.77795.987

281.8% -1.8% 1.1%1.0%0.7790.789890.4% 1.8% 0.5%0.8%122.371108.482

292.0% -1.6% 1.1%1.0%0.8050.808900.3% 1.6% 0.5%0.7%135.888122.214

302.1% -1.4% 1.1%1.0%0.8280.824910.1% 1.4% 0.5%0.7%150.209136.799

312.3% -1.1% 1.1%1.0%0.8480.834920.0% 1.1% 0.5%0.6%165.349152.409

322.4% -0.7% 1.2%1.0%0.8670.83893-0.1% 0.9% 0.4%0.5%181.387169.078

332.6% -0.1% 1.2%1.0%0.8760.82894-0.2% 0.7% 0.4%0.5%198.436186.882

342.6% 0.5% 1.2%1.0%0.8770.80895-0.3% 0.6% 0.4%0.4%216.648205.844

352.7% 1.2% 1.2%1.0%0.8790.78996-0.4% 0.5% 0.4%0.4%229.053219.247

362.7% 1.7% 1.2%1.0%0.8910.78397-0.4% 0.4% 0.4%0.3%247.806238.612

372.6% 2.0% 1.1%1.0%0.9200.80098-0.5% 0.4% 0.4%0.3%267.095258.341

382.3% 2.0% 1.1%1.0%0.9630.83799-0.5% 0.4% 0.4%0.2%286.781278.219

392.0% 1.8% 1.0%1.0%1.0160.889100-0.5% 0.4% 0.4%0.2%306.714298.452

401.6% 1.6% 1.0%1.0%1.0810.9551010.2%326.734323.610

411.3% 1.4% 1.0%1.0%1.1561.0291020.1%346.679344.191

421.1% 1.3% 1.0%1.0%1.2421.1101030.1%366.388364.633

431.0% 1.3% 0.9%1.0%1.3311.1881040.0%385.708384.783

440.9% 1.4% 0.9%1.0%1.4241.2681050.0%400.000400.000

450.8% 1.5% 0.9%1.0%1.5281.355106400.000400.000

460.8% 1.5% 0.9%1.0%1.6541.464107400.000400.000

470.8% 1.3% 0.9%1.0%1.8091.615108400.000400.000

480.7% 0.8% 0.9%1.0%1.9861.808109400.000400.000

490.7% 0.3% 1.0%1.0%2.1802.032110400.000400.000

500.6% -0.3% 1.0%1.0%2.3982.285111400.000400.000

510.6% -0.7% 1.1%1.1%2.6542.557112400.000400.000

520.7% -0.7% 1.1%1.1%2.9362.828113400.000400.000

530.9% -0.5% 1.2%1.2%3.2493.088114400.000400.000

541.2% 0.0% 1.2%1.2%3.5963.345115400.000400.000

551.4% 0.5% 1.3%1.3%3.9793.616116400.000400.000

561.6% 0.9% 1.3%1.3%4.4033.922117400.000400.000

571.7% 1.2% 1.3%1.4%4.8724.272118400.000400.000

581.8% 1.4% 1.4%1.4%5.3924.681119400.000400.000

591.9% 1.5% 1.4%1.5%5.9665.146120400.000400.000

601.9% 1.6% 1.5%1.5%6.6025.662Male

SSA SSA SSA 2002 2012SSA SSA SSA 2002 2012

1990 2002 2012Scale Exp. IAM 1990 2002 2012Scale Exp. IAM

Age -2006 -2006 -2022G2Table Table Age -2006 -2006 -2022G2Table Table0 1.9% 0.4% 1.8%1.0%1.9431.801611.3% 1.7% 1.3%1.3%5.0514.352

1 2.6% 0.4% 1.9%1.0%0.4860.450621.3% 1.8% 1.2%1.3%5.6994.899

2 2.0% 0.9% 1.9%1.0%0.3160.287631.2% 2.0% 1.2%1.3%6.4305.482

3 3.1% 2.8% 1.9%1.0%0.2370.199641.2% 2.3% 1.1%1.3%7.2546.118

4 2.8% 2.3% 1.9%1.0%0.1770.152651.2% 2.5% 1.0%1.3%8.1856.829

5 2.6% 2.0% 1.8%1.0%0.1600.139661.2% 2.7% 0.9%1.3%8.7807.279

6 2.5% 1.9% 1.7%1.0%0.1500.130671.1% 2.7% 0.9%1.3%9.4387.821

7 2.5% 2.0% 1.7%1.0%0.1400.122681.1% 2.6% 0.9%1.3%10.1688.475

8 2.6% 2.8% 1.7%1.0%0.1250.105691.0% 2.3% 0.8%1.3%10.9799.234

9 2.8% 3.4% 1.8%1.0%0.1190.098700.9% 2.1% 0.8%1.3%11.88210.083

103.1% 4.5% 1.9%1.0%0.1200.094710.8% 2.0% 0.8%1.3%12.89211.011

113.2% 5.1% 1.9%1.0%0.1260.096720.8% 1.9% 0.8%1.3%14.02812.030

123.0% 4.7% 1.8%1.0%0.1350.105730.7% 1.8% 0.8%1.3%15.31513.154

132.6% 4.0% 1.4%1.0%0.1510.120740.7% 1.8% 0.8%1.3%16.78214.415

142.1% 3.1% 1.1%1.0%0.1760.146750.7% 1.8% 0.8%1.3%18.46615.869

151.9% 2.6% 1.0%1.0%0.2050.174760.7% 1.8% 0.8%1.3%20.41317.555

161.7% 2.2% 0.9%1.0%0.2310.199770.7% 1.8% 0.8%1.3%22.67619.500

171.5% 1.8% 0.9%1.0%0.2510.220780.6% 1.8% 0.8%1.3%25.32421.758

181.2% 1.2% 0.9%1.0%0.2620.234790.6% 1.8% 0.8%1.3%28.44024.412

190.9% 0.6% 0.8%1.0%0.2670.245800.6% 1.8% 0.9%1.3%32.13127.579

200.5% -0.1% 0.7%1.0%0.2680.253810.5% 1.8% 0.9%1.2%36.51431.501

210.2% -0.7% 0.7%1.0%0.2690.260820.5% 1.8% 0.8%1.2%41.65536.122

220.1% -1.1% 0.7%1.0%0.2710.266830.4% 1.8% 0.7%1.1%47.58341.477

230.1% -1.2% 0.7%1.0%0.2750.272840.3% 1.7% 0.6%1.0%54.29347.589

240.3% -1.3% 0.8%1.0%0.2770.275850.3% 1.7% 0.5%1.0%61.72554.441

250.5% -1.3% 0.8%1.0%0.2800.277860.2% 1.6% 0.5%0.9%69.77561.972

260.6% -1.3% 0.9%1.0%0.2870.284870.1% 1.5% 0.4%0.8%78.38870.155

270.7% -1.2% 0.9%1.0%0.2940.290880.1% 1.4% 0.4%0.7%87.51278.963

280.8% -1.0% 0.9%1.0%0.3070.300890.0% 1.3% 0.4%0.7%97.08088.336

290.9% -0.7% 0.9%1.0%0.3230.31390-0.1% 1.2% 0.4%0.6%107.00398.197

301.0% -0.4% 0.9%1.0%0.3480.33391-0.1% 1.1% 0.4%0.6%117.256108.323

311.0% -0.2% 0.9%1.0%0.3760.35792-0.2% 1.0% 0.4%0.5%128.179119.188

321.0% 0.1% 0.9%1.0%0.4000.37593-0.3% 0.9% 0.4%0.5%140.355131.334

330.9% 0.5% 0.9%1.0%0.4220.39094-0.3% 0.8% 0.4%0.4%154.575145.521

340.8% 0.8% 0.9%1.0%0.4450.40595-0.3% 0.8% 0.4%0.4%171.923162.722

350.7% 1.1% 0.8%1.0%0.4700.424960.7% 0.4%0.4%191.530182.120

360.5% 1.3% 0.8%1.0%0.4990.447970.7% 0.4%0.3%209.161199.661

370.4% 1.3% 0.8%1.0%0.5340.476980.7% 0.4%0.3%227.595217.946

380.2% 1.3% 0.7%1.0%0.5740.514990.7% 0.4%0.2%246.726236.834

390.0% 1.1% 0.7%1.0%0.6210.5601000.7% 0.4%0.2%266.423256.357

40-0.2% 0.9% 0.7%1.0%0.6760.6131010.2%286.541283.802

41-0.4% 0.8% 0.7%1.0%0.7320.6671020.1%306.919304.716

42-0.4% 0.6% 0.7%1.0%0.7870.7231030.1%327.387325.819

43-0.4% 0.4% 0.7%1.0%0.8360.7741040.0%347.770346.936

44-0.3% 0.2% 0.7%1.0%0.8790.8231050.0%367.898367.898

45-0.1% 0.0% 0.8%1.0%0.9190.866106387.607387.607

460.0% -0.1% 0.8%1.0%0.9690.917107400.000400.000

470.1% -0.2% 0.8%1.0%1.0340.983108400.000400.000

480.2% -0.4% 0.9%1.0%1.1221.072109400.000400.000

490.4% -0.5% 0.9%1.0%1.2181.168110400.000400.000

500.5% -0.6% 1.0%1.0%1.3391.290111400.000400.000

510.6% -0.6% 1.1%1.0%1.5111.453112400.000400.000

520.8% -0.4% 1.1%1.1%1.7051.622113400.000400.000

530.9% 0.1% 1.1%1.1%1.9231.792114400.000400.000

541.1% 0.7% 1.2%1.1%2.1701.972115400.000400.000

551.2% 1.3% 1.2%1.2%2.4482.166116400.000400.000

561.3% 1.8% 1.2%1.2%2.7622.393117400.000400.000

571.4% 2.1% 1.2%1.2%3.1172.666118400.000400.000

581.4% 2.1% 1.2%1.2%3.5173.000119400.000400.000

591.4% 2.0% 1.2%1.3%3.9683.393120400.000400.000

601.3% 1.8% 1.3%1.3%4.4773.844Female

Table 14 - Scale G2 versus Population Improvement and Resulting IAM 2012 Basic Table, Female RisksTable 15 - Relationship of 2012 IAM Table

with and without Projection to a2000 Table and Female to Male Projected Basic 1000qx as of: Ratio to a2000 Table Ratio: Female to Male2012 2052 2012 2052

Age Male Female Male Female Male Female Male Female 2012 2052 VI - The 2012 Individual Annuity Mortality Period Table VII - The 2012 Individual Annuity Reserve Table and Projection FactorsVIII -

Validation of 2012 IAM Table

Table 16 - Comparison of 2012 IAM Basic Table

(Adjusted to 2002) to 2000-2004 Experience Attained Age Group Male A/E Ratio Female A/E Ratio60 - 64

65 - 69

70 - 74

75 - 79

80 - 84

85 - 89

90 - 94

95 - 99

Table 17 - Comparison of 2012 IAM Basic Table

(Adjusted to January 1, 2007) to Preliminary 2005 - 2008 Experience Attained Age Group Male A/E Ratio Female A/E RatioIX - Impact to Reserves

Figure 3

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Male Risks, Ages 0-64

0.00Qx Rate per $1,000Age

2012 IAM Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation (50+)

Figure 4

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Male Risks, Ages 65-90

0.00Qx Rate per $1,000Age

2012 IAM Male Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation

Figure 5

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Male Risks, Ages 91-115

0.00Qx Rate per $1,000Age

2012 IAM Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation

Figure 6

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Female Risks, Ages 0-64

0.00 Qx Rate per $1,000Age2012 IAM Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation (50+)Figure 7

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Female Risks, Ages 65-90

0.00 Qx Rate per $1,000Age2012 IAM Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation (50+)Figure 8

Mortality Rate per 1,000 Comparison

Proposed 2012 Table to a2000 Table

Female Risks, Ages 91-115

0.00Qx Rate per $1,000Age

2012 IAM Basic Table2012 IAM Period Tablea2000 Tablea2000 Valuation (50+)

Table 18 - Comparison of Reserves at Issue

Table 19 - Comparison of Reserves 10 Years after Issue2012 w/o 2012 with 2012 w/o Adding Total

a2000 Improvement Improvement Improvement Improvement2012 Life Annuity at Age 65 Male11.60 12.37 12.76 6.6% 3.1% 9.9%Female 12.62 13.00 13.32 3.0% 2.4% 5.5%

Life Annuity at Age 75 Male8.50 9.209.45 8.3% 2.7% 11.2%Female 9.41 9.95 10.16 5.7% 2.1% 8.0%

Life Annuity at Age 85 Male5.50 5.635.72 2.3% 1.5% 3.9%Female 5.91 6.296.37 6.4% 1.3% 7.7%

20 Year C&L at Age 65 Male14.54 14.58 14.79 0.3% 1.4% 1.7%

Female 14.69 14.83 15.01 1.0% 1.2% 2.2%

20 Year C&L at Age 75 Male13.67 13.53 13.59 - 1.1% 0.5% - 0.6%

Female 13.71 13.71 13.77 - 0.1% 0.5% 0.4%

Age 50 deferred to 80 Male1.05 1.271.57 21.3% 23.3% 49.6%Female 1.36 1.511.76 11.0% 16.6% 29.4%

Age 60 deferred to 80 Male1.78 2.142.46 19.8% 15.4% 38.2% Female 2.26 2.502.78 10.5% 11.1% 22.7%Initial Reserves per $1,000 @ 5% InterestPercentage Increase2012 w/o 2012 with 2012 w/o Adding Total

a2000 Improvement Improvement Improvement Improvement2012 Life Annuity at Age 65 Male8.50 9.209.79 8.3% 6.3% 15.1%Female 9.41 9.95 10.43 5.7% 4.8% 10.8%

Life Annuity at Age 75 Male5.50 5.635.95 2.3% 5.6% 8.1%Female 5.91 6.296.57 6.4% 4.5% 11.1%

Life Annuity at Age 85 Male3.21 2.822.91 -12.1% 3.3% - 9.2%Female 3.32 3.303.39 - 0.6% 2.8% 2.2%

20 Year C&L at Age 65 Male11.10 11.18 11.51 0.7% 3.0% 3.7%

Female 11.35 11.58 11.87 2.0% 2.5% 4.6%

20 Year C&L at Age 75 Male9.69 9.459.56 - 2.5% 1.1% - 1.4%

Female 9.76 9.759.85 - 0.1% 1.1% 0.9%

Age 50 deferred to 80 Male1.78 2.142.63 19.8% 23.1% 47.4%Female 2.26 2.502.91 10.5% 16.4% 28.6%

Age 60 deferred to 80 Male3.21 3.764.31 17.0% 14.7% 34.2% Female 3.92 4.324.78 10.1% 10.7% 21.8%Reserves per $1,000 10 YearsAfter Issue @ 5% InterestPercentage Increase

EXHIBIT I

2012 Individual Annuity Mortality Table Basic Rates

EXHIBIT

I2012 IAM Basic Table

Male, Age Nearest Birthday

Age 1000qx2012 Age 1000qx2012 Age 1000qx2012 Age 1000qx2012EXHIBIT

I2012 IAM Basic Table

Female, Age Nearest Birthday

Age 1000qx2012 Age 1000qx2012 Age 1000qx2012 Age 1000qx2012EXHIBIT II

2012 Individual Annuity Mortality Period Table

RatesEXHIBIT

II2012 IAM Period Table

Male, Age Nearest Birthday

Age 1000qx2012 Age 1000qx2012 Age 1000qx2012 Age 1000qx2012EXHIBIT

II2012 IAM Period Table

Female, Age Nearest Birthday

Age 1000qx2012 Age 1000qx2012 Age 1000qx2012 Age 1000qx2012EXHIBIT III

Projection Scale G2

EXHIBIT

IIIProjection Scale G2

Male, Age Nearest Birthday

Age G2x Age G2x Age G2x Age G2x

EXHIBIT

IIIProjection Scale G2

Female, Age Nearest Birthday

Age G2x Age G2x Age G2x Age G2x

EXHIBIT IV

Generational Mortality Table Development

EXHIBIT IV

Example of Generational Mortality Table and Use of Projection FactorsAge 2012 2013 2014 2015 2016 2017 2018 2070

quotesdbs_dbs20.pdfusesText_26[PDF] pwc cybersecurity report 2019

[PDF] pwc global

[PDF] pwc global fintech report 2019

[PDF] pwc tax calculator france

[PDF] pwd karnataka

[PDF] pxn denial code

[PDF] py7zr github

[PDF] pycharm download anaconda

[PDF] pycharm download for chromebook

[PDF] pycharm download older version

[PDF] pycharm download packages

[PDF] pycharm download student

[PDF] pycharm download themes

[PDF] pycharm download tutorial