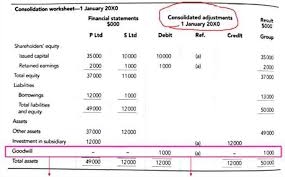

1. Consolidated worksheet adjusting entries Eliminating parents

1. Consolidated worksheet adjusting entries Eliminating parents

o This example does not cover goodwill. Elimination of dividend paid o Since these journal entries are the same account and by the same amount no entry is.

1 How to Prepare Consolidated Financial Statements by Adjustment

1 How to Prepare Consolidated Financial Statements by Adjustment

Mar 31 2016 ... example

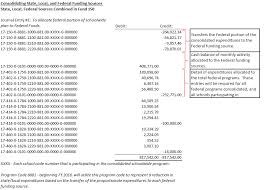

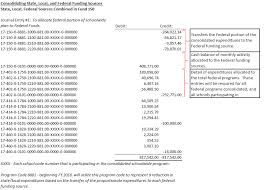

CONSOLIDATION OF FUNDS MANUAL FOR TITLE I SCHOOLWIDE

CONSOLIDATION OF FUNDS MANUAL FOR TITLE I SCHOOLWIDE

Table A: Example Consolidated Schoolwide Pool. School. State The recommended steps (requiring the journal entries within the accounting system) are as follows ...

Practice Aid for Testing Journal Entries and Other Adjustments

Practice Aid for Testing Journal Entries and Other Adjustments

Dec 8 2008 ... entries

Following are the required journal entries by the investor to record

Following are the required journal entries by the investor to record

if) the parent also publishes consolidated financial statements in the same annual report. General Electric Co. is an example of a company that regularly

SAP Offline Word Template

SAP Offline Word Template

Mar 29 2017 The consolidation of journal entries in the distributed SAP Business One environment is the prerequisite for ... It is

CONSOLIDATION OF FUNDS MANUAL FOR TITLE I SCHOOLWIDE

CONSOLIDATION OF FUNDS MANUAL FOR TITLE I SCHOOLWIDE

Jul 30 2017 Table A: Example Consolidated Schoolwide Pool ... The recommended steps (requiring the journal entries within the accounting system) are as ...

In depth: Achieving hedge accounting in practice under IFRS 9

In depth: Achieving hedge accounting in practice under IFRS 9

Sep 30 2023 accounting achieved by subsidiary A is reversed on consolidation and replaced with hedge accounting ... journal entries with the same net result.

ProSystem fx® Engagement CONSOLIDATION BEST PRACTICES

ProSystem fx® Engagement CONSOLIDATION BEST PRACTICES

▫ To bring consolidated prior period comparative data into a trial balance if for example

Governmental Accounting and Financial Reporting Handbook

Governmental Accounting and Financial Reporting Handbook

Jun 14 2022 Typical Consolidation Entries . ... The sample entries included herein start with the typical consolidating journal entries and.

1 How to Prepare Consolidated Financial Statements by Adjustment

1 How to Prepare Consolidated Financial Statements by Adjustment

31 mar. 2016 candidates are advised to build a more concrete foundation by for example

Accounting for tax consolidation under A-IFRS

Accounting for tax consolidation under A-IFRS

1 août 2005 Specific tax consolidation accounting adjustments. 29. 4. Disclosure requirements. 42. 4.1. Overview. 42. 4.2. Example disclosures.

Practice Aid for Testing Journal Entries and Other Adjustments

Practice Aid for Testing Journal Entries and Other Adjustments

8 déc. 2008 Effect of Internal Controls on Journal Entry Testing. ... other adjustments (for example entries posted directly to financial statement ...

Tax Consolidation Accounting

Tax Consolidation Accounting

accounting for the effects of the tax consolidation system. This will the example journal entries by the head entity as “investment in.

1. Consolidated worksheet adjusting entries Eliminating parents

1. Consolidated worksheet adjusting entries Eliminating parents

an opposite journal entry to avoid double counting the net assets of a Example. • Question o Parent paid $17000 to acquire 100% of issued shares of the ...

Compiled Interpretation 1052 (May 2019)

Compiled Interpretation 1052 (May 2019)

UIG Interpretation 1052 Tax Consolidation Accounting (as amended) is set out The journal entries shown in the examples include the usual consolidation ...

Oracle® Fusion Cloud EPM - Working with Financial Consolidation

Oracle® Fusion Cloud EPM - Working with Financial Consolidation

Periodic Year-to-Date

SCHOOL OF ACCOUNTING SCIENCES

SCHOOL OF ACCOUNTING SCIENCES

14 fév. 2017 Journal entries. Describe the specific accounts affected by the journals and clearly convey the classification of the account (e.g. P/L; ...

Application Help - SAP Business Planning and Consolidation

Application Help - SAP Business Planning and Consolidation

20 mai 2019 Journals: create and manage journal entries containing adjustments used for correcting collected and consolidated data.

SCHOOL OF ACCOUNTING SCIENCES

SCHOOL OF ACCOUNTING SCIENCES

13 fév. 2018 The following example illustrates the basic consolidation process: ... Journal entries relating to deferred taxation are also required.

[PDF] consolidation worksheet entries

[PDF] consorting laws tasmania

[PDF] consti meaning welsh

[PDF] constipation and spotting early pregnancy

[PDF] constitution 13th amendment text

[PDF] constitution 14th amendment pdf

[PDF] constitution 14th amendment summary

[PDF] constitution 14th amendment text

[PDF] constitution 2nd amendment text

[PDF] constitution 4th amendment text

[PDF] constitution française

[PDF] constitution francaise préambule

[PDF] constitution marocaine 2011

[PDF] constitution of france pdf