- 580 and 669, your rating is fair, and you are considered to be a subprime borrower and the dealership will consider your application. 670 and 739, you have a good rating, and as such, you are not likely to default on your finance agreement.

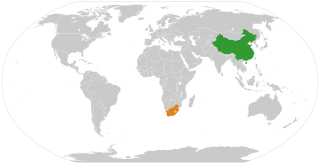

Finance will be approved. Can a foreigner finance a car in South Africa?

580 and 669, your rating is fair, and you are considered to be a subprime borrower and the dealership will consider your application. 670 and 739, you have a good rating, and as such, you are not likely to default on your finance agreement.

Finance will be approved..

Can I buy car with business account in South Africa?

be a South African citizen or foreign national with permanent residency. have a valid driving license. have an income of at least R7 500 per month..

Can I buy car with business account in South Africa?

In South Africa, there are many lenders who offer small business vehicle financing in order to help business purchase new vehicles.

With vehicle and asset finance you can buy or lease the car of your choice, depending on affordability..

Do I qualify for vehicle finance South Africa?

Loan Term.

A vehicle financing contract will be valid for a predetermined period of time, typically between 12 and 72 months, over which you'll prepay the money loaned to you, with interest and fees..

How does vehicle finance work in South Africa?

Foreign nationals can apply for vehicle and Asset finance accounts when they are in SA and once they've opened a transactional account with us.

Our Non residence team will be able to help you open an account and all you need to do is follow the below steps..

How does vehicle finance work in South Africa?

Loan Term.

A vehicle financing contract will be valid for a predetermined period of time, typically between 12 and 72 months, over which you'll prepay the money loaned to you, with interest and fees..

How to buy a car through your business South Africa?

Foreign nationals can apply for vehicle and Asset finance accounts when they are in SA and once they've opened a transactional account with us.

Our Non residence team will be able to help you open an account and all you need to do is follow the below steps..

How to buy a car through your business South Africa?

In South Africa, there are many lenders who offer small business vehicle financing in order to help business purchase new vehicles.

With vehicle and asset finance you can buy or lease the car of your choice, depending on affordability..

How to buy a car through your business South Africa?

Loan Term.

A vehicle financing contract will be valid for a predetermined period of time, typically between 12 and 72 months, over which you'll prepay the money loaned to you, with interest and fees..

How to get car finance in South Africa?

In recent months, there has been an increase in the prime lending rate for car loans, leading to an elevation in the average interest rate on car finance to approximately 10.75%.

This rise can be attributed, in part, to the global economic challenges following the COVID-19 pandemic..

What do I need to qualify for vehicle finance South Africa?

Apply for finance

1be 18 years old or older.2be a permanently employed salaried individual, earning a minimum salary of R6500 pm.3have a valid South African drivers licence with no endorsements.4be a South African citizen or permanent resident; and.5have a good credit history..What is the best way to finance a car in South Africa?

The best deal for those buying from a dealer will usually be a car loan.

This specialised kind of loan accepts a vehicle as collateral, which allows lenders to set a relatively low interest rate.

Of course, this also means that if the buyer defaults on payments, the vehicle can be seized to recover the loan..

- Foreign nationals can apply for vehicle and Asset finance accounts when they are in SA and once they've opened a transactional account with us.

Our Non residence team will be able to help you open an account and all you need to do is follow the below steps.