|

2022 Form 1040-NR

Form 1040-NR Department of the Treasury—Internal Revenue Service U S Nonresident Alien Income Tax Return 2022 OMB No 1545-0074 IRS Use Only—Do not write or staple in this space For the year Jan 1–Dec 31 2022 or other tax year beginning 2022 ending 20 See separate instructions Filing Status Check only one box |

|

Form 1040-NR US Nonresident Alien Income Tax Return 2022

Form1040-NRDepartment of the Treasury—Internal Revenue Service U S Nonresident Alien Income Tax Return 2022OMB No 1545-0074 IRS Use Only—Do not write or staple in this space For the year Jan 1–Dec 31 2022 or other tax year beginning 2022 ending 20 See separate instructions Filing Status Check only one box |

|

2023 Form 1040-NR

Form 1040-NR Department of the Treasury—Internal Revenue Service U S Nonresident Alien Income Tax Return 2023 OMB No 1545-0074 IRS Use Only—Do not write or staple in this space For the year Jan 1–Dec 31 2023 or other tax year beginning 2023 ending 20 See separate instructions Your first name and middle initial Last name |

|

1040-NR US Nonresident Alien Income Tax Return

Reserved Dependents 4 Reserved 5 Married nonresident alien 6 Qualifying widow(er) (see instructions) Child’s name 7 Dependents: (see instructions) (1) First name Last name If more than four dependents see instructions and check here (2) Dependent’s identifying number |

Who should file 1040 Nr?

You must file Form 1040-NR if any of the following conditions apply to you. You were a nonresident alien engaged in a trade or business in the United States during 2019. You must file even if: You have no income from a trade or business conducted in the United States, You have no U.S. source income, or

Who must file a 1040 Nr?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information. Claiming a Refund or Benefit. You must also file an income tax return if you want to:

Who needs to file 1040NR?

If you’re a nonresident alien, you will need to file tax form 1040-NR if you work in the United States or have U.S. sourced income, such as income from a rental property. Additionally, you may need to file Form 1040-NR if you received wages that are subject to income tax. This includes a taxable scholarship or fellowship grant.

How to Fill Out Simple Form 1040-NR for 2021. Step-by-step Guide

Do I Need to File a Form 1040-NR as a Nonresident?

How to File Form 1040-NR for 2022 for U.S. Rental Property

|

Form 1040-NR Department of the Treasury—Internal Revenue Service

Form 1040-NR Department of the Treasury—Internal Revenue Service. U.S. Nonresident Alien Income Tax Return. (99) 2021 OMB No. 1545-0074. |

|

2021 Instructions for Form 1040-NR

Jan 18 2022 1040-NR. U.S. Nonresident Alien Income Tax Return ... The lines on Form 1040-NR are arranged so that |

|

2005 Form 1040NR

Cat. No. 11364D. (1) First name. Form 1040NR (2005). Total income exempt by a treaty from page 5 Item M. 22. 29. Moving expenses. Attach Form 3903. |

|

2012 Form 1040NR

Form 1040NR. Department of the Treasury. Internal Revenue Service. U.S. Nonresident Alien Income Tax Return. ? Information about Form 1040NR and its |

|

2011 Form 1040NR

Form 1040NR. Department of the Treasury. Internal Revenue Service. U.S. Nonresident Alien Income Tax Return. For the year January 1–December 31 2011 |

|

2010 Form 1040NR

Form 1040NR (2010). Total income exempt by a treaty from page 5 Schedule OI |

|

2008 Form 1040NR

Cat. No. 11364D. (1) First name. Form 1040NR (2008). Total income exempt by a treaty from page 5 item M. 22. 29. Moving expenses. Attach Form 3903. |

|

1999 Form 1040NR

Cat. No. 11364D. (1) First name. Form 1040NR (1999). Total income exempt by a treaty from page 5 Item M. 22. 30. Moving expenses. Attach Form 3903. |

|

2004 Form 1040NR

Cat. No. 11364D. (1) First name. Form 1040NR (2004). Total income exempt by a treaty from page 5 Item M. 22. 29. Moving expenses. Attach Form 3903. |

|

2001 Form 1040NR

Cat. No. 11364D. (1) First name. Form 1040NR (2001). Total income exempt by a treaty from page 5 Item M. 22. 30. Moving expenses. Attach Form 3903. |

|

Form 1040-NR - Internal Revenue Service

40-NR 2020 U S Nonresident Alien Income Tax Return Department of the Treasury—Internal |

|

2020 Instructions for Form 1040-NR - Internal Revenue Service

pub › irs- pdf PDF |

|

Preparing for Tax Filing

You must also complete Form 8843 and mail with your tax return before the April 15 deadline |

|

Non-Resident Alien Frequently Asked Questions - SUNY

the deadline for filing my tax return? If you are filing Form 1040NR-EZ or Form 1040NR, the |

|

2016 Form 1040NR - E-filecom

40NR Department of the Treasury Internal Revenue Service U S Nonresident Alien Income |

|

2018 Form 1040NR

40NR Department of the Treasury Internal Revenue Service U S Nonresident Alien Income |

|

2020 New Jersey Nonresident Return, Form NJ-1040NR

as shown on Form NJ-1040NR Your Social Security Number 28a Pension Exclusion (See |

|

ð ð ð ð ð 2020 Form RI-1040NR - Rhode Island Division of

shown on Form RI-1040 or RI-1040NR Spouse's signature Spouse's driver's license number |

|

COMPLETING IRS FORM 1040NR-EZ - Amherst College

mediaPDF |

|

Form 1040NR - Internal Revenue Service

[PDF] Form NR Internal Revenue Service irs gov pub irs pdf fnr pdf |

|

Instructions for Form 1040NR - Internal Revenue Service

[PDF] Instructions for Form NR Internal Revenue Service irs gov pub irs pdf inr pdf |

|

2011 Form 1040NR - Internal Revenue Service

[PDF] Form NR Internal Revenue Service irs gov pub irs prior fnr pdf |

|

2010 Form 1040NR - Internal Revenue Service

[PDF] Form NR Internal Revenue Service irs gov pub irs prior fnr pdf |

|

Form 1040NR - Internal Revenue Service

[PDF] Form NR Internal Revenue Service irs gov pub irs prior fnr pdf |

|

NJ-1040NR -Non-Resident Income Tax Return

[PDF] NJ NR Non Resident Income Tax Return state nj us treasury taxation pdf current nr pdf |

|

Instructions for Completing Form 1040NR-EZ - MyCIIS

[PDF] Instructions for Completing Form NR EZ MyCIIS my ciis edu Instructions for Completing Form NREZ pdf ? |

|

International Student Tax Information

[PDF] International Student Tax Information northlandcollege edu international student tax information pdf |

|

HOW TO FILE AMENDED RETURN For Nonresident Alien

[PDF] HOW TO FILE AMENDED RETURN For Nonresident Alien unr edu Documents Amendment pdf |

|

CT-1040NR/PY - CTgov

You must file Form CT NR PY, Connecticut Nonresident and Part Year Resident Income Tax Return, if you were a nonresident or part year resident of |

- 1040nr instructions

- 1040nr-ez

- formulaire 1040nr en francais

- comment remplir le formulaire 1040

- schedule e form 1040

Form 1040Nr - Fill Out and Sign Printable PDF Template

Source: signNow

IRS 1040NR form

Source: pdfFiller

2020 1040-NR Form and Instructions (1040NR)

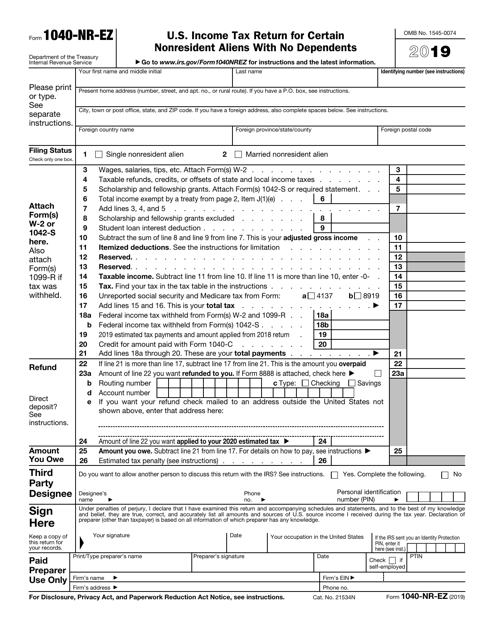

Source:https://data.templateroller.com/pdf_docs_html/2000/20000/2000023/irs-form-1040-nr-ez-u-s-income-tax-return-for-certain-nonresident-aliens-with-no-dependents_big.png

IRS Form 1040-NR-EZ Download Fillable PDF or Fill Online US

Source:https://www.signnow.com/preview/493/362/493362535/large.png

1040nr - Fill Out and Sign Printable PDF Template

Source: signNow

2014 Form IRS 1040-NR Fill Online Printable Fillable Blank

Source:https://www.signnow.com/preview/1/670/1670798.png

form 1065 schedule d 2015 pdf

2016 Schedule D (Form 1065) - Internal Revenue Service

form 1116

1116, Foreign Tax Credit - Internal Revenue Service

- form 1116 instructions

- form 2555

- form 6251

- form 1040

form 1120 schedule g 2015

Schedule G (Form 1120) (Rev December 2011)

form 16 pdf

Form 16tx - Income Tax Department