How do I download Form 16 in PDF format?

Form 16 PDF download link is available below in the article, download PDF of Form 16 using the direct link given at the bottom of content. Form 16 PDF Download for free using the direct download link given at the bottom of this article.

How do I download Form 16?

Here’s the full list of steps on how to download Form 16 online: Step 1: Visit the TRACES portal of the Income Tax Department. Step 2: Login by entering your User ID, Password and PAN before entering the captcha code. Step 3: After logging in, click on the ‘Downloads’ tab and select ‘Form 16’. Step 4: Select the desired year of assessment.

What information is included in Form 16?

Form 16 is the certificate issued under section 203 of the Income tax Act for tax deducted at source (TDS) from income under the head 'salary'. It is issued on deduction of tax by the employer from an employee's salary and deposit of the same with the government. ... The form has to two parts: Part A and Part B.

How can I edit Form 16 PDF documents?

Below you can get an idea about how to edit and complete a Form 16 Download Pdf step by step. Get started now. Push the“Get Form” Button below . Here you would be introduced into a page that enables you to carry out edits on the document. Select a tool you want from the toolbar that pops up in the dashboard.

When Will Form 16 Be Available For 2022-23?

The due date to issue Form 16 is 15th June 2023. If your employer deducted TDS from April ‘22 - March ’23, then Form 16 must be issued latest by 15th June '23. If you lose your Form 16, you can request a duplicate from your employer. cleartax.in

Part A of Form 16

Part A of Form 16 provides details of TDS deducted and deposited quarterly details of PAN and TAN of the employer and other information. An employer can generate and download this part of Form 16 through the TRACES (https://www.tdscpc.gov.in/app/login.xhtml) portal. Before issuing the certificate, the employer should authenticate its contents. It i

Part B of Form 16

Part B of Form 16 is an Annexure to Part A. Part B is to be prepared by the employer for its employees and contains details of the breakup of salary and deductions approved under Chapter VI-A. If you change your job in one financial year, you should take Form 16 from both employers. Some of the components of Part B notified newly are: 1. Detailed b

Details Required from Form 16 While Filing Your Return

With reference to the image below, here is where you can locate certain information for filing your income tax return for FY 2022-23 (AY 2023-24). 1. Allowances exempt under Section 10 2. Break up of deductions under Section 16 3. Taxable salary 4. Income (or admissible loss) from house property reported by an employee and offered for TDS 5. Income

What Is The Eligibility Criteria For Form 16?

According to the regulations issued by the Finance Ministry of the Indian Government, every salaried individual whose income falls under the taxable bracket is eligible for Form 16. If an employee’s income does not fall within the tax brackets set, they will not need to have Tax Deducted at Source (TDS). Hence, in these cases, the company is not ob

Points to Be Noted While Checking Form 16

Once an individual receives Form 16 from the employer, it is their responsibility to ensure that all the details are correct.One should verify the details mentioned in Form 16, for example, details of the amount of income, TDS deducted, etc.If any of the detail is mentioned incorrectly, one should immediately reach out to the organisation’s HR/Payroll/Finance department and get the same corrected.The employer would then correct their end by filing a revised TDS return to credit the TDS amount against the correct PAN. Once the revised TDS return is processed, the employer will issue an updat

Upload Form 16 and File Income Tax Return

Our software automatically picks up all the relevant information from your Form 16 and prepares your tax return. There is no need to enter anything manually. cleartax.in

|

1[FORM NO. 16 [See rule 31(1)(a)] PART A Certificate under section

Sep 2 2021 1[FORM NO. 16. [See rule 31(1)(a)]. PART A. Certificate under section 203 of the Income-tax Act |

|

FORM NO. 16A [See rule 31(1)(b)] Certificate under section 203 of

FORM NO. 16A. [See rule 31(1)(b)]. Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source. Certificate No. Last updated on. |

|

Form 16 Inspection certificate

Building Regulation 2021 • Section 53 • Form 16 • Version 1 • September 2021 This form is to be used for the purposes of section 10 of the Building Act ... |

|

FORM 16 [See Rule 34(1)] FORM OF APPLICATION FOR GRANT

FORM 16. [See Rule 34(1)]. FORM OF APPLICATION FOR GRANT OR RENEWAL OF TRADE CERTIFICATE. To. The Registering Authority ……………………………. … |

|

FORM NO. 16

FORM NO. 16. [See rule 31(1)(a)]. Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source from income chargeable under the head |

|

FORM 16 [See Rule 34(1)] FORM OF APPLICATION FOR GRANT

FORM 16. [See Rule 34(1)]. FORM OF APPLICATION FOR GRANT OR RENEWAL OF TRADE CERTIFICATE. To. The Registering Authority ……………………………. … |

|

APPLICATION FOR DISABILITY INSURANCE BENEFITS

Form SSA-16 (06-2022) UF. Discontinue prior editions. Social Security Administration. APPLICATION FOR DISABILITY INSURANCE BENEFITS. Page 1 of 7. |

|

FORM 16

FORM 16. [See rule 34 (1)]. Form of application for grant or renewal of Trade Certificate. To. The Registering Authority. |

|

Employee Ref. No. : EMP001 From 01Apr2014 To 15Mar2015 Form

Mar 19 2015 Form 16 Part B. Details of Salary paid and any other income and tax deducted. Gross Salary. (a) Salary as per provisions contained in ... |

|

FORM – 16 [rule 14] FOR STUDENTS EDUCATION EDUCATION

Application Form for verification of Scheduled Caste/Schedule Caste convert to Buddhism/. De-Notified Tribe (Vimukta Jati) /Nomadic Tribe/Other Backward Class/ |

|

Form 16 - Income Tax Department

FORM NO 16 [See rule 31(1)(a)] PART A Certificate under section 203 of the Inc |

|

Form 16 - Webtel

16 [See rule 31(1)(a)] PART A Certificate under section 203 of the Inc ome-tax Act, 1961 for |

|

E-Tutorial Download Form 16A - SureTDS

e will contain Form 16A details for all requested PANs • Download T'ACE“ PDF Generation Utility |

|

FORM NO16 [See Rule 31(1) (a) ]

16 [See Rule 31(1) (a) ] CERTIFICATE UNDER SECTION 203 OF THE INCOME-TAX ACT, |

|

E-Tutorial - Download Form 16 - TaxGuru

d request for Form 16 for a particular FY can be submitted only after Form 24Q statement for Q4 |

|

DIGITALLY SIGNED FORM16 - STACOS

load Digital Form16 Software TRACES PART-A with PART-B in a single digitally signed PDF |

|

FORM NO 16A [See rule 31(1)(b)] Certificate under - TDSMAN

16A [See rule 31(1)(b)] Certificate under section 203 of the Income- tax Act, 1961 for tax |

|

FORM 16 [See Rule 34(1)] FORM OF APPLICATION FOR

reby apply for issue of / renewal of a trade certificate(s): 1 Applicant's name : |

|

Form 16tx - Income Tax Department

[PDF] Form tx Income Tax Department incometaxindia gov in forms pdf |

|

FORM NO 16

[PDF] FORM NO jammukashmir nic in pdf itrForm pdf |

|

e-Tutorial - Download Form 16A

[PDF] e Tutorial Download Form A csb gov in assets Uploads e Tutorial Download Form pdf |

|

e-Tutorial - Download Form 16 - TaxGuru

[PDF] e Tutorial Download Form TaxGuru taxguru in wp content e Tutorial Download Form pdf |

|

e-Tutorial Download Form 16 - SureTDS

[PDF] e Tutorial Download Form SureTDS suretds e Tutorial Download Form pdf |

|

Understanding Form 16 and 26AS

[PDF] Understanding Form and AS iitk ac in Understanding Form and AS June pdf |

|

FORM 16

[PDF] FORM transport bih nic in Forms Form pdf |

|

itr-2 indian income tax return - PwC

[PDF] itr indian income tax return PwC pwc jp ja japan india income tax return mar pdf |

|

Form 15G-TDS - OnlineSBI

[PDF] Form G TDS OnlineSBI retail onlinesbi sbi downloads form g pdf |

|

itr-1 sahaj individual income tax return stamp receipt no - Webtel

D Total TCS Claimed D D Total Taxes Paid ( D+D+D+D) Details of Tax Deducted at Source on Income Other than Salary[As per Form A |

ONGC Walk-In Jobs 2015 Advt Application Form Download PDF

Source:https://www.pdffiller.com/preview/15/714/15714156/large.png

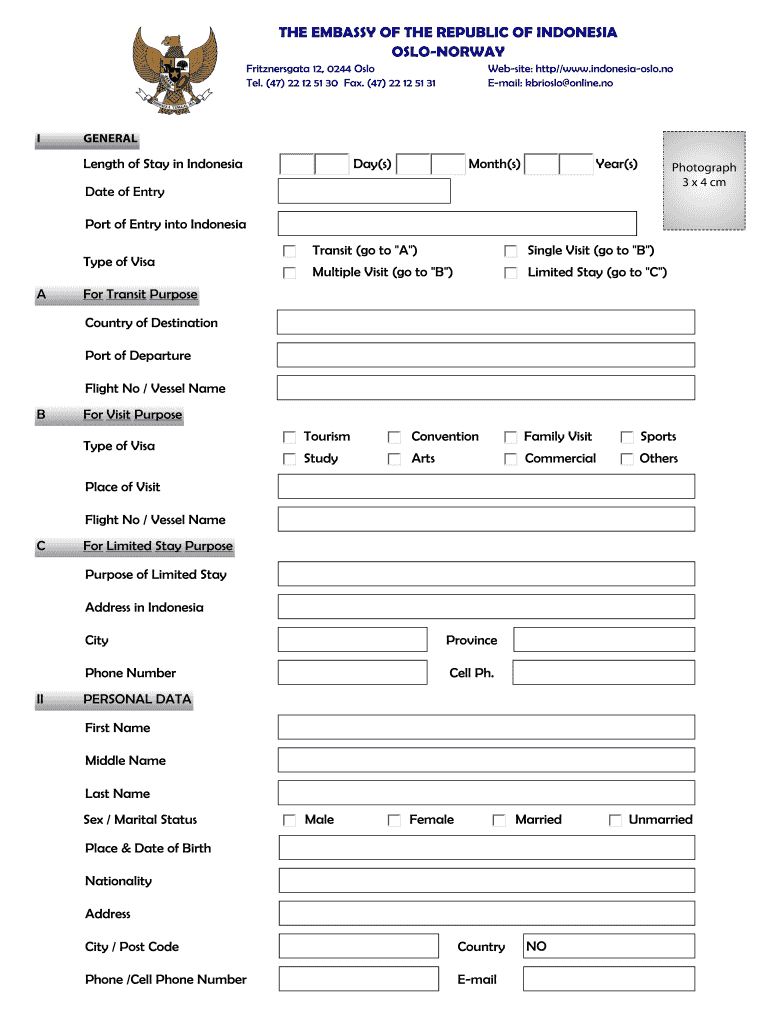

Indonesia Visa Application Form Download Pdf - Fill Online

Source:https://v5c2h2r6.stackpathcdn.com/wp-content/uploads/pdf-thumbnails/small/form19-pdf-799.jpg

![PDF] PF Form 19 PDF Download – InstaPDF PDF] PF Form 19 PDF Download – InstaPDF](https://image.slidesharecdn.com/mnnitjrfjobs2016applicationformdownloadpdf-150915105122-lva1-app6892/95/mnnit-jrf-jobs-2016-application-form-download-pdf-1-638.jpg?cb\u003d1442314540)

PDF] PF Form 19 PDF Download – InstaPDF

Source:https://image.slidesharecdn.com/mnnitjrfjobs2016applicationformdownloadpdf-150915105122-lva1-app6892/95/mnnit-jrf-jobs-2016-application-form-download-pdf-1-638.jpg?cb\u003d1442314540

MNNIT JRF Jobs 2016 Application Form Download PDF

Source:https://netstorage-briefly.akamaized.net/images/950e494527132e1a.jpg

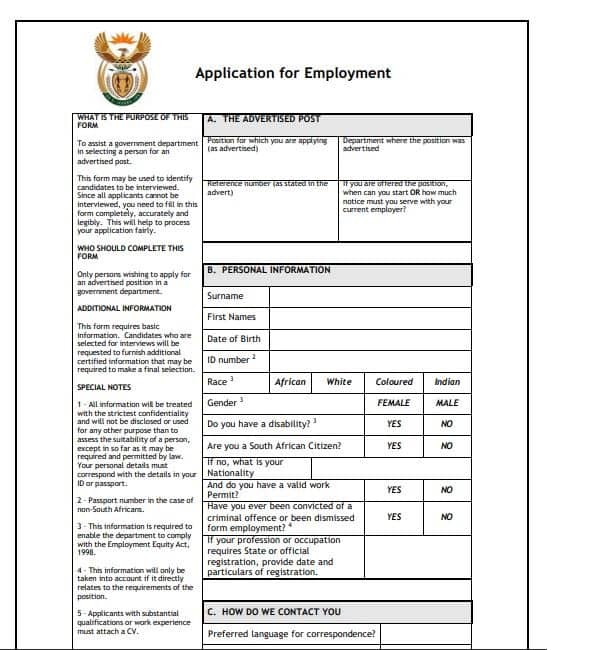

Z83 form: word form pdf form download how to fill it and an

Source:https://www.pdffiller.com/preview/15/212/15212029.png

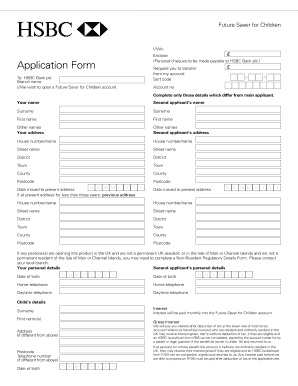

Hsbc Forms Download - Fill Online Printable Fillable Blank

Source:https://v5c2h2r6.stackpathcdn.com/wp-content/uploads/pdf-thumbnails/pcc-application-form-270215-pdf-126.jpg

form 2555

Form 2555, Foreign Earned Income - Internal Revenue Service

- form 2555 instructions

- form 2555ez 2016

- form 2555 ez

- tax form f2555ez

- form 2555 ez instructions

- form 8965

- irs form 1040

- form 8938

form 2555 2016

Form 2555, Foreign Earned Income - Internal Revenue Service

- form 2555 instructions

- tax form f2555ez

- form 2555 ez

- 1040 form 2016

- form 2555 ez instructions

- form 8938

- irs form 1040

- form 8965

form 2555 ez

Form 2555-EZ Foreign Earned Income Exclusion - Internal Revenue

- form 2555 ez instructions

- form 2555 instructions

- 1040 form 2016

- www irs gov form2555ez

- form 2555/ 2015

- where to send form 1040 from overseas

- form 1040

- form 8938

form 2555-ez 2016

Form 2555-EZ Foreign Earned Income Exclusion - Internal Revenue

- 2555 ez instructions

- form 2555 instructions

- 1040 form 2016

- form 1040

- form 2555 ez 2015

- www irs gov form2555ez

- form 2555/ 2015

- where to send form 1040 from overseas