|

2023 Form 8949

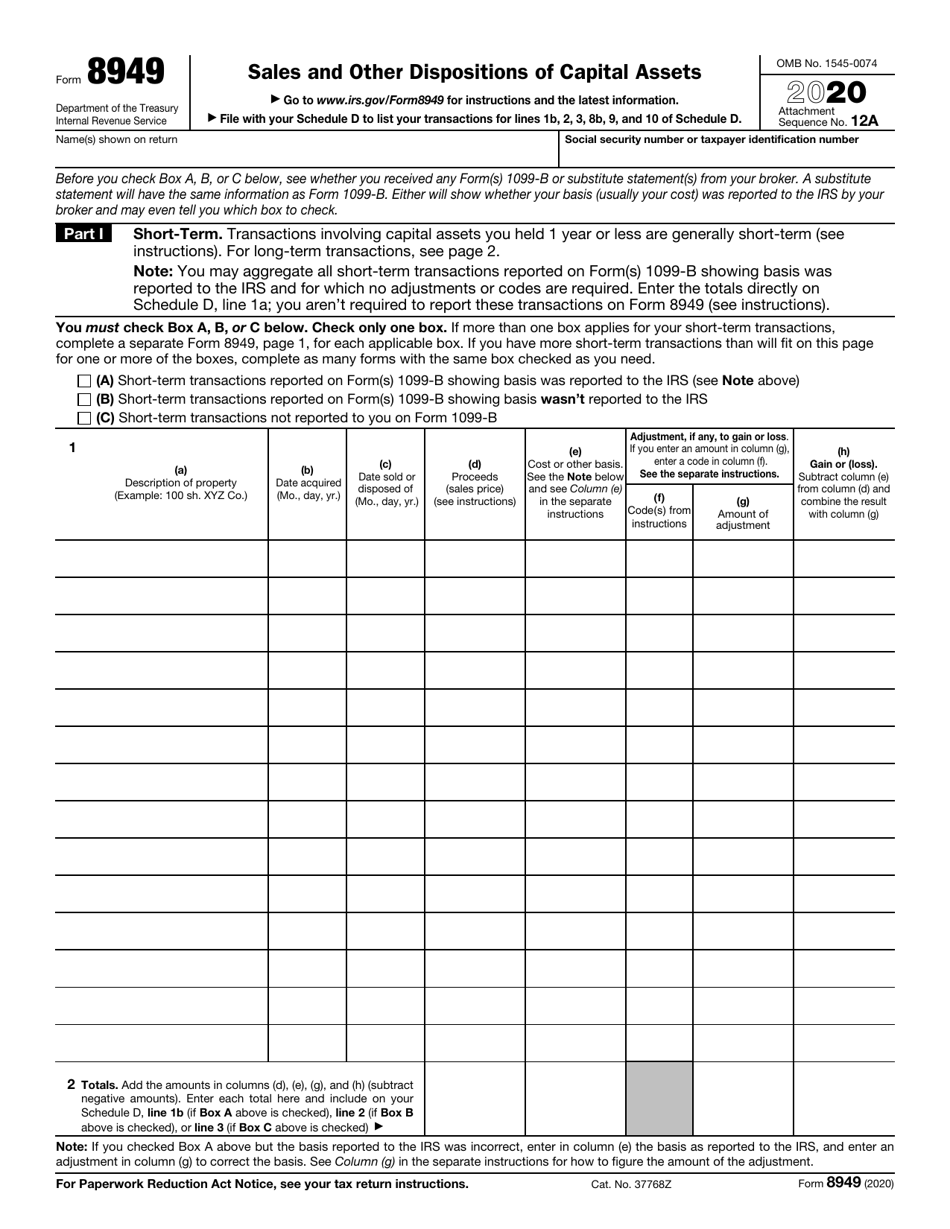

Download the official IRS PDF file of the 2023 Form 8949 which is used to report sales and other dispositions of capital assets on your tax return The form has instructions boxes and columns to list your transactions by type date and basis |

|

23 Internal Revenue Service Department of the Treasury

Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Purpose of Form Use Form 8949 to report sales and exchanges of capital assets Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return |

What is the purpose of Form 8949?

The Form 8949 is also known as a Sales and Other Dispositions of Capital Assets form. It will be used to report capital gains and losses from transactions that involved certain transactions, such as those involving investment properties. Both short-term and long-term capital gains will be included on the Form 8949.

How do I report transactions on Form 8949?

Use Form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital gains. See the Instructions for Form 8949. Complete all necessary pages of Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D.

How do I fill out form 8949?

Follow these tips to quickly and accurately submit IRS 8949 Instructions. Click the button Get Form to open it and begin editing. Fill all required lines in your document making use of our convenient PDF editor. Switch the Wizard Tool on to finish the process even simpler. Check the correctness of filled details.

How Does IRS Form 8949 Work?

Per the IRS, you'll use Form 8949 to report the following: 1. The sale or exchange of any capital asset that’s not reported on another form or schedule 2. Gains from involuntary conversions of capital assets not used in your trade or business, not including casualty or theft 3. Non-business bad debts 4. Worthlessness of a security 5. The election t

Who Uses IRS Form 8949?

Anyone who has received one or more Form 1099-B, Form 1099-S, and IRS-allowed substitutes for those forms should file Form 8949. Look carefully at the 1099 forms you've received from your broker. You may not need to file Form 8949 if the cost or other basisfor all of your transactions was reported to the IRS and if you don't need to make any adjust

Where to Get A Form 8949

The IRS provides an interactive Form 8949on its website. You can complete it online and print it out. The form should also be available from any tax preparation software you use. thebalancemoney.com

How to Fill Out and Read Form 8949

Check Box A, B, or C in Part I, depending on which reporting option applies. Enter information on all of your short-term transactions under Line 1 (sales and exchanges) of capital assets, including stocks, bonds, and real estate that fit that reporting category. Your description for each property in Column "a" on Form 8949 should be based on the de

Can Form 8949 Be e-filed?

You must enter each transaction in separate rows of the electronic form if you want to e-file your Form 8949, or you can include Form 8949 as a PDF attachment to your return. You can also mail paper copies of both Form 8949 and Form 8453 for an IRS e-filed return. thebalancemoney.com

Where to Mail Form 8949

You can mail Form 8949 along with Schedule D and your Form 1040 or Form 1040-SR to the appropriate address. Where you mail your return is based on where you live. You can find the proper address on the IRS' website. thebalancemoney.com

How to fill out IRS Form 8949

IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital Assets)

IRS Form 8949 Line-by-Line Instructions 2023: How to Report Stocks on Your Tax Return 🔶 TAXES S2•E59

|

Form 8949 Sales and Other Dispositions of Capital Assets

Form 8949. Department of the Treasury. Internal Revenue Service. Sales and Other Dispositions of Capital Assets. ? Go to www.irs.gov/Form8949 for |

|

2021 Instructions for Form 8949

7 janv. 2022 Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you ... |

|

2020 Instructions for Form 8949

26 janv. 2021 Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the. IRS on Forms 1099-B or 1099-S (or substitute statements) ... |

|

Sales and Other Dispositions of Capital Assets

Form 8949. Department of the Treasury. Internal Revenue Service. Sales and Other Dispositions of Capital Assets. ? Go to www.irs.gov/Form8949 for |

|

2018 Instructions for Form 8949

3 janv. 2019 Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you ... |

|

2016 Instructions for Form 8949

28 nov. 2016 Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you ... |

|

2011 Instructions for Schedule D (and Form 8949)

16 déc. 2011 Complete Form 8949 before you complete line 1 2 |

|

2021 Instructions for Form 8949

6 déc. 2021 File Form 8949 with the Schedule D for the return you are filing. This includes. Schedule D of Forms 1040 1040-SR |

|

Draft Form 8949

This is an early release draft of an IRS tax form instructions |

|

2019 Instructions for Form 8949

11 déc. 2019 Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you ... |

|

Form 8949 - Internal Revenue Service

than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for |

|

2020 Instructions for Form 8949 - Internal Revenue Service

irs-priorPDF |

|

Quickfinder® - Thomson Reuters Tax & Accounting

ng Capital Gains and Losses—Form 8949 Note: For most transactions, columns (f) and (g) can |

|

Form 1099-B - Communications

e D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions) |

|

IRS Provides Form 8949 Relief

ng in 2012, capital gain and loss transactions that would have previously been reported by |

|

2019 Form 1099-B Reference Guide - Vanguard

lete Form 8949 and Schedule D, you must report your gross proceeds and cost basis, your |

|

MI-8949 - State of Michigan

rm 8949 Sale of Property Enter the total gain in the federal column Form MI-8949 computations |

|

Example Tax Forms - American Tree Farm System

|

|

Form 8949 - Rural Tax Education

files-ouPDF |

|

Form 8949, Sales and Other Dispositions of Capital Assets

[PDF] Form , Sales and Other Dispositions of Capital Assets irs gov pub irs pdf f pdf |

|

2016 Instructions for Form 8949 - Internal Revenue Service

[PDF] Instructions for Form Internal Revenue Service irs gov pub irs pdf i pdf |

|

Form 8949 Sales and Other Dispositions of Capital Assets

[PDF] Form Sales and Other Dispositions of Capital Assetsruraltax files ou expform pdf |

|

Sales and Other Dispositions of Capital Assets - Form8949com

[PDF] Sales and Other Dispositions of Capital Assets Form form SampleForm pdf |

|

IRS Provides Form 8949 Relief - BDO

[PDF] IRS Provides Form Relief BDO gbq Tax Update IRS Provides Form Relief BDO pdf |

|

Reporting Capital Gains and Losses #8212;Form 8949 - Thomson

[PDF] Reporting Capital Gains and Losses Form Thomson tax thomsonreuters Reporting Capital Gains and Losses Form pdf |

|

MI-8949 - State of Michigan

[PDF] MI State of Michigan michigan gov documents taxes MI pdf |

|

Schedule WD - Wisconsin Department of Revenue

[PDF] Schedule WD Wisconsin Department of Revenue revenue wi gov DORForms ScheduleWD pdf |

|

Filing Your Tax Forms After Selling Your Restricted Stock

[PDF] Filing Your Tax Forms After Selling Your Restricted Stock morganstanleyfa daad ec a b fed pdf |

|

2016 Tax Form 1099-B: Reporting Instructions

Use this box to enter a one letter code that will assist the recipient in reporting the transaction on Form and or Schedule D Use the code below that applies |

Form 8949 - Fill Out and Sign Printable PDF Template

Source: signNow

IRS Form 8949 Download Fillable PDF or Fill Online Sales and Other

Source:https://tokentax.co/static/fe87407fc0d0a6334158eb61c9783a69/6189f/form-8949.png

Crypto Tax Forms

Source: Form 8949 Cryptocurrency Download

IRS Form 8949

Source:https://data.templateroller.com/pdf_docs_html/2117/21173/2117337/irs-form-8949-sales-and-other-dispositions-of-capital-assets_print_big.png

IRS Form 8949 Download Fillable PDF or Fill Online Sales and Other

Source:https://www.coursehero.com/thumb/8e/20/8e2003f997b188996ab7af95606c1222b78690e9_180.jpg

45pdf - 1 CP0301(Algorithmic Form 8949 Complete the Booth's

Source:https://data.formsbank.com/pdf_docs_html/284/2842/284232/page_1_thumb_big.png

form 8965

Form 8965, Health Coverage Exemptions - Internal Revenue Service

form 940

Form 940 - Internal Revenue Service

- form 941

- bug 940

form 941

Form 941 - Internal Revenue Service

form 941 b 2015 pdf

Form 941 (Schedule B) - Internal Revenue Service