|

2023 Schedule L (Form 990)

SCHEDULE L (Form 990) Department of the Treasury Internal Revenue Service Transactions With Interested Persons Complete if the organization answered “Yes” on Form 990 Part IV line 25a 25b 26 27 28a 28b or 28c; or Form 990-EZ Part V line 38a or 40b |

|

That file Form 990 or Form 990-EZ parts of Schedule B (Form

An organization\'s completed Form 990 or 990-EZ and a section 501(c)(3) organization\'s Form 990-T Exempt Organization Business Income Tax Return generally are available for public inspection as required by section 6104 Schedule B (Form 990 990-EZ or 990-PF) Schedule of Contributors is available for public inspection for section 527 |

|

2015 Form 990 or 990-EZ (Schedule L)

Schedule L (Form 990 or 990-EZ) 2015 Part IV Business Transactions Involving Interested Persons Complete if the organization answered “Yes” on Form 990 Part IV line 28a 28b or 28c Page 2 Provide additional information for responses to questions on Schedule L (see instructions) Schedule L (Form 990 or 990-EZ) 2015 |

|

2015 Form 990 or 990-EZ (Schedule N)

Purpose of Schedule Schedule N (Form 990 or 990-EZ) is used by an organization that files Form 990 or Form 990-EZ to report going out of existence or disposing of more than 25 percent of its net assets through sale exchange or other disposition |

What does Form 990 tell the general public?

In short, Form 990 provides information to those who read it about the NPO’s programs, financial health, fundraising activities, lobbying activities, political campaigning activities, tax compliance, policies, compensation of certain individuals and independent contractors, and grantees, among other items that could be of interest about the NPO.

What is the deadline for Form 990?

Most nonprofit organizations are required to annually file a Form 990 with the IRS. The filing is tied to the nonprofit’s fiscal year end and is due on the fifteenth day of the fifth month after the fiscal year ends. For organizations with calendar fiscal years, the filing deadline is May 15.

Who is required to file a 990 Form?

The following nonprofits are also required to file Form 990: Private foundations, regardless of their income. They will file Form 990-PF. Smaller nonprofits that have gross receipts of $50,000 or less. These companies must file a Form 990-n or e-Postcard.

When is the deadline for filing 990?

When is Form 990 due? Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. For organizations on a calendar year, the Form 990 is due on May 15th of the following year.

|

2015 Form 990 or 990-EZ (Schedule L)

? Information about Schedule L (Form 990 or 990-EZ) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2015. Open To Public. Inspection. Name |

|

2015 Instructions for Schedule L (Form 990 or 990-EZ)

10 nov. 2015 2015. Instructions for Schedule L. (Form 990 or 990-EZ). Transactions With Interested Persons. Department of the Treasury. |

|

Short Form Return of Organization Exempt From Income Tax

Form 990-EZ (2015). Page 2. Part II. Balance Sheets (see the instructions for Part II). Check if the organization used Schedule O to respond to any question |

|

2015 Schedule O (Form 990 or 990-EZ)

? Information about Schedule O (Form 990 or 990-EZ) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2015. Open to Public. Inspection. Name |

|

2015 Form 990 or 990-EZ (Schedule A)

? Information about Schedule A (Form 990 or 990-EZ) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2015. Open to Public. Inspection. Name |

|

Return of Organization Exempt From Income Tax

Form 990 (2015). Page 2. Part III. Statement of Program Service Accomplishments. Check if Schedule O contains a response or note to any line in this Part |

|

2015 Form 990 or 990-EZ (Schedule G)

? Information about Schedule G (Form 990 or 990-EZ) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2015. Open to Public. Inspection. Name |

|

2015 Form 990 (Schedule I)

Information about Schedule I (Form 990) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2015. Open to Public. Inspection. |

|

2015 Instructions for Form 990 Return of Organization Exempt From

12 janv. 2016 Instructions to the Form 990 schedules are published separately from these instructions. Organizations that have total gross income from. |

|

2015 Form 990 or 990-EZ (Schedule L) - Internal Revenue

ormation about Schedule L (Form 990 or 990-EZ) and its instructions is at www irs gov/form990 OMB |

|

2015 Instructions for Schedule L (Form 990 or 990-EZ)

pub › irs-priorPDF |

|

AICPA Comments on Form 990 and Instructions

June 17, 2015 on Form 990, Return of Organization Exempt from Income Tax, and instructions Schedule would have to go to the instructions to determine that |

|

View 2015 Form 990 - Chamberlin House, Inc

uploadsPDF |

|

990 for 2015 Public Disclosure - Friends Without A Border

uploads › 2016/12PDF |

|

Form 990 2015 Monterey Bay Aquarium

|

|

2015 990 - PLOS

0 (2015) SEE SCHEDULE O FOR ORGANIZATION MISSION STATEMENT CONTINUATION 0 |

|

2015 990EZ - Falls Church Homeless Shelter

0-EZI Form 2015 Initial return مام Short Form OMB No 1545-1150 meaning of section 512(b)(13)? If "Yes," Form 990 and Schedule R may need to be completed instead of |

|

990 - Random Tuesday, Inc

uploads › 2018/10PDF |

|

Form 990 or 990-EZ - Internal Revenue Service

[PDF] Form or EZ Internal Revenue Service irs gov pub irs pdf fsl pdf |

|

Form 990 or 990-EZ - Internal Revenue Service

[PDF] Form or EZ Internal Revenue Service irs gov pub irs pdf isl pdf |

|

2015 Instructions for Form 990-EZ - Internal Revenue Service

[PDF] Instructions for Form EZ Internal Revenue Service irs gov pub irs prior iez pdf |

|

2015 Schedule O (Form 990 or 990-EZ) - Internal Revenue Service

[PDF] Schedule O (Form or EZ) Internal Revenue Service irs gov pub irs prior fso pdf |

|

2015 Form 990 or 990-EZ (Schedule L)

[PDF] Form or EZ (Schedule L) zillionforms Draft F PDF |

|

990 or Form - PETA

[PDF] or Form PETA peta wp content uploads PETA pdf |

|

2015 Form 990 or 990-EZ (Schedule A)

[PDF] Form or EZ (Schedule A) spincafeoh form ez scedule a pdf |

|

Form 990 - The Nature Conservancy

[PDF] Form The Nature Conservancy nature about us governance form fy pdf |

|

Form 990 - Amnesty International

[PDF] Form Amnesty International amnestyusa files pdf s aiusa pdf |

|

Return of Organization Exempt From Income Tax - American Civil

Information about Form and its instructions is at A For the calendar year, or tax year beginning and ending B C D Employer identification number E |

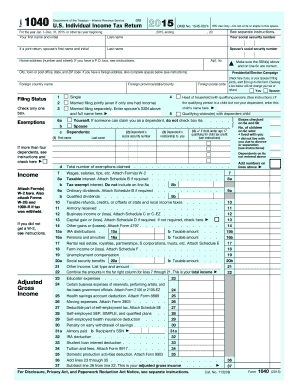

File:Form 1040a 2015pdf - Wikimedia Commons

Source:https://upload.wikimedia.org/wikipedia/commons/thumb/b/ba/Form_1040%2C_2015.pdf/page2-180px-Form_1040%2C_2015.pdf.jpg

File:Form 1040 2015pdf - Wikimedia Commons

Source:https://www.signnow.com/preview/6/964/6964168.png

Forms 1040 - Fill Out and Sign Printable PDF Template

Source: signNow

Irs 2015 Schedule D Fillable - Fill Out and Sign Printable PDF

Source:https://www.formsbirds.com/formimg/individual-income-tax/8070/form-1040-schedule-se-self-employment-tax-form-2015-l2.png

Form 1040 (Schedule SE)- Self-Employment Tax Form (2015) Free Download

Source:https://www.coursehero.com/thumb/a5/16/a516c38de4185be69f4fd8c3776bdc4f05d8b2d3_180.jpg

1040 Schedule C - Schmitz - SCHEDULE C(Form 1040 Profit or Loss

Source:https://upload.wikimedia.org/wikipedia/commons/thumb/7/77/Form_1040a%2C_2015.pdf/page2-180px-Form_1040a%2C_2015.pdf.jpg

form action html

Les formulaires en HTML - Helpclic

form w2

Form W-2 (PDF) - Internal Revenue Service

- w-2 form 2016

- 1099 form

- w2 form 2017

- tecno w2

- 1040 form

- w2beauty

- formulaire w2 usa

- margival

formal and informal letter examples

formal and informal letters - zsmetarnowpl

- formal letter examples pdf

- informal letter in english example

- writing a formal letter example

- formal and informal letters examples pdf

- informal letter layout

- informal letter pdf

- the difference between formal and informal letter

- english letter writing samples pdf

formal and informal letters examples pdf

formal and informal letters - zsmetarnowpl

- formal letter examples pdf

- informal letter in english example

- formal and informal letter examples

- the difference between formal and informal letter

- writing a formal letter example

- informal letter pdf

- informal letter layout

- english letter writing samples pdf