How do I report rental income to Airbnb?

Taxable rental income must be reported on Schedule C or Schedule E of Form 1040. Most Airbnb hosts will report income on a Schedule E. Real estate owners providing substantial hospitality services to guests will use Schedule C. Airbnb will send Form 1099-K to hosts with more than 200 reservations or earn over $20,000 in a calendar year.

How much tax do Airbnb hosts pay?

On average, sales tax is about 12% of gross rental income. These taxes are separate from income tax collected by the IRS. Hosts are responsible for collecting and remitting sales tax to the state, city, or both. Is Quickbooks good for Airbnb accounting?

What Is The Best Tax Structure For Airbnb Rental Properties?

Airbnb Business Structure (You Need An LLC) #airbnb #taxtips #llc

DO YOU PAY TAX ON AIR BNB? EXPLAINED

|

General guidance on the taxation of rental income

party may rely upon it as tax or legal advice or use it for any other purpose. It also includes all structures or other property belonging to the ... |

|

1 This guide has been prepared by an independent third-party law

Tax can be tricky and it is important to ensure that you keep up to date Rate of Tax (ZAR) ... As Airbnb is not supplying the rental service itself. |

|

This is a repository copy of Airbnb and taxation: Developing a

fixed tax rate for shared lodging platforms such as Airbnb to increase hosts' revenue and address seasonality in tourism. The annual revenue of the various |

|

Tax Guide 2021 - Belgium - ENGLISH - Final.docx - Airbnb

All Belgian resident taxpayers who receive taxable income have a tax filing obligation in Belgium. Page 2. Belgian income tax rates. The tax rate applied |

|

Responsible Hosting -_France_(EN v20.01.2022) .docx - Airbnb

01 Jan 2022 are French tax residents or rent out a property located in France via ... calculated based on tax rate of the taxpayer during the last year ... |

|

POLAND – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS

Coming within the charge to income tax in Poland. Under flat tax rate of business income (19%) and lump sum tax for rental income (8.5% and. 12.5%) there are |

|

FRANCE – TAX CONSIDERATIONS ON LETTING PROPERTY

31 Dec 2018 The following rules apply if you are a non-resident French taxpayer: ? Income tax as from the first euro: Progressive tax rate applicable which ... |

|

PORTUGAL – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS

This income is subject to taxation at the progressive tax rates in the case of Portuguese residents (between 145% and 48%) |

|

BELGIUM – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS

31 Dec 2018 All Belgian resident taxpayers who receive taxable income have a tax filing obligation in. Belgium. Belgian income tax rates. The tax rate ... |

|

Tax Guide 2021 - Hungary.docx - Airbnb

the tax that may arise on income earned from short-term lets in Hungary The tax rate is 15% of the profit |

|

General guidance on the taxation of rental income - Airbnb

Tax documents, such as 1099-K, are reported on a gross basis Any gross rent that is refunded should be included as gross rental income and also taken as a deduction Example: You receive a payout of $5,000 for a Guest's 10-day stay The Guest only stays for 8 days and you offer a $1,000 refund via Airbnb |

|

5 Guide to preparing an annual Self-Assessment tax return - Airbnb

Airbnb General guidance on the UK taxation of rental income received The tax rates applicable to taxable property income will depend on the level of other |

|

Airbnb and taxation: Developing a seasonal tax system - White Rose

Airbnb earns 9 percent to 12 percent from guests for each reservation—the precise rate varies based on the length of stay—and 3 percent from hosts Alternatively, governments can also impose a local tax on the service For example, Airbnb hosts' revenue in some U S localities can be subject to income taxes |

|

A SIMPLE GUIDE TO AIRBNB TAX - Property Tax Returns

IS MY AIRBNB INCOME TAXABLE? Income earned from providing short-term accommodation is taxable in New Zealand This means that you will be required to |

|

Inferring Tax Compliance from Pass-through: Evidence from Airbnb

Using data on Airbnb listings across a number of U S metropoli- tan areas, as well as variation in enforcement agreements across time, location, and tax rate, we |

|

Airbnb Agreements with State and Local Tax Agencies

The structure of these agreements is perplexing and should be reviewed for legality The agreements provide major benefits to third-parties, especially lodging |

|

State Short-Term Rental Tax Rate Chart - REALTOR Party

Information regarding local taxes and rates is available on state revenue/tax Airbnb or HomeAway, must register with the Department of Revenue for a |

|

Taxing your Airbnb and family bach - Deloitte

22 mar 2019 · Tax Alert March 2019 In this issue: Taxing your Airbnb and family bach Andrea Scatchard and The Taxation (Annual Rates for 2019-20, |

|

The Sharing Economy Part 1: New Business Models + - Publications

Both Uber and Airbnb have worldwide operations and use a similar international tax structure And both companies are dipping deep into the market shares of |

|

Airbnb - Butler & Co

In 2017, 18, the deduction from property income (as currently allowed) will be restricted to 75 of finance costs with the 25 that remains having a basic rate tax |

|

[PDF] General guidance on the taxation of rental income - Airbnb

If you are subject to US income tax, you must report your rental income as a cash basis or accrual basis taxpayer If you are a cash basis taxpayer, you report rental income on your return for the year you actually or constructively receive it and you deduct all expenses in the year you actually pay them |

|

[PDF] Appendix D Common sections in the tax return - Airbnb

and capital gains tax position for individual hosts who receive rental income tax rate was the same as in 2017 18, the change in the finance cost restriction |

|

[PDF] belgium – tax considerations on short-term lettings - Airbnb

Dec 31, 2018 · All Belgian resident taxpayers who receive taxable income, have a tax filing obligation in Belgium Belgian income tax rates The tax rate |

|

[PDF] Airbnb Agreements with State and Local Tax Agencies

The structure of these agreements is perplexing and should be reviewed for legality The agreements provide major benefits to third parties, especially lodging |

|

[PDF] Inferring Tax Compliance from Pass-through: Evidence from Airbnb

Using data on Airbnb listings across a number of US metropoli tan areas, as well as variation in enforcement agreements across time, location, and tax rate, we |

|

[PDF] Airbnb and taxation: Developing a seasonal tax system - White Rose

fixed tax rate for shared lodging platforms such as Airbnb, to increase hosts' revenue and address seasonality in tourism The annual revenue of the various |

|

[PDF] a simple guide to airbnb tax - Property Tax Returns

At Property Tax Returns, we understand the complex taxation rules that apply to Airbnb properties While Airbnb's popularity in NZ has skyrocketed over the last |

|

[PDF] Taxing your Airbnb and family bach - Deloitte

Mar 22, 2019 · Tax Alert March 2019 In this issue Taxing your Airbnb and family bach suggested tax rate but Inland Revenue will notify the employer if they |

|

[PDF] Tourism and the Sharing Economy - World Bank Document

The projected annual growth rate for global P2P accommodation is this is clearly noted Most of the data for the Jamaica case study were provided by Airbnb in Jamaica are loss of tax revenue, and real and or perceived risks to visitor |

|

[PDF] State Short-Term Rental Tax Rate Chart - REALTOR Party

Maximum Rate ( ) Comments Source A room remarketer, such as Airbnb or VRBO, is required to collect and submit applicable taxes monthly to the District |

- airbnb tax deductions 2019

- airbnb tax advice

- airbnb allowable expenses

- airbnb tax evasion

- airbnb taxes

- depreciation on airbnb property

- airbnb tax withholding

- airbnb tax documents

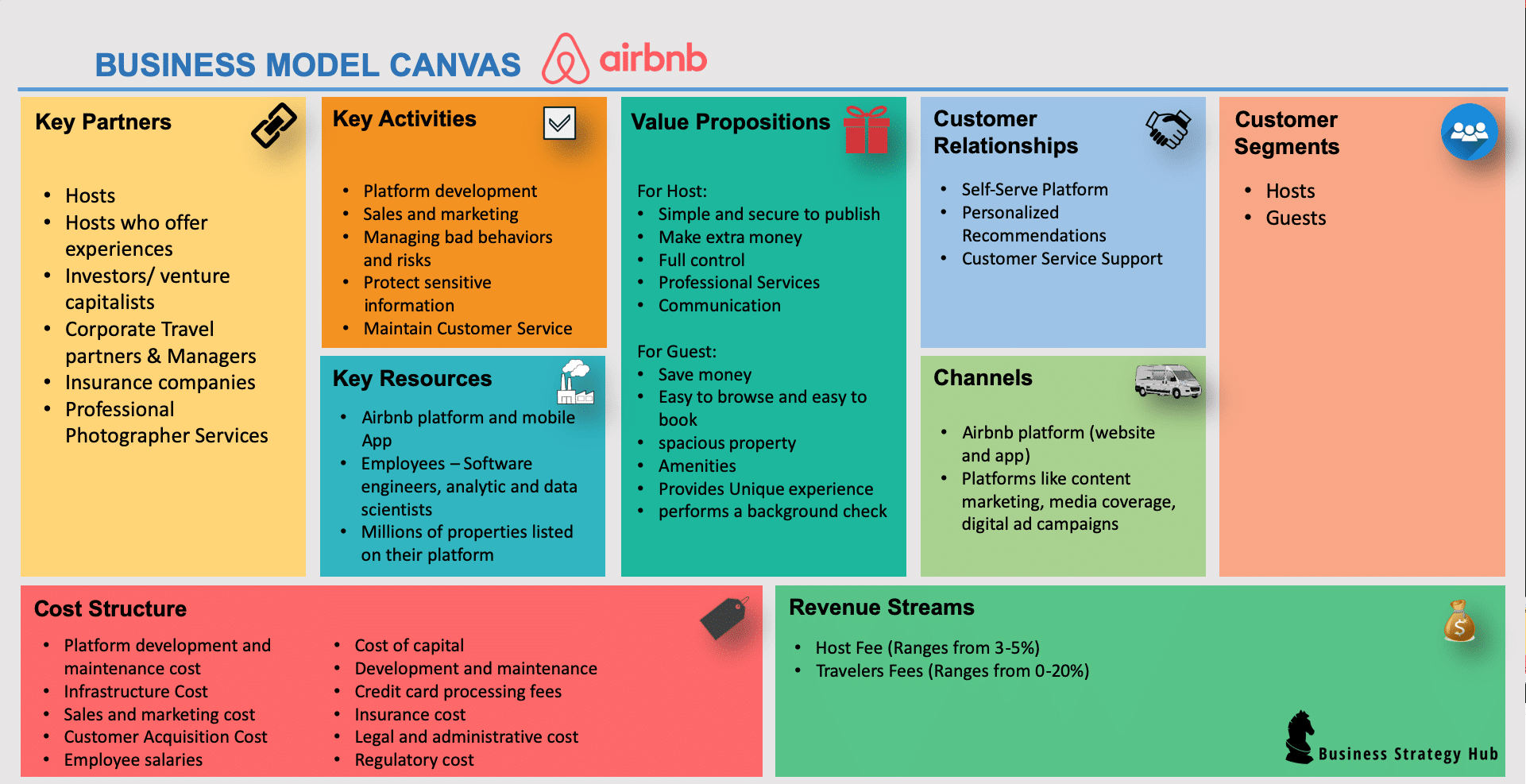

Airbnb-business-model-canvaspdf

Source: Airbnb

Airbnb Business Model - How Airbnb Makes Money?

Source:https://bstrategyhub.com/wp-content/uploads/2019/06/Business-model-canvas-Airbnb.png

Airbnb Business Model

Source: How does Airbnb make money?

Airbnb Business Model - How Airbnb Makes Money?

Source:https://www.emerald.com/insight/proxy/img?link\u003d/resource/id/urn:emeraldgroup.com:asset:id:article:10_1108_JTF-11-2015-0048/urn:emeraldgroup.com:asset:id:binary:JTF-11-2015-0048001.tif

Airbnb: the future of networked hospitality businesses

Source: Emerald

Vizologi - AIRBNB BUSINESS MODEL

Source: How does Airbnb make revenue?

airbnb tax uk 2019

[PDF] Impact of Airbnb on customers' behaviour in the UK hotel - SHURA

- airbnb allowable expenses uk

- airbnb tax advice

- airbnb tax deductions 2019

- tax on airbnb

- is airbnb income taxable

- airbnb tax rules

- not declaring airbnb income

- furnished holiday let tax

airbnb total revenue 2018

[PDF] REPORT:

- airbnb annual report 2018 pdf

- airbnb revenue

- airbnb revenue 2018

- airbnb annual report 2020

- airbnb revenue 2019

- airbnb statistics 2018

- airbnb income statement

- airbnb business model

airbnb tourist tax florida

[PDF] Airbnb and taxation: Developing a seasonal tax system - White Rose

- florida rental tax 2019

- florida vacation rental tax rate 2019

- florida rental income tax

- florida tourist tax 2019

- florida sales tax on rental property

- florida sales tax on residential rental property 2019

- florida rental tax 2020

- 2019 florida hotel tax rates by county

airbnb trend report

[PDF] Airbnb Submission - Parliament of Western Australia

- airbnb growth

- airbnb future strategy

- airbnb emerging markets

- airbnb statistics

- airbnb annual report 2019

- airbnb statistics 2018

- trends of airbnb

- airbnb experiences data