|

Retirement Market Outlook 2023

INTRODUCTION T ROWE PRICE INSIGHTS 2023 U S RETIREMENT MARKET OUTLOOK November 2022 1 As of June 30 2022 Includes assets held in defined contribution plans and individual retirement accounts (IRAs) IRA data are estimated Source: “Retirement Assets Total $33 7 Trillion in Second Quarter 2022” Investment Company Institute September 15 2022 |

How much money does a 401(k) hold?

Savings rolled over from 401 (k)s and other employer-sponsored retirement plans also account for about half of the $11.0 trillion held in individual retirement account assets as of September 30, 2022.

How much is a 401(k) plan worth in 2021?

The value of retirement assets in 401 (k) plans in the United States grew overall during the period from 2000 to 2021, reaching a value of around 7.26 trillion U.S. dollars as of the end of second quarter 2021. Most of the 401 (k) plan assets were invested in mutual funds. Get notified via email when this statistic is updated.

What percentage of the US retirement market is 401(k)?

In comparison, 401 (k) assets were $3.1 trillion and represented 17 percent of the US retirement market in 2011. See Investment Company Institute, “ The US Retirement Market, Second Quarter 2021 .” Note: Components may not add to the total because of rounding. Sources: Investment Company Institute and Department of Labor

What is a 401(k) plan?

A 401 (k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute... Frequently Asked Questions About 401 (k) Plan Research How large are 401 (k)s?

|

Inside the Structure of Defined Contribution/401(k) Plan Fees 2013

The Deloitte/ICI Defined Contribution/401(k) Fee Study . of different plan size market segments. The Survey found that asset-based investment-related ... |

|

401(k) Benchmark Report

a breakdown based on industry and size we allow individual plan sponsors to benchmark their own performance against the appropriate peer group. The 401(k) |

|

Defined Contribution/401(k) Fee Study

of different plan size market segments. The Survey found that asset-based investment-related fees represent about three-quarters (74%) of defined |

|

Large Bank Retirement Services: A Comparative Practices Study

Feb 2 2000 size. 401(k) products are especially likely to have more than one market. Only four banks indicated that they focus only on the middle ... |

|

A Look at 401(k) Plan Fees

Do the investment options track an established market index or is there a higher level of investment management services provided? 8. Do any of your plan's |

|

Long-term value creation in US retirement

Aug 1 2019 The largest retirement market is the United. States |

|

Forces of Change in an Evolving Retirement Market - SEI

company split into two business units and split its 401(k) plan into two separate plans To accommodate an investment platform of this size and complexity, the |

|

Long-term value creation in US retirement - McKinsey & Company

11 août 2019 · In many respects, the DC market is the keystone of the US retirement market: segments (e g , large segment 401(k) vs small segment; higher |

|

Inside the Structure of Defined Contribution/401(k) Plan - Deloitte

The results showed that the 'all-in' fee varies across plans of different plan size market segments The Survey found that asset-based investment-related fees |

|

401(k) Benchmark Report - Judy Diamond Associates

In this year's report, we've continued to track the overall performance of 401(k) plans both by industry, as well as by size of company Our basic methodology is |

|

Strategies for Identifying and Capturing Retirement - The Standard

1 juil 2013 · NUVEEN INVESTMENTS Drivers, Market Size Product Innovation Drivers of Dramatic Growth of the Defined Contribution/401(k) Market |

|

The 403(b) - SPARK Institute

participants in 401(k) and other defined contributions plans Contact: Bob Table 16 - Industry Revenue Potential by Plan Size Segments at Year-End 2011 |

|

A Look at 401(k) Plan Fees - US Department of Labor

It highlights the most common fees and encourages you, as a 401(k) plan Larger plans, by virtue of their size, are more likely to pool investments on their own funds seek to obtain the investment results of an established market index, such |

|

[PDF] 401(k) Benchmark Report - Judy Diamond Associates

In this year's report, we've continued to track the overall performance of 401(k) plans both by industry, as well as by size of company Our basic methodology is |

|

[PDF] Fidelity

May 9, 2019 · after a slight dip at the end of 2018, buoyed by positive stock market Average 401(k), IRA and 403(b) balances rebounded in Q1 2019 |

|

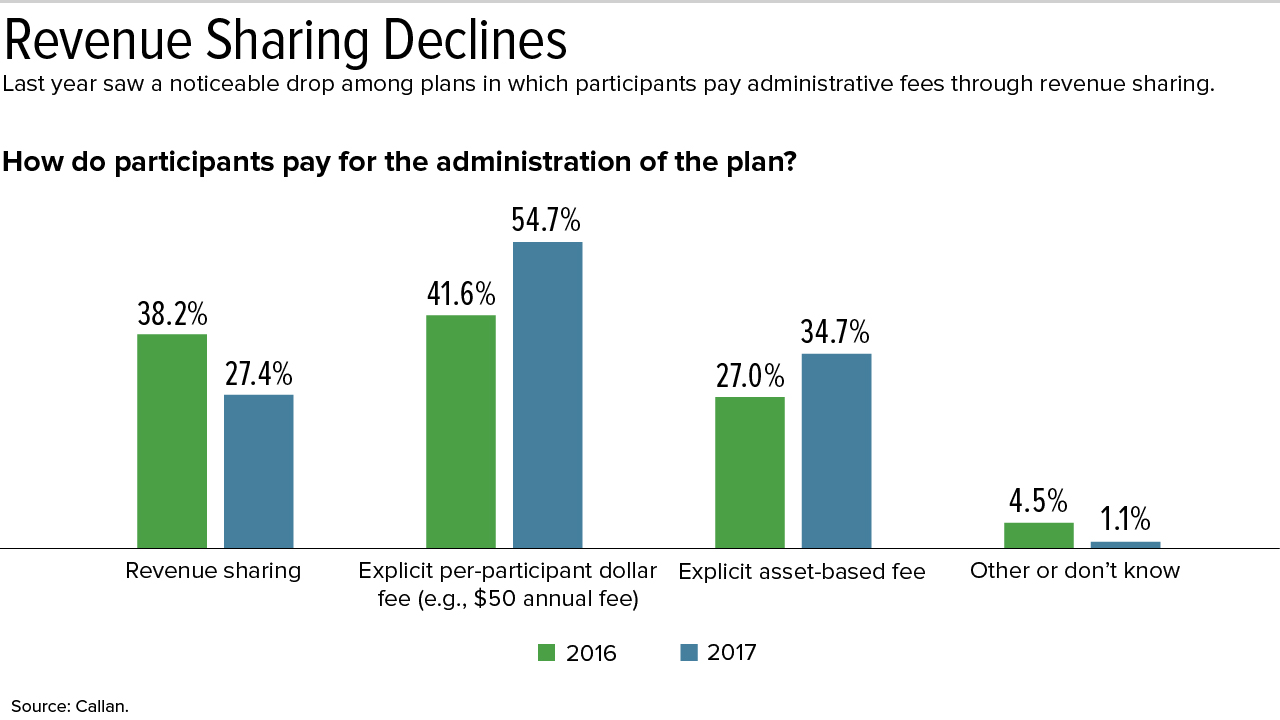

[PDF] 2019 Defined Contribution Trends - Callan

What is the size of the primary DC plan? offered a 401(k) plan as the primary DC plan The proportion of In what industry is your employer? In addition to the |

|

[PDF] Forces of Change in an Evolving Retirement Market - SEI

company split into two business units and split its 401(k) plan into two separate plans To accommodate an investment platform of this size and complexity, the |

|

[PDF] Inside the Structure of Defined Contribution/401(k) - Deloitte

The Deloitte ICI Defined Contribution 401(k) Fee Study plans, to estimate industry wide fees, the survey responses of different plan size market segments |

|

[PDF] Employee Costs and Risks in 401(k) Plans - Bureau of Labor Statistics

longed stock market declines2 Another risk involves the lack of investment di versification A House Democratic Com mittee analysis noted that 401(k) plans |

|

[PDF] media kit - 401K Specialist

the definitive source for retirement plan advisors, regardless of age, experience or asset size Why are more and more advisors getting into the 401(k) market? |

- 401k market value

- 401k plan size

- 401k market share

- defined contribution market size

- 401 k plan statistics

- 401k participation rates by industry

- retirement industry statistics

- how many employees to have a 401k

401(k) Sponsors Focus on Benchmarking—and Lowering—Fees

Source:https://cdn.shrm.org/image/upload/v1/Benefits/18-0290_401k_Fund_Fees-02_xumjbs

401(k) Sponsors Focus on Benchmarking—and Lowering—Fees

Source:https://s3-prod.pionline.com/s3fs-public/styles/800x600/public/INTERACTIVE_180629958_AR_-1_IDYJZHOJLKKW.jpg

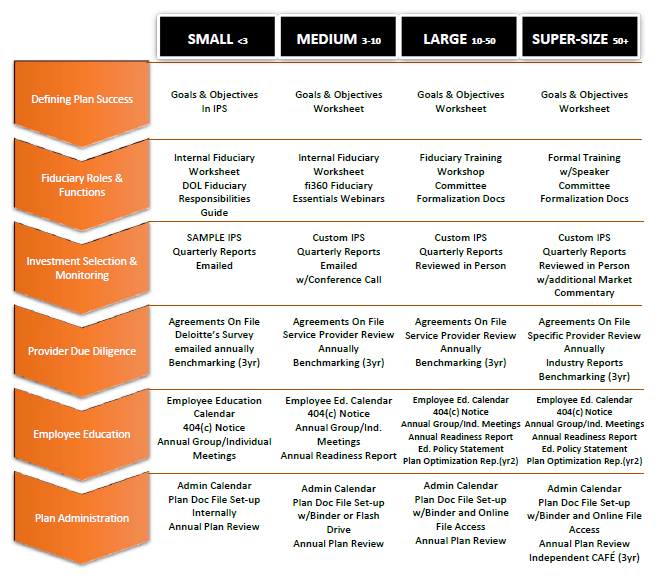

US retirement assets at $28 trillion in Q1 little changed from

Source:https://401kbestpractices.com/wp-content/uploads/2015/01/servicemodelstrategies.png

401k Service Models-the Complete Guide

Source:https://i2.wp.com/financialsamurai.com/wp-content/uploads/2017/10/401k-savings-targets-by-age.jpg?fit\u003d1456

401k Savings By Age: How Much Should You Save For Retirement

Source:https://www.ici.org/deployedfiles/ICI/Site%20Properties/images/20/rc_401k_faq_fig1.jpg

401k max 2020 after tax

[PDF] How High Earners Can Maximize Their Retirement - Hartford Funds

- 401k contribution limits 2020

- vanguard after-tax 401k

- retirement before or after-tax

- mega backdoor roth

- after-tax 401k contribution limit

- 401k after-tax contribution limits 2020

- contributions are made in after-tax dollars to quizlet

- after-tax to roth

- 401k max 2020 after tax

- 401k limits 2020 after tax

- 401k max contribution 2020 after tax

- 401k contribution limits 2020 after tax

- irs 401k limits 2020 after tax

- maximum 401k contribution 2020 after tax

401k max 2020 calculator

[PDF] Retirement plan catch-up contributions - Lincoln Financial Group

- Solo 401k calculator

- SEP IRA calculator

- Solo 401k contribution limits 2019

- Solo 401k contribution limits 2020

- [PDF] pre-retirement catch-up form - ICMA-RChttps://www.icmarc.org › ...

- 457 Plan Contribution Limit. 2020. 2019. Annual Deferrals. $19

- 500. $19

- 000 ... each year to calculate your total unused deferral amount. Unused Deferral ... contribution amount must include any 401(k) contributions made during the year.[PDF] Example Calculation for PPP Loans - McGill & Hill Grouphttps://www.mcgillhillgroup.com › 2020-04-07-Example-Calculation-...

- Apr 7

- 2020 · ($100

- 000 Limit) ... 3) Total employer paid retirement benefits (including 401(k) profit sharing plans ... Sample Loan/Grant Amount Calculation.[PDF] Retirement plan catch-up contributions - Lincoln Financial Grouphttps://www.lfg.com › wcs-static › pdf

- The annual 402(g) limit is an individual limit that applies to 401(k) and 403(b) plans. ... disadvantages of offering this provision are the calculation and the need to ... If a participant reaches normal retirement age (NRA) in 2020

- the catch-up is.[PDF] Your Smart Target Member Kit Midcareer - CalSTRS.comhttps://www.calstrs.com › publication › your-smart-target-member-kit

- 2020. For your security

- when you update your mailing or email address

- ... Here are three examples for her Member-Only retirement benefit calculation

- not including any unused sick ... If she continues working until her 62nd birthday

- she would be eligible for the maximum ... Roth 403(b)

- Roth 457(b)

- Roth 401(k)

- Roth IRA.Related searchesSolo 401k growth calculator

- Fidelity 401k calculator

- Where to deduct solo 401k contribution

- Fidelity se 401k calculator

- Solo 401k calculator S corp

- IRS Publication 560 for 2019

- Fidelity Solo 401k

- Fidelity self-employed 401(k) contribution Remittance Form

- 401k limits 2020 calculator

- 401k max contribution 2020 calculator

- 401k contribution limits 2020 calculator

- maximum 401k contribution 2020 calculator

401k max 2020 contribution

[PDF] Maximum contribution, minimal work: the Solo 401(k) - TD Ameritrade

- maximum profit sharing contribution 2020

- profit sharing plan maximum contribution 2019

- defined benefit plan contribution limits 2020

- defined benefit plan contribution limits 2019

- 401k employer contribution limits 2020

- profit sharing plan maximum contribution 2018

- maximum pension contribution 2020

- 401k contribution limits 2019

- 401k max contribution 2020 over 50

- 401k max contribution 2020 catch up

- 401k max contribution 2020 employer

- 401k max contribution 2020 married

- 401k max contribution 2020 after tax

- max 401k catch up contribution 2020

- 401k max contribution 2020 calculator

- 401k max contribution 2020 irs

401k max 2020 roth

[PDF] 2019-2020 Contribution Limits for IRAs and - The Entrust Group

- max profit sharing contribution 2020

- 2020 retirement plan limits chart

- profit sharing plan maximum contribution 2019

- 2020 annual limits pdf

- 401k 2020 contribution limit irs

- 401(k max 2019)

- defined benefit plan contribution limits 2020

- 2020 annual limits relating to financial planning pdf

- 401k limits 2020 roth and traditional

- 401k limits 2020 roth

- 401k contribution limits 2020 roth

- max 401k contribution 2020 roth

- maximum 401k contribution 2020 roth

- roth 401 k max income 2020