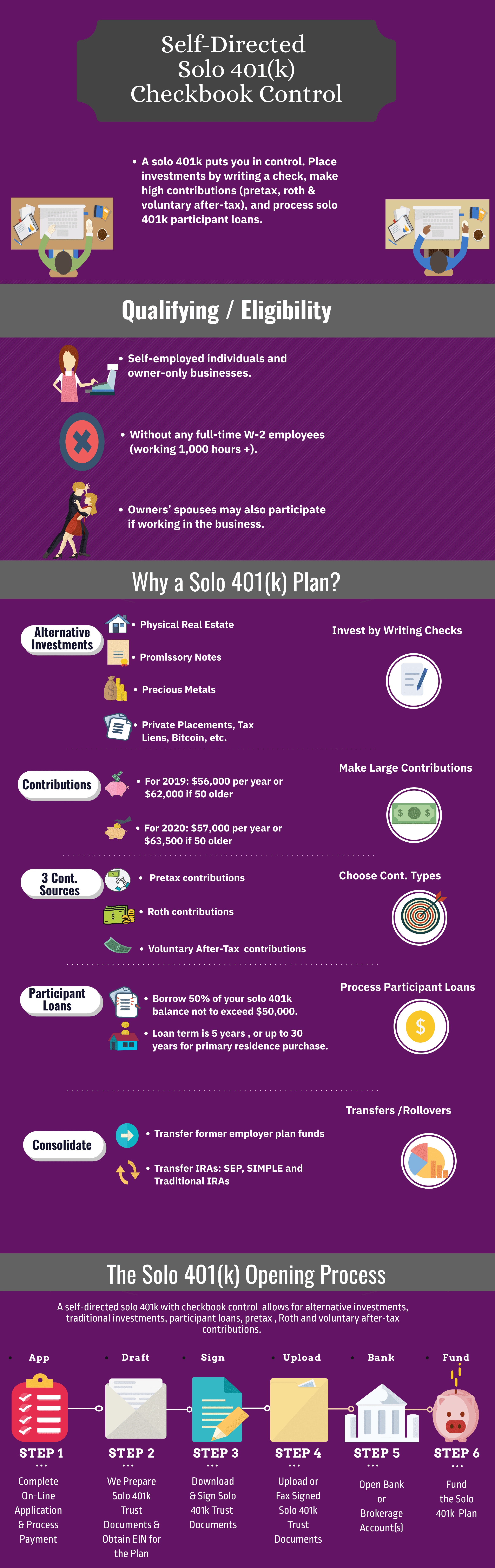

What are the 401(k) contribution limits?

Contributions to a 401 (k) plan must not exceed certain limits described in the Internal Revenue Code. The limits apply to the total amount of employer contributions, employee elective deferrals and forfeitures credited to the participant's account during the year. See 401 (k) and Profit-Sharing Plan Contribution Limits.

What is the 401k catch-up contribution limit for 2018?

The catch-up contribution limit for employees aged 50 and over who participate in 401k, 403b, most 457 plans and the federal government's Thrift Savings Plan remains unchanged at $6,000. The next page contains details on both the unchanged and adjusted limitations for 2018.

What is the limit on elective deferrals to a 401(k) plan?

The limit on employee elective deferrals to a SIMPLE 401 (k) plan is: $16,000 ($15,500 in 2023, $14,000 in 2022, $13,500 in 2021 and 2020; and $13,000 in 2019) This amount may be increased in future years for cost-of-living PDF adjustments Your plan's terms may impose a lower limit on elective deferrals

What is a 401(k) plan?

A 401 (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee’s wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

Plan Assets Must Not Be diverted.

The plan must make it impossible for its assets to be used for or diverted to, purposes other than the benefit of employees and their beneficiaries. As a general rule, the assets cannot be diverted to the employer. irs.gov

Contributions Or Benefits Must Not discriminate.

Under the plan, contributions or benefits must not discriminate in favor of highly compensated employees. Generally, employees with compensation of $150,000 or more from the employer in the prior year are considered highly compensated for 2023 ($135,000 for 2022, $130,000 for 2021 and for 2020; $125,000 for 2019; $120,000 for 2015, 2016, 2017 and 2

Contributions and Allocations Are LIMITED.

Contributions to a 401(k) plan must not exceed certain limits described in the Internal Revenue Code. The limits apply to the total amount of employer contributions, employee elective deferrals and forfeitures credited to the participant's account during the year. See 401(k) and Profit-Sharing Plan Contribution Limits. irs.gov

Elective Deferrals Must Be LIMITED.

In general, plans must limit 401(k) elective deferrals to the amount in effect under IRC section 402(g) for that particular year. The elective deferral limit is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2021 and in 2020 and $19,000 in 2019.) The limit is subject to cost-of-living adjustments. However, a 401(k) plan might also allow participants

Minimum Vesting Standard Must Be MET.

A 401(k) plan must satisfy certain requirements regarding when benefits vest. To "vest" means to acquire ownership. The vested percentage is the participant's percentage of ownership in his or her account. All participants must be fully (100%) vested in their 401(k) elective deferrals. A traditional 401(k) plan may require completion of a specific

Employee Participation Standards Must Be MET.

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements: 1. Has reached age 21 2. Has at least 1 year of service 2.1. (A traditional 401(k) plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not mo

Distribution Rules Must Be followed.

Generally, distributions cannot be made until a "distributable event" occurs. A "distributable event" is an event that allows distribution of a participant's plan benefit and includes the following situations: 1. The employee dies, becomes disabled, or otherwise has a severance from employment. 2. The plan ends and no other defined contribution pla

Benefits Must Not Be Assigned Or alienated.

The plan must provide that its benefits cannot be assigned or alienated. A loan from the plan to a participant or beneficiary is not treated as an assignment or alienation if the loan is secured by the participant's account balance and is exempt from the tax on prohibited transactions under IRC 4975(d)(1) or would be exempt if the participant were

Top-Heavy Plan Requirements Must Be MET.

A plan is top-heavy for any plan year for which the total value of accrued benefits or account balances of key employees is more than 60% of the total value of accrued benefits or account balances of all employees. Additional requirements apply to a top-heavy plan, including the requirement that non-key employees receive a minimum contribution and

|

2018-0001 Release Date: 3/30/2018 CC:TEGE:EB:QP4

30 mars 2018 January 11 2018. Number: 2018-0001 ... Regulations under Section 401(k) provide that a hardship distribution can only be made. |

|

History of 401(k) Plans: An Update

5 nov. 2018 2018 Employee Benefit Research Institute |

|

Rules and Regulations

20 juil. 2018 401(k)(2)(B) amounts held by the plan's ... 401(k)(3) |

|

401(k) LAWSUITS: WHAT ARE THE CAUSES AND

401(k)s are now the main type of employer-sponsored retirement plan. with creating regulations offering guidance |

|

2018 Instructions for Forms 1099-R and 5498

13 juil. 2018 made under a section 401(k) plan must meet the requirements of Regulations section 1.401(k)-1(f). (Regulations section 1.403(b)-3(c) for a ... |

|

171309 Deloitte Retirement Plan Loan Leakage POV

1 juil. 2022 defaults from 401(k) accounts over the next 10 years ... (2018). The Inconvenient Truth of Fiduciary Loan Regulation. Retrieved from. |

|

Internal Revenue Service

17 août 2018 correspondence dated February 22 2018 and May 3 |

|

2018 Instruction 1040

26 mars 2020 paying" rule for tax returns and pay- ... of 2018 and you meet the other rules un- ... for section 401(k)(11) and SIMPLE plans). |

|

BIPARTISAN BUDGET ACT OF 2018

9 févr. 2018 Appropriations for Disaster Relief Requirements Act 2018 ... of sections 401(k)(2)(B)(i) |

|

401(k) - Internal Revenue Service

401(k) Plan Checklist all plan requirements, and shouldn't be used as important that you review the requirements for operating your 401(k) retirement plan 8-2018) Catalog Number 48552T Department of the Treasury Internal Revenue |

|

History of 401(k) Plans: An Update - Employee Benefit Research

5 nov 2018 · Currently (for calendar year 2018), the maximum annual deferral that an individual can make to his or her 401(k) account is $18,500 (if age 50 or over, the participant may be eligible for up to $6,000 in catch-up contributions) |

|

Individual 401(k) Plan Document - Vanguard

E SIMPLE 401(k) Rules – Notwithstanding anything in this Plan to the contrary, is effective and such provisions apply to Plan operations as of April 1, 2018 |

|

401(k) - Center for Retirement Research - Boston College

May 2018, Number 18-8 with creating regulations, offering guidance, and 2017) Bloomberg Bureau of National Affairs 2018 ERISA Litigation Tracker |

|

Summary Plan Description for Employees Savings Plan 2018

Government regulations for 401(k) plans, such as the Plan, include a “ nondiscrimination test” to assure that all Plan Members benefit equitably, regardless of pay |

|

Plan Information - John Hancock

2018 John Hancock Life Insurance Company of New York, Valhalla, NY election in place as per Section 401(k)(12) of the Internal Revenue Code? 2018 Does the plan have two or more different eligibility rules for any single money type? |

|

401(k) - Ascensus

(Employers may apply this new safe harbor, created by the final hardship distribution regulations, to distributions taken on or after January 1, 2018 ) The plan |

|

What Employers Need To Know About H-2A Workers & 401(k) Plans

ACA Employer Shared Responsibility Regulations specifically decline to exclude For 2019 PY, an employee who earns more than $120,000 in 2018 PY |

|

Retirement plans guide: Facts at a glance (PDF) - Invesco

($275,000 for 2018) Solo 401(k) – 401(k) program designed for business owners with no employees 2 – Business owner contribution requirements are |

|

[PDF] 401(k) Plan Checklist - Internal Revenue Service

Every year it's important that you review the requirements for operating your 401( k) retirement plan Use this checklist to help you keep your plan in compliance |

|

[PDF] Publication 4806 (Rev 11-2018) - Internal Revenue Service

Contribution Limits ∎ 100 percent of the participant's compensation, or ∎ $55,000 for 2018 and $56,000 for 2019 If you, the employer, make contributions to a profit sharing plan, you can deduct up to 25 percent of the compensation paid during the taxable year to all participants |

|

[PDF] Instructions for Form 5500 - US Department of Labor

return report requirements of the 2018 Form 5500 See also requirements of Code section 401(k)(3)(A)(ii) by adopting the ''SIMPLE'' provisions of section |

|

[PDF] 401(k) PLAN 04-06-2018 - Brookhaven National Laboratory

Apr 6, 2018 · 04 06 2018 401(k) Plan's requirements Because the Under these regulations, you have the right to receive information regarding the |

|

[PDF] 401(k) LAWSUITS - Center for Retirement Research - Boston College

May 2018, Number 18 8 with creating regulations, offering guidance, and 2017) Bloomberg Bureau of National Affairs 2018 ERISA Litigation Tracker |

|

[PDF] Schwab Individual 401(k) Plan - Charles Schwab

©2018 Charles Schwab Co, Inc All rights reserved Your Employer has adopted the Schwab Individual 401(k) Plan (“the Plan”) to help The Plan document must follow certain federal laws and regulations that apply to retirement plans |

|

[PDF] New Disability Claims Procedure Rules To Take Effect In April 2018

Jan 25, 2018 · The Final Rule applies to disability claims filed after April 1, 2018 disability plans and other plans (eg, defined benefit plans, 401(k)s, ERISA |

|

[PDF] How America Saves 2018 - Vanguards Pressroom

Jun 3, 2018 · America Saves 2018 A report on Vanguard 2017 defined alternative (QDIA) regulations promulgated under the Roth 401(k) adoption |

|

[PDF] What Employers Need To Know About H-2A Workers & 401(k) Plans

ACA Employer Shared Responsibility Regulations specifically decline to exclude For 2019 PY, an employee who earns more than $120,000 in 2018 PY |

- maximum profit sharing contribution 2019

- 401k guidelines

- how to contribute $55

- 000 to 401k

- 401k handbook

- simple 401(k) contribution limits 2019

- 401k resources

- 401(k) administration guide

- 401k contribution age limit

- 401(k) regulations

- irs 401 k regulations

Solo 401k Controlled Group Rules - My Solo 401k Financial

Source:https://www.mysolo401k.net/wp-content/uploads/2019/10/Solo-401k.png

Solo 401k FAQs - My Solo 401k Financial

Source:https://www.kitces.com/wp-content/uploads/2017/10/Graphics_2-2.png

2018 Rules To Calculate Required Minimum Distributions (RMDs)

Source:https://www.trco.com/wp-content/uploads/2018/05/download_pdf_trco_official.jpg

401k Plan Termination Process

Source: The Ryding Company

401K Specialist Issue 3 2018

Source:https://i1.rgstatic.net/publication/46553032_Participation_in_and_Contributions_to_401k_Pension_Plans_Evidence_from_Plan_Data/links/0046352cea9c056bf8000000/largepreview.png

PDF) Participation in and Contributions to 401(k) Pension Plans

Source:https://www.julyservices.com/wp-content/uploads/2018/02/ADPACPTests_TechDoc.pdf.jpg

401k regulations 2019

[PDF] Proposed Hardship Withdrawal Regulations - Groom Law Group

- 2019 publication 560

- solo 401k

- solo 401k 5500 filing requirements

- publication 560 calculator

- owner-only 401k

- solo 401k rules

- irs 401k calculator

- self-employed 401k

- 401k guidelines 2019

401k regulations withdrawal

[PDF] US Bank 401(k) Savings Plan Summary Plan Description

- fidelity 401k terms of withdrawal pdf

- cares act 401k withdrawal

- charles schwab 401k withdrawal covid

- charles schwab 401k terms of withdrawal pdf

- does michigan tax 401k contributions

- fidelity 401k loan withdrawal terms and conditions

- state of michigan 401(k withdrawal)

- michigan tax early withdrawal 401k

- 401k requirements withdrawal

- 401k guidelines withdrawal

- 401k withdrawal requirements at age 70.5

- 401k withdrawal rule

- 401k withdrawal requirements at age 70

- 401k withdrawal rule changes

- 401k withdrawal rule of 55

- 401k withdrawal rule of thumb

401k rules

[PDF] Understanding the Roth 401(k) - Benefits

- solo 401k rules

- 401k rules for employers

- department of labor 401(k rules)

- self-directed 401k rules irs

- 401k law

- safe harbor 401k rules

- 401k regulations

- solo 401k eligibility

- 401k rules 2020

- 401k rules covid

- 401k rules for withdrawal

- 401k rules cares act

- 401k rules coronavirus

- 401k rules for employers

- 401k rules change

- 401k rules and regulations

401k statistics 2018

[PDF] 2018 Defined Contribution Trends - Callan

- 401(k participation statistics 2019)

- 401(k) participation statistics 2018

- american 401k statistics

- what percentage of u.s. population has a 401k

- bureau of labor statistics 401(k) plans

- retirement plan participation rates

- 401(k) automatic enrollment statistics

- 401k market size