|

Guidance for Coronavirus-Related Distributions and Loans from

Section 401(k)(2)(B)(i) generally provides that amounts attributable to elective contributions under a qualified cash or deferred arrangement may not be distributable to participants or beneficiaries earlier than severance from employment death or disability plan termination attainment of age 591⁄2 hardship of the employee entitlement to a |

|

Instructions for Form 8915-F (Rev January 2024)

30 jan 2024 · 2022 disaster distribution from your 401(k) plan in the If you aren't repaying qualified 2020 disaster distributions other than coronavirus- |

Is there a way to withdraw from 401K without penalty?

The IRS allows penalty-free withdrawals from retirement accounts after age 59½ and requires withdrawals after age 72. (These are called required minimum distributions, or RMDs).

You can withdraw money from your IRA at any time.

However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

What is Form 8915 E?

Form 8915 is used to report a disaster-related retirement distribution, and any repayments of those funds.

For tax years 2021 and 2022, Form 8915-F replaces Form 8915-E, which was the form used to report 2020 COVID-related qualified disaster distributions.

|

Guidance for Coronavirus-Related Distributions and Loans from

loan offsets is extended to the federal income tax return deadline for the year of the distribution. Section 401(k)(2)(B)(i) generally provides that amounts |

|

Instructions for Form 8915-F (Rev. February 2022)

15 fév. 2022 coronavirus-related distribution or other ... in 2021 (coronavirus-related distributions ... of plan such as a 401(k) plan and an IRA |

|

2021 Instructions for Form 5329

1 sept. 2021 additional tax on early distributions doesn't ... including 2020 coronavirus-related ... stock bonus plan (including a 401(k) plan);. |

|

2020 Instructions for Form 8915-E

11 fév. 2021 disaster is the coronavirus. 2. The distribution is a hardship distribution from a 401(k) plan a hardship distribution from a tax-sheltered ... |

|

Form 8915-F (January 2022)

Go to www.irs.gov/Form8915F for instructions and the latest information. Did you claim coronavirus-related distributions on 2020 Form 8915-E? |

|

2021 Instructions for Form 8915-D

14 fév. 2022 Internal Revenue Service ... you repay coronavirus-related distributions for 2021? ... more than one type of plan such as a 401(k). |

|

2020 Instructions for Form 8915-E

11 fév. 2021 Internal Revenue Service ... coronavirus-related distributions eligible for ... more than one type of plan such as a 401(k). |

|

2021 Publication 969

published go to IRS.gov/Pub969. COVID-19 is an eligible medical expense for tax purpo- ... Distributions may be tax free if you pay qualified medi-. |

|

2021 Publication 575

28 fév. 2022 of qualified coronavirus-related distributions see Qualified. Disaster Relief |

|

Retirement Plan Distributions

and tax issues for coronavirus-related distributions Excess 401(k) and 401(m) contributions. • Permitted withdrawals from an eligible automatic ... |

|

Guidance for Coronavirus-Related Distributions and Loans from

to distributions from eligible retirement plans that are coronavirus-related distributions additional tax under § 72(t) of the Internal Revenue Code (Code) (including the Section 401(k)(2)(B)(i) generally provides that amounts attributable to |

|

2020 Instructions for Form 8915-E - Internal Revenue Service

11 fév 2021 · If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31, you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E A distribution made December 31, 2020, is not a coronavirus-related distribution |

|

2020 Instructions for Form 5329 - Internal Revenue Service

18 fév 2021 · coronavirus-related distributions See The 10 additional tax on early distributions does stock bonus plan (including a 401(k) plan); TIP |

|

Common Tax Questions on CARES Act Withdrawals - Fidelity

On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help those plans [such as a 401(k) or 403(b)] Nonqualified CARES Act withdrawal, you'll need to download IRS Form 8915- E |

|

Coronavirus-Related Distributions

Coronavirus-Related Distribution (CRD) is a distribution that is made from an eligible retirement o Meet some other reason that the IRS decides to say is OK retirement plans such as 401(k) plans, 403(a) and (b) plans and annuities, and |

|

IRS releases Q&As on Coronavirus-related relief for retirement plans

A coronavirus-related distribution is a distribution that is made from an eligible retirement plan to a qualified individual from January 1, 2020 to December 30, 2020, |

|

Cares Act Distributions ncome tax overview

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) provides for up to $100,000 in distributions from all 401(a), 401(k), 403(a), 403(b), and On June 19, 2020, the IRS updated the definition of a “qualified individual” who |

|

Withdrawal – Coronavirus Related Distribution (CARES Act) - Varipro

the 10 early withdrawal penalty pursuant to IRS guidance when they file their personal taxes All changes must be initialed in pen (including numbers crossed |

|

[PDF] Notice 2020-50 (PDF) - Internal Revenue Service

Guidance for Coronavirus Related Distributions and Loans from Retirement distribution Section 401(k)(2)(B)(i) generally provides that amounts attributable to |

|

[PDF] 0 Early Withdrawals from Retirement Accounts During the Great

Income Division of the IRS as part of the Joint Statistical Research Program withdrawal, but a ten percent penalty in addition to the regular income tax from their employer and takes a withdrawal from a qualified 401(k) plan, they will pay |

|

[PDF] “CARES” Act - Smith, Gambrell & Russell, LLP

Apr 8, 2020 · Until the IRS issues guidance under the CARES Act, it may be Includes distributions from 401(k) plans, 403(b) plans, governmental 457(b) distribution right just for coronavirus related distributions, but could (for some |

|

[PDF] Withdrawal – Coronavirus Related Distribution (CARES Act) - Varipro

Country of residence Unless I have attached a completed IRS Form W 8BEN, withholding federal tax of 30 will apply 2 How much do you want to withdraw? 3 |

|

[PDF] COVID-19 hardship withdrawals and the impact to your participants

Mar 19, 2020 · hardship withdrawals in 401(k) or 403(b) plans, or change the general standards for The Internal Revenue Service (IRS) has not yet granted |

|

[PDF] COVID-19 Distribution Request Form - UA Local 342

Jul 1, 2020 · S \Supplemental 401(k) Retirement\Forms\Distributions\Distribution Forms Word I am liable for any income tax assessed by the IRS or State |

|

[PDF] Coronavirus Relief: What You Need to Know - T Rowe Price

Apr 15, 2020 · the 2020 coronavirus pandemic, the IRS has your bank account information already on minimum distribution and student loan relief □ □ |

- 401k withdrawal coronavirus irs

- irs 401k withdrawal covid 19

- irs.gov 401k withdrawal covid

401(k) Withdrawals: What Know Before Making One

Source: Ally

Publication 590-B (2019) Distributions from Individual Retirement

Source:https://www.irs.gov/pub/xml_bc/66303u25.gif

Publication 590-B (2019) Distributions from Individual Retirement

Source:https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026be426c2af200d-pi

Use Form 8915-E to report repay COVID-related retirement account

Source:https://www.signnow.com/preview/41/790/41790920.png

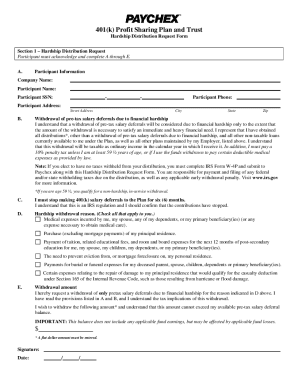

Paychex 401K Distribution Form - Fill Out and Sign Printable PDF

Source:https://www.irs.gov/pub/xml_bc/15142b12.gif

Publication 575 (2020) Pension and Annuity Income

Source: Internal

401k withdrawal covid proof

[PDF] SUMMARY TABLE AND IN-DEPTH ANALYSES OF - Ice Miller LLP

- 401k withdrawal coronavirus proof

- covid 19 401k withdrawal proof

401k withdrawal covid qualifications

[PDF] CARES Act Provisions

401k withdrawal covid reddit

[PDF] Prison's Response To COVID-19 Contested In Expert - Lawcom

- covid 19 401k withdrawal reddit

401k withdrawal covid vanguard

[PDF] Table of Contents - Norfolk Southern

- vanguard 401k withdrawal covid 19