|

402(g) contributions limits for plan participants

The chart below provides applicable limits for the current and recent tax years RETIREMENT PLANS 2019 2018 2017 2016 Elective Deferrals 401(k)/403(b) - 402(g)(1) 19000 18500 |

What is a 402(g) limit?

Salary Reduction Simplified Employee Pension Plans (SAR-SEPs), and Savings Incentive Match Plans for Employees (SIMPLE-IRAs). The 402 (g) limit is an individual limit and not a plan limit, so you must aggregate all elective deferrals contributed to all the plans in which you participate during the taxable year.

How much can I defer to my new employer's 401(k) in 2020?

The maximum you may defer to your new employer’s plan in 2020 is $17,000 (your $19,500 individual limit - $2,500 that you’ve already deferred to your former employer’s 401 (k)). The amount you can defer to both plans can’t exceed your individual limit for that year.

What are the 2019 tax limits for elective deferrals?

The 2019 limits are contained in Notice 2018-83, released Nov. 1. The limitation under Code Section 402 (g) (1) on the exclusion for elective deferrals described in Code Section 402 (g) (3) is $19,000. The IRS set the 2018 level at $18,500; the level for 2016 and 2017 was $18,000.

What is a 401(k) & 403(b) deferral limit?

In general, individuals must aggregate all the elective deferrals they made to any plan during the year. For example, if an individual made elective deferrals to a 401 (k) and a 403 (b) plan in 2023, their 402 (g) limit would still be $22,500, not $45,000 ($22,500 per plan).

Correcting Excess Deferrals

The excess deferrals can be correcting by distributing the excess (including earnings) by the due date of your tax return. irs.gov

Consequences If Excess Is Not Corrected

If the excess is not timely distributed, it is: 1. included in your taxable income for the year contributed, and 2. taxed a second time when the deferrals are ultimately distributed from the plan. The excess deferrals may not be distributed until a distribution is otherwise permissible under the terms of your plan. Additionally, you do not receive

Effect of Catch-Up Contributions

In determining whether you have exceeded the 402(g) limit, you can consider any catch-up contributions that you are eligible to make under IRC Section 414(v). Your catch-up contribution limit for 2023 is $7,500 (2020, 2021 and 2022 is $6,500). You are eligible to make a catch-up contribution if your plan provides for catch-up contributions and you

Additional Resources

Retirement Topics – ContributionsHow much salary can you defer if you’re eligible for more than one retirement plan?Retirement Topics – What happens when an employee has elective deferrals in excess of the limits? irs.gov

|

402(g) contributions limits for plan participants

The chart below provides applicable limits for the current and recent tax years. RETIREMENT PLANS. 2019. 2018. 2017. 2016. Elective Deferrals 401(k)/403(b) - |

|

2021 Limitations Adjusted as Provided in Section 415(d) etc

1 jan. 2021 limitations applicable to deferred compensation plans are also affected ... The limitation under § 402(g)(1) on the exclusion for elective ... |

|

ASC Compliance Off-Calendar and Projection Testing

16 juil. 2019 Catch-up Limits: 2017: $6000 ... Employee is not reported on 2018 402(g) test. ... Original $36 |

|

2022 Limitations Adjusted as Provided in Section 415(d) etc.

described in section 402(g)(3) is increased from $19500 to $20 |

|

WASHINGTON The Internal Revenue Service today announced cost

1 jan. 2019 2019 Limitations Adjusted As Provided in Section 415(d) etc. ... The limitation under § 402(g)(1) on the exclusion for elective deferrals ... |

|

WASHINGTON The Internal Revenue Service today announced cost

1 jan. 2020 participant's compensation limitation as adjusted through 2019 |

|

Retirement plan catch-up contributions

The annual 402(g) limit is an individual limit that applies to 401(k) and 403(b) the annual contribution limit for 2018 and 2019. Example 2:. |

|

Your guide to 403(b) tax-deferred annuity or voluntary savings plans

These are governed by Sections 415 and 402(g) of the Internal. Revenue Code (IRC). 2019 the limit is the lesser of $56 |

|

Voluntary 403(b) and 457(b) plan comparison-2019

100% of compensation in 2019. W Contributions must be aggregated with Roth contributions when applying limits. W Governed by Sections 415 and 402(g) limits. |

|

Retirement Plan Catch-Up Contributions

Appendix – Annual Deferral Limits Chart annual 402(g) limit or another plan-imposed limit ... from the ADP test for the 6/30/2019 plan year. |

|

Regulatory limits for 2020 - Vanguard Institutional

The 2020 plan limits for SIMPLE 401(k)/IRA plans are $13,500 for deferrals and 2019 2020 IRC §402(g) limit on 401(k), 403(b), and 457 elective deferrals** |

|

Cost of living adjustments

2019 2018 401(a)(17)/ 404(l) Annual Compensation 290,000 285,000 280,000 275,000 402(g)(1) Elective Deferrals 19,500 19,500 Limit 6,000 6,000 6,000 5,500 219(b)(5)(B) IRA Catch-Up Contributions 1,000 1,000 1,000 1,000 |

|

402(g) contributions limits for plan participants - TIAA

The chart below provides applicable limits for the current and recent tax years RETIREMENT PLANS 2019 2018 2017 2016 Elective Deferrals 401(k)/403(b) |

|

Basics of 401(k) Plans – Session 2 - asc-netcom

21 jan 2019 · o Code §402(g) and §401(a)(30) limit elective deferrals o Code §415 limits annual Dollar threshold = $120,000 - 2018 and $125,000 - 2019 |

|

Retirement plan catch-up contributions - Lincoln Financial Group

The catch-up is triggered once a participant meets the annual 402(g)/457 limit for the year or as a the annual contribution limit for 2018 and 2019 Example 2: |

|

General Testing Information - Empower Retirement - Plan Service

7 nov 2019 · For 2019 the compensation limit is $280,000 IRC §402(g)—Limitation on Elective Deferrals For 2019, the IRS limit on participant contributions |

|

Employer-Sponsored Retirement Plans Contribution and Benefit Limits

Source: Based on Internal Revenue Service data , November 2019 Elective Deferral Limit: The maximum annual pre-tax contribution a (IRC) 402(g) limit |

|

Retirement Plan Catch-Up Contributions

402(g) limit is an individual limit that applies to 401(k) and 403(b) plans special catch-up - §402(g)(7) 7 from the ADP test for the 6/30/2019 plan year 21 |

|

[PDF] IRS Indexed Limits for 2020 - The Standard

A lower limit applies to SIMPLE plans 3 All compensation from a single employer (including all members of a controlled group) must be aggregated for purposes of this limit 4 For the 2020 plan year, an employee who earns more than $125,000 in 2019 is an HCE |

|

[PDF] COLA Table

Cost of Living Adjustments for Retirement Items Code Section 2020 2019 2018 402(g)(1) Elective Deferrals 19,500 219(b)(5)(A) IRA Contribution Limit |

|

[PDF] Regulatory limits for 2020 - Vanguard

2019 2020 IRC §402(g) limit on 401(k), 403(b), and 457 elective deferrals** $18,500 $19,000 $19,500 Catch up contribution limit for employees 50 and older |

|

[PDF] Employer-Sponsored Retirement Plans Contribution and Benefit Limits

Source Based on Internal Revenue Service data , November 2019 Elective Deferral Limit The maximum annual pre tax contribution a (IRC) 402(g) limit |

|

[PDF] 2019 Retirement Plan Contribution Limits - SUNY

Nov 1, 2018 · plan are aggregated under IRC Section 402(g) $19,000 $18,500 457 Deferral Limits The lesser of the limitation on vested contributions to |

|

[PDF] Your guide to 403(b) tax-deferred annuity or voluntary - TIAA

There are maximum limits to how much you can contribute to your retirement plans each year These are governed by Sections 415 and 402(g) of the Internal |

|

[PDF] General Testing Information - Empower Retirement - Plan Service

Nov 7, 2019 · For 2019 the compensation limit is $280,000 IRC §402(g)—Limitation on Elective Deferrals For 2019, the IRS limit on participant contributions |

|

[PDF] Retirement plan catch-up contributions - Lincoln Financial Group

The catch up is triggered once a participant meets the annual 402(g) 457 limit for the year or as a the annual contribution limit for 2018 and 2019 Example 2 |

- 402g limit 2020 catch-up

- hce limit 2019

- hce limit 2020

- defined benefit plan contribution limits 2019

- 401(a)(17) limit 2019

- hce limit 2018

- key employee 2020

- irs notice 2019-59

- 402g limit 2019 catch up

- 402g limit 2019 irs

- 402g limit 2019 after tax

- 401k 402g limit 2019

- irs 402(g) limit 2019

- 402g contribution limits 2019

- 402(g) limit 2019

2020 Retirement Plan Limitations

Source: Pittsburgh Benefits Tax Wealth

Irs Announces Employee Benefit Plan Limits For 2019 - Dokter Andalan

Source:https://www.kitces.com/wp-content/uploads/2018/11/Parent-Subsidiary-Controlled-Group-b.png

Coordinating Contributions Across Multiple Defined Contribution Plans

Source:https://mvpplanadmin.com/wp-content/uploads/2018/10/2019-Increase.jpg

2019 Qualified Plans Deduction Limits - MVP Plan Administrators

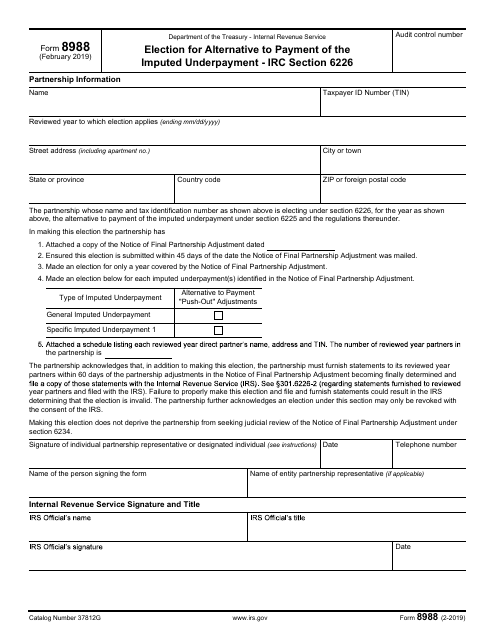

Source:https://data.templateroller.com/pdf_docs_html/1862/18624/1862491/irs-form-8988-election-alternative-to-payment-the-imputed-underpayment_big.png

IRS Form 8988 Download Fillable PDF or Fill Online Election for

Source:https://www.kitces.com/wp-content/uploads/2018/11/Combined-Controlled-Group.png

40k 3rd edition box set

[PDF] To whom it may concern, I am writing because it is my sad duty to

- 40k 3rd edition box set

- warhammer 40k 3rd edition box set

- warhammer 40k 3rd edition box

410 17 euros en lettre

[PDF] Lettre de demande d'autorisation unique pour un parc de production

- lettre administrative exemple

- le grand livre des modèles de lettres pdf

- unités

- dizaines

- centaines

- milliers

- tableau unité dizaine centaine dixième centième millième

- lettre de motivation

- tableau des unités

- demande d'emploi

- 410 17 euros en lettre

416 ccq

[PDF] Le choix de la loi applicable à la succession limité - Commentary

- article 416 ccq

42 000 btu to tons

[PDF] compressors - AC SUPPLY CO

- ashrae square foot per ton

- how many square feet does a 3 ton air conditioner cool?

- hvac tons

- how many tons of ac per square foot

- heat pump size calculator by square footage

- 3 ton vs 3.5 ton ac

- heat pump btu

- ac tonnage calculator per square foot

- 42 000 btu to tons

- 42 000 btu to kw