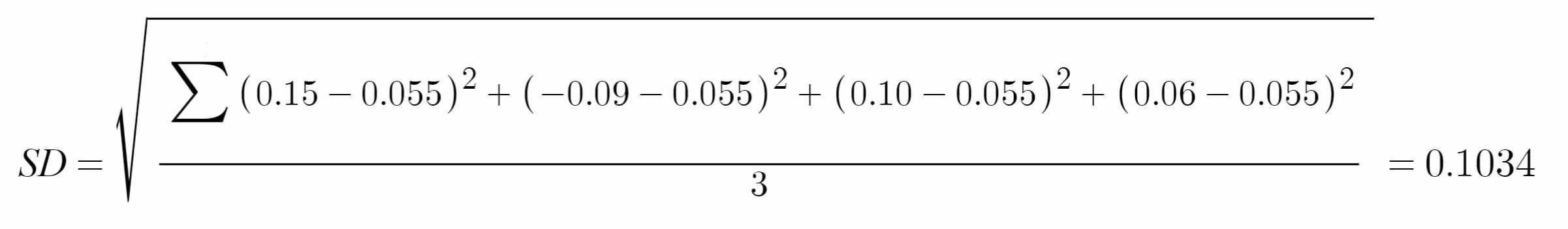

portfolio standard deviation formula

|

Chapter 1 Portfolio Theory with Matrix Algebra

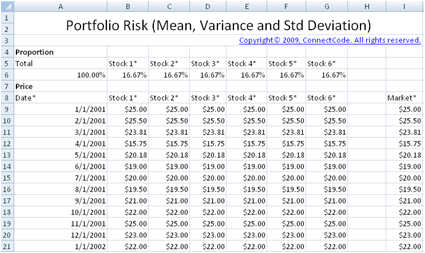

07-Aug-2013 The matrix algebra formulas are easy to translate ... and portfolio standard deviation ? |

|

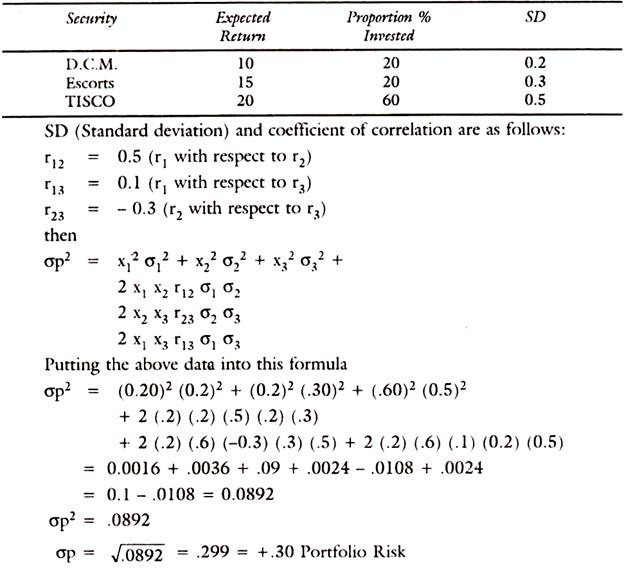

Markowitz Portfolio Analysis: The Demonstration Portfolio Problem

The key factors in calculating portfolio standard deviation are the weights standard deviations |

|

Chapter 7 Portfolio Theory

What are the variance and StD of a portfolio with 1/3 invested The volatility (StD) of portfolio return is: ... Standard Deviation (% per month). |

|

22% 32% 13% 23%

What are the investment proportions of the minimum variance portfolio of the two risky funds and what is the expected value and standard deviation of its |

|

3. Basics of Portfolio Theory

Develop the basic formulas for two- three- |

|

Risk and Return – Part 2

See the handout to convince yourself. Calculating the Standard Deviation of a Portfolio's Returns. The following formula is used. n is the number |

|

Handout 4: Gains from Diversification for 2 Risky Assets Corporate

The standard deviation (?) on the portfolio is: From the formula for the standard deviation: ... When ? = 1 the formula for variance becomes:. |

|

?P = x1 ?1 + x2 ?2 + x3 ?3

Recall that the standard deviation of the return on a portfolio having two risky assets can be determined using the formula. |

|

Value at Risk (B)

The RiskMetrics methodology for calculating a portfolio's value at risk is at the portfolio standard deviation through a fairly simple formula. The. |

|

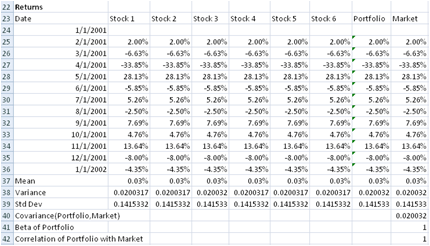

MIT Sloan Finance Problems and Solutions Collection Finance

information to determine which option has the higher market value? If What is the mean and standard deviation of portfolio. P's return? |

|

Lecture 3: Portfolio Management-A Risky and a Riskless Asset

Standard Deviation of Portfolio Return: One Risky Asset and a Riskless Asset Formula: holds when one asset is risky and the other is riskless: ?[Rp(t)] = ?ip ?[Ri(t)] where ?[Ri(t)] is the standard deviation of return on risky asset i in period t; |

|

3 Basics of Portfolio Theory - University of Scranton

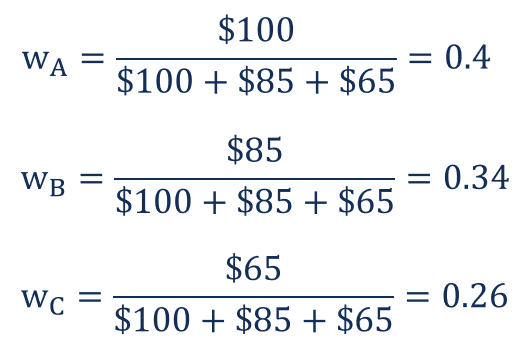

a two-security portfolio the weights of the two securities w 1 and w 2 must add up to one This means w 1 + w 2 = 1 (3 5) The expected return of the portfolio is simply the weighted average of the expected returns of the individual securities in the portfolio |

|

Portfolio Variance - Definition Formula and Example

Aug 7 2013 · and portfolio standard deviation values for all possible portfolios whose weights sum to one As in the two risky asset case this set can be described in a graph with on the vertical axis and on the horizontal axis |

|

1 Portfolio mean and variance - Columbia University

The performance of our portfolio can then be described by =?r1+ (1??)r2 (4) =E(r) =?r1+ (1??)r2 (5)f(?) =V ar(r) =?2?2 + (1??)2?2 + 2?(1??)?12 (6)denoting the (random) rate of return expected rate of return and variance of return respec-tively when using weights?and 1?? De?ning the correlation coe?cient?betweenr1 andr2 via ?12 ?=?1?2 |

|

Videos

The minimum-variance portfolio is found by applying the formula: wMin(S) = ? 2 B ? Cov(BS) ? 2 S + ? 2 B ? 2Cov(BS) = 225 ? 45 900 + 225 – 2 × 45 = 1739 wMin(B) = 8261 The minimum variance portfolio mean and standard deviation are: E(rMin) = 1739 × 20 + 8261 × 12 = 13 39 ?Min = [W 2 S ? 2 S + W 2 B ? 2 B + 2WSWBCov(SB)]1/2 |

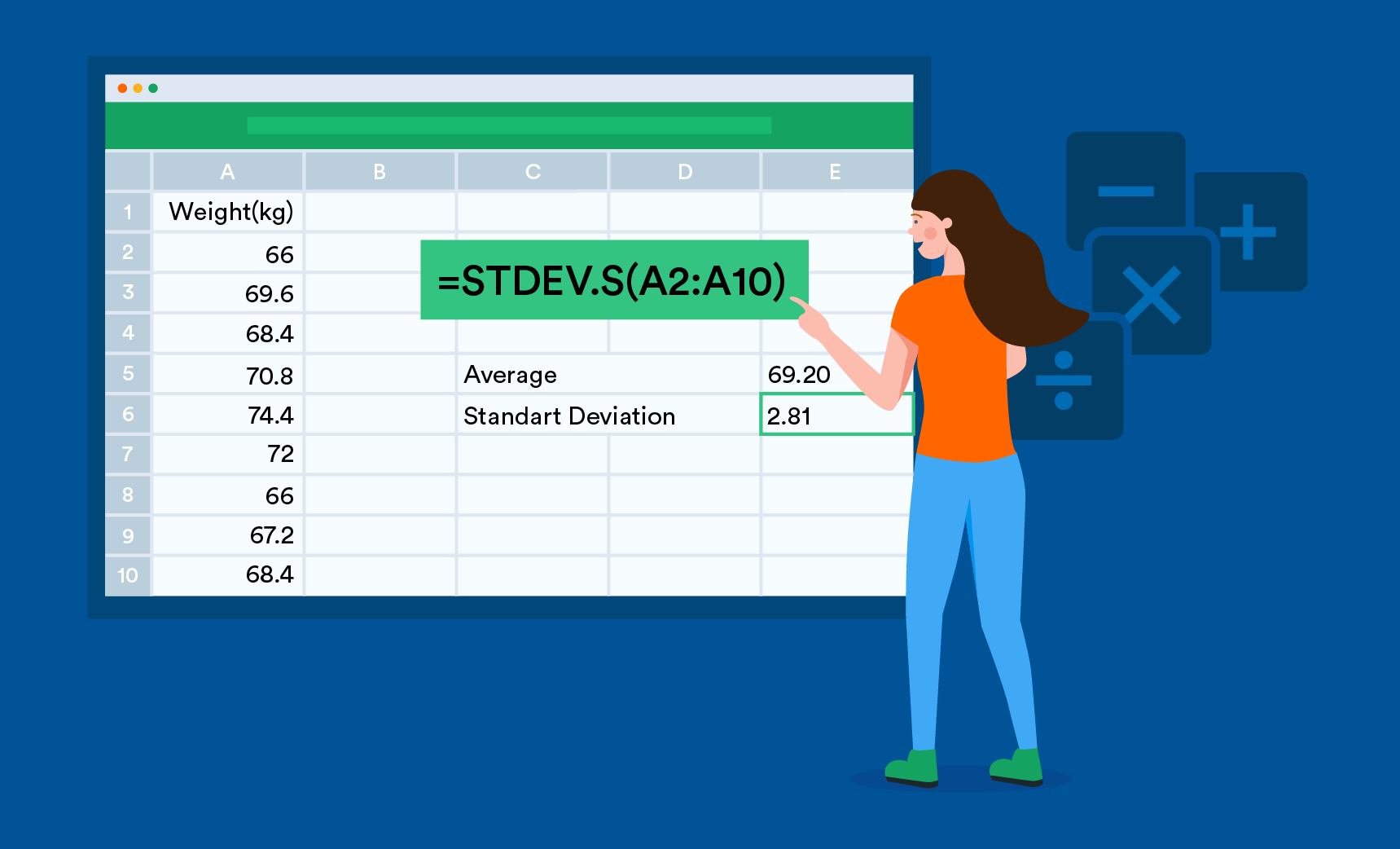

How do you calculate standard deviation of a portfolio?

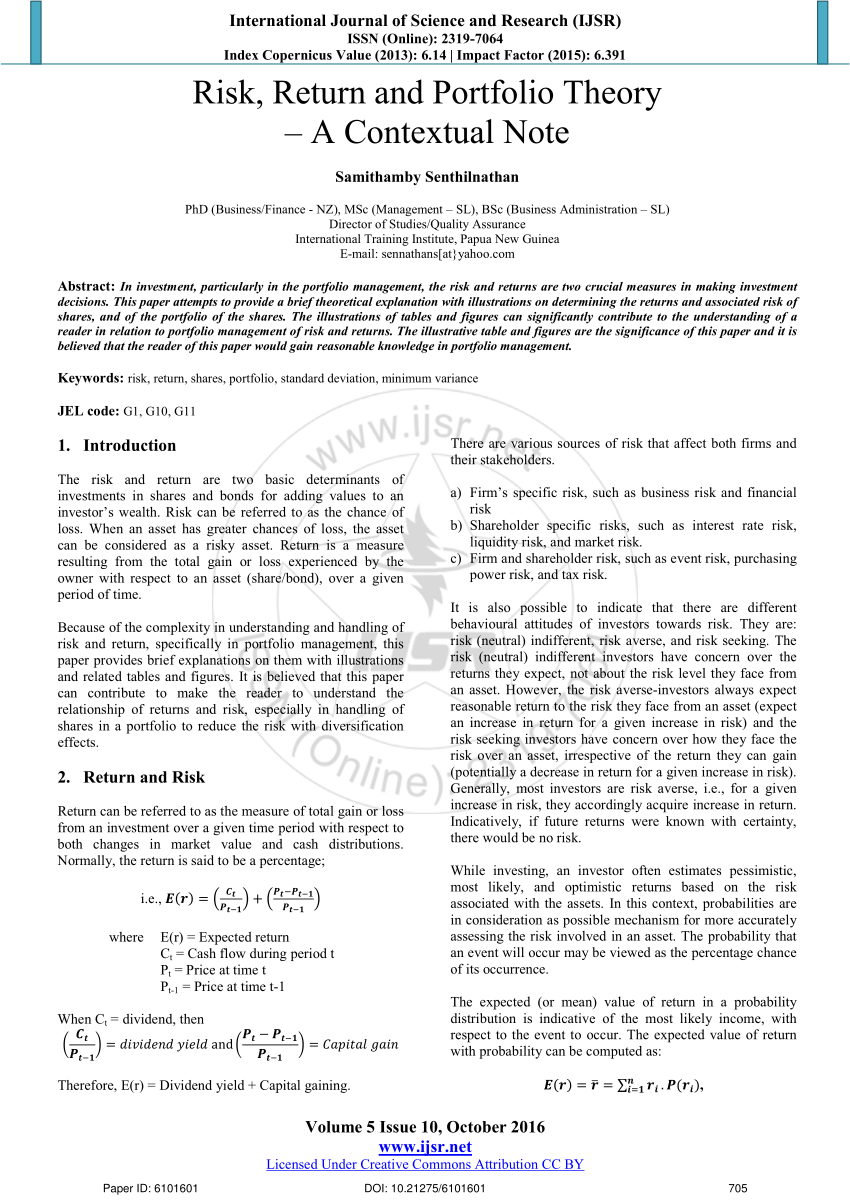

- Portfolio Standard Deviation is calculated based on the standard deviation of returns of each asset in the portfolio, the proportion of each asset in the overall portfolio i.e., their respective weights in the total portfolio, and also the correlation between each pair of assets in the portfolio. A high portfolio standard deviation highlights ...

What does standard deviation measure in my portfolio?

- Portfolio Standard Deviation is the standard deviation of the rate of return on an investment portfolio and is used to measure the inherent volatility of an investment. It measures the investment’s risk and helps in analyzing the stability of returns of a portfolio.

What is the standard deviation of the returns on a portfolio?

- Standard Deviation of Portfolio Definition. Standard deviation of portfolio return measures the variability of the expected rate of return of a portfolio. Formula. Consider the portfolio combining assets A and B. The formula becomes more cumbersome when the portfolio combines 3 assets: A, B, and C. Calculation Examples. A portfolio combines two assets: X and Y. ...

What is the formula for finding the standard deviation?

- Standard Deviation, ? = ? i = 1 n ( x i ? x ¯) 2 n. In the above variance and standard ...

|

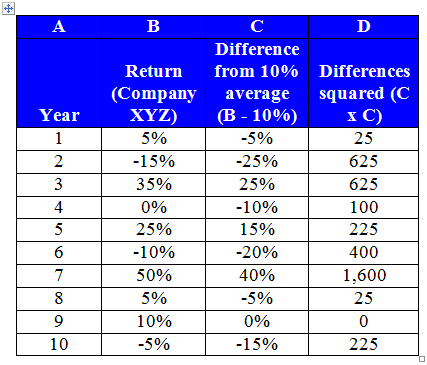

Risk and Return – Part 2

See the handout to convince yourself Calculating the Standard Deviation of a Portfolio's Returns The following formula is used n is the number |

|

Chapter 11 Expected Returns Variance and Standard Deviation

Deviation • Variance and standard deviation still measure the volatility of finding the portfolio return in each possible formulas as for an individual asset |

|

Chapter 7 Portfolio Theory

Standard Deviation ( , per m onth) Re tu rn ( , pe r m o nth) 2 ρ12 = ±1: Perfect correlation between two assets Portfolio Frontiers with Special Return |

|

Getting More Out of Two Asset Portfolios - CORE

the Efficient Frontier for a Portfolio of Two Risky Stocks The equations for calculating a two-asset portfolio's mean and standard deviation are available in any |

|

3 Basics of Portfolio Theory

Develop the basic formulas for two-, three-, and n-security portfolios The standard deviation of the returns of the portfolio is a measure of the uncertainty in the |

|

Portfolio Risk and Return - James Madison University - (educjmu

Portfolio theory addresses how risk is affected when a portfolio consists of more Calculating the standard deviation requires calculating the expected value of |

|

Outline Portfolio Expected Return and Standard Deviation - NYU Stern

Optimal portfolio choice with 2 risky assets Prof Lasse H With 2 securities, the portfolio variance is: 'volatility' is another word for 'standard deviation' Prof |

|

Diversification in an Equally-Weighted Portfolio - Squarespace

b Calculate the minimum number of stocks necessary so that the standard deviation is within 0 5 points of the standard deviation of a well-diversified portfolio |

|

Value at Risk (B) - Columbia Business School

Portfolio Standard Deviation The RiskMetrics methodology for calculating a portfolio's value at risk is based on the assumption that a portfolio's profit and loss |