portugal pension tax exemption

|

Portugal offers a special regime for new residents with attractive tax

It deals mainly with individuals receiving pension income. A separate it can indeed be tax exempt in Portugal or taxed at a special rate. This analysis. |

|

Taxation of Pensions in Portugal: A Semi-Dual Income Tax System

Tax deductible expens- es (e.g. contributions to retirement saving vehicles) are capped by an income-related global tax deduction amount. Total taxable income |

|

Agreement Between The United States And Portugal

A Portuguese benefit may affect your U.S. benefit retirement disability |

|

Portugal T2S: Tax impact on account structure and service offering

To be exempt from Portuguese withholding tax on interest from debt Credit institutions financial companies |

|

Portugal: Selected Issues; IMF Country Report No. 19/222; June 19

19 juin 2019 income is partially or fully tax exempted and pension benefits are taxed. OECD (2018b) includes. Portugal among the countries that rely ... |

|

Stocktaking of the tax treatment of funded private pension plans in

investment and pension income are tax-exempt to regimes where two out of three in Austria |

|

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED

America and the Portuguese Republic for the Avoidance of Double Taxation arising in and owned by a resident of one country will be exempt from tax by ... |

|

Taxation of Pensions in Portugal

euroFINESCO: Those with small pensions (less than €6000 p.a.) and no other forms of income are exempt from filing. This means that not filing a tax return |

|

New Forms of Tax Competition in the European Union: an Empirical

taxpayers exemption on portions of taxable income and various deductions (see Appendix Table A2 Pension schemes were first implemented in Portugal in. |

|

The tax treatment of retirement savings in private pension plans

1 déc. 2018 OECD PROJECT ON FINANCIAL INCENTIVES AND RETIREMENT SAVINGS ... tax-exempt to regimes where two out of three ... Malta |

|

Portugal o?ers a special regime for new residents - Deloitte US

Portugal levies an annual municipal tax based on the registered value of Portuguese real estate at rates between 0 3 and 0 45 (depending on the municipality and the type of real estate) Additional Property Tax will also be levied at a rate between 0 7 and 1 5 on properties with registered tax value equal or higher than €600000 |

|

Transfer UK Pension To Portugal Pension Advice Blacktower

Portugal – New Tax on Pension Income of Non-Habitual Residents Portugal’s annual State Budget Law for 2020 introduced a change to the ”non-habitual resident” (NHR) tax regime 1 The provision adopted would impose a 10-percent tax on foreign-source pension income This was expected in light of |

|

Non-habitual residents in Portugal Non-habitual residents in

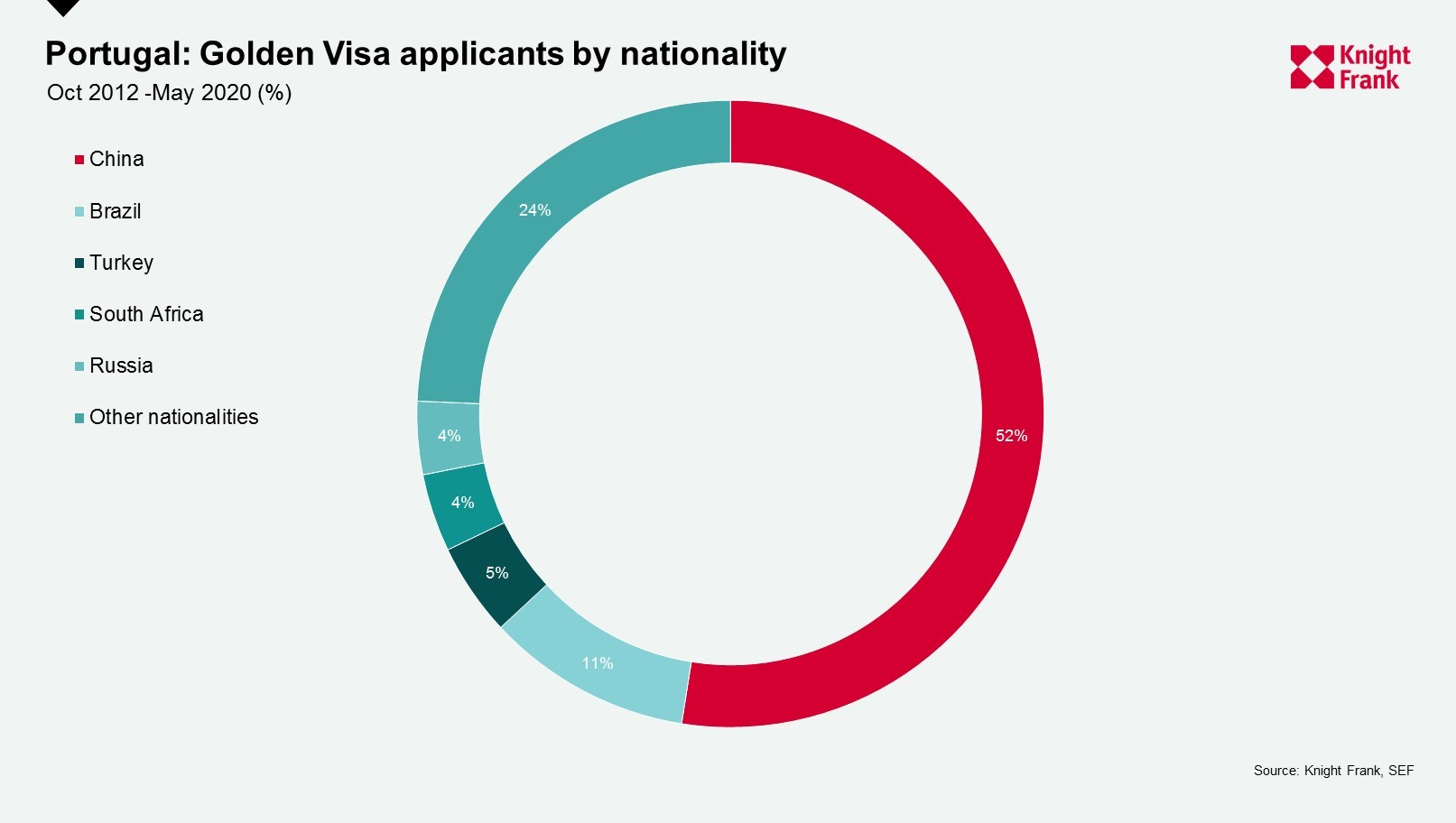

1 Obtain a Portuguese tax identification number register as a tax resident in Portugal and obtain the password to access the Tax Authority website (Portal das Finanças) 2 Apply for NHR status by 31 March of the year following the first year they became a tax resident in Portugal The non-habitual resident tax scheme (NHR) is a scheme |

|

Agreement Between The United States And Portugal

To establish an exemption from compulsory coverage and taxes under the Portuguese system your employer must request a U S certificate of coverage (form USA/P1) from the U S at this address:Social Security AdministrationOffice of Earnings and International Operations P O Box 17741Baltimore MD 21235-7741USA |

|

Blacktower Group – Tax in Portugal 2019

tax exemption on UK pension income and many other sources of foreign income NHR and Pensions The rules of the Non-Habitual Resident regime allow expats in Portugal to receive some forms of UK pension income tax-free in both countries In fact there are rules in place that may enable you to take your entire fund tax-free |

|

Searches related to portugal pension tax exemption filetype:pdf

full tax exemption applies to the following income obtained outside of Portugal: Pension income paid by non-Portuguese resident entities provided that such pension income does not derive from contributions that have been deducted for Portuguese individual income tax purposes (taxation at source is not required) |

Is my pension taxable in Portugal?

- Whether the pension is located in the UK, Malta, or Gibraltar, your pension funds will be exempt from income tax in Portugal. Your pension will then be taxable at the lower income tax rates available in the country where it is located.

Does Portugal tax non-residents?

- In effect, most double tax conventions (of which Portugal signed 87) grants the possibility to tax most categories of income to the country of source of such income, although in practice, so as to attract foreign investment, many countries will not make use of that possibility to tax non-residents.

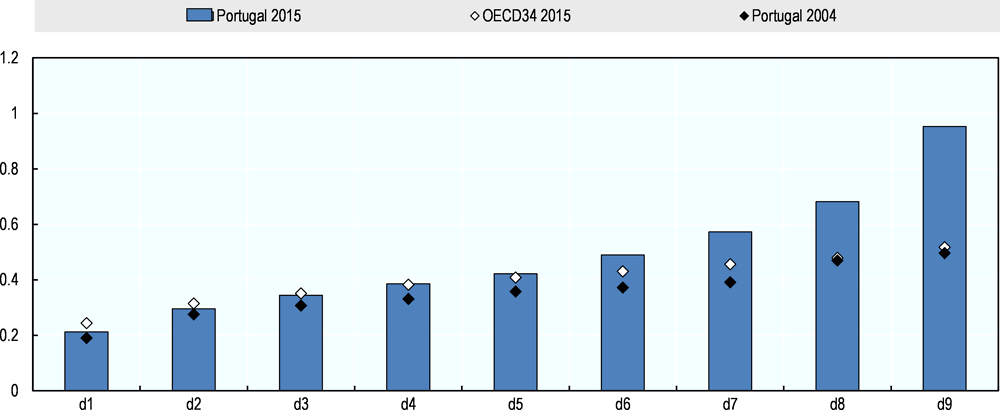

Is Portugal's pension system egalitarian?

- Portugal’s pension system is essentially financed by means of social insurance contributions. It is not designed to be egalitarian, though there are a few redistributive effects. Entitlement therefore primarily depends on your previous contributions into the system. Private pension schemes are not commonplace in Portugal.

|

Find out more Portugal offers a special regime for new - Deloitte

Portuguese special tax regime It deals mainly with individuals receiving pension income it can indeed be tax exempt in Portugal or taxed at a special rate |

|

GMS Flash Alert 2020-192 Portugal – New Tax on Pension Income

23 avr 2020 · to Portugal was the possibility for them to benefit from a tax exemption for certain types of foreign-source income, including pension income |

|

Taxation of Pensions in Portugal: A Semi-Dual Income Tax System

Additionally, the public system includes non-contributory, means-test- ed pension benefits and top-up minimum contributory benefits, fully funded by general taxes |

|

THE PORTUGUESE NON-HABITUALS RESIDENTS REGIME

foreign source income, including employment income, pensions, dividends and income may be exempt from Personal Income Tax in Portugal, provided that |

|

NEWSLETTER - Rogério Fernandes Ferreira & Associados

Legal 500 – Band 1 Tax “Portuguese Law Firm”/ Band 1 Tax “RFF Leading Individual” Portuguese Personal Income Tax foreign-sourced pension exemption |

|

Special tax regime for Non-Habitual Portuguese Resident individuals

abroad, a full tax exemption, for certain types of income derived by individuals A Pension income paid by non-Portuguese resident entities, provided that such |

|

Personal Income Tax

residents abroad are exempt from Personal Income Tax in Portugal provided that Pensions enjoy a ten-year exemption under the non habitual resident regime |

|

PORTUGALS NON-HABITUAL RESIDENT REGIME AN OVERVIEW

lights” with the tax authorities In any case, all EU member states are white-listed State and Occupational pensions will be tax-exempt in Portugal provided they |

|

NON-HABITUAL RESIDENTS TAX REGIME BENEFITS: The Non

applicable to Portuguese sourced income and may benefit from potential tax Foreign sourced occupational pensions shall benefit from a tax exemption if they |