profit sharing plan maximum contribution 2020

|

Profit Sharing Plans for Small Businesses - US Department of Labor

A profit sharing plan allows you to decide (within limits) from year to year whether to contribute for participants. The plan document will need a set |

|

2021/2022 dollar limitations for retirement plans

Some new limitations will apply to retirement plans and other benefit plans Traditional and Roth IRA contribution limit ... Profit Sharing 401(k) and. |

|

Profit Sharing Plans for Small Businesses

? 100 percent of the participant's compensation or. ? $57 |

|

2021 Publication 560

Defined contribution limits for 2021 and SEP (simplified employee pension) plans. ... IRA before 2020 contributions under a SEP. |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Calculating Your Maximum Plan Year Contribution Your maximum annual deductible contribution for profit sharing is 25% of compensation up to a total. |

|

2020 Limitations Adjusted as Provided in Section 415(d) etc.

The limitation for defined contribution plans under section 415(c)(1)(A) is amount used to determine the lengthening of the 5-year distribution period ... |

|

Publication 3998 (Rev. 11-2020)

DEFINED CONTRIBUTION PLANS. DEFINED BENEFIT. PLANS. Payroll. Deduction IRA. SEP. SIMPLE IRA Plan. Profit Sharing. Safe Harbor 401(k). Automatic Enrollment. |

|

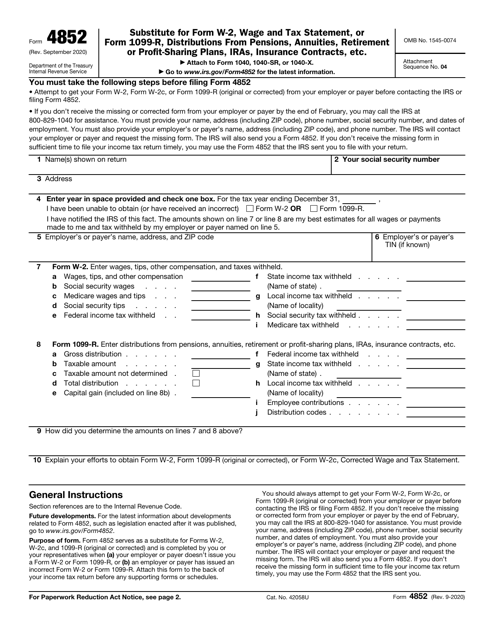

2022 Instructions for Forms 1099-R and 5498

Retirement or Profit-Sharing Plans IRAs |

|

Most Key Dollar Limits for Benefits and Executive Compensation to

17 nov. 2021 defined benefit plan. • The annual allocation limit for defined contribution plans is increased from $58000 to $61 |

|

2020 Instructions for Forms 1099-R and 5498

14 févr. 2020 Retirement or Profit-Sharing Plans IRAs |

|

2020 Contribution Limits and Tax Reference Guide - Merrill

• Maximum total contributions per employee are limited to the lesser of $57000 or 100 of compensation and compensation taken into account for retirement plan contributions is capped at $285000 per employee • 401(k) salary deferrals and employer contributions to profit-sharing plans are aggregated for purposes of this limit; catch-up |

|

CHOOSING A RETIREMENT SOLUTION - Internal Revenue Service

maximum contribution eligible for the credit is $2000 The credit rate can be as low as 10 percent or as high as 50 percent depending on the participant’s adjusted gross income; and A Roth program that can be added to a 401(k) plan to allow participants to make after-tax contributions into separate accounts providing an additional way |

|

The Tax Rates on Cashing Out of Profit Sharing Budgeting Money - Th

profit sharing plan is a type of plan that gives employers flexibility in designing key features It allows you to choose how much to contribute to the plan (out of profits or otherwise) each year including making no contribution for a year Profit sharing plans have additional advantages: Can help attract and keep talented employees |

|

Part I Section 401 -- Qualified Pension Profit-Sharing and

For purposes of determining covered compensation for the 2020 year the taxable wage base is $137700 The following tables provide covered compensation for 2020 ATTACHMENT I 2020 COVERED COMPENSATION TABLE CALENDAR CALENDAR YEAR OF 20 COVERED YEAR OF SOCIAL SECURITY COMPENSATION BIRTH RETIREMENT AGE TABLE II 1907 1972 $ 4488 |

|

PROFIT SHARING PLAN AND MONEY PURCHASE PLAN CONTRIBUTION

15 Maximum Profit Sharing Plan Dollar Contribution Amount 15 $ 41566 (Subtract Line 13 from Line 12) 16 Profit Sharing Plan Contribution Amount 16 $ 11152 (The lesser of Line 14 and Line 15) 17 Total Paired Plan Contribution Amount 17 $ 1858 6 (The sum of Line 13 and Line 16) 2009 Example Yourself |

|

Searches related to profit sharing plan maximum contribution 2020 filetype:pdf

Maximum contribution limit Single $3600 $3650 Family $7200 $7300 Catch-Up (age 55 by the end of the year) $1000 $1000 Minimum annual deductible for High Deductible Health Plan (HDHP) Single $1400 $1400 Family $2800 $2800 HDHP maximum out-of-pocket expenses Single $7000 $7050 Family $14000 $14100 |

Can I take money out of my profit sharing?

- You can only withdraw profit-sharing money under certain circumstances. You will receive a distribution if your employer ends the plan without creating a replacement. You can take your money once you reach age 59 1/2 or if you suffer a qualified financial hardship.

Does profit sharing count towards 401k limit?

- The column labeled “Total Contribution Limit” is the maximum you can apply to your 401k plan in any given year if you are under age 50. This includes all possible contributions, including employee contributions, employer contributions, profit-sharing, or any other allowable contributions.

What is Max 401k contribution?

- The IRS maximum 401K contribution is how much you can personally contribute to your 401K during a calendar year. Your employer’s maximum 401K contribution limit is entirely up to them – but the max on total contributions (employee plus employer) to your 401K is $61,000 in 2022 (or 100% of your salary, whichever is less).

|

2020/2021 dollar limitations for retirement plans - RBC Wealth

Some new limitations will apply to retirement plans and other benefit plans in 2021 as a result of The limits for 2021, as well as the 2020 limits, are as follows : Maximum employer non-elective contribution Profit Sharing, 401(k), SEP and |

|

Employer-Sponsored Retirement Plans Contribution and Benefit Limits

2020 Employer-Sponsored Retirement Plans Maximum Contribution and Benefit Limits: employer profit-sharing accounts (also known as the IRC 415 limit) |

|

2020 Publication 560 - Internal Revenue Service

1 mar 2021 · fined contribution plan is $57,000 for 2020 and Defined benefit limits for 2020 and 2021 stead of setting up a profit-sharing or money |

|

401(k), 403(b) and Profit-Sharing Plan 2020 Contribution Limits

The annual additions paid to a participant's account cannot exceed the lesser of: 1 100 of the participant's compensation, or 2 $57,000 ($63,500 including |

|

Retirement Plan Benefit and Contribution Limits for 2020

The Internal Revenue Service has announced the contribution limits and thresholds for retirement plans for the Tax retirement plan parameters Type of Limitation or Threshold 2020 2019 2018 401(k) SEP-IRA and Profit Sharing Plan |

|

2019 - 2020 Qualified Plan Limits pdf - T Rowe Price

AND CONTRIBUTIONS FOR RETIREMENT PLANS AND IRAS RETIREMENT PLANS 2020 Amount 2019 Amount 401(k), 403(b), PROFIT SHARING AND |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Calculating Your Maximum Plan Year Contribution If you are Your maximum annual deductible contribution for profit sharing is 25 of Total profit sharing and salary deferral contributions may not exceed $57,000 for 2020 and $58,000 for |

|

General Overview 401(k) PROFIT SHARING PLAN - Nicholas

A profit sharing 401(k) plan allows contributions through three different over 5 owner, compensation over $130,000 in 2020 (may limit to top 20 ), or a |

|

Business Owner Guide - Invesco

1 Maximum considered compensation is $285,00 for 2020, indexed for inflation As with all profit-sharing plans, all contributions to an age-weighted plan are |

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)