taxes for american retirees in spain

|

Agreement Between The United States And Spain

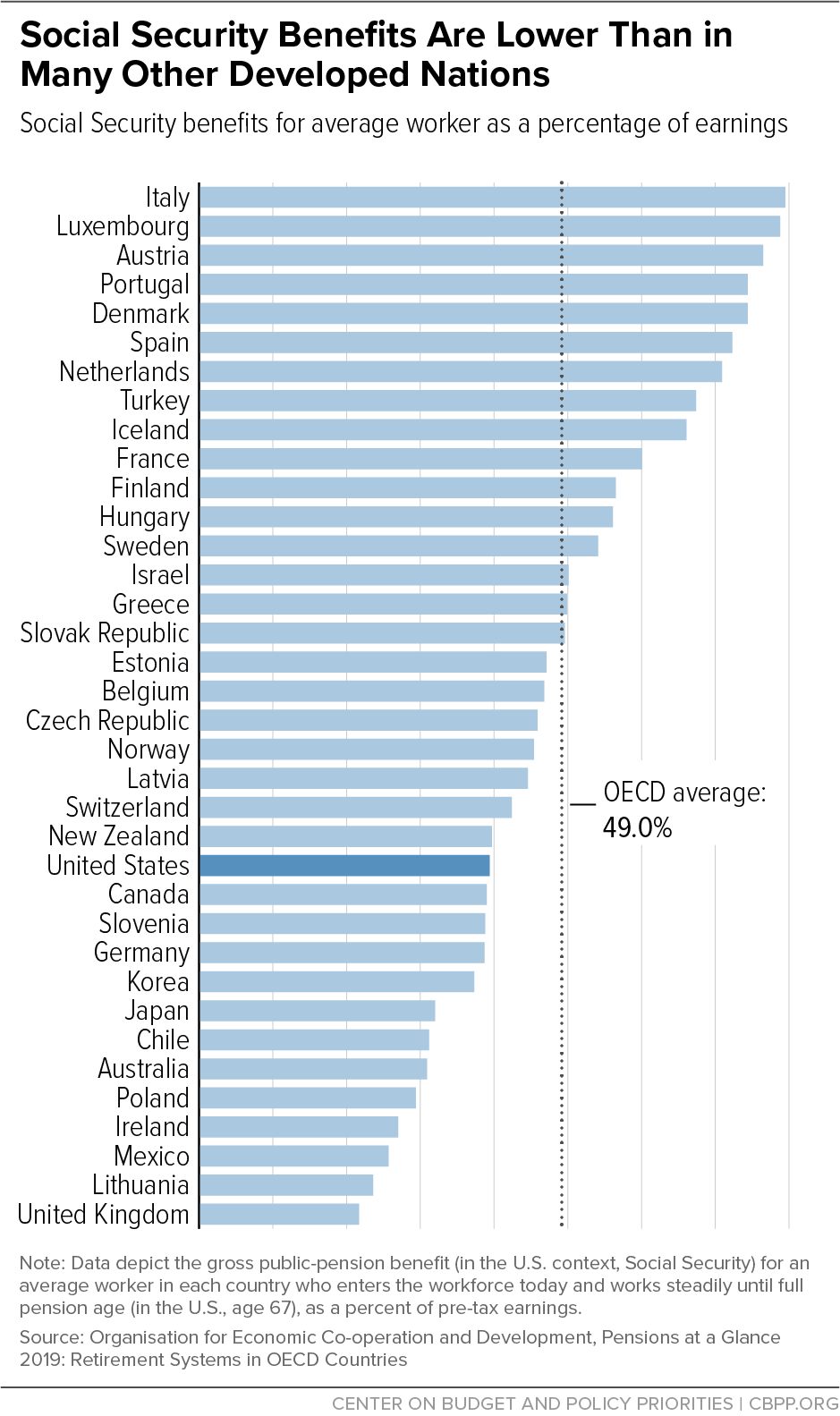

A Spanish pension may affect your U.S. benefit The agreement covers Social Security taxes ... Security retirement disability and survivors. |

|

Agreement Between the United States of America and the Kingdom

Spain to Improve International Tax Compliance and to Implement FATCA purposes of section 1471 of the U.S. Internal Revenue Code Spanish retirement. |

|

Agreement Between The United States And Portugal

covers Social Security taxes (including the. U.S. Medicare portion) and Social Security retirement disability |

|

Agreement Between The United States And France

covers Social Security taxes (including the. U.S. Medicare portion) and Social Security retirement disability and survivors insurance benefits. |

|

United states-trinidad and tobago income tax convention

Convention Signed at Port of Spain January 9 1970;. Ratification Advised by the Senate of the United States of America |

|

Tax Guide for U.S. Citizens and Resident Aliens Abroad

IRS.gov/Spanish (Español). • IRS.gov/Chinese (??) retirement plan and your 2021 modified adjus- ... tax filing requirements that apply to U.S. citi-. |

|

2021 Publication 519

20 avr. 2022 IRS.gov/Spanish (Español) ... Table A. Where To Find What You Need To Know About U.S. Taxes ... 1040-SR U.S. Tax Return for Seniors. |

|

Living in France

You must then pay a tax using tax stamps. The issuance of your residence permit does not automatically mean that you are permitted to work. You must register |

|

Your Payments While You Are Outside the United States

Spain. • Sweden. • Switzerland. • United Kingdom If you are under full retirement age your ... subject to U.S. Social Security taxes. It. |

|

Trouble-free travel - What you need to know about French customs

customs territory* or a non-EU territory for tax purposes*. Goods you have purchased or may not be imported: Staffordshire bull terriers |

|

Agreement Between The United States And Spain

Agreement Between The United States And Spain Agreement Between The United States And Spain Contents Introduction 1 Coverage and Social Security taxes 2 Certificate of coverage 4 Monthly benefits 5 A Spanish pension may affect your U S benefit 8 What you need to know about Medicare 8 Claims for benefits 9 |

Snapshot of Taxes in Spain

- Primary tax forms: Modelo 100

How Do Expat Taxes in Spain Work For Americans Living there?

- Americans who are considered tax residents of Spain are typically subject to taxation on their worldwide income, and most will need to file a Spanish tax return.

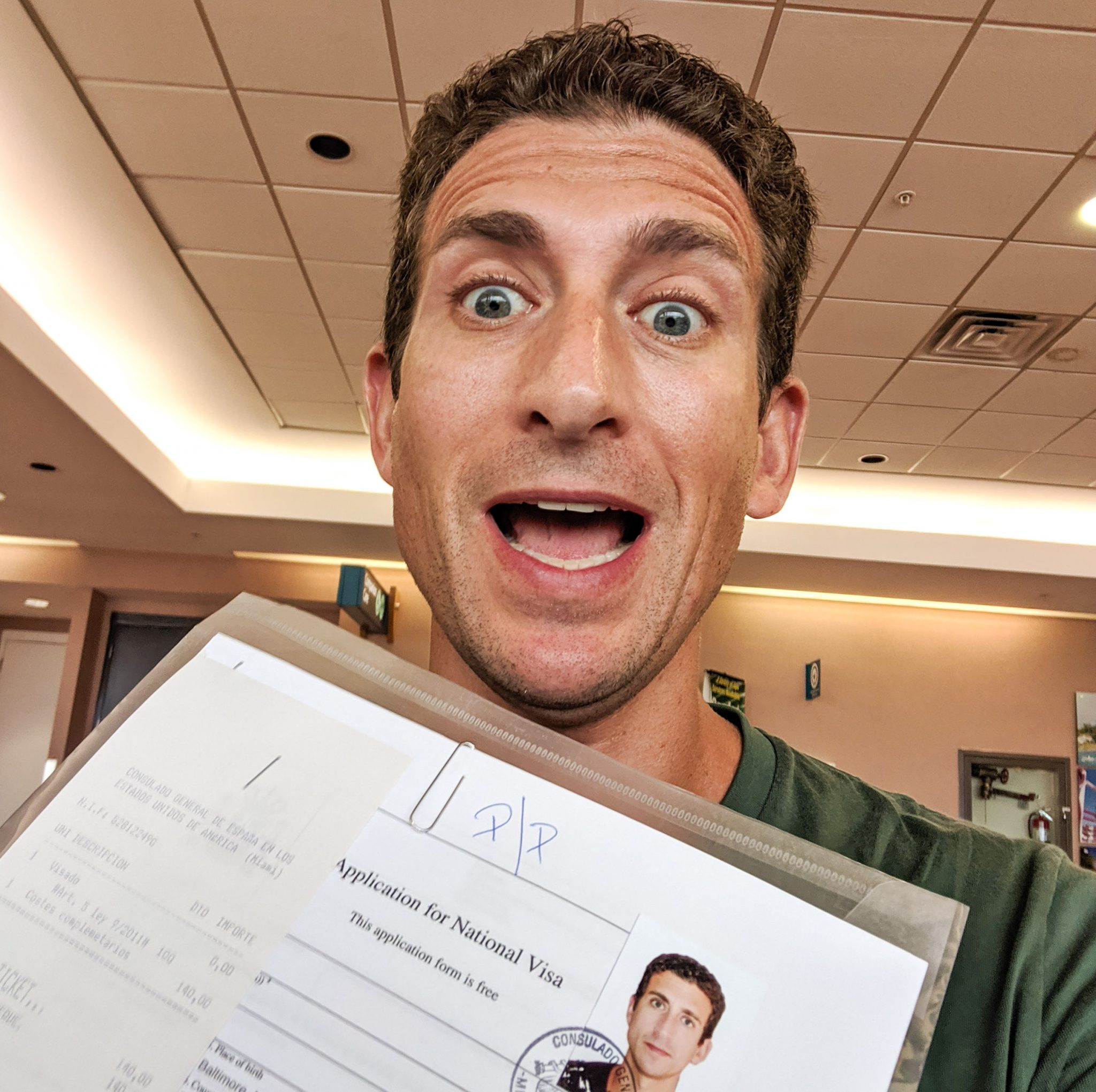

Do Us Expats Living in Spain Also Have to File Us Taxes?

- Due to the US’s citizenship-based taxation system, any American citizen or permanent resident who meets the minimum income reporting threshold must file a US tax return, regardless of where in the world they reside

- Americans abroad get an automatic two-month filing extension until June 15th which can be extended further to October 15th

- However, a...

Does Spain Have A Tax Treaty with The Us?

- Spain does have a tax treaty with the US that, in theory, prevents double taxation

- However, the benefits are limited due to the Savings Clause, which allows the US government to act as if the treaty didn’t exist

- Most Americans in Spain are better off claiming one or more of the tax breaks mentioned below.

Common Tax Deductions Available For Expats in Spain

- Many US expats avoid the issue of navigating foreign and US tax filing because they’re worried about being double-taxed

- While the idea of having to pay taxes on the same income to two different governments might sound frightening, the reality is that most expats can avoid it by claiming tax breaks

- In some cases, strategic filing as an expat can e...

Tax Implications of Renting Out Your Us Residence While in Spain

- Americans who move to Spain but own property in the US often choose to rent it out

- If you do this, just make sure to report any relevant income/expenses associated with the rental of the property via Schedule E

- Note: Because this income is considered passive US-sourced income, you cannot exclude it via the FEIE

Us Expats Living in Spain May Need to File An FBAR Or Form 8938

- US expats with a total of at least $10,000 in one or more foreign accounts at any time during the tax year must file FinCEN form 114, otherwise known as a Foreign Bank Account Report (FBAR)

- Meanwhile, Americans owning foreign assets valued at a combined total of over $200,000 on the last day of the tax year — or $300,000 at any point during the ye...

I’m A Us Expat Who’s Lived in Spain For years. Do I Owe Past Us Tax Returns?

- Yes

- Even if you didn’t know that you had to pay US taxes as an expat, you still must do so for any year that you met the minimum income reporting threshold

- If you realize you owe past tax returns, file them as soon as possible.

Getting Caught Up on Your Us Taxes with The Streamlined Procedure

- The good news for those behind on their US tax returns is that the IRS offers a voluntary amnesty program called the Streamlined Procedurethat allows expats who non-willfully fell behind on their taxes to catch up without additional fees or penalties

- To do so, they must file their last three tax returns, six FBARs (if applicable), and include a st...

Do Americans pay tax on rental income in Spain?

Americans living in Spain are technically subject to taxation on rental income by both governments. However, they can often avoid double taxation by claiming one of the tax breaks mentioned above.

Do I need to file a tax return in Spain?

Luckily for retirees, Spain has low property taxes. There are some instances where you will need to file a Spanish income tax return. This is the case if you reside in Spain for more than six months of the year and your income is above 22,000 Euros. The income tax still applies when your income comes largely from U.S. accounts.

Is my 401k taxable in Spain?

“I think the value of your 401K is subject to Spanish wealth tax, which is between zero and 2% depending on region. The first 1M per person is exempt if you buy a home in Spain.” “Your state pension is not taxable. I have exactly the same. My gestor said any retirement connected to government was excluded. I was a teacher in Arizona!!”

Can an expat retire in Spain?

If you’re a resident of Spain, you can take advantage of the country’s comprehensive public healthcare program. As an expat retiree, you can qualify for public healthcare if you are a resident, an employee or self-employed worker in Spain who pays into Social Security or a state pensioner.

|

Agreement Between The United States And Spain - Social Security

The agreement covers Social Security taxes (including the U S Medicare portion ) and Social Security retirement, disability and survivors insurance benefits |

|

Tax treaty - US Embassy in Spain

Convention between The United States of America and The Kingdom of Annotation: The first income tax treaty between United States and Spain and the similar entity organized for purposes of providing retirement, disability, or other |

|

Pension Country Profile: Spain - OECD

Retirement savings accounts (RSAs): capital guaranteed individual savings TQPP Tax Qualified Pension Plan UK United Kingdom US United States of |

|

TAXATION OF NON-RESIDENTS - Agencia Tributaria

16 mai 2011 · The way in which an individual or organisation must pay tax in Spain is permanent disability or severe disability or for retired public servants as a considered to be partnerships or organisations not subject to US |

|

Publication 554 - Internal Revenue Service

14 jan 2021 · it helpful to visit a Volunteer Income Tax Assistance (VITA), Tax Counseling for the Elderly (TCE), or American Association of Retired Persons |

|

THE EFFECTS OF THE INTRODUCTION OF TAX INCENTIVES ON

2 In the US, there are two schemes favouring retirement savings, IRAs and 401(k) episode: the introduction of tax incentives of retirement in Spain in 1988 We |

|

Optimal progressivity of personal income tax: a - Banco de España

wealth inequality in Spain, they show that it exceeds income inequality and it U S earnings and wealth inequality 3 Heterogeneity is introduced in this setup via The households can be either of working-age or retired and they are all |