taxes in spain compared to us

|

Agreement Between The United States And Spain

The agreement covers Social Security taxes. (including the U.S. Medicare portion) and Social. Security retirement disability and survivors insurance benefits. |

|

INCOME TAX CONVENTION WITH SPAIN WITH PROTOCOL

18 avr. 1990 GEORGE BUSH. CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE KINGDOM OF. SPAIN FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION ... |

|

Agreement Between the United States of America and the Kingdom

Spain to Improve International Tax Compliance and to Implement FATCA reporting obligations under FATCA with other U.S. tax reporting obligations of. |

|

United states-trinidad and tobago income tax convention

Convention Signed at Port of Spain January 9 1970; (c) To prevent the United States from imposing a tax burden comparable to that. |

|

Wealth and Inheritance Taxation: An Overview and Country

In France Germany |

|

Measures against tax havens in Spain Ecuador and the United

measures against tax havens are a common practice in different Anti-tax haven measures in Spain ... $365 million as compared to the USD $415 mil-. |

|

Technical Explanation of the Protocol Amending the Convention

19 jui. 2014 For example if a U.S. LLC with members who are residents of Spain elects to be taxed as a corporation for U.S. tax purposes |

|

Protocol Amending the Convention US and Spain for the ...

14 jan. 2013 (b) in a state that has an agreement in force containing a provision for the exchange of information on tax matters with the Contracting State. |

|

New Protocol amending the current U.S. - Spain Tax Treaty

On 14 January 2013 the U.S. and Spain signed a new protocol (the 1990 tax treaty for the avoidance of double taxation in force between the two countries ... |

|

Spain Highlights 2022 - Deloitte US

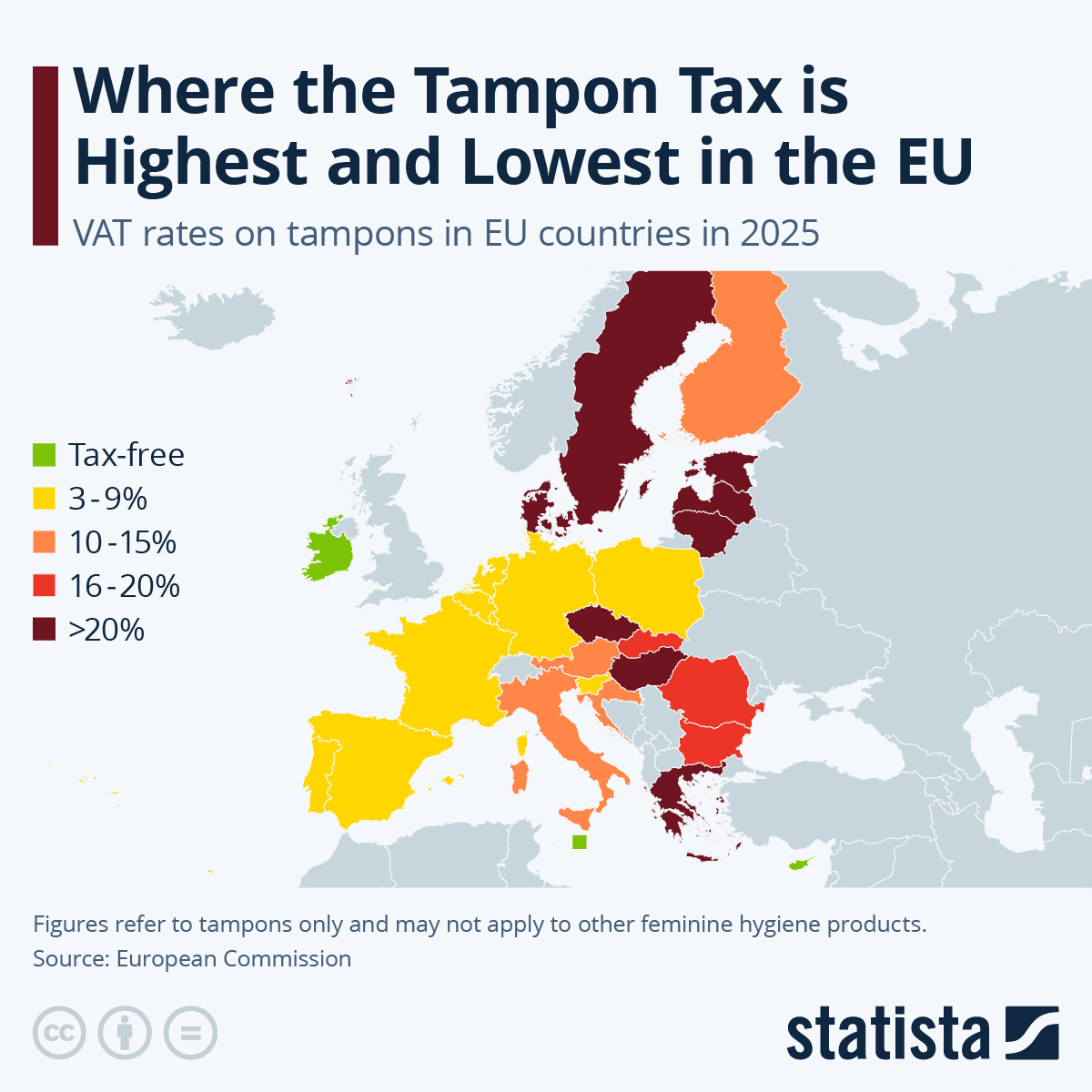

Nonresident individuals and companies without a PE in Spain are subject to a 24 withholding tax (19 if the recipient is resident in the EU or in the EEA if the country of residence of the recipient exchanges tax information with Spain) unless the rate is reduced by a tax treaty or the royalties qualify for an exemption under the EU interest |

|

US Expat Taxes for Americans Living in Spain Bright!Tax

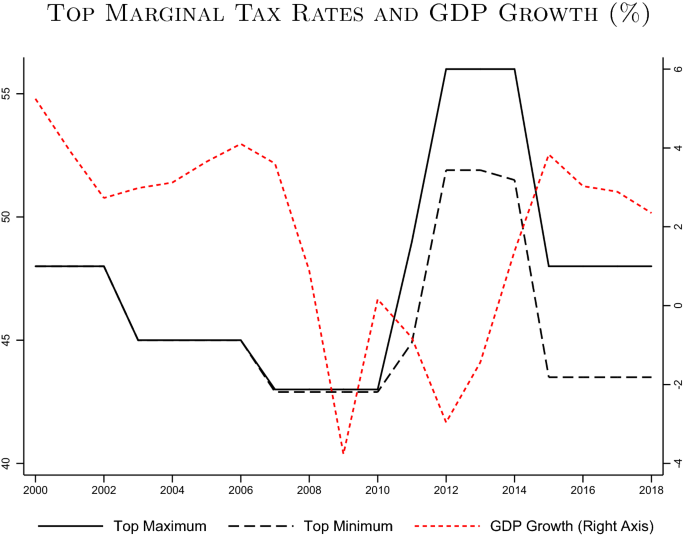

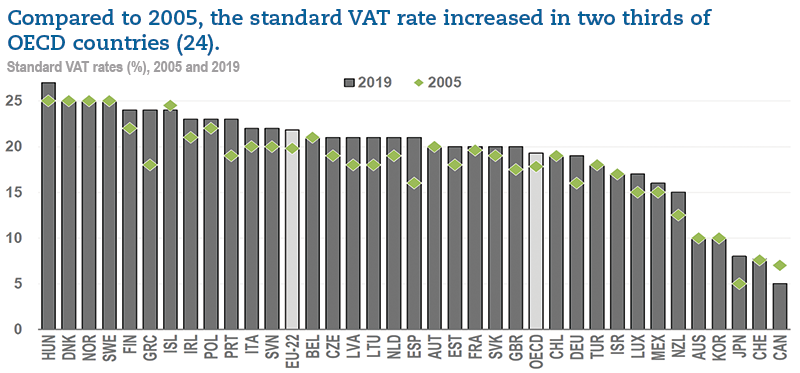

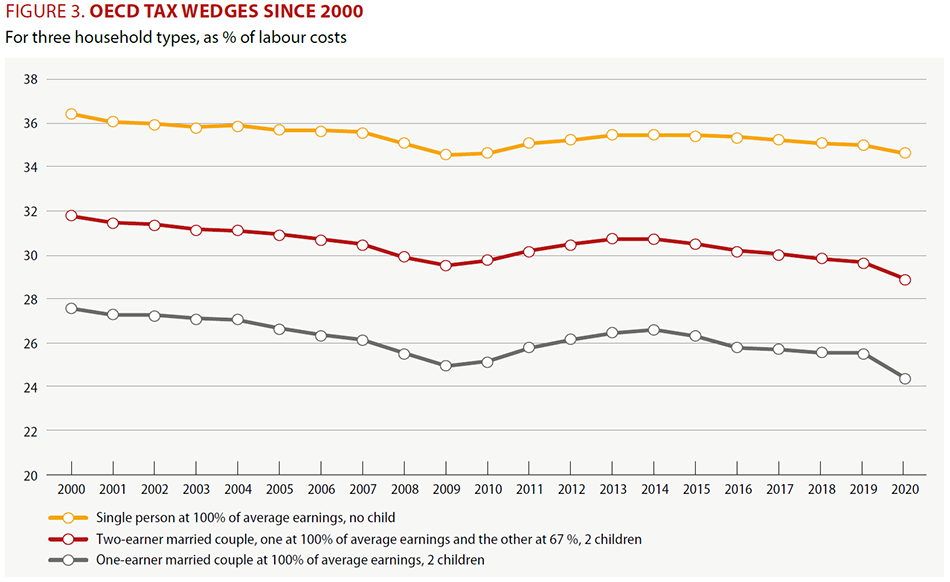

tax-to-GDP ratio in Spain has increased from 33 0 in 2000 to 38 4 in 2021 Over the same period the OECD average in 2021 was above that in 2000 (34 1 compared with 32 9 ) During that period the highest tax-to-GDP ratio in Spain was 38 4 in 2021 with the lowest being 29 7 in 2009 |

|

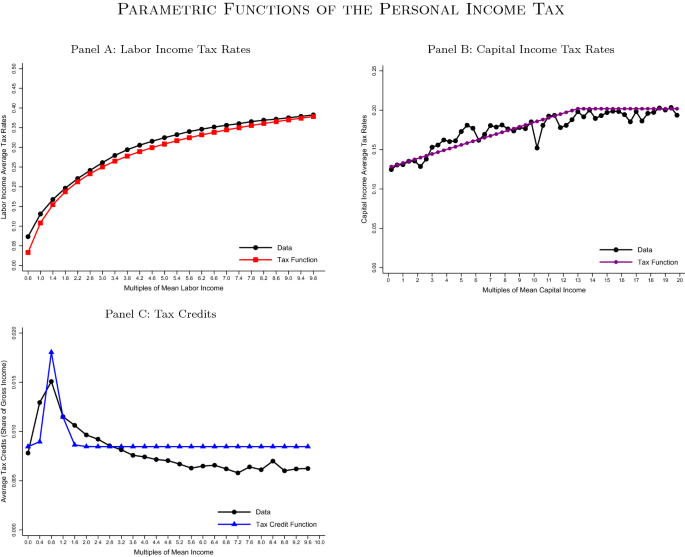

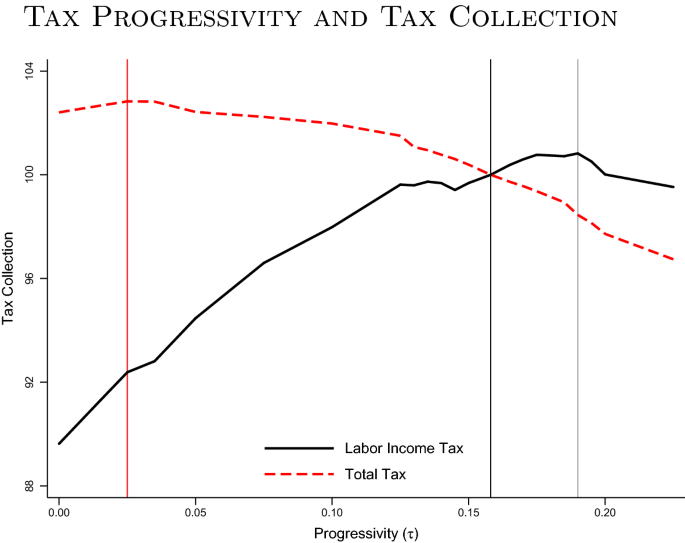

Taxing Wages - Spain - OECD

In Spain income tax and employer social security contributions combine to account for 88 of the total tax wedge compared with 77 of the total OECD average tax wedge The tax wedge for the average single worker in Spain increased by 0 3 percentage points from 39 0 in 2020 to 39 3 in 2021 |

Do Americans have to file a tax return in Spain?

Americans who are considered tax residents of Spain are typically subject to taxation on their worldwide income, and most will need to file a Spanish tax return. Who qualifies as a tax resident in Spain? Specific tax obligations can vary by visa, however. Who it’s for: Those who receive a job offer from a Spanish employer

How much tax do you pay if you live in Spain?

Tax breaks: No residency taxes if you spend less than 183 days in Spain; income is taxed at a rate between 17% and 50% depending on location Who it’s for: Those with enough savings and/or passive income to support themselves financially without needing to work — especially popular among retirees

How do US taxes compare internationally?

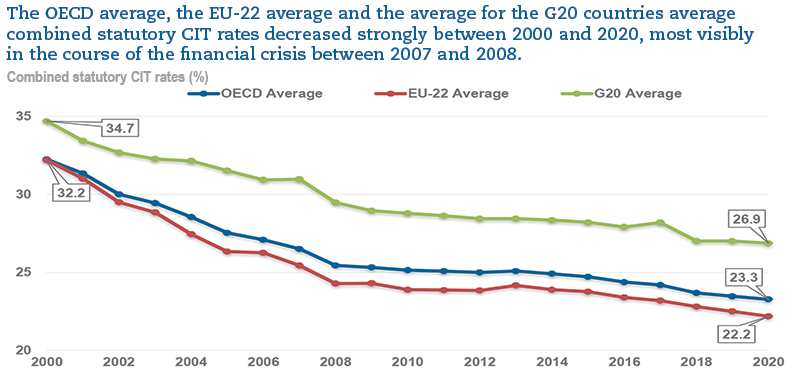

Total US tax revenue equaled 24 percent of gross domestic product, well below the 34 percent weighted average for other OECD countries.Total US tax revenue equaled 24 percent of gross domestic product, well below the 34 percent weighted average for other OECD countries.

What is the tax-to-GDP ratio in Spain?

In 2017, Spain had a tax-to-GDP ratio of 33.7% compared with the OECD average of 34.2%. In 2016, Spain was ranked 20th out of the 36 OECD countries in terms of the tax-to-GDP ratio.

|

Tax treaty - US Embassy in Spain

The United States of America and the Kingdom of Spain, desiring to conclude a The Convention shall apply also to any identical or substantially similar taxes |

|

WEALTH INEQUALITY AND HOUSEHOLD STRUCTURE: US VS

international comparisons using household data for the US and Spain (the SCF and the EFF) We estimate welfare programs, bequests, or taxation However |

|

INCOME TAX CONVENTION WITH SPAIN, WITH PROTOCOL

18 avr 1990 · employment income which are similar to those in the models and in other United States income tax conventions Special tax relief at source, |

|

Taxation and Investment in Spain 2016 - Deloitte

Spain Taxation and Investment 2016 Contents 9 0 Contact us subsidiary must be subject to an income tax similar to the Spanish corporate income tax, |

|

Agreement Between The United States And Spain - Social Security

The agreement covers Social Security taxes (including the U S Medicare portion ) and Social Security retirement, disability and survivors insurance benefits It |

|

Report on Spains Digital Services Tax - USTR

13 jan 2021 · and absolute number of U S companies affected by Spain's DST increases when compared with lower revenue thresholds Applying a |

|

Taxation in Europe: recent developments - European Commission

24 juil 2002 · TABLE 28: PERSONAL INCOME TAX RATES IN US (2002) (SINGLE INDIVIDUAL) Ministerio de Hacienda (Spain): http://www minhac es companies that are subject to a tax comparable to Luxembourg corporate income |

|

Spain and the United States: The Quest for Mutual Rediscovery

10th anniversary meeting of the Spain-US Council in Seville new US direct investment was just $22 million in 1950-59, compared with Spain's economic success during the Aznar period – zero budget deficit, tax reductions, 4 million new |

|

Real Estate Property Taxation in Europe

UIPI Taxation Committee (concerning the local income tax), rental income is SPAIN Whole income 30 SWEDEN Whole income 30 SWITZERLAND US* SLO BEL* BU L DEN A verage Sale, 10 years after purchasing |

|

Wealth and Inheritance Taxation: An Overview and - EconStor

Overview and Country Comparison, ifo DICE Report, ISSN 2511-7823, ifo Institut - Leibniz- Institut für Netherlands, Poland, Spain, and the USA, inheritances |