texas state income tax rate 2019

|

96-369 January 2019 Fiscal Notes

8 janv. 2019 a combination of state and local revenue. School districts levy property taxes to fund the local share. Texas property tax rates ... |

|

05-907 2019 Texas Franchise Tax Report Information and Instructions

United States armed services; and. • provide a letter from the Texas Veterans Commission. (TVC) verifying the honorable discharge of each owner. A taxable |

|

2022 State Individual Income Tax Rates - January 1 2022

1 janv. 2022 STATE INDIVIDUAL INCOME TAXES. (Tax rates for tax year 2022 -- as of January 1 2022). TAX RATE RANGE Number. FEDERAL. (in percents) of. |

|

Relief from Rising Values

2019 Property Tax Reforms Cutting Tax Rates at a Record Pace. Figure 1. Texas Local Property Taxes sions of state funds to bring our local taxes more in. |

|

TEXAS PROPERTY TAX CODE -2019 EDITION

1 janv. 2020 Te 2019 edition of the Texas Property Tax Code is now available. ... means the Comptroller of Public Accounts of the State of Texas. |

|

Property Tax Process Post-Senate Bill 2 (2019) – Explanatory Q&A

14 juil. 2021 passed by the Texas Legislature in 2019. ... of property taxation in three primary ways: (1) lowering the tax rate a taxing unit can adopt. |

|

Constitutional amendments proposed for November 2019 ballot

27 août 2019 Texas Constitution Art. 8 sec. 1(a) requires all taxation in the state to be equal and uniform. Sec. 24 allows the Legislature ... |

|

A Field Guide to the Taxes of Texas

State tax collections saw higher cumulative growth rates than Texas personal income from fiscal 2012 through 2015 The 2019 passage of House Bill 1525 by. |

|

96-1728 Biennial Property Tax Report

Texas Property Tax. EXHIBIT 1. Tax Revenue in Texas by Source 2018-2019. Type of Tax. 2018 Tax Amount. Percent of. Total Tax. 2019 Tax Amount. Percent of. |

|

96-369 June/July 2019 Fiscal Notes

In fiscal 2018 Texas motor fuels taxes brought in. $3.7 billion |

|

State Individual Income Tax Rates and Brackets for 2019

Top State Marginal Individual Income Tax Rates 2019 WAWA MT 6 90 OR 9 90 ID 6 93 WY NV CA 13 30 UT* 4 95 CO* 4 63 AZ 4 54 NM 4 90 AK VTNH** ND8 75 5 00 2 90 MN 9 85 WINYSDNY 7 65 MI*8 82 8 82 4 25 IAPA*NE 6 84 8 53 I L*OH3 07 IN*5 00 4 95 3 23 WVKSVAMOKY*6 50 5 75 5 70 5 40 5 00 NC* TN** OK2 00 5 25 5 00 ARSC 6 90 7 00 MSALGA |

Key Findings

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state taxcollections.

Notable Individual Income Tax Changes in 2019

Several states changed key features of their individual income tax codes between 2018 and 2019. These changes include the following: 1. As part of a broader tax reform package, Kentucky replaced its six-bracket graduated-rate income tax, which had a top rate of 6 percent, with a 5 percent single-rate tax. 2. New Jersey created a new top rate of 10....

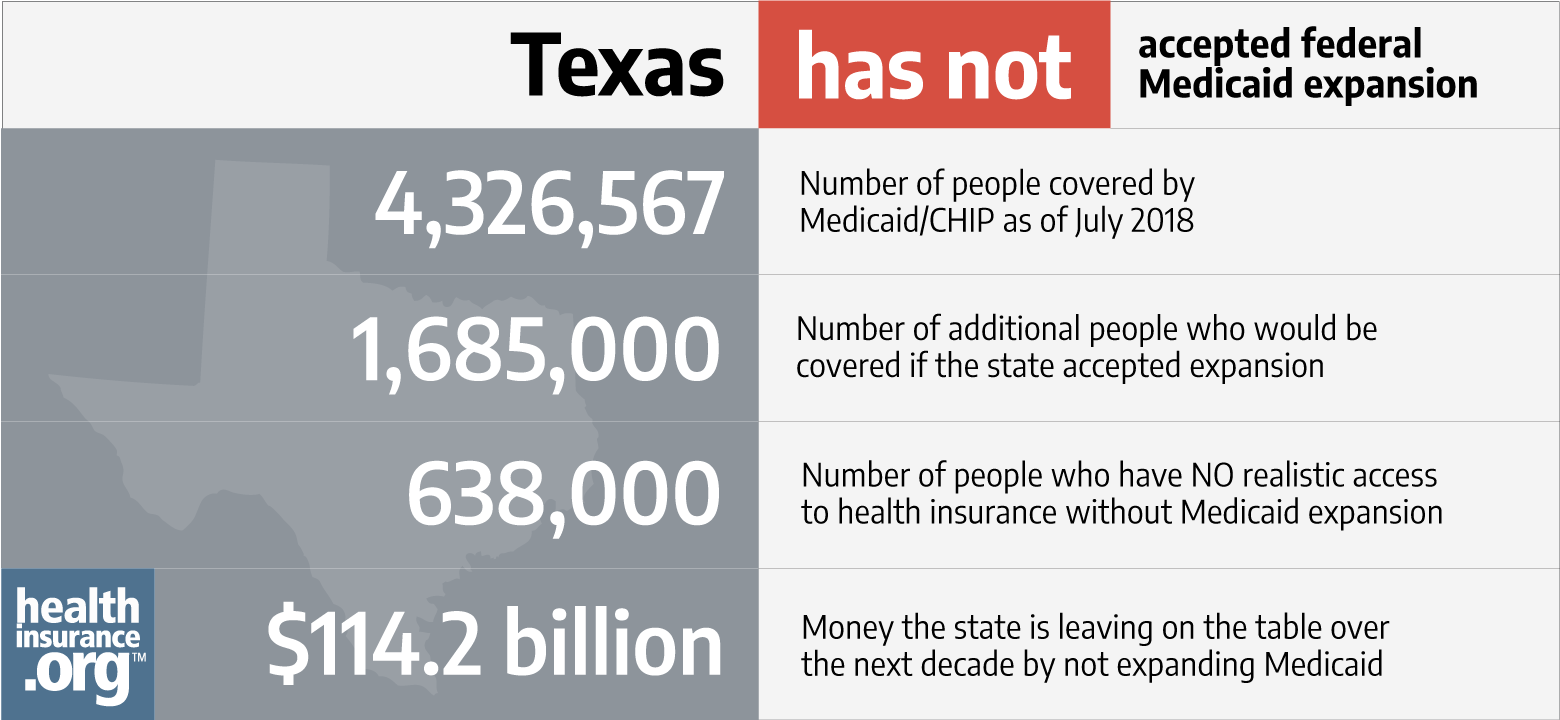

Does Texas have an income tax?

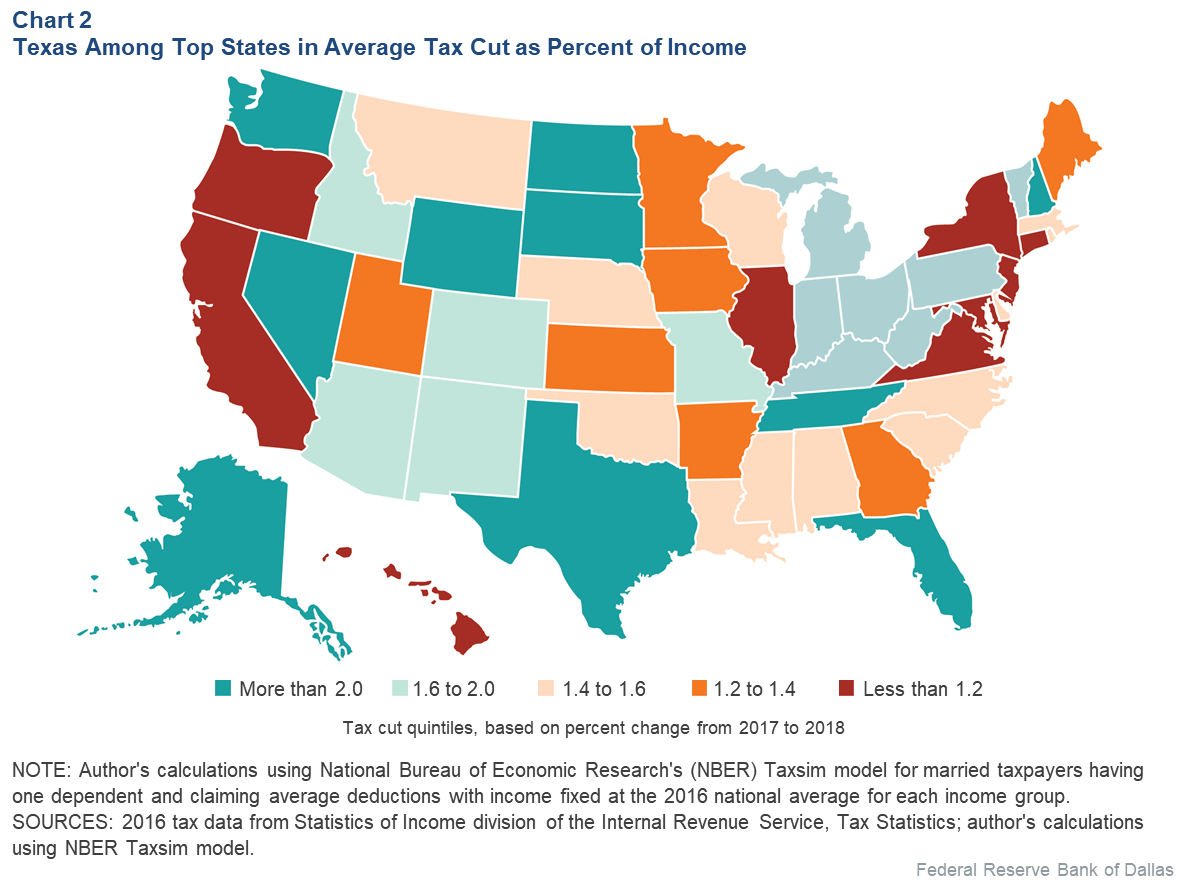

Texas is one of nine states that doesn’t have an individual income tax. The other states without an individual income tax are: Instead of taxing income, Texas generates revenue from sales and use tax, property tax and corporate income tax.

What are the sale taxes in Texas?

The Texas (TX) state sales tax rate is currently 6.25%. Depending on local municipalities, the total tax rate can be as high as 0%. At the local levels, Texas city taxes can range from .25% – 2%; county rates vary from .5% – 1.5%; transit from .25% – 1%; and special purpose districts from .125% – 2%.

How much tax do you pay a year living in Texas?

If you make $70,000 a year living in Texas you will be taxed $8,168. Your average tax rate is 11.67% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate. Use our income tax calculator to estimate how much tax you might pay on your taxable income.

How much is a franchise tax in Texas?

The franchise tax rate ranges from 0.331% to 0.75% on gross revenue for tax years 2022 and 2023. The state of Texas doesn’t assess a property tax on real estate, but all of its localities do. The state does provide exemptions that reduce property taxes for qualified owners.

|

A Field Guide to the Taxes of Texas (PDF) - Texas Comptroller

federal receipts and other sources of revenue These funds are State tax collections saw higher cumulative growth rates than Texas personal income from fiscal 2011 through 2014 2019 as taxable spending in these industries plateaued |

|

State Corporate Income Tax Rates and Brackets for 2019

20 mar 2019 · Nevada, Ohio, Texas, and Washington forgo corporate income taxes but instead impose gross receipts taxes on businesses, generally thought |

|

State Individual Income Tax Rates and Brackets for 2019

7 jui 2019 · Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all FISCAL |

|

State Corporate Income Tax Rates - Federation of Tax Administrators

TAX RATE (a) FEDERAL TAX RATE TAX BRACKETS NUMBER (percent) INCOME TAX STATE (percent) LOWEST HIGHEST OF BRACKETSFINANCIAL |

|

State Tax Matters - October 4, 2019 - Deloitte

4 oct 2019 · and Remittance as of October 1 and Single Local Use Tax Rate Option “For federal income tax accounting periods ending in 2019 or later, |

|

State Tax Matters - Deloitte

7 fév 2020 · Corporate Income Tax Rate Reduction Sales/Use/Indirect: Utah: New Law Repeals State Tax Reform Legislation Enacted in 2019 that Had GILTI reflected in its federal taxable income that is deducted when determining |

|

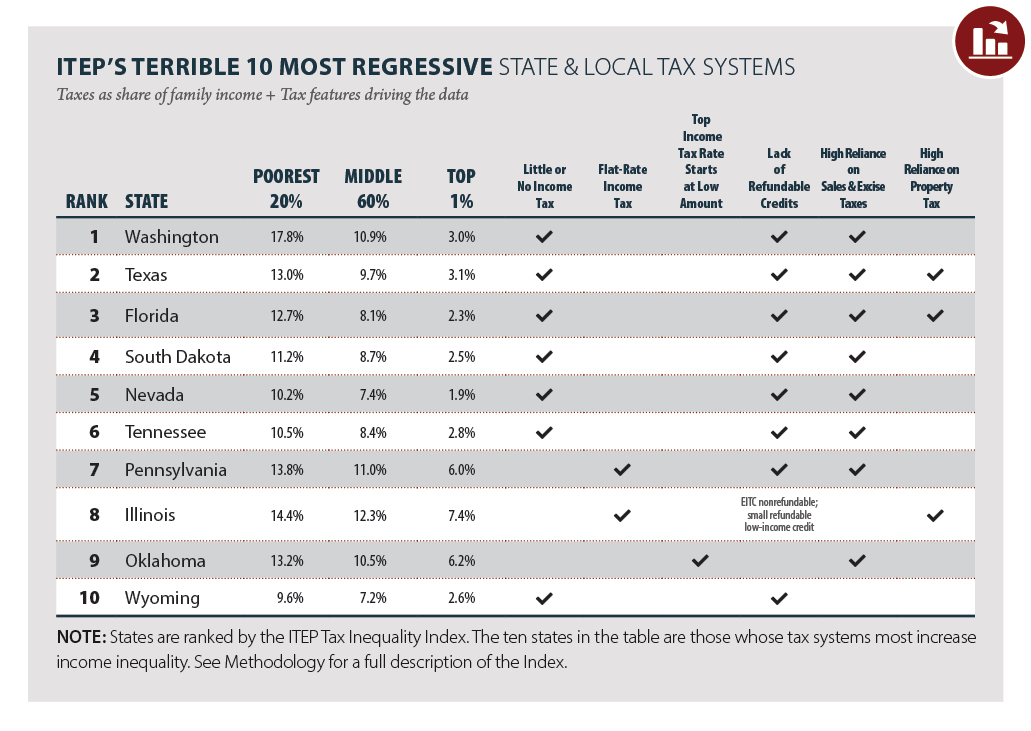

Who Pays Texas Taxes? - Every Texan

January 2019 Who Pays Texas Taxes? In a state with a fair tax system, the taxes that each income group paid have similar paid in state and local taxes Each group contains one-fifth (20 percent) of all Texas households, or about 2 million |

|

State Tax Revenues Were Strong Through 2019 but - Urban Institute

26 mai 2020 · percent in the fourth quarter of 2019 The growth varied among passage of the TCJA, which was the largest federal tax overhaul since 1986 |

|

STATE INCOME TAX EXPENDITURES - Urban Institute

17 jan 2020 · 1 Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2019-2023” JCX-55-19, December 18, 2019; |

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)