thailand customs form d

|

Customs Alert ASEAN Trade In Goods Agreement (ATIGA) and Form

21 Jun 2022 D requirements for importers utilizing the ATIGA duty privileges in Thailand. ... Thai Customs has started to accept a Back-to-Back Form D for. |

|

ATIGA-07-1 - Annex 7 - Revised CO Form D

EXPORTER: The term “Exporter” in Box 11 may include the manufacturer or the producer. 8. FOR OFFICIAL USE: The Customs Authority of the importing Member State |

|

Untitled

15 Jun 2022 Back-to-Back Form D มีอายุเท่ากับ Form D. ฉบับแรกที่สิ้นอายุเร็ว ... identified by the Customs Officers examining them. Name of manufacturer ... |

|

National Single Window

Statistics of e-Form D sent to other ASEAN member states. (As of December Thai Customs Dept. and. Other Government Agency. HTTPs/GIN. Mail/SMTP. Mail/SMTP. |

|

Thailand

24 Sept 2019 form D is the third country invoicing can be blank. Each AMS uses ... Customs Declaration. Document (ACDD) and e-Phyto Cerificate via the ASW. |

|

As of the 36th SC-AROO Meeting 21-23 June 2021 Decisions of SC

23 Jun 2021 Thailand informed that she could accept such CO Form D in case of PCA. ... Thai Customs indicated that she could only implement this arrangement ... |

|

-รองรับการใช้หลักฐานการรับรองถิ่นกาเนิดสินค

15 Jun 2022 Back-to-Back Form D มีอายุเท่ากับ Form D. ฉบับแรกที่สิ้นอายุเร็ว ... identified by the Customs Officers examining them. Name of manufacturer ... |

|

New Customs Updates on the Use of FTAs for imports into Thailand

20 Jan 2022 ATIGA (Form D). AHTN 2017. ASEAN – China (Form E). HS 2017. ASEAN ... Importers will be able to indicate the Origin Criterion in Field 64 of the ... |

|

ASEANs FTAs and Rules of Origin

According to Thailand Customs though |

|

ASEAN-Trade-in-Goods-Agreement.pdf

1 “ASEAN-6” refers to Brunei Darussalam Indonesia |

|

Trade Facilitation: e-Certificate of Origin and e-ATIGA Form D

May 22 2562 BE e-Certificate of Origin and e-ATIGA Form D. Ms Supitcha Monatrakul ... 11. Forward e-Form D. Utilization. Customs. Thailand. NSW / ASW. |

|

??????????????????????????????????atiga

(3)* Electronic Certificate of Origin (E Form D) ???? ????????????????????? Self Certification ??? Form D ... Thailand Origin. ???????? WO. |

|

Untitled

Jun 15 2565 BE ISSUED RETROACTIVELY: Due to involuntary errors or omissions or other valid causes |

|

-??????????????????????????????????????????

Jun 15 2565 BE -Form D/e-Form D ??????????????????? ??????????????????????? Issued Retroactively ?????. ??????????????????? 3-4. |

|

ASEANs FTAs and Rules of Origin

use in the Form D issue procedures needed for each shipment to be cleared through customs. Thailand is currently negotiating FTAs with nearly ten countries |

|

Unofficial Translation CUSTOMS ACT B.E. 2560 (2017) MAHA

declaration submission and a duty payment for goods imported into or the law on Industrial Estate Authority of Thailand or any other similar area to be ... |

|

8. Form D (ATIGA).pdf

FORM D. Issued in. (Country). See Overleaf Notes THAILAND. SINGAPORE. 2. CONDITIONS: The main conditions for admission to the preferential treatment ... |

|

As of the 36th SC-AROO Meeting 21-23 June 2021 Decisions of SC

Jun 23 2564 BE Any minor discrepancies |

|

NOTIFICATION OF THE DEPARTMENT OF FOREIGN TRADE RE

Box 9 of Certificate of Origin (Form D) that for goods manufactured under Regional Clause 2 Exporter of goods originated in Thailand to Association of. |

|

Customs Alert ASEAN Trade In Goods Agreement (ATIGA) and Form

Jun 21 2565 BE We have listed the main changes here below. What to Know? Back-to-Back Form D for consolidated shipments. Since 1 May 2022 |

|

Customs Alert ASEAN Trade In Goods Agreement (ATIGA) and Form

Since 1 May 2022 Thai Customs has started to accept a Back-to-Back Form D for consolidated shipments from ASEAN countries A Back-to-Back Form D is usually obtained by companies for export of goods to an ATIGA country with duty privileges after previously importing the same shipment from another ATIGA country under Form D |

|

Specfinem - DITP

FOR OFFICIAL USE: The Customs Authority of the importing Member State must indicate (4) in the relevant boxes in column 4 whether or not preferential treatment is accorded MULTIPLE ITEMS: For multiple items declared in the same Form D if preferential treatment is not granted to any of the |

|

NOTIFICATION OF THE DEPARTMENT OF FOREIGN TRADE RE Issuance

Clause 2 Exporter of goods originated in Thailand to Association of Southeast Asian Nations (ASEAN) wishing to apply for a certificate of origin (Form D) for the purpose of applying the Generalized System of Preference under Association of Southeast Asian Nations (ASEAN) shall apply for certificate of origin (Form D) prescribed in Appendix |

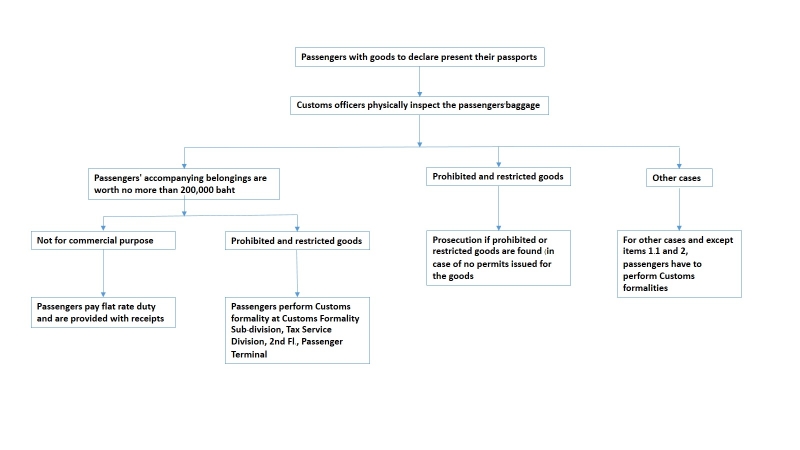

Customs Controls and Procedures

Customs procedures for goods arriving in Thailand in any manner are like those existing in most other countries. An importer is required to file an entry form together with other requisite documents, including a bill of lading, invoice, and packing list via the e-Customs system. Customs duties are due upon the arrival of the vessel carrying the imp...

Customs Incentives Schemes

Various customs incentives schemes, each with its own specific conditions and duty privileges, are available, including the following: 1. Duty and tax compensation (tax coupons). 2. Duty drawback for imported raw materials used in export production. 3. Duty drawback for re-export in the same state. 4. Free zones (Customs or Industrial Estate Author...

Offences and Penalties

Although, technically, an offence against the customs law is a criminal offence, in practice, legal procedures are usually concerned with the recovery of tax arrears and fines. Offences include non-compliance with customs procedures, false declarations, and the most serious offence of smuggling and evasion of customs duties. Statutory penalties are...

How does customs work in Thailand?

Customs procedures for goods arriving in Thailand in any manner are like those existing in most other countries. An importer is required to file an entry form together with other requisite documents, including a bill of lading, invoice, and packing list via the e-Customs system.

What is the classification of imports in Thailand?

Classification of imports is based on the Harmonized Commodity Description and Coding System (the so-called ‘Harmonized System’). Thailand has adopted the Association of Southeast Asian Nations (ASEAN) Harmonized Tariff Nomenclature (AHTN) 2017, which is based on the Harmonized System 2017, as its import tariff nomenclature.

Can I enter Thailand without paying import fees?

Thailand customs allows visitors to enter Thailand with personal effects, the value of which does not exceed 80,000 Baht, without paying import fees as long as: 1) the items are specifically for personal or professional use; 2) the amount of goods are reasonable; and 3) the items are not subject to restriction or prohibition.

When are customs duties due?

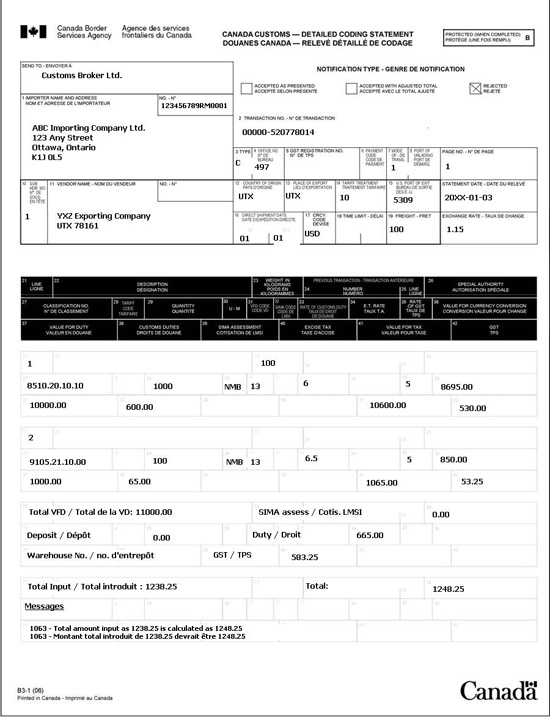

Customs duties are due upon the arrival of the vessel carrying the imported goods, and goods may be stored in a Customs bonded warehouse for up to 45 days with no submission of an import entry and 60 days in the case of submission of an import entry. Landing and storage charges must be paid before the goods are released.

|

National Single Window - United Nations ESCAP

Thai Customs Department Page 2 Overview of e-Services in Thai Customs WWW Statistics of e-Form D received from other ASEAN member states |

|

ASEANs FTA and Rules of Origin in English Version

use in the Form D issue procedures needed for each shipment to be cleared through customs Thailand is currently negotiating FTAs with nearly ten countries, |

|

Issuance of Certificate of Origin under ASEAN Trade in Goods

Box 9 of Certificate of Origin (Form D) that for goods manufactured under Regional Value Clause 2 Exporter of goods originated in Thailand to Association of |

|

THAILAND

to export from Thailand while enjoying FTAs benefits' for foreign investors, customs brokers, Form D, Self-Certification* 2 ASEAN-China Form FTA 5 Thailand-New Zealand (TNZCEP) 1 July 2005 Self-declaration 6 Japan- Thailand |

|

E-ATIGA FORM D - Office of Standard, ETDA

22 mai 2019 · e-Certificate of Origin and e-ATIGA Form D Ms Supitcha 11 Forward e-Form D Utilization Customs Thailand NSW / ASW ebXML Gate |

|

8 Form D (ATIGA)pdf

FOR OFFICIAL USE: The Customs Authority of the importing Member State must indicate (V) in the relevant boxes in column 4 whether or not preferential |

|

IMPLEMENTATION OF ATIGA e-FORM D ASEAN SINGLE - MITI

1 avr 2019 · INTRODUCTION TO ASW ATIGA e-FORM D VIA ASW PLATFORM OBJECTIVES and ASEAN Customs Thailand; Vietnam and Brunei |

|

1 Agreement between Japan and the Kingdom of Thailand for an

Thailand and the customs authority of Japan should take necessary measures to ASEAN Free Trade Area) if information in the copy of Form D is useful for |

|

Asean - PwC Asia Pacific Customs and Trade

22 jan 2018 · Implementation of e-Form D in Indonesia, Malaysia, Singapore, Thailand and Vietnam Page 13 Customs and excise rate changes in India, |

|

ATIGA

1 jan 2018 · NOTIFICATION ON THE IMPLEMENTATION of e-FORM D UNDER THE ASEAN ASEAN member states of Indonesia, Singapore, Thailand and authority in the country of export to the Royal Malaysian Customs Department |