u.s. tax withholding on payments to foreign persons

|

Annual Withholding Tax Return for U.S. Source Income of Foreign

Income of Foreign Persons Section 1 Record of Federal Tax Liability (do not show federal tax deposits here) ... d Tax paid by withholding agent . |

|

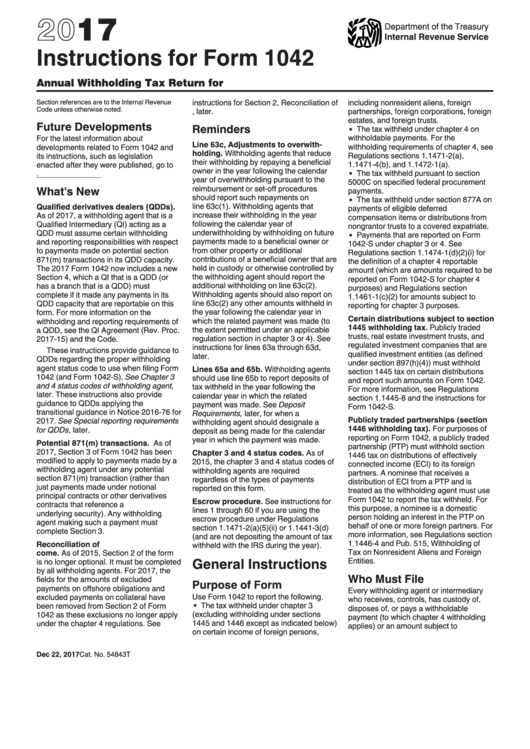

2021 Instructions for Form 1042

31 déc. 2021 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons ... 3 of Form 1042 applies to payments made by a withholding agent ... |

|

Annual Withholding Tax Return for U.S. Source Income of Foreign

Income of Foreign Persons Section 1 Record of Federal Tax Liability (Do not show federal tax deposits here) ... d Tax paid by withholding agent . |

|

Annual Withholding Tax Return for U.S. Source Income of Foreign

Income of Foreign Persons Section 1 Record of Federal Tax Liability (Do not show federal tax ... b Total U.S. source substitute payments reported:. |

|

NRA Withholding and Reporting on Payments to Foreign Nationals

These payments are not subject to withholding generally. However if the recipient failed to provide you with a U.S. taxpayer identification number |

|

REPORTING AND WITHHOLDING ON PAYMENTS TO FOREIGN

WITHHOLDING ON. PAYMENTS TO. FOREIGN PERSONS Part II: Establishes a claim of tax treaty withholding ... The Foreign Person is required to file a US Tax. |

|

Annual Withholding Tax Return for U.S. Source Income of Foreign

Income of Foreign Persons Section 1 Record of Federal Tax Liability (Do not show federal tax ... b Total U.S. source substitute payments reported:. |

|

Annual Withholding Tax Return for U.S. Source Income of Foreign

FD. FF. FP. I. SIC. If you will not be liable for returns in the future check here ?. Enter date final income paid ?. Check if you are a: QI/Withholding |

|

Overview of Payments to Foreign Persons

trust foreign estate |

|

Withholding of Tax on Nonresident Aliens and Foreign Entities

2 mar. 2022 withholding on a payment of U.S. source in- come. Payments to foreign persons including nonresident alien individuals |

|

Payments made to foreign persons: A basic overview - Tax

• Both the foreign person and the U S withholding agent are personally responsible for taxes on U S sourced income • Unsatisfied tax obligations of a foreign person will be sought from the U S withholding agent by the IRS |

|

Searches related to u s tax withholding on payments to foreign persons PDF

majority of taxpayers requesting a refund of tax shown as withheld on a Form 1042-S Foreign Person’s U S Source Income Subject to Withholding by filing a Form 1040NR U S Nonresident Alien Income Tax Return actually appear to be substantially more compliant than a comparable portion of the overall U S |

Employment Taxes

For information on withholding and employment taxes on payments to foreign persons located in the U.S. and U.S. persons abroad, refer to the following: 1. Pay for Personal Services Performed 2. Federal Income Tax Withholding on Wages paid to Nonresident Aliens 3. Social Security Tax / Medicare Tax and Self-Employment 4. Federal Unemployment Tax

Pensions and Annuity Withholding

Generally, pension and annuity paymentsare subject to federal income tax withholding. The withholding rules apply to the taxable part of payments from an employer pension annuity, profit-sharing, stock bonus, or other deferred compensation plan. The rules also apply to payments from an Individual Retirement Arrangement (IRA), an annuity, endowment,...

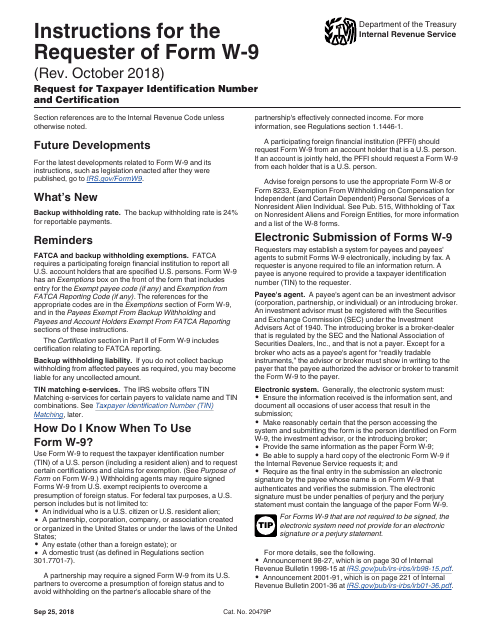

Backup Withholding

Generally, backup withholdingapplies only to U.S. citizens and resident aliens, and not to nonresident aliens (NRA). The payer must backup withhold 24% from a reportable payment made to a U.S. person that is subject to Form 1099 reporting if: 1. The U.S. person has not provided its Taxpayer Identification Number (TIN) in the manner required, 2. The...

Do foreign people need to pay income tax in US?

Yes, U.S. citizens have to pay taxes on foreign income if they meet the filing thresholds, which are generally equivalent to the standard deduction for your filing status. You may wonder why U.S. citizens pay taxes on income earned abroad. U.S. taxes are based on citizenship, not country of residence.

How to file tax returns with foreign income?

File Form 2555 for Foreign Income. 2020, 2021 Credit, Deduction For U.S. Citizens Living Abroad U.S. Citizens Working Or Living Abroad Can Prepare Taxes Online At eFile.com. Claim The Foreign Tax Credit And Find Out If You Also Have To Pay Foreign Taxes.

What is non resident withholding?

You may need to withhold tax if you make nonwage payments to nonresidents. This is called nonresident withholding. Payers who withhold tax on nonresidents are called withholding agents. Examples of withholding agents:

|

REPORTING AND WITHHOLDING ON PAYMENTS TO FOREIGN

IRS Nationwide Tax Forum 2008 Foreign Person (NRA, foreign corp, partnership, estate Part II: Establishes a claim of tax treaty withholding exemption |

|

Withholding Taxes on Foreign Workers - Internal Revenue Service

Federal Agency Seminar 2011 Withholding and Reporting of Income Tax on Non-Wage Payments to Foreign Persons Presented by Kevin P Mackesey |

|

Overview of Payments to Foreign Persons

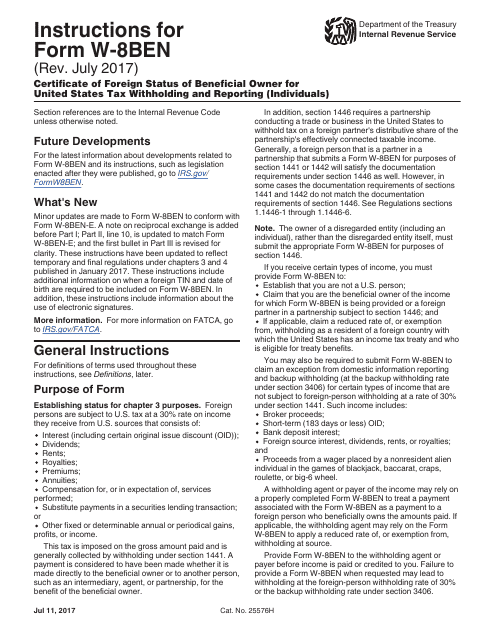

trust, foreign estate, and any other person that is not a U S person Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding |

|

US Tax Issues for Foreign Partners: US Withholding - Duane Morris

US Withholding Tax – In General • Mechanism for collecting US tax on mobile income paid to foreign persons: – Burden imposed on payor of income; and |

|

Taxation of foreign nationals by the US—2016 - Deloitte

it is important for foreign nationals coming to the United Special reporting and withholding rules may both spouses must report and pay US tax on their |

|

Do You Have to Withhold 30% on Payments to a Non-US

result, no U S withholding tax would apply to compensation payment for an individ- agent in the U S rather than the non-U S individual based abroad Lastly |

|

US Tax Information for Foreign Vendors - Finance & Business - UC

inside the U S taxes be withheld from payments made to foreign vendors unless the income Form W-8BEN is used by foreign vendors who are individuals to |

|

Foreign Withholding Rules & FATCA - Ivins, Phillips & Barker

Recent proposals to modify U S model tax treaty may require Withholding Agents to Payments made to a foreign individual – individuals are not subject to |