us dividend withholding tax singapore

|

Worldwide Real Estate Investment Trust (REIT) Regimes

8 oct. 2019 United States of America ... The withholding tax on Belgian dividends received by a RREC is no longer creditable (nor refundable). |

|

Sg-tax-international-tax-singapore-highlights-2021.pdf

Taxation of dividends: Singapore operates a one-tier corporate tax system under which corporate tax paid on a company's profits is final. Dividends paid by |

|

ETF taxation report for investors 2019 Singapore

withholding tax rate applies on dividends from US equities. • ETF distributions will be remitted or deemed remitted to. Singapore. |

|

ETF taxation report for Singapore investors

dividends and capital gains in the source county of investment. • Fund level — Taxes applied that it should not be subject to US federal income tax on. |

|

Government and Public Sector

See the Joint Committee on Taxation. Report "Economic and U.S. Income Tax Issues Raised By Sovereign Wealth Fund Investment In The United States |

|

DIVIDEND TAX ABUSE: HOW OFFSHORE ENTITIES DODGE

11 sept. 2008 typically subject to a 30% rate of taxation on their U.S. stock dividends. ... application of the 30% dividend withholding tax. |

|

Branch Profits Tax Concepts

3 sept. 2014 income tax treaties in effect at that time exempted those dividends from U.S. withholding tax and they did so based on the address of. |

|

ETF taxation report for Singapore investors 2018

Investment level — Withholding tax (WHT) on interest dividends and capital gains in the Singapore investors |

|

Territorial vs. Worldwide Corporate Taxation: Implications for

same income and sometimes |

|

Worldwide Corporate Tax Guide - EY

20 juil. 2020 A. At a glance. Corporate Profits Tax Rate (%). 15. Capital Gains Tax Rate (%). 15. Branch Tax Rate (%). 15. Withholding Tax (%). Dividends. |

|

Singapore Highlights 2022 - Deloitte US

Dividends paid by Singapore resident companies are tax exempt in the hands of the recipient As noted under “Taxation of dividends” above foreign-source dividends are taxable if received or deemed to be received in Singapore unless certain conditions are satisfied |

|

International Tax Singapore Highlights - Deloitte US

Dividends paid by Singapore resident companies are tax exempt in the hands of the recipient Foreign-source dividends are taxable if received or deemed to be received in Singapore unless certain conditions are satisfied Capital gains:Singapore does not tax capital gains |

Which countries impose tax on dividends paid to non-resident shareholders?

As a result, most major countries have deals with the U.S. to apply only a 15% withholding tax to dividends paid to nonresident shareholders. Some examples include Australia, Canada, France, Germany, Ireland, and Switzerland.

What if I receive a form 972 from a foreign shareholder?

If you receive a Form 972 from a foreign shareholder qualifying for the direct dividend rate, you must pay and report on Form 1042 and Form 1042-S any withholding tax you would have withheld if the dividend actually had been paid. Dividends paid by foreign corporations (Income Code 8).

Is there withholding tax from the Irish Fund > Singapore investor leg?

Apologies I may have misread your query earlier. Essentially there is no withholding tax from the Irish Fund > Singapore Investor leg. But there may be withholding tax from the underlying securities into the Irish Fund, depending on what the fund invests in.

Can foreign tax withholding on dividends be avoided?

Any withheld dividends on stocks that you held for less than 16 days during the 31-day period that begins 15 days before the ex-dividend date are considered unqualified dividends that will decrease the total amount of foreign tax credit you can claim. Can Foreign Tax Withholding on Dividends Be Avoided in IRAs and 401Ks?

|

Country Tax Profile: Singapore - assetskpmg

There is no foreign-exchange controls in Singapore Dividends are not subject to withholding tax whether paid to a resident or non-resident |

|

UNDERSTANDING FOREIGN WITHHOLDING TAX - BlackRock

Investors are generally exempt from U S withholding tax when they hold U S listed ETFs or U S stocks directly in a Registered Retirement Saving Plan ( RRSP) or |

|

ETF taxation report for investors 2019 Singapore - HKEX

1 General in nature 2 Only consider the impact of tax on dividend and interest withholding tax rate applies on dividends from US equities • ETF distributions |

|

Asia Tax Bulletin - Mayer Brown

15 avr 2020 · dividend withholding tax, which will be welcomed by tax treaty with Singapore, which will, once it is the US and many other countries in the |

|

Worldwide Real Estate Investment Trust (REIT) Regimes - PwC

A withholding tax exemption is available for dividends paid out of income stemming from Dividend distributions by the G-REIT are subject to a 26 4 withholding tax markets such as Singapore or Australia, it is expected to continue growing The South African REIT regime is mainly based on the NAREIT in the US |

|

Taxation and Investment in Singapore 2016 - Deloitte

8 0 Contact us Page 3 1 Singapore Taxation and Investment 2016 (Updated October 2016) any dividend withholding tax paid in the foreign country |

|

ETF taxation report for Singapore investors 2018 - Asia Risk Events

Investment level — Withholding tax (WHT) on interest, dividends dividend and interest income Singapore investors, except for investing into US equities |

|

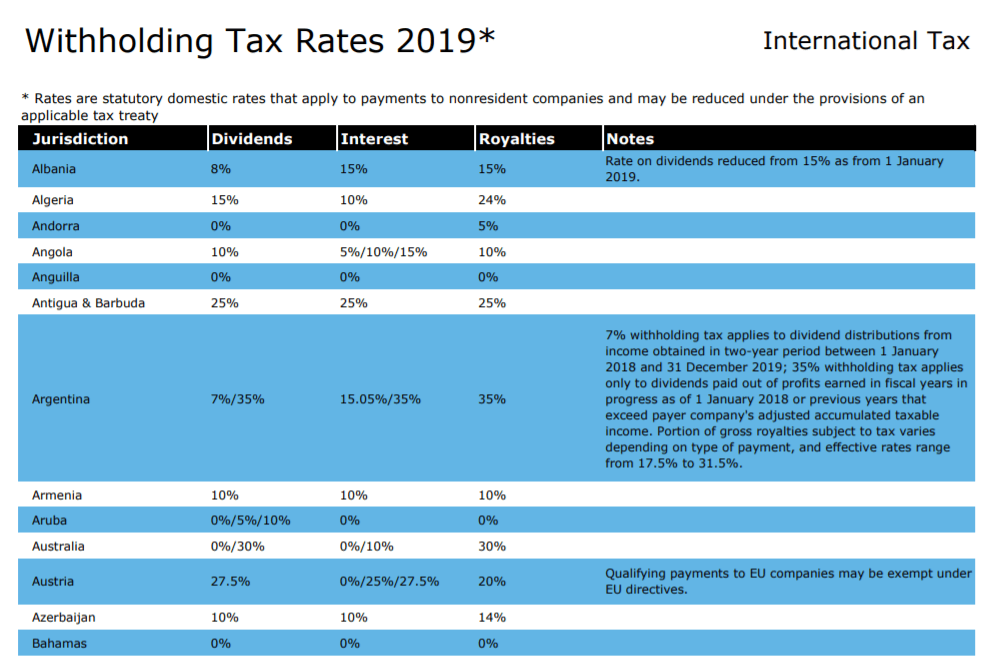

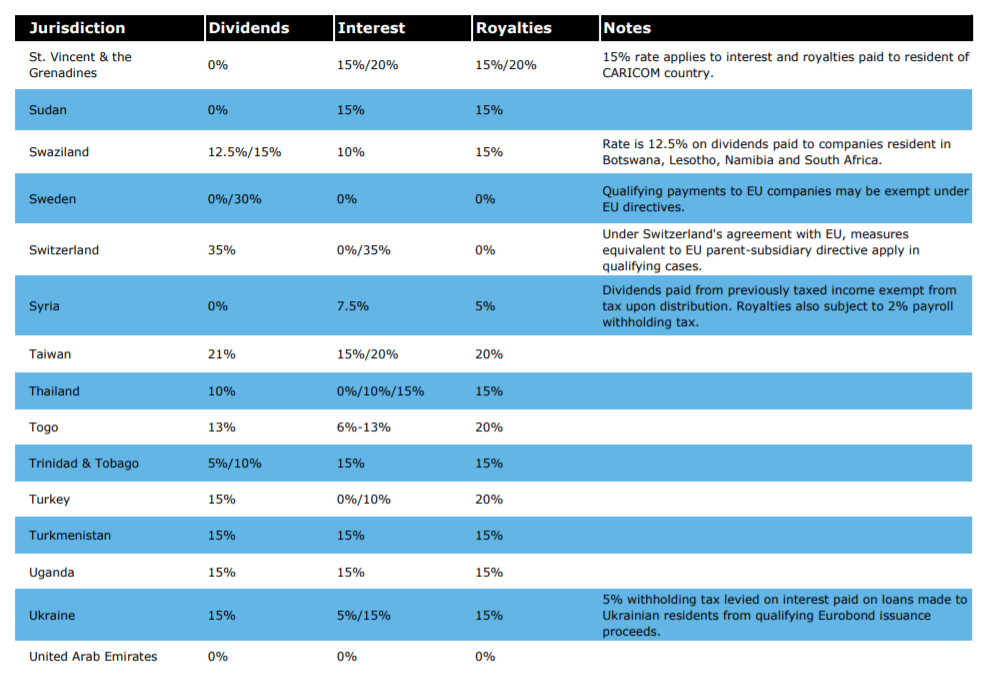

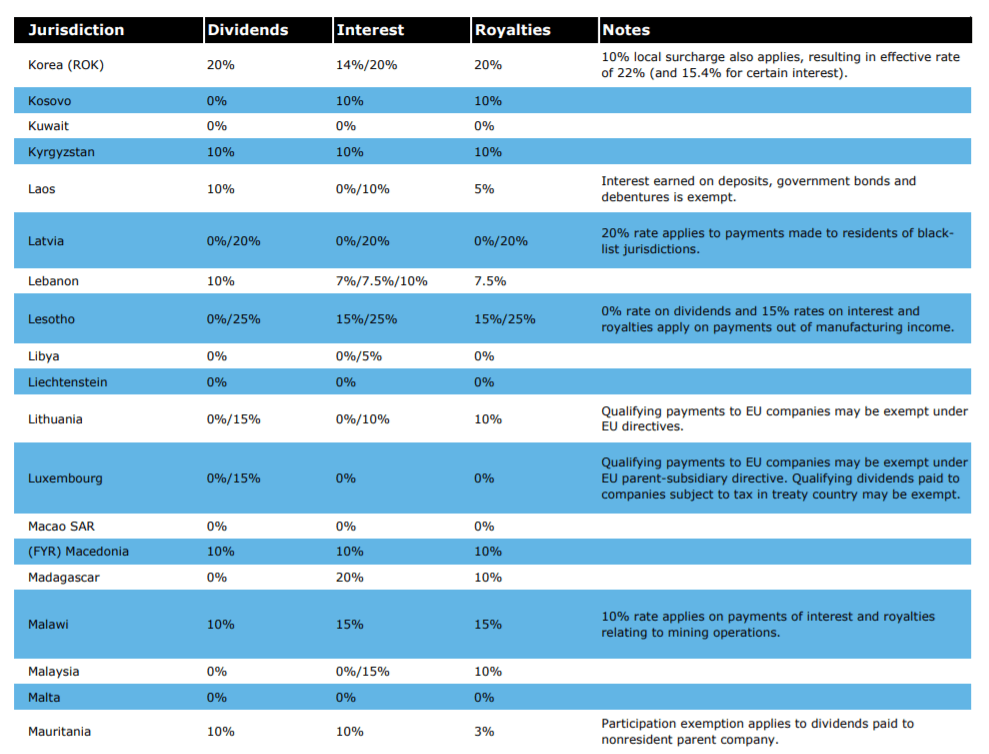

Withholding Tax Rates - S&P Global

1 jan 2021 · 5 If payment source is from Capital Contribution Reserves then the dividend will be subject to a withholding tax rate of 0 6Johannesburg Stock |

|

TDAS252 - TD Ameritrade Singapore

U S withholding for investors outside of the U S DIVIDENDS FROM U S SECURITIES Dividend income from a U S company received by an investor outside the U S (TD Ameritrade Singapore) does not provide tax advice Investors who |

|

Worldwide Corporate Tax Guide - EY

20 juil 2020 · Gagan Malik (resident in Singapore) +65 6309-8524 Jesus Castilla, International Tax – US Inbound Initiative +1 (305) 415- (c) A 7 dividend withholding tax rate applies to dividends paid out of profits accrued during |