us france double taxation treaty

|

Convention between the government of the united states of america

entitled to exemption from such taxes under this or any other income tax convention which applies to these taxes;. (b) in the case of France |

|

U.S.-FRANCE ESTATE TAX TREATY

U.S.-FRANCE ESTATE TAX TREATY government of the French Republic for the avoidance of double taxation and ... State of his domicile by mutual agreement. |

|

Protocol amending U.S.-France Income Tax Treaty signed January

13 jan. 2009 States of America and the Government of the French Republic for the. Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. |

|

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE

the saving clause in this Convention is at France's request |

|

Technical Explanation - US-France Tax Treaty Protocol of 13 Jan 2009

13 jan. 2009 treaty policy and the Treasury Department's Model Income Tax Convention published on November 15 |

|

Protocol Amending the U.S.-French Income Tax Treaty signed

8 déc. 2004 America and the Government of the French Republic for the ... management in France and that is not subject to company tax therein shall be. |

|

TAX CONVENTION WITH THE KINGDOM OF MOROCCO

Morocco for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with common to other U.S. income tax treaties. |

|

Memorandum of Understanding regarding the January 13 2009

13 jan. 2009 Government of the United States of America and the Government of the French. Republic for the Avoidance of Double Taxation and the ... |

|

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED STATES OF

Jan 1 1996 · CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF THE FRENCH REPUBLIC FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME AND CAPITAL GENERAL EFFECTIVE DATE UNDER ARTICLE 33: 1 JANUARY 1996 TABLE OF ARTICLES Article 1 |

|

Convention between the Government of the United States of

Convention between the Government of the United States of America and the Government of the French Republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital signed in Paris on August 31st1994 amended by the Protocol signed in Washington on December 8th2004 and by the Protocol |

|

Technical Explanation - US-France Tax Treaty Protocol of 13

Jan 13 2009 · convention between the government of the united states of america and the government of the french republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital signed at paris on august 31 1994 as amended by the protocol signed on december 8 2004 |

|

Searches related to us france double taxation treaty PDF

U S -FRANCE ESTATE TAX TREATY Convention between the government of the United States of America and the government of the French Republic for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on estates inheritances and gifts signed at Washington on November 24 1978 amended by the Protocol signed at |

How does the convention prevent international double taxation?

The Convention confirms that the country of residence will avoid international doubletaxation by providing relief for the tax imposed by the source country. It also provides foradministrative cooperation between the tax authorities of the two countries in applying theConvention and the taxes covered by the Convention.

Do US companies pay taxes in France?

in the case of a United States company owning at least 10 percent ofthe voting power of a company that is a resident of France and from which theUnited States company receives dividends, the French income tax paid by or onbehalf of the distributing corporation with respect to the profits out of which thedividends are paid.

What are the benefits of a bilateral tax treaty?

It also provides foradministrative cooperation between the tax authorities of the two countries in applying theConvention and the taxes covered by the Convention. The benefits of the Convention are limitedto qualified residents of the two countries.

What if a partnership is not exempt from French tax?

(d) If, for any taxable period, a partnership of which an individual member is aresident of France so elects, for United States tax purposes, any income which solely byreason of paragraph 4 of Article 14 is not exempt from French tax under this Article shallbe considered income from sources within France.

|

Income Tax Treaty PDF - Internal Revenue Service

The new Convention preserves the special French tax benefits for U S citizens residing in France and for French residents who are partners of U S partnerships |

|

Technical Explanation PDF - Internal Revenue Service

the saving clause in this Convention is, at France's request, unilateral, U S income tax treaties in referring only to the avoidance of income tax and not all taxes |

|

The United States - French Income Tax Convention - CORE

For a discussion thereof, see McCaffery, The Franco-American Convention Relative to Double Taxation, 36 Colum L Rev 382 (1936) [hereinafter cited as |

|

US-FRANCE ESTATE TAX TREATY - France in the United States

U S -FRANCE ESTATE TAX TREATY Convention government of the French Republic for the avoidance of double taxation and the prevention of fiscal |

|

Double taxation: taxes on income

893; Treaty Series 988 OF THE FRENCH REPUBLIC, being desirous of avoiding double taxation and potentiary of the United States of America to France; |

|

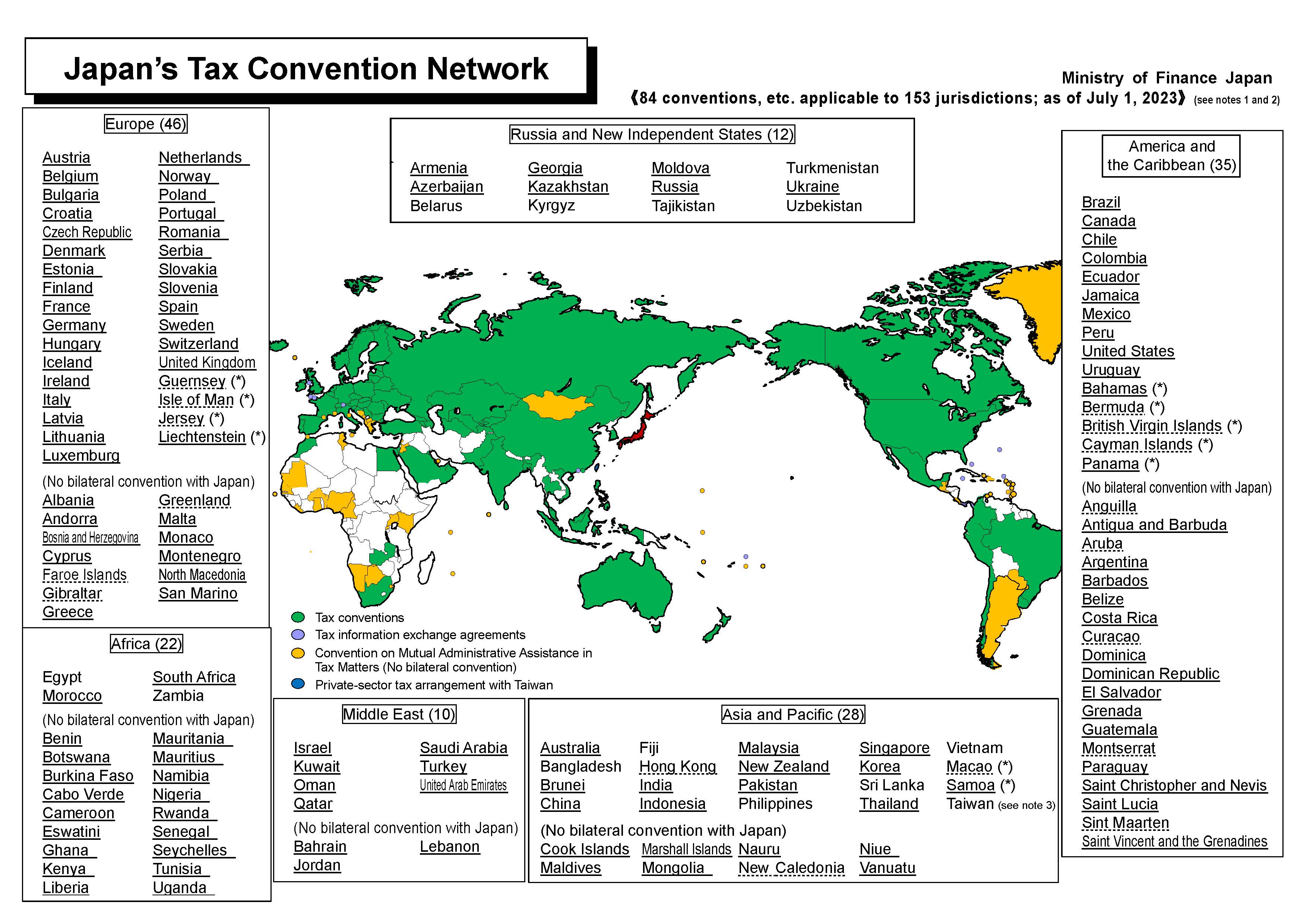

Countries with a Double Tax Treaty with the USA

France 01 01 1996 15 0 0 0 Article 30 / Protocol Georgia*** 01 01 1976 This is the effective date when the latest income tax treaty with the United |

|

Protocol amending US-France Income Tax Treaty, signed January

13 jan 2009 · States of America and the Government of the French Republic for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with |

|

Technical Explanation - US-France Tax Treaty Protocol of - Treasury

13 jan 2009 · Negotiations took into account the U S Department of the Treasury's current tax treaty policy and the Treasury Department's Model Income Tax |