us uae income tax treaty

|

Bilateral Agreement between the US and the United Arab Emirates

17 juin 2015 Account Tax Compliance Act (“FATCA”) which introduce a reporting regime for ... The term “IRS” means the U.S. Internal Revenue Service. |

|

Doing-business-guide-uae-2021.pdf

practices. Foreign income and tax treaties. The UAE has concluded around 128 double taxation treaties of which around 90 are already in force. |

|

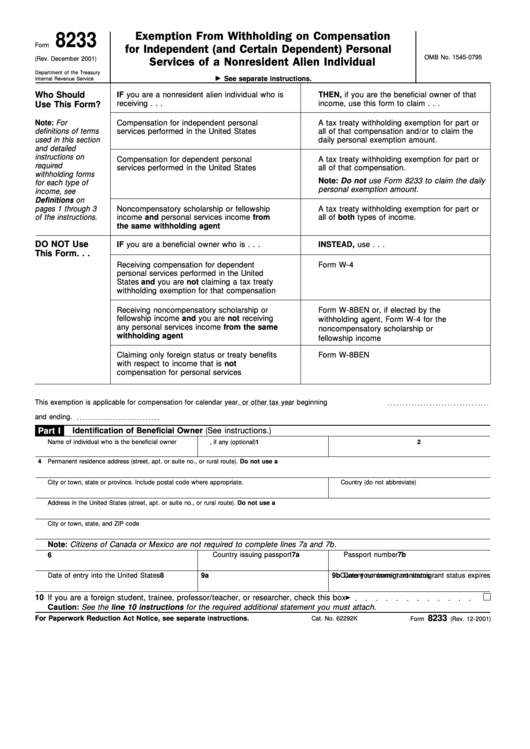

Table 1. Tax Rates on Income Other Than Personal Service Income

generally the treaty rates of tax are the same. Interest ccc. Dividends. Pensions and Annuities. Income Code Number. 1. 6. 7. 15. Name. Code. Paid by U.S.. |

|

SYNTHESISED TEXT OF THE MULTILATERAL CONVENTION TO

The existing taxes to which the Agreement shall apply are: (a). In United Arab Emirates: (i) income-tax;. (ii) corporation tax;. (iii) wealth-tax. (hereinafter |

|

TAX CONVENTION WITH THE REPUBLIC OF INDONESIA

The Convention is the first tax treaty to be negotiated between the United States and. Indonesia. It is based on model income tax conventions of the |

|

TAX CONVENTION WITH SWISS CONFEDERATION

The maximum rates of tax that may be imposed on dividend and royalty income are generally the same as in the current U.S. - Switzerland treaty. |

|

Tax Guide for U.S. Citizens and Resident Aliens Abroad

U.S. income tax regardless of where you are tax filing requirements that apply to U.S. citi- ... any tax treaty not to be a U.S. resident for a tax. |

|

TAX CONVENTION WITH SOUTH AFRICA GENERAL EFFECTIVE

The income tax convention between the United States and South Africa of December 13 Like other U.S. tax treaties |

|

TAX CONVENTION WITH THE KINGDOM OF MOROCCO

common to other U.S. income tax treaties. Treaty benefits use a Moroccan address and therefore get the reduced Treaty rates on dividends. |

|

Latin America Tax Insights

13 août 2021 Tax Insights. Brazil moves into second phase of its income tax reform. Brazil ratifies income tax treaties with Switzerland and UAE:. |

| UAE Highlights 2021 - Deloitte US |

|

Bilateral Agreement between the US and the United Arab

For purposes of this agreement and any annexes thereto (“Agreement”) the following terms shall have the meanings set forth below: a) The term “United States”means the United States of America including the States thereof but does not include the U S Territories |

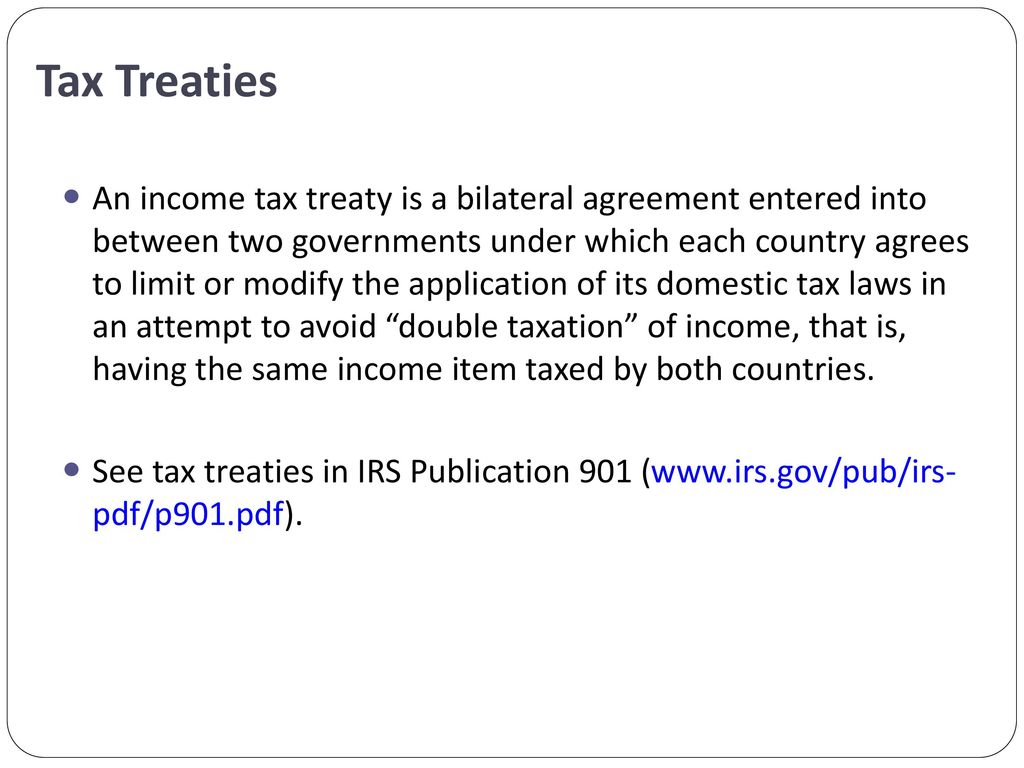

Does the United States have a tax treaty with foreign countries?

The United States has income tax treaties (or conventions) with a number of foreign countries under which residents (but not always citizens) of those countries are taxed at a reduced rate or are exempt from U.S. income taxes on certain income, profit or gain from sources within the United States.

What are UAE's double taxation agreements?

UAE’s double taxation treaties are meant to reduce the withholding taxes applied in the home countries of foreign companies operating in the Emirates. For a complete list of all UAE’s double taxation agreements, you can ask our agents in company registration in Dubai.

Can foreign companies pay taxes in the UAE?

All the taxes paid by a foreign company operating in the UAE can be credited in the company’s home country based on the double taxation agreement and the domestic tax laws. Recently the UAE and the US have signed an agreement for international tax compliance.

Does a tax treaty offer a reduced tax rate?

For more details on the whether a tax treaty between the United States and a particular country offers a reduced rate of, or possibly a complete exemption from, U.S. income tax for residents of that particular country, refer to Publication 901, U.S. Tax Treaties.

|

Bilateral Agreement between the US and the United Arab Emirates

17 jui 2015 · Government of the United Arab Emirates to Improve International Tax Compliance 6045(c) of the U S Internal Revenue Code; or (xiii) any tax- exempt trust on adapting the terms of this Agreement and other agreements |

|

Income Tax Treaty PDF - Internal Revenue Service

Morocco for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on common to other U S income tax treaties |

|

ADGM Tax Environment - PwC

Please do not hesitate to contact us Tax The UAE double tax treaty network is large, especially for a country that Central America (1) South America (3) |

|

New double tax treaty with United Arab Emirates - PwC

7 fév 2017 · The new UK-UAE double tax treaty contains a standard employment income Article 14, which allows UAE resident STBVs to claim exemption |

|

Tax Agreements with Tax Havens and Other Small Countries - STEP

US individuals and foreign individuals resident in most tax-treaty countries pay a further 15 US federal tax ($90,000 per $1 million), bringing the US tax liability to about and the Grenadines, and the United Arab Emirates The US also has |

|

United Arab Emirates - Fbr

Pakistan - United Arab Emirates Income Tax Treaties 1993 Income Tax Convention Signatories: Pakistan; United Arab Emirates Signed: February 7, 1993 |

|

Countries with a Double Tax Treaty with the USA

Armenia*** 01 01 1976 30 0 0 0 n a Australia 01 12 1983 15 0 10 0 Article 16 / Protocol Austria 01 01 1999 15 0 0 0 Article 16 Azerbaijan |

|

Administration of Double Tax Treaties - the United Nations

its inception and assisted us in securing commitments from the other authors, as well as ence in negotiating and administering double tax treaties A view was UAE for treaty purposes even though the UAE did not impose a tax on income |

|

Tax and Regulatory Analysis - Abu Dhabi Global Market

3 1 US Federal Income Tax Implications – Summary Table ADGM entities can benefit from the extensive UAE double tax treaty network, which includes 92 |

![Technical Explanation US-Japan Income Tax [PDF] Technical Explanation US-Japan Income Tax [PDF]](https://0.academia-photos.com/attachment_thumbnails/32089347/mini_magick20190425-4386-1eitd6y.png?1556243020)