us uk tax treaty pension income

|

UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION

Article 10 (Dividends) represents a new approach to meshing by treaty |

|

Technical Explanation - U.S-U.K. Income Tax Convention of 24 July

22 juil. 2002 pension schemes established in the United Kingdom. (4) Article 24 (Relief from Double Taxation) confirms the benefit of a credit to citizens. |

|

Uk/USA Double Taxation Agreement - 2002

from 6 April 2003 for income tax and capital gains tax from 1 May Article 18 (Pension Schemes) and Articles 19 (Government Service) |

|

Agreement Between The U.S. And The United Kingdom

A U.K. pension may affect your U.S. benefit 3121(l) of the Internal Revenue Code to pay Social Security taxes for U.S. citizens and residents. |

|

Exchange of Notes - U.S.U.K. Double Taxation Convention

24 juil. 2001 the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and on Capital Gains which has been ... |

|

Digest of Double Taxation Treaties April 2018

6 avr. 2018 Where a treaty is recent the effective date for UK income tax purposes is shown in the table. ... Phone us or go to www.hmrc.gov.uk. |

|

2011-0096 Release Date: 12/30/2011 CC:INTL:B01

30 déc. 2011 and the U.S.-U.K. income tax treaty. (the U.K. Treaty). 2 to certain transfers between pension funds. Transfers from one Malta pension fund ... |

|

Memorandum

29 août 2008 of the U.S.-U.K. income tax treaty to a rollover distribution from a U.K. pension scheme to a U.S. retirement plan. |

|

INFO 2010-0151 Release Date: 6/25/2010 CC:INTL:BO1

25 juin 2010 income tax treaty (the Treaty)1 and self-invested pension plans (SIPPs) in the United. Kingdom. You asked about transfers by a U.S. resident ... |

Overview

A pension may be liable to UK tax and tax in another country. This can arise where: 1. a UK resident receives a pension from another country 2. a non-resident receives a pension subject to UK tax In these circumstances, look at the relevant double taxation agreement (DTA) to establish which country has primary taxing rights. The following guidance ...

Government Pensions

This pension type is usually under the Government Service Article of a DTA. It is normally the case that a pension that is paid by the government of a country to one of its former employees will continue to be taxed by that government. However, that is not always what has been agreed in a particular DTA. For that reason, it is important to check th...

Non-Government Pensions

This pension type is usually under the Pensions Article of a DTA. The general Pensions Article does not usually give a definition of ’pension’. Some DTAs refer to ‘pension’, whilst others refer to ‘pensions and similar remuneration’. The phrase ‘pensions and similar remuneration’ covers lump sum payments as well as pension, whereas the phrase ‘pens...

Can a foreign pension plan be a tax treaty?

While the United States generally taxes its residents on their worldwide income regardless of their citizenship or the source of the income, an income tax treaty to which the United States is a party could modify the usual rules and mitigate some of the disadvantages of participating in a foreign pension plan.

What is the US & UK tax treaty?

US UK Tax Treaty: The United States and the UK have entered into several different International Tax Treaties. These treaties impact how the IRS enforces US Tax law — and vice versa. The two main treaties are the Double Tax Treaty and the Foreign Account Reporting Act. The focus of this article will be the US and UK Income Tax Treaty.

Is a UK pension taxable in the US?

In other words, if the pension from the other contracting state (UK) would be exempt in the UK if the person was a resident in the UK, then it will also be exempt from tax in the US. If the UK deems the 25% distribution as tax-free, does that make the pension “exempt from tax in the UK,” and therefore is not taxable in the US?

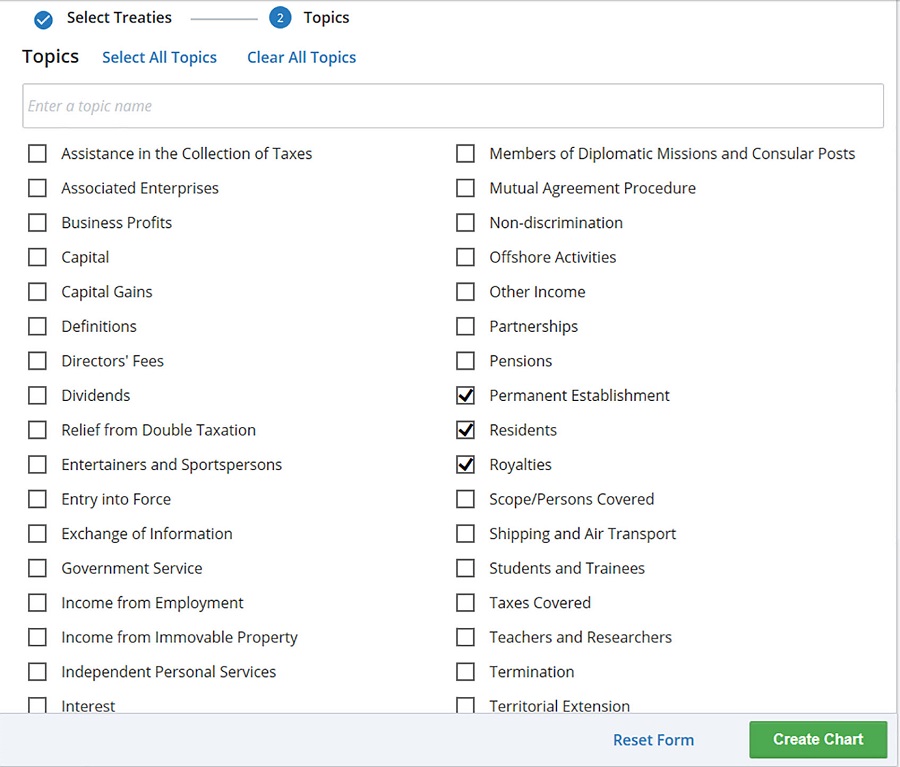

Are the tables a Complete Guide to all income tax treaties?

The tables are not meant to be a complete guide to all provisions of every income tax treaty. As a withholding agent, you should consult the actual provisions of the tax treaty that apply to the person to whom you are making payment if you have any reason to question the documentation you have received.

|

US-UK income tax treaty, signed July 24, 2001, London

b) the benefits conferred by a Contracting State under paragraph 2 of Article 18 ( Pension Schemes) and Articles 19 (Government Service), 20 (Students), and 28 ( |

|

UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION

America and the Government of the United Kingdom of Great Britain and United States income tax treaties, and to the model income tax convention of the (b) However, such pension shall be taxable only in the other Contracting State if the |

|

Technical Explanation PDF - Internal Revenue Service

An Income Tax Convention with the United Kingdom of Great Britain and Northern The fact that a charitable organization or pension fund is exempt from tax in the The broad standard of tax jurisdiction embodied in United States tax treaties |

|

TB Special Edition 6 - UK/USA Double taxation Agreeement

Article II of the protocol amended Article 10(4) of the treaty so that tax exempt UK pension funds entitled to zero US withholding tax on dividends paid by US companies will also be entitled to zero US withholding tax on dividends where they invest in US equities through either US regulated investment companies or US |

|

Public Consultation Double Tax Treaty with the United States of

14 oct 2016 · Article 6 – Income from real property (Immovable Property) 16 Article 17 – Pensions, Social Security, Annuities, Alimony and Child Support The UK's tax treaty with the US allows a zero withholding tax rate on dividends in |

|

Treaty residence of pension funds - OECD

1 avr 2016 · pension or retirement benefits or to earn income for the benefit of one See also Article 4(3)(a) and 3(1)(o) of the U S -U K Tax Treaty, which |

| [PDF] The Dearth of US Tax Treaties with Latin America - University of ...repository.law.miami.edu › cgi › viewcontent20 fév. 2020 · United States Income Tax Treaties – A to Z, su- pra. 2 ... icy/treaties/Documents/ teus-uk.pdf');">PDF |

The Dearth of US Tax Treaties with Latin America - University of

20 fév 2020 · United States Income Tax Treaties – A to Z, su- pra 2 icy/treaties/Documents/ teus-uk pdf (discussing paragraph 2 of article 24 of the Convention) 29 tralia taxes pensions under a “TTE” system—there is no tax deduc- |

|

Income Tax Consequences in the UK - RAF Lakenheath - AFmil

Thanks to the United States - United Kingdom tax treaty, you can deduct your contributions to a qualified U K pension scheme on your U S taxes Plus, your |

|

United States Tax Treaty Policy: An Overview - CORE

a summary of the highlights of the OECD model income tax treaty, which forms mists, from the United States, the United Kingdom, the Nether- lands and Italy,4 base there 7 7 Pensions are taxable only in the state of residence; 78 income |

|

The Taxation of Pensions - Joint Vienna Institute

17 jan 2019 · The taxation of retirement income/pensions is a very, very complicated issue double taxation treaties do not pay attention to the fundamental |