us withholding tax rates 2018

|

Notice 1036 (Rev. December 2018)

Tables for Income Tax Withholding are net wages after employee performing services in the United States use ... employer |

|

2018 Publication 15

25 janv. 2018 Bracket Method Tables for Income Tax Withholding. The. 2018 withholding tables ... ber of the U.S. Armed Forces on active duty who moves. |

|

Withholding Tax Facts 2018

31 janv. 2018 tax. Listed below are the actual 2018 local income tax rates. ... income tax for a reporting period DO NOT MAIL us your. Form MW506. |

|

2018 Instruction 1040

26 mars 2020 credit American opportunity credit |

|

2019 Publication 15

17 déc. 2018 Notice 2018-92. 2018-51 I.R.B. 1038 |

|

2018 Publication 15-A

21 févr. 2018 Tax and Employee Medicare Tax Withholding Tables; ... The 2018 withholding ... able in the case of a member of the U.S. Armed Forces on. |

|

January 2018

1 janv. 2018 Appendix VI: Withholding Tax Rates . ... to the valuation of the MSCI Malaysia Index in US dollars effective Sept 30th |

|

Global Tax Developments Quarterly Accounting for Income Taxes

9 févr. 2018 implications on accounting for income taxes under US GAAP ... 2018 introduce concessionary corporate tax rates for income. |

|

November 2018 WTU-001 Withholding Tax Update

1 nov. 2018 The current withholding tax rates will continue for 2019 . These rates are available in Publication W-166 Wisconsin. Employer's Withholding ... |

|

Tax Guide Page 1 of 70 10:16 - 25-Jan-2018 Employer's

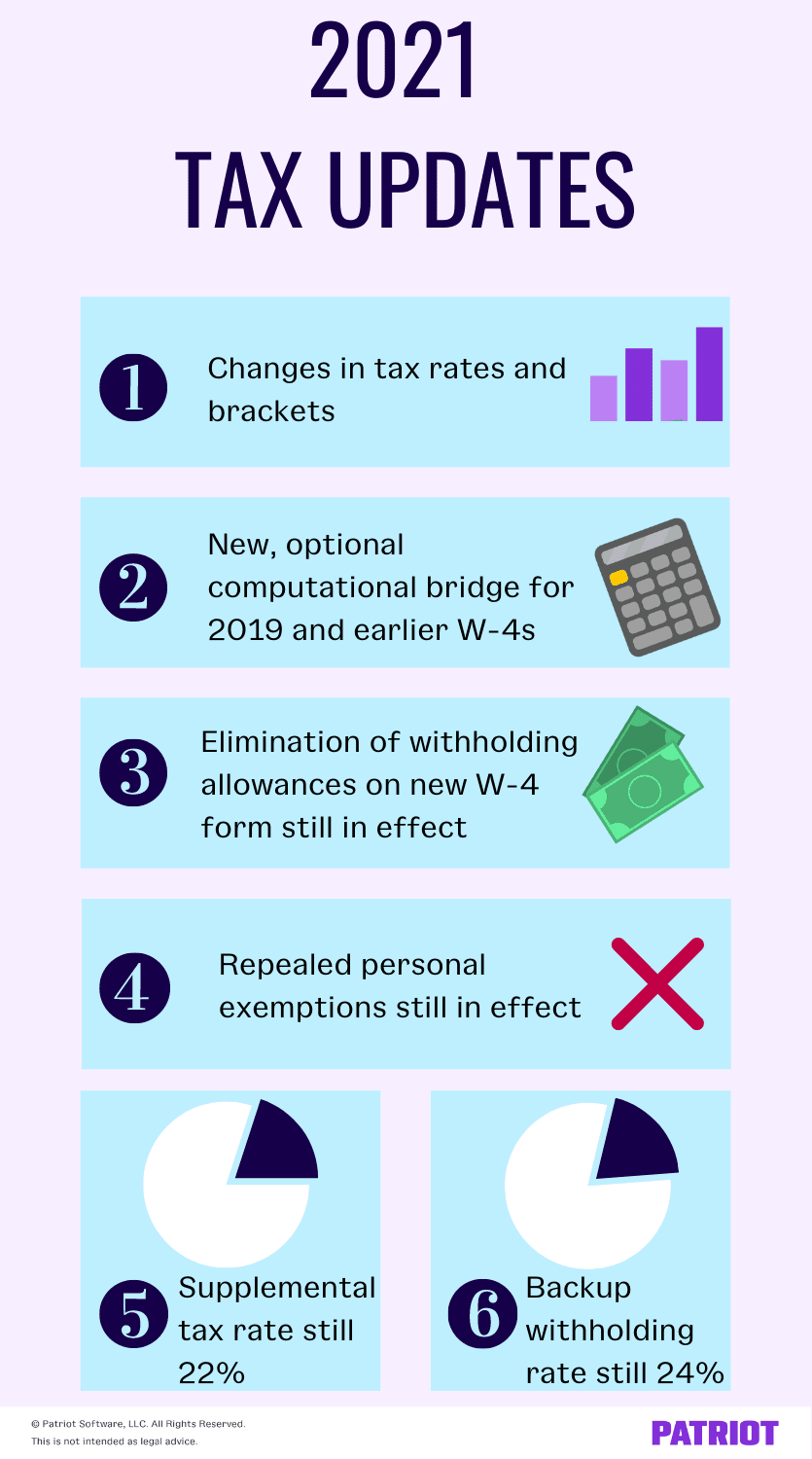

The 2018 amount for one with- holding allowance on an annual basis is $4150 Withholding on supplemental wages P L 115-97 lowered the withholding rates on supplemental wages See section 7 for the new rates Backup withholding P L 115-97 lowered the backup withholding rate to 24 |

|

IRS Releases New 2018 Withholding Tables To Reflect Tax

For 2018 the 20 long term capital gains tax rate applies when the lesser of adjusted net capital gain or taxable income is at least $479000 (MFJ) $425800 (single) $239500 (MFS) and $452400 (HOH) for 2018 For 2019 these amounts are $488850 (MFJ) $434550 (single) $244425 (MFS) and $461700 (HOH) |

|

INDIVIDUAL TAX RATE TABLE 2018 - H&R Block

INDIVIDUAL TAX RATE TABLE 2018 Updated for the Tax Cuts and Jobs Act Inflation-Adjusted Amounts As of January 14 2019 Your tax rate is just one part of your overall tax picture Other factors such as your filing status and taxable income also affect what you pay in taxes Want help understanding how it all matters to you? |

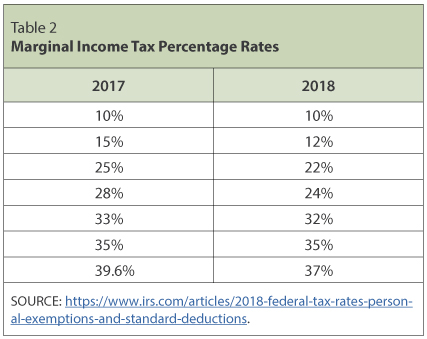

Income Tax Brackets and Rates

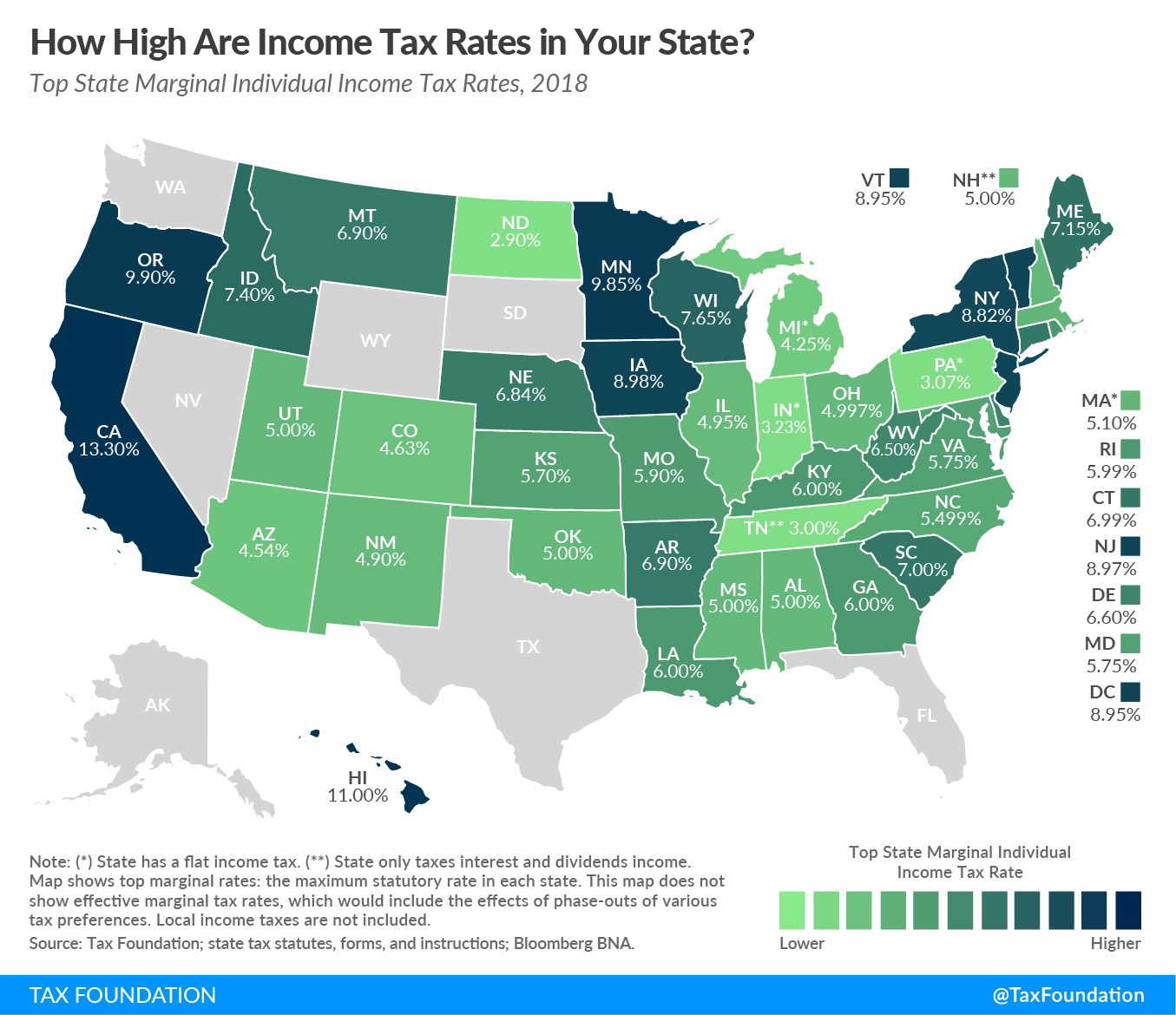

In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income tax rate of 37 percent will hit taxpayers with taxable incomeof $500,000 and higher for single filers and $600,000 and higher for married couples filing jointly.

Standard Deduction and Personal Exemption

The standard deduction for single filers will increase by $5,500 and by $11,000 for married couples filing jointly (Table 2). The personal exemption for 2018 is eliminated.

Alternative Minimum Tax

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two...

What's new in the 2018 income-tax withholding tables?

The Internal Revenue Service (IRS) has updated the income-tax withholding tables for 2018 to reflect changes made by the new tax law. The updated tables reflect the new rates for employers to use during the 2018 tax year. Employers are instructed to use the 2018 withholding tables as soon as possible, but not later than February 15, 2018.

What are the tax policies for 2018?

Table 1. Tax Brackets and Rates, 2018 The standard deduction for single filers will increase by $5,500 and by $11,000 for married couples filing jointly (Table 2). The personal exemption for 2018 is eliminated. Stay informed on the tax policies impacting you. Subscribe to get insights from our trusted experts delivered straight to your inbox.

What taxes do employers have to withhold?

Most employers must withhold (except FUTA), deposit, report, and pay the following employment taxes. Income tax. Social security tax. Medicare tax. FUTA tax. There are exceptions to these requirements.

Can I claim exemption from tax withholding for 2018?

You may claim exemption from withholding for 2018 if both of the following apply. For 2017 you had a right to a refund of all For 2018 you expect a refund of all federal income tax withheld because you no expect to have tax liability. If you’re exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it.

|

Table 1 Tax Rates on Income Other Than Personal Service Income

Feb 2019) ➢ This table lists the income tax rates on interest, dividends, royalties, and other income that is not effectively connected with the conduct of a U S |

|

Notice 1036 (Rev December 2018) - Internal Revenue Service

Tables for Income Tax Withholding are net wages after employee performing services in the United States, use employer, unchanged from 2018 There is no |

|

Worldwide Corporate Tax Guide - EY

20 mai 2020 · ownership does not occur F Treaty withholding tax rates Albania has entered into tax treaties with several jurisdictions In October 2018, the |

|

Tax Reform: Changes to Federal Withholding Tax Rules - Deloitte

22 déc 2017 · The backup withholding rate is derived from the individual federal tax rate tables The Act reduced the backup withholding rate from 28 to 24 for payments made on or after January 1, 2018 |

|

Withholding Tax Study 2018 - assetskpmg

WHT rate of 1 6695 (0 from 1 January 2018), foreign non-UCITS funds should therefore be entitled to they have US investors or include US investments |

|

Withholding Tax Rates - ICE

Updated Withholding Tax Table Effective March 1, 2021 An updated Index Dividend Withholding Tax Table is now available on the ICE Data Indices website |

|

US TAXATION OF FOREIGN NATIONALS - Global Tax Network

Rental of a Residence 53 • Investments in Foreign Corporations 54 Appendix A 2018 US Individual Income Tax Rates 55 Appendix B List of US Tax Treaties |

|

Tax - KPMG International

Minimum tax is due from loss-making companies or whose income tax is less than the minimum tax due Ivory Coast Fiscal Guide 2017/2018 2 Rates (cont ) Rates Individual tax investment in US, French and Japanese ports Djibouti is |

|

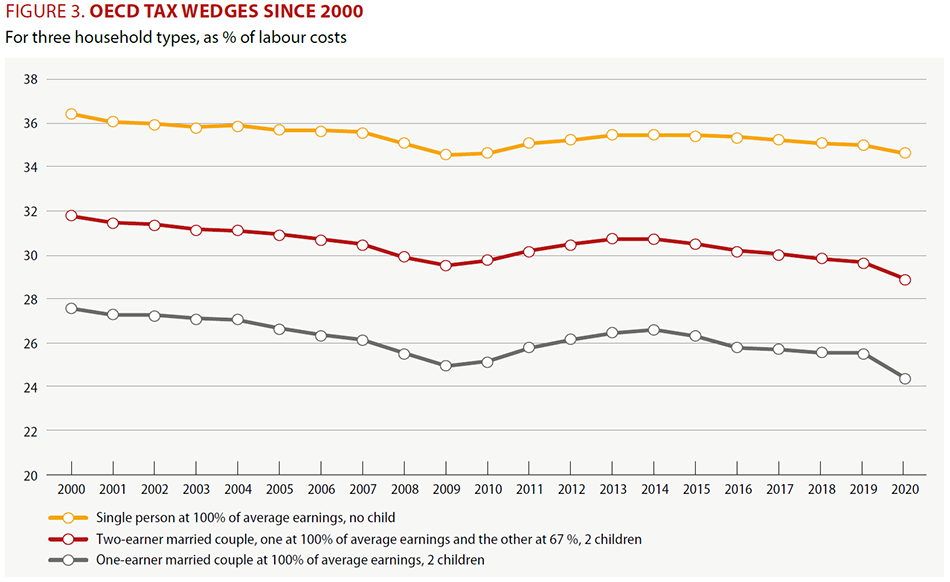

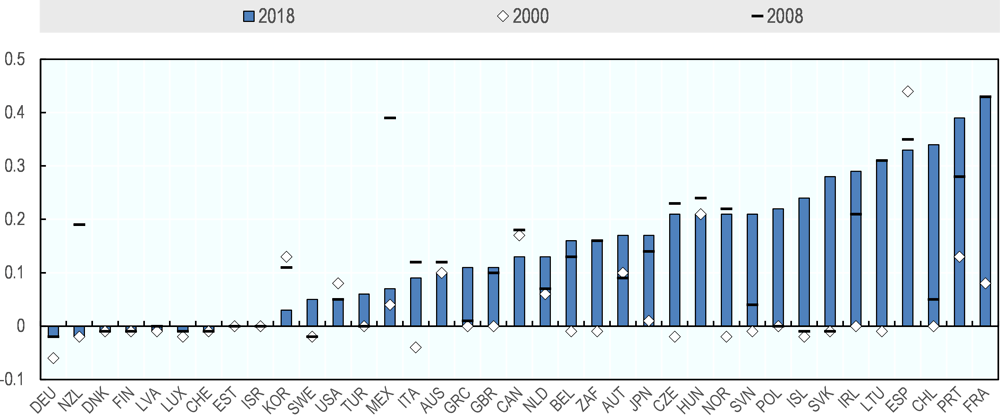

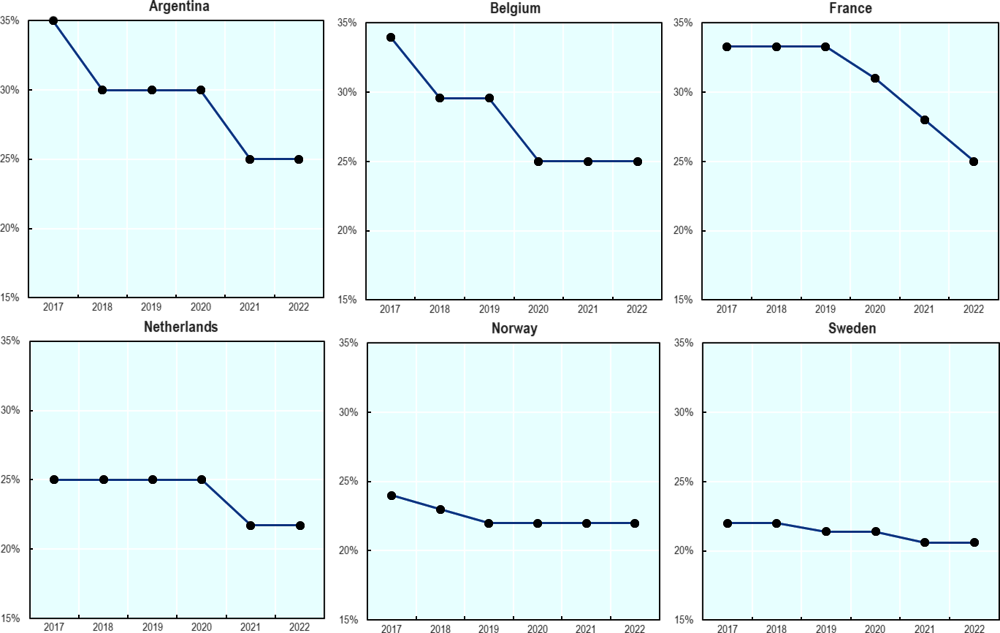

Taxing Wages - The United States - OECDorg

The OECD average tax wedge in 2019 was 36 0 (2018, 36 1) In the United States in 2019, this reduction (10 9 percentage points) was greater than the In the United States, income tax and employer social security contributions combine to |