us withholding tax rates for non residents

|

Withholding of Tax on Nonresident Aliens and Foreign Entities

2 mar. 2022 more paid to certain nonresident alien individu- als must be reported on Form 1042-S. ... to a chapter 4 withholding rate pool of U.S. pay-. |

|

Preparation Is Key When A Non-U.S. Tax Resident Joins The Board

is subject to U.S. federal tax withholding as well as to specific tax U.S. taxation of compensation paid to non-resident directors. |

|

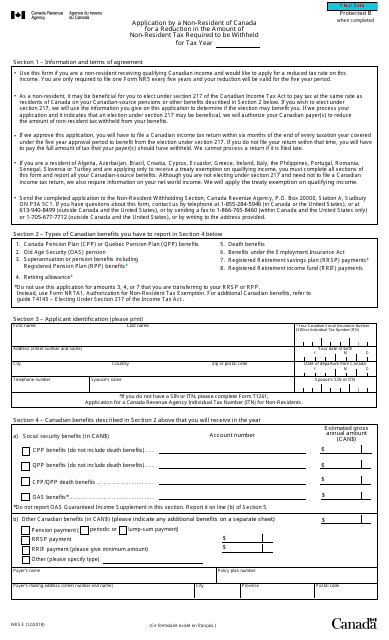

UNITED STATES - CANADA INCOME TAX CONVENTION

Under Canadian law the credit for foreign taxes on dividends |

|

2021 Instructions for Form 1040-NR

18 jan. 2022 U.S. Nonresident Alien Income Tax Return ... 2021 Tax Table . ... Not all of the U.S. tax that you owe was withheld from that income. |

|

Untitled

U.S. offices of foreign banks and the structure of U.S. taxation combined U.S. withholding tax rate on loans to U.S. residents from foreign banking ... |

|

2021 Publication 519

20 avr. 2022 Can I be a nonresident alien and a resident alien in the same ... What is the tax rate on my income subject to U.S. tax? See chapter 4. |

|

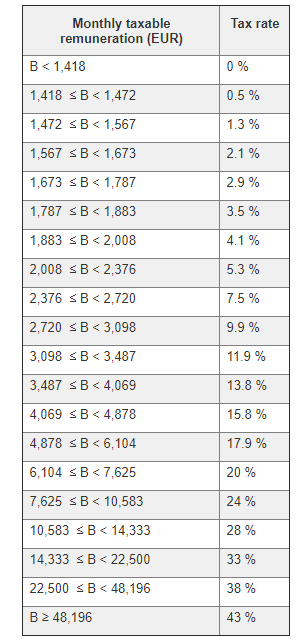

Non-Resident Withholding Tax Rates for Treaty Countries1

Payments of Old Age Security and Canada/Quebec Pension. Plan benefits to U.S. residents are taxable only in the U.S. and are not subject to Canadian withholding |

|

Table 1. Tax Rates on Income Other Than Personal Service Income

Source Income Subject to Withholding. whether a U.S. tax resident is entitled to the listed rate of tax from a foreign treaty country although. |

|

CIBC

If so the rental income that you earn may be taxed in both the U.S. and Canada. U.S. taxation. For U.S. tax purposes |

|

NRWT - payers guide

16 oct. 2020 when you're required to deduct NRWT (non-resident withholding tax). • when to pay the deductions to us. • what information you're required ... |

|

Taxation of Non-Resident Aliens (NRAs) - Morgan Stanley

TAXATION OF NON-RESIDENT ALIENS (NRAS) persons generally are required to withhold 10 to 15 of the amount realized on the disposition The treatment of various items of income and the rates of withholding applied to such items often vary depending on the relevant treaty Income subject to withholding tax may be taxable in the NRA's home country |

How much tax do foreigners have to withhold?

Persons purchasing U.S. real property interests from foreign persons generally are required to withhold 10% to 15% of the amount realized on the disposition. The treatment of various items of income and the rates of withholding applied to such items often vary depending on the relevant treaty.

Are non-resident aliens taxed?

Taxation of Non-Resident Aliens (NRAs) Individuals who are neither U.S. citizens nor U.S. residents, referred to in the Internal Revenue Code as non-resident aliens or “NRAs”, may be subject to income tax on certain U.S. source income and subject to gift and estate tax on U.S. situs assets.

What is the withholding rate on non-immigrant scholarships?

The withholding rate is 14% on taxable scholarship and fellowship grants paid to nonresident aliens temporarily present in the United States in “F,” “J,” “M,” or “Q” nonimmigrant status. Payments made to nonresident alien individuals in any other immigration status are subject to 30% withholding. Nondegree candidate.

What is the WHT rate for non-residents?

For non-residents, the WHT rate will be reduced to 7.5% through the use of a DTT with certain territories. The 15% WHT rate applies on the gross payment on interest, royalties, and certain lease payments to related parties resident in low-tax jurisdictions. * WHT on dividends and interest is currently suspended until 5 May 2024.

|

Non-Resident Withholding Tax Rates for Treaty - assetskpmg

The following items apply under the provisions of the Canada-U S treaty: Interest —Interest is defined as income from debt claims of every kind, whether or not |

|

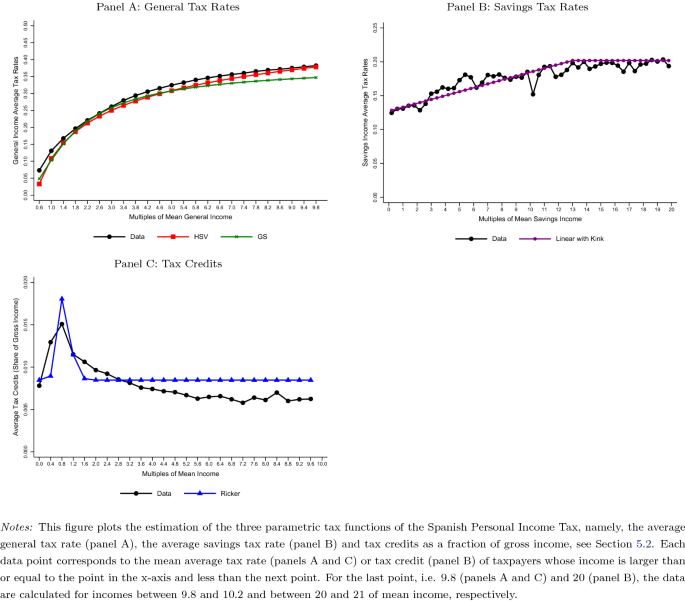

Table 1 Tax Rates on Income Other Than Personal Service Income

This table should not be relied on to determine whether a U S tax resident is entitled to the listed rate of tax from a foreign treaty country, although generally the |

|

Other Tax Rates - KPMG International

Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 (11) The protocol to the Canada-U S treaty entered into force on December 15, 2008 |

|

US Witholding Tax Rates on Ordinary REIT Dividends to Non-US

REIT Dividends to Non-U S Investors The tax rates in the chart also apply to REIT capital gain distributions so long as the non-U S investor owns 10 or less of a REIT U S Income resident in Cyprus or Egypt, no more than 5 of |

|

Taxation of foreign nationals by the US—2016 - Deloitte

Nonresident aliens US investment income is generally taxed at a flat 30 tax rate, which may be reduced by a tax treaty Certain types of investment income may be exempt from US tax |

|

US TAXATION OF FOREIGN NATIONALS - Global Tax Network

Rental of a Residence 53 • Investments in Foreign Corporations 54 Appendix A 2018 US Individual Income Tax Rates 55 Appendix B List of US Tax Treaties |

|

US Tax Issues for Foreign Partners: US Withholding - Duane Morris

US Withholding Taxes Tax Treaties Nonresident alien individual partners – 39 6 in 2015 ▫ US tax is withheld at highest IRC §1 or §11 rate in effect |

|

Implications of Introducing US Withholding Taxes on Foreigners

To attract foreign investors, before-tax interest rates would have to rise (to offset the tax), raising the cost of capital to domestic firms and reducing incentives to |

|

UNDERSTANDING FOREIGN WITHHOLDING TAX - BlackRock

not the ETF is held in a taxable or non-taxable investment account What do you pay? The U S withholding tax rate charged to foreign investors on U S |

|

Tax implications of investing in the United States - RBC Wealth

income from U S investments may be subject to the U S domestic tax rate which is generally a flat 30 U S non-resident withholding tax rate Note that a |