us withholding tax rates for uk citizens

|

UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION

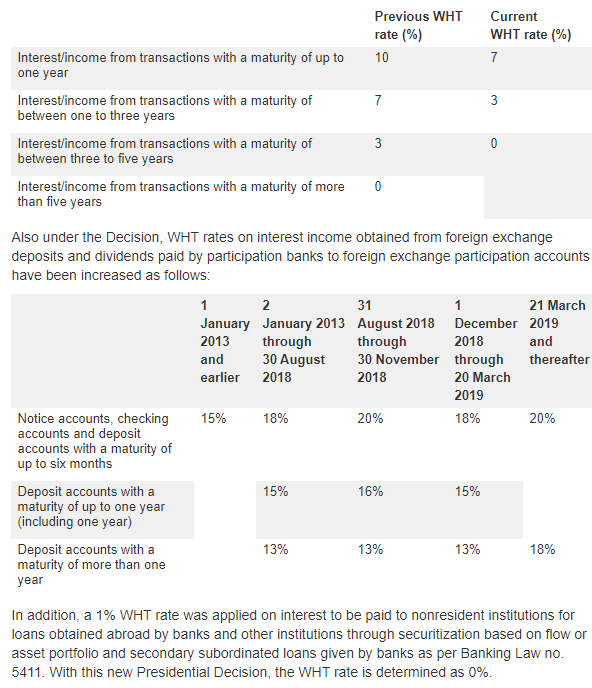

The United States will reduce its withholding rates to 15 percent on income of United States citizens residing in the United Kingdom and United Kingdom ... |

|

Technical Explanation - U.S-U.K. Income Tax Convention of 24 July

22 juil. 2002 citizen of the United States the saving clause permits the United States to include the ... rate of withholding tax to 15 percent. |

|

Untitled

tax on a loan to a U.S. resident from a U.K. branch of a Swiss bank would be 5 percent but ... U.S. withholding tax rate on loans to U.S. residents from. |

|

Preparation Is Key When A Non-U.S. Tax Resident Joins The Board

is subject to U.S. federal tax withholding as well as to specific tax U.S. taxation of compensation paid to non-resident directors. |

|

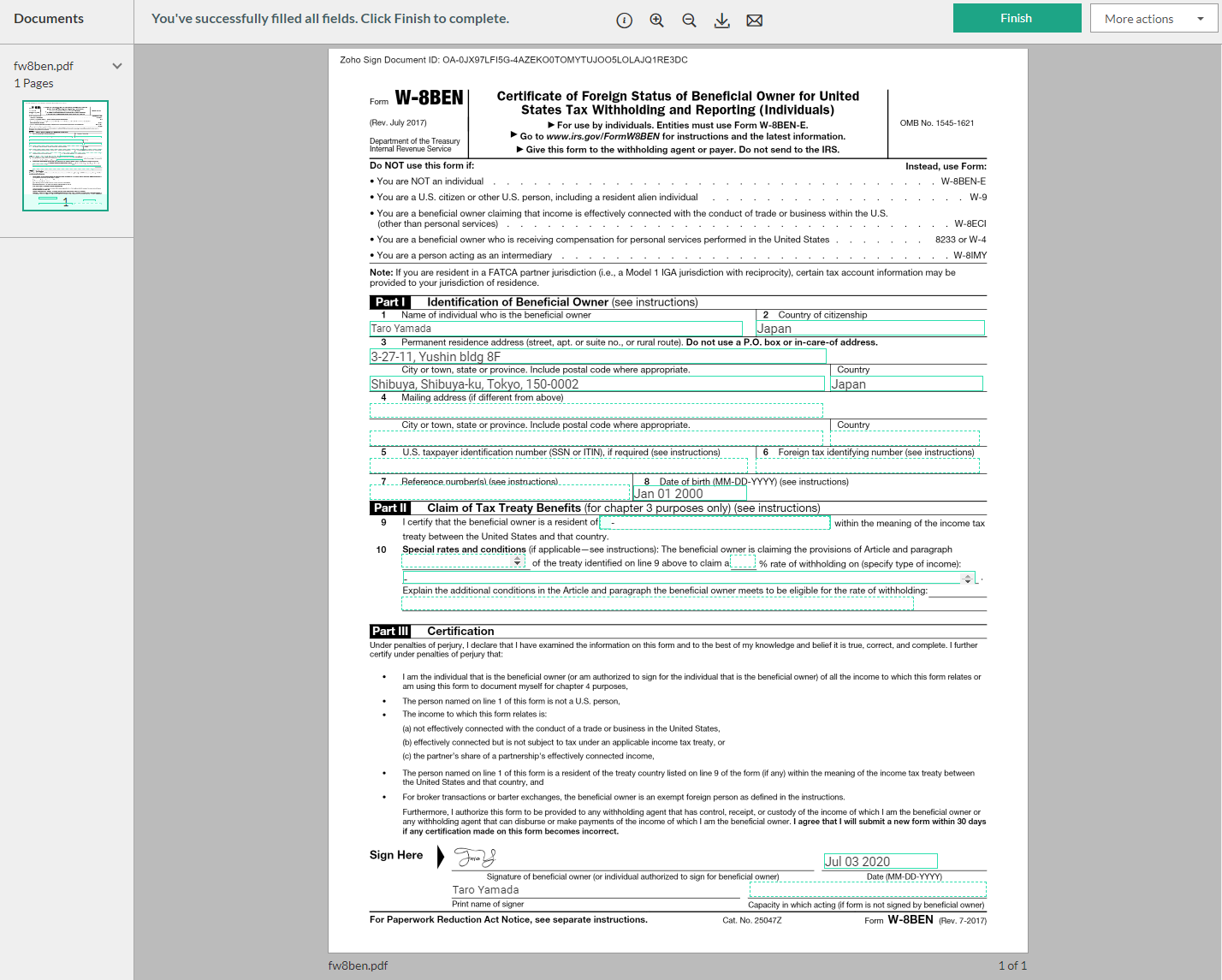

Certificate of Foreign Status of Beneficial Owner for United States

States Tax Withholding and Reporting (Individuals) You are a U.S. citizen or other U.S. person including a resident alien individual . |

|

Digest of Double Taxation Treaties April 2018

6 avr. 2018 The rate of withholding tax on a PAIF distribution (interest) is the ... You are a British citizen or a national of another member state of ... |

|

Instructions for Form W-8BEN (Rev. October 2021)

30 nov. 2020 United States Tax Withholding and Reporting (Individuals) ... persons are subject to U.S. tax at a 30% rate on income they receive from U.S. ... |

|

Withholding of Tax on Nonresident Aliens and Foreign Entities

2 mar. 2022 to a chapter 4 withholding rate pool of U.S. pay- ees. See Identifying the Payee later |

|

Uk/USA Double Taxation Agreement - 2002

Effective in the US from 1 May 2003 for taxes withheld at source (Residence)) and by reason of citizenship may tax its citizens |

|

US/UK Tax Issues for Internationally Mobile Executives

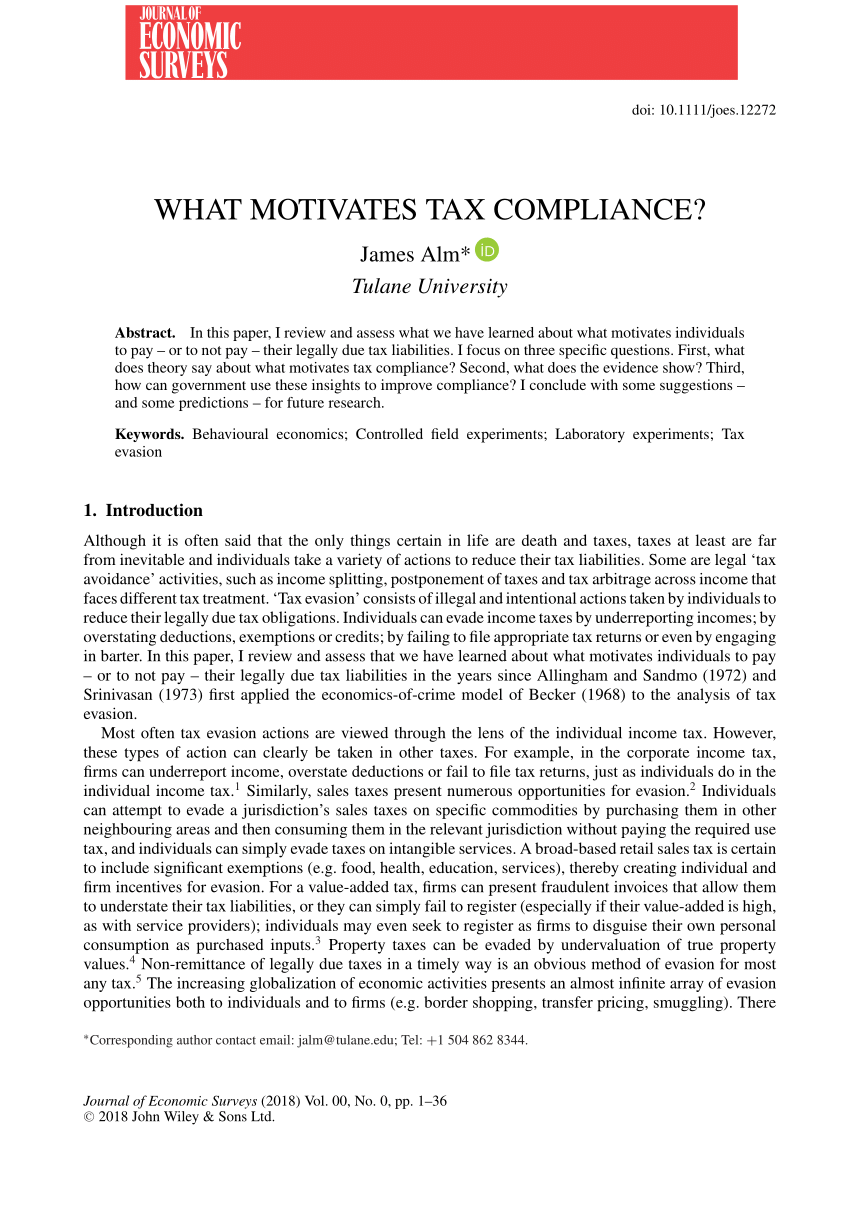

the US. Residents and non-residents are taxed in the US according to very different rules regarding income deductions and tax rates. As discussed below |

|

Taxation of Non-Resident Aliens (NRAs) - Morgan Stanley

Persons purchasing U S real property interests from foreign persons generally are required to withhold 10 to 15 of the amount realized on the disposition The treatment of various items of income and the rates of withholding applied to such items often vary depending on the relevant treaty |

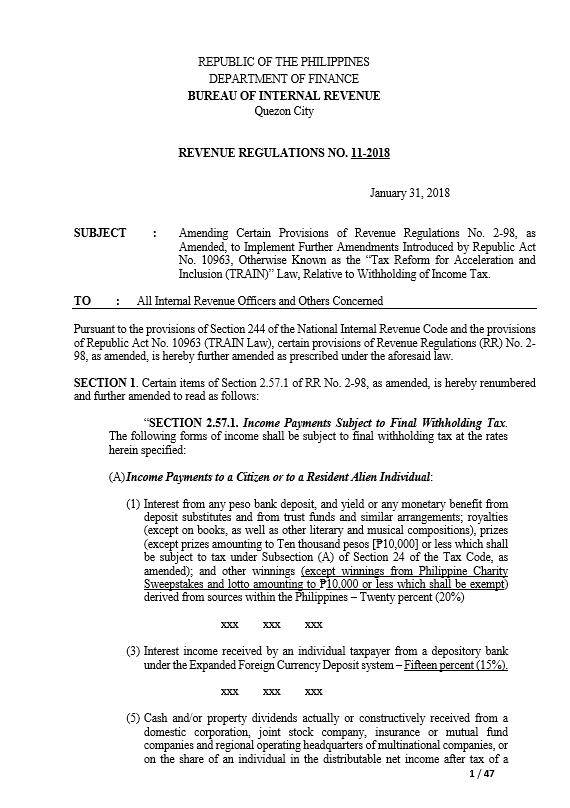

How much tax do foreigners have to withhold?

Persons purchasing U.S. real property interests from foreign persons generally are required to withhold 10% to 15% of the amount realized on the disposition. The treatment of various items of income and the rates of withholding applied to such items often vary depending on the relevant treaty.

How much tax does a UK resident pay on US dividends?

By contrast, if the UK resident receives US dividends then the rates of US withholding tax vary from 0% to 15% depending on who the recipient is, how long they have held the shares and how many shares they hold (as a percentage of the total amount of the payer).

Can a foreign person claim a reduced rate of withholding?

See Regulations section 1.1441-7 (b) for these requirements. Exceptions to TIN requirement. A foreign person does not have to provide a U.S. or foreign TIN to claim a reduced rate of withholding under a treaty for chapter 3 purposes if the requirements for the following exceptions are met. Income from marketable securities (discussed next).

What is tax withholding?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4. For help with your withholding, you may use the Tax Withholding Estimator.

|

UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION

The United States will reduce its withholding rates to 15 percent on dividends to United Kingdom portfolio investors and to five percent on dividends to United Kingdom parent corporations This reduction follows the pattern adopted in other United States treaties |

|

Non-Resident Withholding Tax Rates for Treaty - assetskpmg

Non-Resident Withholding Tax Rates for Treaty Countries (10) The following terms apply under the provisions of the Canada-U K treaty, including Plan benefits to U S residents are taxable only in the U S and are not subject to Canadian |

|

United Kingdom - Deloitte

The main rate of corporation tax is 20 as from 1 April 2015 (reduced from 21 ) There typically is no withholding tax on dividends paid by UK companies under a nonresident company that is controlled by UK residents The regime |

|

Taxation of foreign nationals by the US—2016 - Deloitte

Individuals classified as resident aliens are taxed on their worldwide income derived from any source Tax rates are graduated and income is determined in the |

|

Technical Explanation - US-UK Income Tax Convention - Treasury

5 mar 2003 · (4) Article 24 (Relief from Double Taxation) confirms the benefit of a credit to citizens and residents of one Contracting State for income taxes paid |

|

Uk/USA Double Taxation Agreement - 2002 - Govuk

Effective in the US from 1 May 2003 for taxes withheld at source Article 24 ( Relief from double taxation) (A) any British citizen, or any British subject not |

|

Tax Considerations for UK Technology Companies Doing - Govuk

US citizens or US residents (as determined for US federal income tax purposes) graduated income tax rates applicable to US persons The non-US person |

|

US Witholding Tax Rates on Ordinary REIT Dividends to Non-US

NOTE: The withholding rate is 30 (other than for a governmental entity) if the non-U S shareholder does not reside in chart also apply to REIT capital gain distributions so long as the non-U S investor owns 10 or less of a REIT residents in Australia, Bangladesh, Bulgaria, Sweden, the U K , and Venezuela , if the |

|

Tax Agreements with Tax Havens and Other Small Countries - STEP

The statutory US withholding tax rate on dividends, interest, royalties and arrangements and the UK which has never taxed its non-domiciled residents on their |

/payrollfiles-57a621f05f9b58974a262cf8.jpg)