us withholding tax rates on capital gains

|

UNITED STATES - CANADA INCOME TAX CONVENTION

Desiring to conclude a Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital. |

|

2022 Publication 505

Mar 14 2022 ard deduction and tax rates used to figure your withholding. ... U.S. income tax withholding because they are subject to income tax. |

|

2021 Instructions for Form 1040-NR

Jan 18 2022 U.S. Nonresident Alien Income Tax Return ... Table A. Who Must File Form 1040-NR ... designated as long-term capital gain. |

|

UNITED STATES - MEXICO INCOME TAX CONVENTION

agree to promptly amend the Convention to incorporate that lower rate; and the Prevention of Fiscal Evasion with Respect to Taxes on Income ... |

|

2021 Publication 17

Dec 16 2021 4 Tax Withholding and Estimated Tax . ... get a job or may file a tax return us- ... (including capital gain distributions and Alaska. |

|

UNITED STATES-NORWAY INCOME AND PROPERTY TAX

convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital have agreed upon the |

|

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED

other recent United States income tax treaties. Though the draft treaty provides the normal general rule that capital gains are taxable in the state of. |

|

FDAP Income

Jan 7 2016 percent tax rate on FDAP may be reduced (or eliminated) pursuant to an income ... income if it is from “sources within the United States”. |

|

United States-Republic of Korea Income Tax Convention

The Convention establishes maximum rates of withholding tax in the source country on income flows of United States capital and technology to Korea. |

|

UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION

TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO. TAXES ON INCOME AND CAPITAL GAINS. The Government of the United States of America and the |

|

United States Highlights 2022 - Deloitte US

For tax years beginning after 31 December 2017 the rate is 50 (reduced from 70 ) for a less-than 20 shareholder; 65 (reduced from 80 ) for a noncontrolling shareholder owning 20 or more; or 100 for distributions among members of the same affiliated group provided other requirements are met |

|

US Taxation of Structured Notes (736903722 1) (003) - Mayer Brown

Withholding Tax U S imposes a 30 withholding tax on payments of U S source “FDAP” income (interest dividends etc ) to foreign investors Portfolio interest exception Capital gains of foreign investors generally exempt Impact of “dividend equivalents” Type 1 Notes |

Short-Term Or Long-Term

To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term. For exceptions to this rule, suc...

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0%if your taxable income is less than or equal to $41,675 for single and married filing separately, $83,350 for married filing jointly or qualifying surviving spouse or $55,800 for head of household. A capital gain rate of ...

Limit on The Deduction and Carryover of Losses

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 16 of Schedule D (Form 1040). Claim the loss on line 7 of your Form 1040 or Form 1040-SR. If your net capital loss is more than thi...

Where to Report

Report most sales and other capital transactions and calculate capital gain or loss on Form 8949, Sales and Other Dispositions of Capital Assets, then summarize capital gains and deductible capital losses on Schedule D (Form 1040), Capital Gains and Losses.

Estimated Tax Payments

If you have a taxable capital gain, you may be required to make estimated tax payments. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax, Estimated Taxes and Am I Required to Make Estimated Tax Payments?

Net Investment Income Tax

Individuals with significant investment income may be subject to the Net Investment Income Tax (NIIT). For additional information on the NIIT, see Topic No. 559.

How much is capital gain taxable?

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $41,675 for single and married filing separately, $83,350 for married filing jointly or qualifying surviving spouse or $55,800 for head of household.

Do foreign corporations pay tax on capital gains?

A foreign corporation generally is exempt from tax on capital gains, unless the gain is from the sale of a US real property interest or is connected with the operation of a US trade or business (tax on the latter may be eliminated under a tax treaty in certain cases). Losses

What if I have a net capital gain?

If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year.

What taxes does the US Impose?

As part of its overall transfer tax system, the US imposes a generation-skipping tax (GST) on certain transfers. The states also impose various estate, gift, and/or inheritance taxes. Other: The federal government imposes a variety of excise taxes, in addition to the social security taxes on wages described above.

|

Summary of worldwide taxation of income and gains - assetskpmg

Otherwise a 10 tax should apply The capital gain may be exempt under the DTT with the U S in some cases Dividends 5 5 |

|

Tax implications of investing in the United States - RBC Wealth

If so, the capital gain distributions may be considered long-term capital gains (i e , where the investment in the RIC is held for more than 12 months) or short-term capital gains Ordinary dividend distributions are subject to a 15 U S withholding tax |

|

US Witholding Tax Rates on Ordinary REIT Dividends to Non-US

chart also apply to REIT capital gain distributions so long as the non-U S investor owns 10 or less of a REIT listed on a U S stock exchange U S Income |

|

Introduction to the taxation of foreign investment in US real - Deloitte

Under current law, for those in the higher end income bracket, capital gains are taxed at a rate of 25 (to the extent of gain attributable to depreciation recapture) |

|

Taxation of foreign nationals by the US—2016 - Deloitte

Appendix C: United States income tax treaties 51 Appendix D: a flat 30 tax rate, which may be reduced by a tax fewer opportunities to defer capital gains |

|

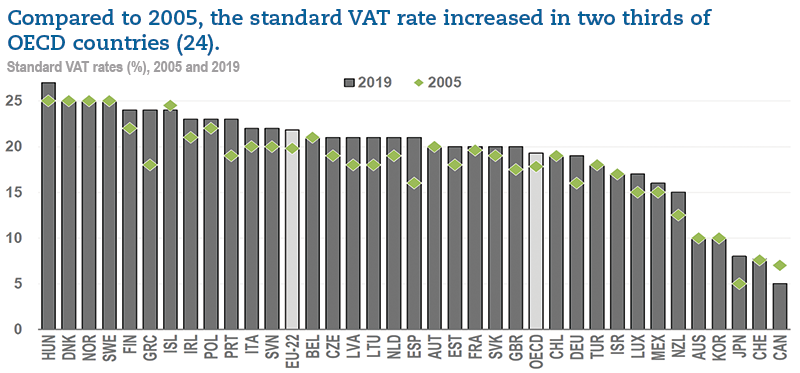

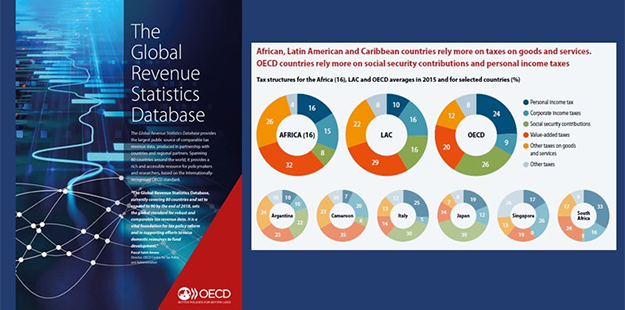

Taxation of corporate and capital income - OECDorg

A federal surtax increased the general federal corporate income tax rate by 1 12 income in the previous 3 years lower or equal to 75 000 UF (approx US$ 2,6 |

|

Tax Guide - Goldman Sachs Asset Management

Cost Basis of Shares Purchased and Calculation of Capital Gains or Losses of long-term capital gain section of the shareholder's U S federal income tax |

|

Worldwide Corporate Tax Guide - EY

20 mai 2020 · several of our tax disciplines from hubs in the United States, Brazil, Europe, and The corporate income tax rate is 5 for software production and Albania must declare the capital gains and pay the tax liability by |

|

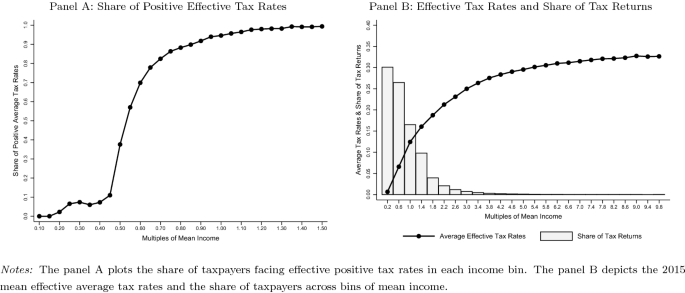

Implications of Introducing US Withholding Taxes on Foreigners

avoidance options, the effective tax rate of any practicable withholding tax is likely to be couraging capital inflows, taxing foreigners' interest income would re- |

|

Israel - Internal Revenue Service

other recent United States income tax treaties Though the draft treaty provides the normal general rule that capital gains are taxable in the state of Israeli source dividends, the comparable maximum Israeli withholding rates will be 25 |