us german tax treaty dividend withholding

|

CONVENTION BETWEEN THE UNITED STATES OF AMERICA

Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention the withholding tax on direct investment dividends on a reciprocal. |

|

U.S.-German Tax Treaty Developments

23 juin 2006 Most importantly for German investors in the United States the Protocol would eliminate the withholding tax on payments of dividends or ... |

|

GERMANY RULES ON S CORP TREATY BENEFITS

During 2012 lower-tier tax court in Cologne |

|

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE

16 juin 1981 16 1981 ("the U.S. Model") |

|

Italian Supreme Court rules that withholding taxes levied on

7 juil. 2022 on dividends distributed to German and US investment ... double tax treaty rate in the cases at issue |

|

Worldwide Real Estate Investment Trust (REIT) Regimes

8 oct. 2019 The withholding tax on Belgian dividends received by a RREC is no ... Based on article 4 of the OECD Model Tax Treaty a RREC should be ... |

|

Protocol Amending the U.S.-German Income Tax Treaty signed

of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion the case of dividends paid by a United States person that is a U.S. ... |

|

CHALLENGES AND OPPORTUNITIES FROM GERMAN TAX LAW

19 janv. 2022 Dividend. Luxembourg. Now: U.S. Corp. cannot derivatively claim exemption from withholding tax via the. US/Germany treaty (Shareholder test ... |

|

ADR – Frequently Asked Questions

14 août 2013 What are the benefits of ADRs to US investors? ... US shares. The adidas AG dividend is subject to a German withholding tax of. |

|

World Tax Advisor - Deloitte US

The German GmbH withheld a domestic dividend withholding tax of 21 1 (the applicable rate at the time) on the payment The US corporation applied for a reduction of the withholding tax to the 5 rate based on article 10(2)(a) of the amended treaty and requested a refund of the excess tax withheld |

|

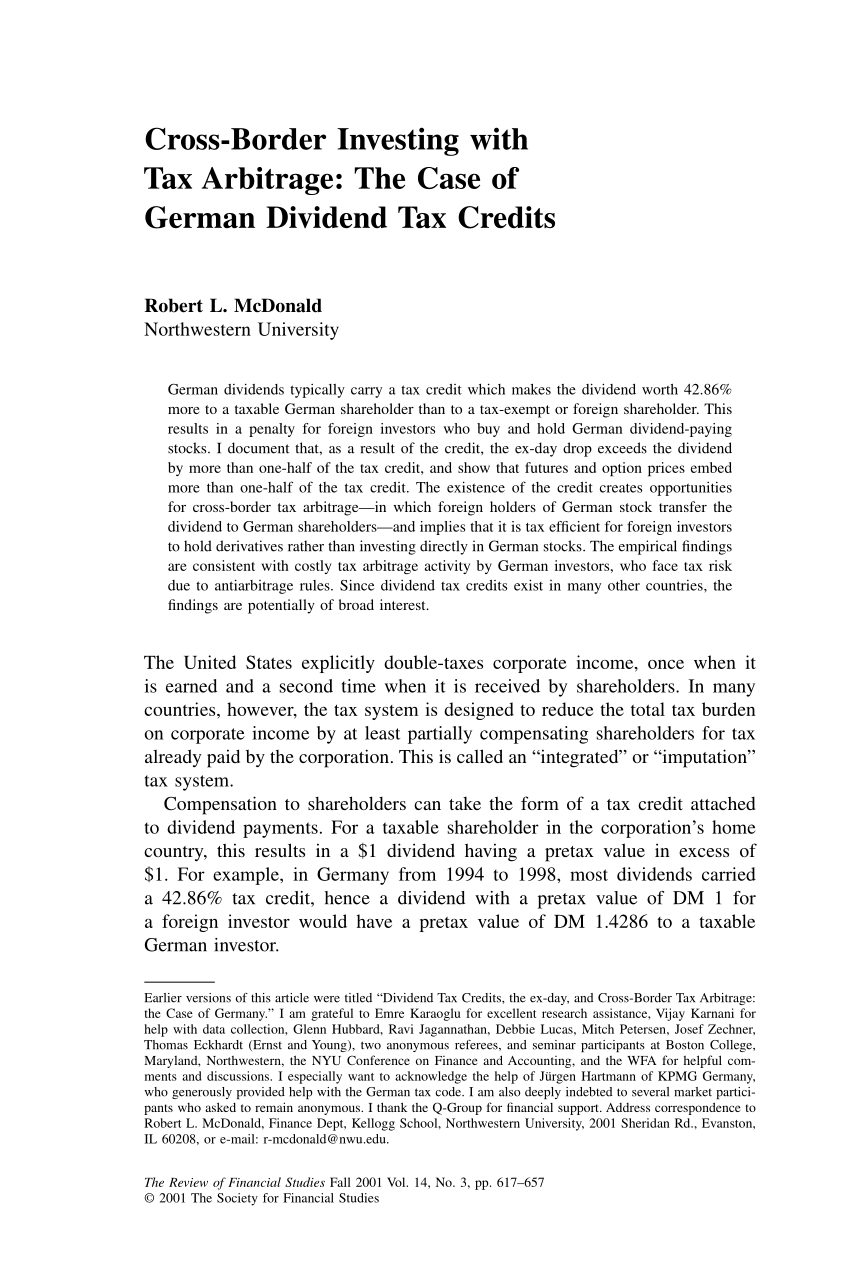

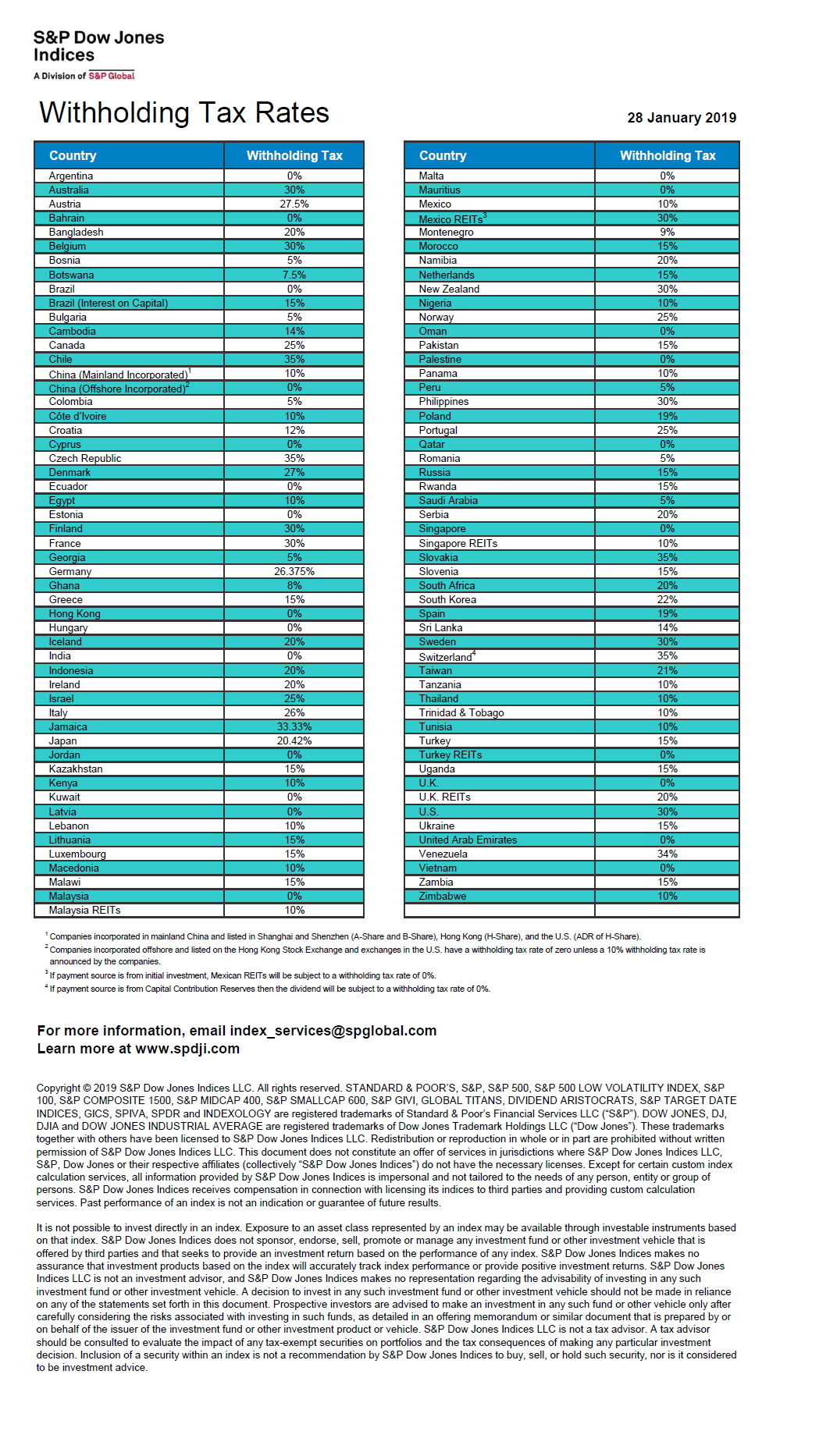

Introduction to income taxation of German corporations and

A dividend paid by a German corporation to its shareholder should be tax non-deductible at the level of the German corporation and should give rise to German dividend withholding of generally 26 375 percent to be withheld from the dividend amount and remitted by the German corporation to the German tax authorities Such dividend withholding tax |

|

Searches related to us german tax treaty dividend withholding PDF

Claim for refund of German withholding taxes on dividends and/or interest according to § 43 b (until 31 12 2000 § 44 d) Einkommensteuergesetz (EStG) under the double Taxation Convention between the Federal Republic of Germany and 1) (claimant‘s country of residence) |

Are German dividends tax deductible?

A dividend paid by German corporation to its shareholder should be tax non-deductible at the level of the German corporation and should give rise to German dividend withholding of generally 26.375 percent to be withheld from the dividend amount and remitted by the German corporation to the German tax authorities.

What are the different taxation concepts in Germany?

The following summarizes key aspects around the different taxation concepts. Corporations with legal seat and/or place of management in Germany are subject to corporate income tax (CIT) of 15 percent plus 5.5 percent Solidarity Surcharge (SolS) thereon, combined 15.825 percent, based on German domestic tax law.

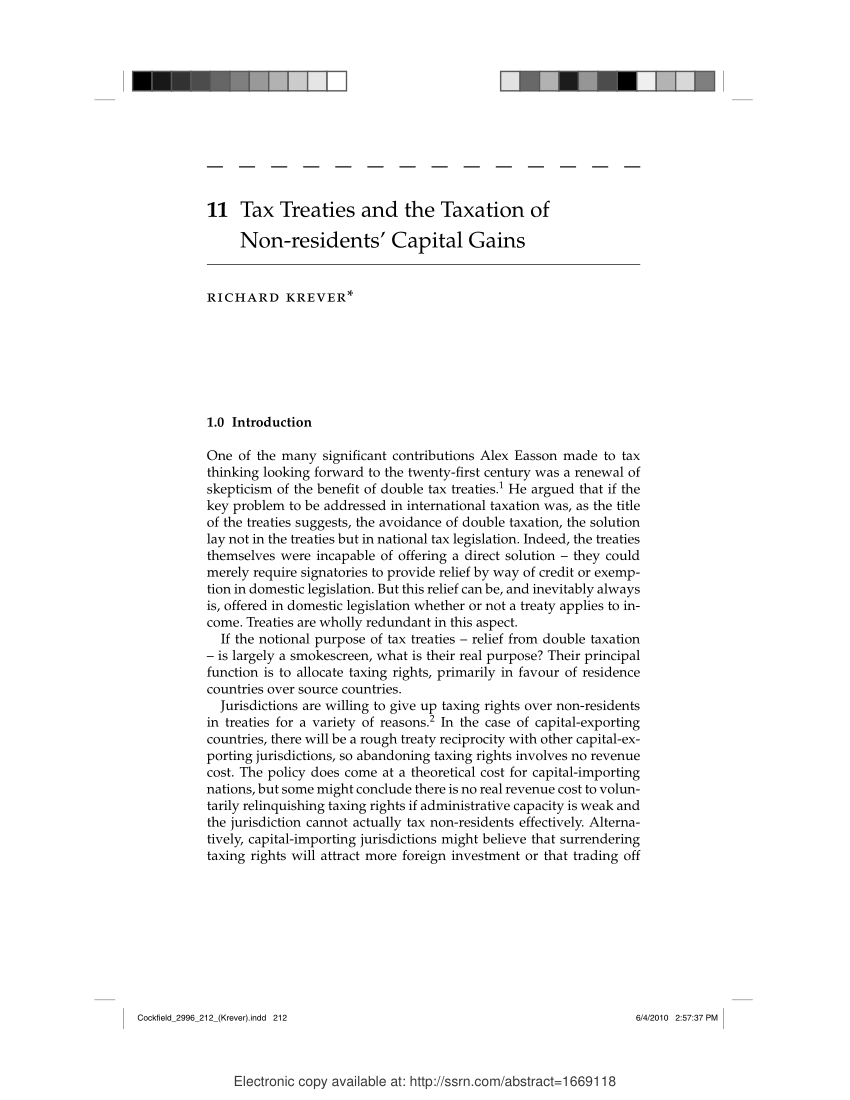

Does the United States have a tax treaty with foreign countries?

The United States has income tax treaties (or conventions) with a number of foreign countries under which residents (but not always citizens) of those countries are taxed at a reduced rate or are exempt from U.S. income taxes on certain income, profit or gain from sources within the United States.

How is German taxable income determined?

corporation’s German taxable income is determined on the basis of the local stat-utory accounts, plus adjustments for tax purposes (e.g. non-deductible expenses, tax-exempt dividend income, adjustments due to different valuation of/accounting for assets and liabilities in German statutory vs. tax balance sheet, etc.).

|

Technical Explanation, US - German Protocol, signed June 1, 2006

15 nov 2006 · Federal Republic of Germany for the avoidance of double taxation and the taxpayer that has a significant amount of foreign source royalty |

|

US-German Tax Treaty Developments - Sullivan & Cromwell LLP

23 jui 2006 · German parent, would generally exempt from withholding tax dividend payments by a U S corporation to a German pension fund and would |

|

Investment Profile Germany - Roedlcom

s audit services including US GAAP and IAS, trade tax Dividend withholding tax 20 , reduced by double tax treaties to 0 - 15 (within EC 0 ) COMPANY |

|

New Double Tax Treaty signed between Germany and - PwC

On 23 April, Germany and Luxembourg signed a new double tax treaty, which Dividend withholding tax – the lower treaty US Real Estate Tax Leader |

|

Re US S Corporations German withholding tax status

in hands of shareholders in US – Whether 'treaty-eligible person' and beneficial owner of dividend paid to it – German-US double taxation convention, arts 1 7 |

|

Countries with a Double Tax Treaty with the USA

Germany 01 01 1990 15 0 0 0 Article 28 / Protocol Greece 01 01 1953 Treaty withholding rate on dividends Treaty withholding rate on interest** |

|

The Limitation on Benefit Clause of the US-German Tax Treaty and

The dividends are subject to U S and German income tax In the United States, those dividends are subject to a thirty percent withholding tax be- cause they are |

|

FISCAL GUIDE FOR GERMAN MARKET

Residents of Double Taxation Treaty (DTT) countries To apply for a Standard Refund, the client must send us the following documents: • Claim for Refund of German Withholding Taxes on Dividends and/or Interest; • Power of Attorney; |

|

Germany - Deloitte

Dividends received by a German resident corporation (from reduced under a tax treaty Royalties The withholding tax on royalties paid to a nonresident |