airbnb depreciation

Should you depreciate a short-term rental?

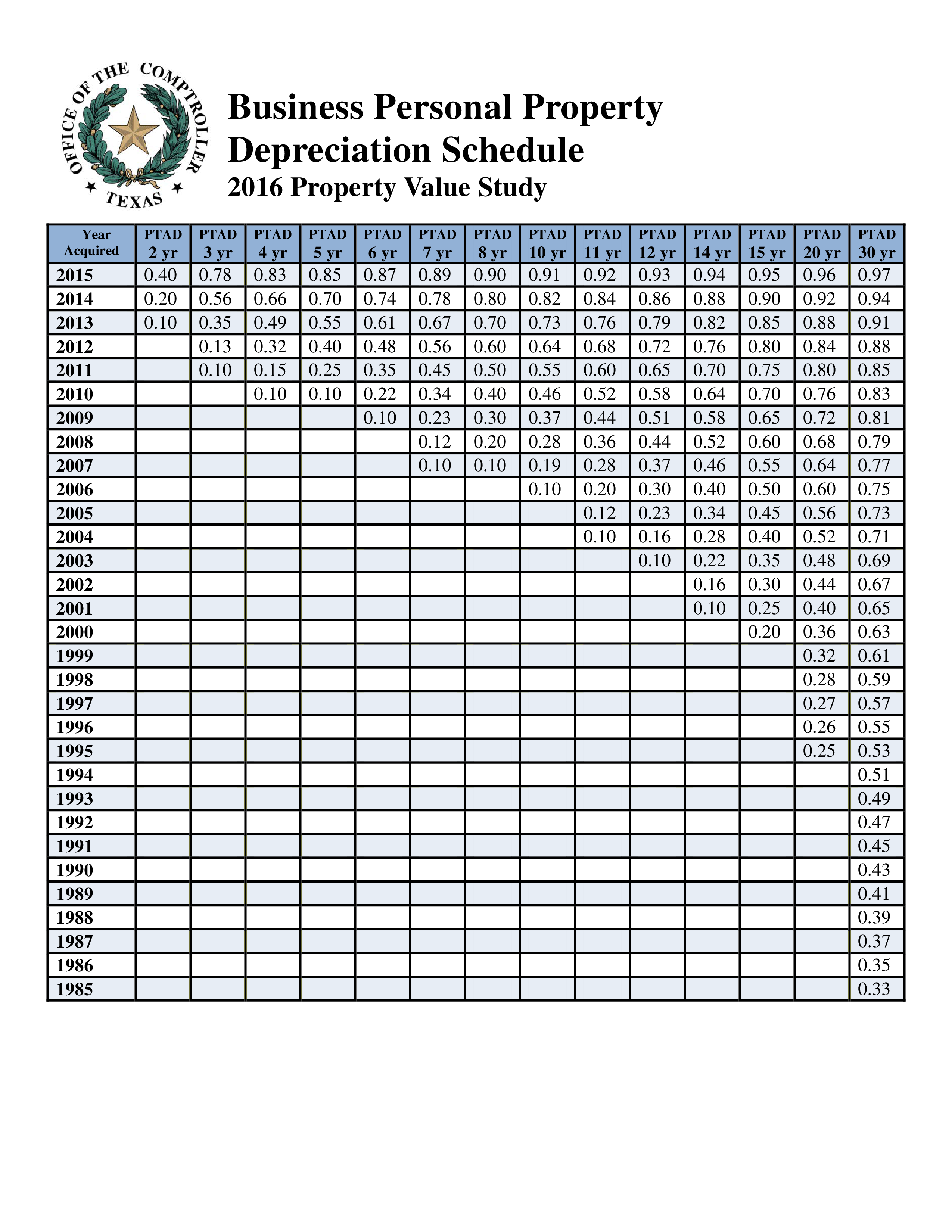

However, investors and their CPAs need to be aware of the depreciation rules that apply to the short-term rental market. The good news is that depreciation will allow many of these investors to realize significant tax savings. Completing cost segregation or other strategies to maximize these deductions can increase these savings even further.

Are Airbnb & EY liable for loss of profit?

Neither Airbnb nor EY shall be liable for any loss of profit or any other damages, including but not limited to direct, indirect, special, incidental, consequential, or other damages in connection with the information contained in this booklet.

Are Airbnb hosts tax deductible?

Airbnb hosts are usually considered owners of rental property, not small business owners, for tax purposes. How Airbnb hosts deduct expenses depends on whether they are renting out an entire home or just part of the home.

What is Airbnb depreciation?

Depreciation is a method used to determine how much of the assets (e.g. your home) value has been used up. For Airbnb rental owners, the cost of buying or improving your home can be depreciated. Depreciating these assets in accordance with the rules from the IRS will allow you to claim a portion of the cost as a deduction on your taxes each year.

|

??????? ???? ??? ??????? ??? ??? ???????

?????? ???? ??? ??????? ??????????? ???? ???? Airbnb ?? ?? ???? ????? ???? ??????? ??????? ???????? ?????? ??? ?????? ??????? ... |

|

?????????

to COVID-19 reintroduces building depreciation but Airbnb properties. ... The depreciation rate for non-residential buildings is. |

|

2021 Publication 527

19 janv. 2022 Chapter 2 discusses depreciation as it ap- plies to your rental real estate activity—what property can be depreciated and how much it. |

|

Tax Guide 2021 - Hungary.docx - Airbnb

Service fees such as the Airbnb Service Fee. ? Depreciation. ? Other taxes including the healthcare tax paid can be deducted as long as five years after. |

|

COVID-19 economic support package: Legislation enacted

17 mars 2020 to also deny depreciation deductions for buildings used to provide “short-stay accommodation” such as baches and AirBnBs. |

|

HUNGARY – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS

Under the costs paid option the following costs can be deducted from your rental income: ? The online website fee. Page 3. ? Utilities |

|

Rental-properties-2021.pdf

30 juin 2021 n Guide to depreciating assets 2021 (NAT 1996). CO-OWNERSHIP OF RENTAL PROPERTY. The way that rental income and expenses are divided. |

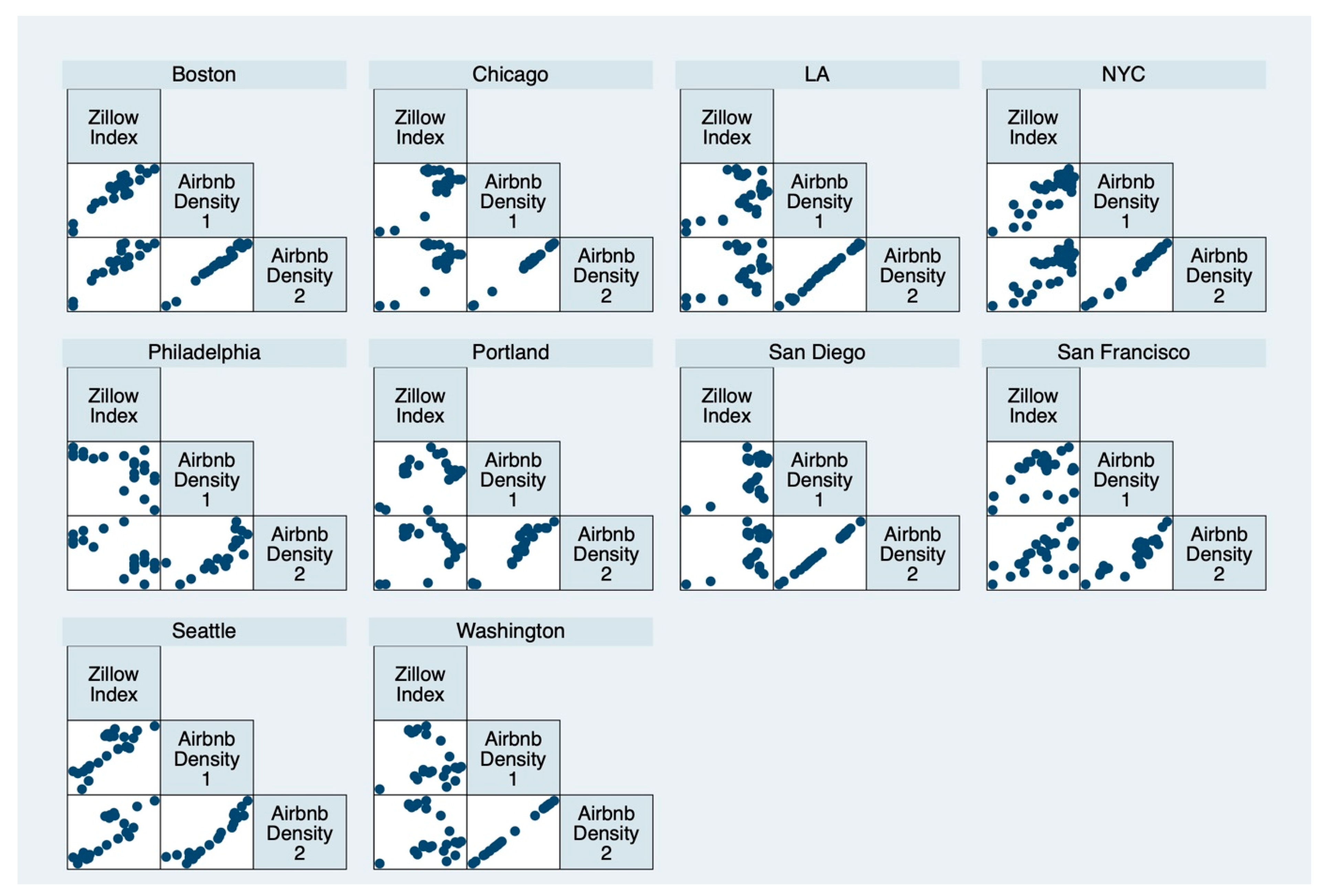

| Online Platforms Creative “Disruption” in Organizational Capital |

|

Online Platforms Creative “Disruption” in Organizational Capital The

17 oct. 2021 transformation have a higher depreciation rate of organizational capital. ... expected after Airbnb's entry in 2014 |

|

Residential Rental Investments

13 avr. 2021 Depreciation – But not on the building. ... Law amended so that full-time AirBnB properties or baches are subject to the ring fencing rules ... |

|

Airbnb Host

Airbnb General guidance on the taxation of rental income Depreciation on amounts paid to acquire the property and to make subsequent improvements |

|

AIRBNB HOST REPORTING GUIDE - H&R Block

Airbnb hosts who offer their property for short-term rental are subject to the income tax rules for residential rental property Airbnb may issue you Form 1099- K |

|

Publication 527 - Internal Revenue Service

29 jan 2021 · Chapter 2 discusses depreciation as it ap- plies to your rental real estate activity —what property can be depreciated and how much it can be |

|

Depreciation on Residential Investment and Commercial - Valuit

confidence in advising clients on property depreciation matters Contents • Property for short term use such as through AirBNB would meet the definition of |

|

How do the standard income tax rules apply to a - Inland Revenue

20 mai 2019 · through Airbnb, Bookabach and Holiday Houses) and You'll also be able to claim deductions for the depreciation of the chattels in the |

|

Rental properties 2019 - Australian Taxation Office

30 jui 2019 · second-hand depreciating assets 3 Tax and natural disasters 3 Publications and services 4 Is your rental property outside Australia? 4 |

|

Airbnbs Impact On Your Taxes Depends On How You - Wood LLP

23 nov 2015 · Airbnb's Impact On Your Taxes Depends On How Airbnb has tips on its website, addressing “How do taxes work including depreciation |

|

Taxing your Airbnb and family bach - Deloitte

22 mar 2019 · However, expenses that are for both rental and private purposes should be apportioned Depreciation losses on assets that are also used by |

|

Special Edition Webinar - Polson Higgs

through Airbnb and BookaBach style providers аа Depreciation, R&M and property fitout When your part time accommodation becomes taxable and what |