airbnb tax implications

How is Airbnb income taxed in the UK?

In general, any money you earn as a Host on Airbnb is considered taxable income that may be subject to different taxes like income tax, business rates, corporation tax or VAT.

You can see what you have earned in your Host earnings summary.

Tax forms for the United Kingdom are due by 31 January each tax year.What is the 90 day rule for Airbnb?

The rule restricts property owners from renting out their entire home or apartment for more than 90 days in a calendar year without requiring planning permission.

This limitation does not apply to shared spaces or individual rooms within a property.What is proof of income on Airbnb?

If you uploaded taxpayer information to your Airbnb account, you will get a Proof of Income form for each unique taxpayer ID associated with your account.

If you haven't uploaded taxpayer information to your Airbnb account, your Proof of Income will summarize all earnings for your host account.Yes, in general, Airbnb income is taxable.

If you are renting out your property abroad, you have to pay income tax on it.

In general, you will be able to deduct some of the allowable expenses, such as mortgage interest, rates, insurance, and so on.30 jan. 2024

Learn About The 14-Day Rule

Tax laws are full of exceptions, but the 14-day rule—sometimes called the "Masters exception" because of its popularity in Georgia during the annual Masters golf tournament—is the most important for anyone considering renting out a vacation home. Under this rule, you don't report any of the rental income you earn from the short-term rental, as long

Learn About Exceptions For Rooms

If you just rent out one room in your house, the 14-day rule applies in the same way as if you rent out your whole house. Fourteen days or less, you don’t even have to report the income on your taxes, but you cannot take any rental expense deductions either. turbotax.intuit.com

Don't Panic If You Get An IRS Letter

The rule is simple: you don't have to report rental income if you stay within the 14-day rule. However, because of reporting laws, companies like Airbnb, HomeAway and VRBO may report to the IRS all income you receive from short-term rentals, even if you rent for less than two weeks. If reported, this income will possibly be reported to you and the

Keep Flawless Records of Rental Periods

You'll have a much easier time with tax issues on your short-term vacation rental if you treat it as a business from the get-go and keep meticulous records. If you rent out your place for two weeks or less, keep careful track of both rental days and those days you used the residence yourself. If you rent for longer than the 14-day exception period,

Document All Business Expenses

You are entitled to deduct all “ordinary and necessary”expenses to operate your rental business. Like the "BnB" in Airbnb, think of your rental as a bed-and-breakfast. If you buy new towels for your guests, repaint the guestroom or put a bottle of wine on the table for incoming guests, you can deduct these expenses from your rental income. By keepi

Apportion Mortgage Interest and Taxes If You only Rent A Room

If you rent out a room, rather than the entire house, for over 14 days, you include the income on your taxes and you can take business expenses. However, you can’t deduct 100% of expenses like mortgage interest and property taxeswhen you are renting 100% of the house. These must be apportioned between personal and business use of your residence. turbotax.intuit.com

Fill Out Form W-9 Taxpayer Identification Number

Airbnb, HomeAway, VRBO, FlipKey and similar companies are required to withhold 28% of your rental income if you don't provide them with a W-9 form. In most cases, the tax on your rental income will be less than 28%. There's no reason to let the tax authorities hold your overpayment all year, so file that W-9. Once you do, the rental company can sto

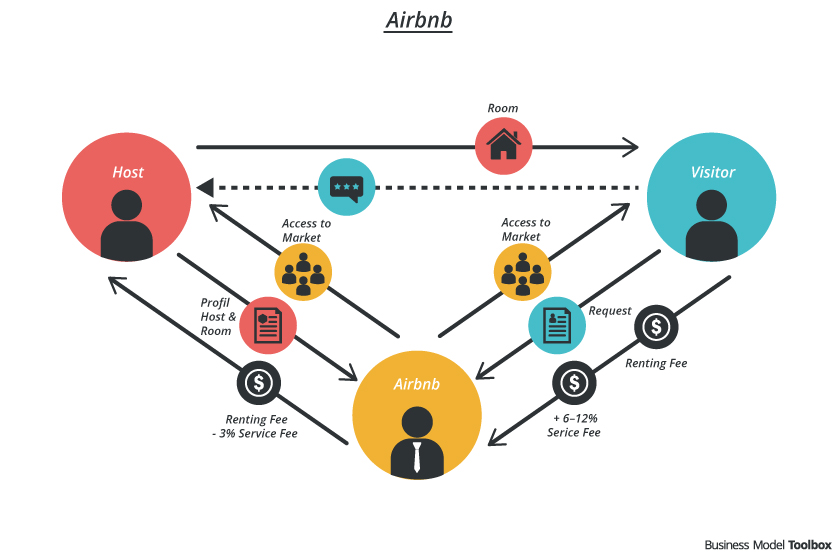

Deduct The Guest-Service Or Host-Service Fees

Airbnb, FlipKey and other short-term rental companies usually charge a percentage fee, called a guest-service fee or a host-service fee that is taken off the top of the rent that guests pay. When these companies send you and the IRS a 1099 formreflecting your house rental earnings for the year, it includes the amount of service fees. If you rented

Learn About Applicable Occupancy Taxes

Some state and local governments impose occupancy taxes on short-term rentals. These vary widely from one jurisdiction to the next, from the name of the tax—hotel tax in some states, transient lodging tax in others—to the rates and rules. In many cases, the host is required to collect the occupancy taxdirectly from renters and submit the money to t

Pay Self-Employment Taxes

When you rent out your home, make bookings and provide amenities or services, like coffee or breakfast, the IRS may treat you as being self-employed in the vacation rental business. If you are self-employed, you have to pay self-employment taxes, as well as income taxes. Self-employment taxescover Social Security and Medicare contributions for inco

Understanding Tax Implications for Airbnb Tax Clients

Airbnb Taxes Every Host Should Know

Airbnb UK hit with extra $2.3 million tax bill

|

General guidance on the taxation of rental income

This booklet is intended solely for information purposes and no Airbnb Host or other third party may rely upon it as tax or legal advice or use it for any other |

|

UNDERSTANDING THE TAX IMPLICATIONS OF PROPERTY

UNDERSTANDING THE TAX IMPLICATIONS. OF PROPERTY RENTALS ON AIRBNB AND. OTHER ONLINE PLATFORMS. Our goal is to provide updates on topical accounting and tax |

|

AIRBNB HOST REPORTING GUIDE

Airbnb hosts who offer their property for short-term rental are subject to the income tax rules for residential rental property. Airbnb may issue you. |

|

A SIMPLE GUIDE TO AIRBNB TAX

At Property Tax Returns we understand the complex taxation rules that apply to Airbnb properties. While. Airbnb's popularity in NZ has skyrocketed over the |

|

IRELAND – TAX CONSIDERATIONS ON SHORT-TERM LETTINGS

Please note that where there is a third party involved in the letting of property in Ireland (i.e.. Airbnb agents |

|

SPAIN – TAX CONSIDERATIONS ON SHORT-TERM LEASES

31 déc. 2018 As Airbnb is not supplying the rental it is the responsibility of the host to consider local VAT obligations of the rental charge. Do I need to ... |

|

UNITED KINGDOM – TAX CONSIDERATIONS FOR SHORT TERM

31 janv. 2019 As Airbnb does not supply accommodation for short-term rental the host is responsible for determining whether. VAT should be applied to the ... |

|

AUSTRALIA – TAX CONSIDERATIONS ON SHORT TERM LETTINGS

31 déc. 2018 Reporting tax in Australia. If applicable you must lodge individual income tax returns with the Australian Taxation Office (ATO) following the ... |

|

Responsible Hosting -_France_(EN v20.01.2022) .docx - Airbnb

1 janv. 2022 FRANCE – TAX CONSIDERATIONS ON SHORT TERM PROPERTY LETS ... report to the French tax authorities the rental income received by the users of ... |

|

FRANCE – TAX CONSIDERATIONS ON LETTING PROPERTY

31 déc. 2018 As Airbnb is not supplying the rental it is the responsibility of the host to consider local VAT obligations of the rental charge. Do I need to ... |

|

Airbnb Host

Tax documents, such as 1099-K, are reported on a gross basis Any gross rent that is refunded should be included as gross rental income and also taken as a deduction Example: You receive a payout of $5,000 for a Guest's 10-day stay The Guest only stays for 8 days and you offer a $1,000 refund via Airbnb |

|

AIRBNB HOST REPORTING GUIDE - H&R Block

Regardless of whether you receive a Form 1099-K, the rental income you earned from Airbnb is reportable on Form 1040, unless the non-taxable rental exception applies (discussed below) It is important to note that the gross amount reported to you will exceed the actual amount paid-out by Airbnb |

|

Understanding the Tax Implications of Property Rentals on Airbnb

However, the introduction of online platforms such as AirBnb and VRBO have made it very Income tax and sales tax implications must be considered before |

|

A SIMPLE GUIDE TO AIRBNB TAX - Property Tax Returns

IS MY AIRBNB INCOME TAXABLE? Income earned from providing short-term accommodation is taxable in New Zealand This means that you will be required to |

|

Inferring Tax Compliance from Pass-through: Evidence from Airbnb

To this end, we estimate the effects of tax enforcement agreements on average booking prices and nights booked per property- month Although Airbnb tax |

|

So you wanna be a landlord? Income tax considerations - CIBC

overlook tax considerations of earning rental income Whether you're income earned by renting your home through services such as Airbnb As well, if you |

|

Taxing your Airbnb and family bach - Deloitte

22 mar 2019 · Accommodation provided by a trust will be addressed by Inland Revenue at a later date Income tax issues The income tax treatment when |

|

Tax - Positive Real Estate

If you're a first-timer, Airbnb recommends starting slightly lower than their It's important that the tax “side effects” of Airbnb rentals (and other short term |