code tva tunisie 2015 pdf

|

Note commune n°17/2015

Sont soumis à la TVA au taux de 12 les services rendus par les entreprises hôtelières y compris les activités qui y sont intégrées tels que l'hébergement la |

|

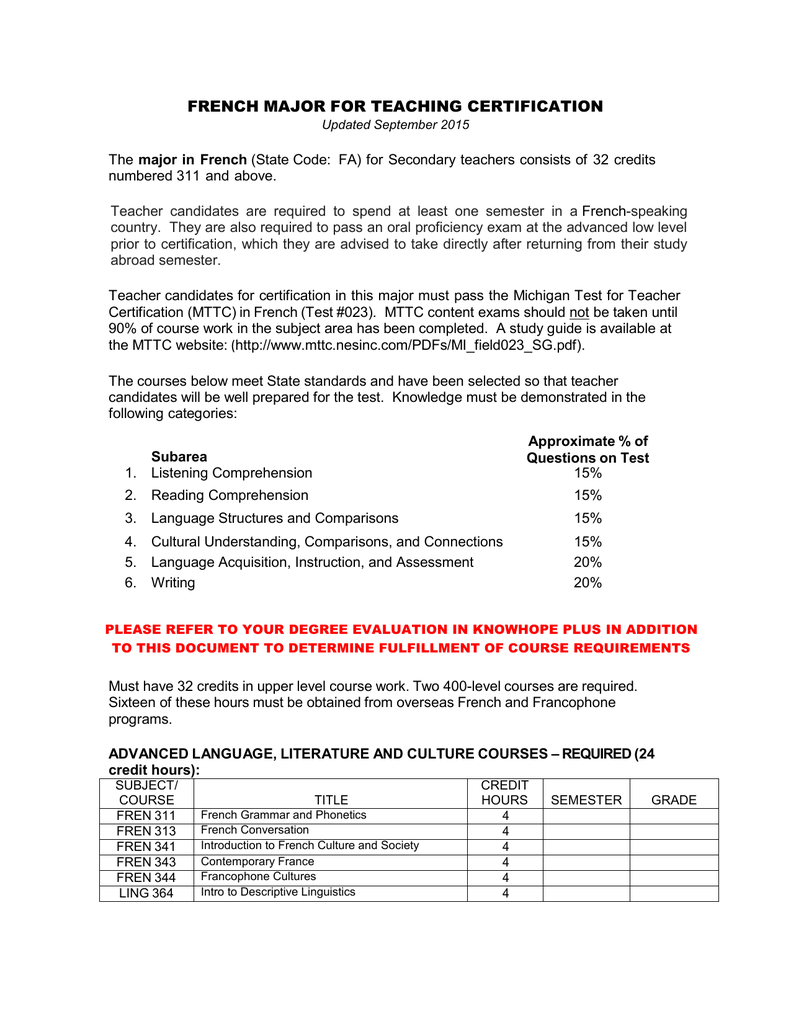

VAT r ates

The purpose of this document is to disseminate information about the VAT rates in force in the Member States of the European Union The information has been supplied by the respective Member States and complemented by the Commissions services The Commission cannot be held responsible for its accuracy or completeness neither does its publication i |

|

I

31 déc 2016 · La réduction du taux de la TVA à 6 pour les produits sus-mentionnés est accordée conformément aux dispositions du décret gouvernemental n° 2015 |

|

PUBLIC FINANCES DIRECTORATE GENERAL TAX POLICY DIRECTORATE

– Legislation in force as of 31 July 2015 – This document summarises the French tax system It does not in any way constitute a statement of the official doctrine of the department that drafted it |

|

Code de la taxe sur la valeur ajoutee loi relative au droit de

l'article 18 du code de la TVA « de leur circonscription » - Le paragraphe VI de Tunis le 15 août 2016 Pour Contreseing Le ministre des finances Slim |

|

Code de la taxe sur la valeur ajoutee loi relative au droit de

(*) L'article 13 du code de la TVA relatif au système fiscal en matière de TVA sur les Tunis le 29 décembre 2015 Pour Contreseing Le ministre des finances |

|

Code de la taxe sur la valeur ajoutee loi relative au droit de

1 L'article 13 du code de la TVA relatif aux régimes des alcools a été abrogé Tunis le 29 décembre 2015 Pour Contreseing Le ministre des finances Slim |

La taxe sur la valeur ajoutée (TVA) célèbre ses soixante ans d'existence : elle a été mise au point en 1954 par Maurice Lauré, inspecteur des finances, avec le soutien de Pierre Mendès France.

Elle a été étendue en 1968 à tous les commerçants et artisans.

Cent cinquante États dans le monde l'ont adoptée.

C'est quoi TVA Tunisie ?

La TVA en Tunisie est une taxe indirecte qui est appliquée à la vente de biens et de services.

Le taux de TVA standard en Tunisie est de 19%, mais il existe également des taux réduits pour certains biens et services.

Comment faire les calculs de TVA Tunisie ?

Soit : (100.000 dinars - 30.000 dinars ) x 1% = 70.000 dinars x 1% = 700 dinars.

Cette taxe doit être payée au plus tard le 28 février de l'année N. * liquidation de la TVA : (70.000 dinars + 700 dinars) x 18% = 12.726 dinars.

Comment récupérer la TVA Tunisie ?

Comment se faire rembourser la TVA ?

1Ces achats s'effectuent avec carte de crédit auprès des commerçants assujettis à la TVA selon le régime réel et affiliés au système de vente par carte de crédit (affichant l'enseigne « CREDIT CARD SALES, TAX BACK » );2Le départ s'effectue par avion ou par bateau;N.B.:

The purpose of this document is to disseminate information about the VAT rates in force in the Member States of the European Union. The information has been supplied by the respective Member States and complemented by the Commissions services. The Commission cannot be held responsible for its accuracy or completeness, neither does its publication i

The parking rate of 12% applies to:

Certain energy products such as: -coal and solid fuel obtained from coal -lignite and agglomerated lignite (except for jet) -- coke and semi‐coke from coal, lignite and peat -uncharred petroleum coke used as fuel. taxation-customs.ec.europa.eu

The parking rate of 13.5% applies to:

Fuel for power and heating, coal, peat, timber, electricity, gas (for heating and lighting, not including auto LPG), heating oil. Νοn-residential property. Βuilding services related to non-residential property, including installation where material is not a significant part of the value of the service. Routine cleaning of non-residential property

The parking rate of 14% applies to:

Wines of fresh grapes with 13% vol. or less (fortified wines, sparkling wines and so-called liqueur wines excluded) Fuels: solid mineral fuels, mineral oils and wood intended for use as fuel, with the exception of wood for heating (firewood) Washing and cleaning products Printed advertising material, commercial catalogues and the like; tourist p

The parking rate of 13% applies to:

Wines produced on an agricultural holding by the producer-farmer. taxation-customs.ec.europa.eu

BELGIUM

Certain recuperation substances and recuperation products. Raw furskins of rabbits and hares. taxation-customs.ec.europa.eu

DENMARK

Newspapers, including newspapers delivered electronically, which are usually published at least once a month. taxation-customs.ec.europa.eu

LITHUANIA

Supply of pharmaceutical products Supply of medical equipment taxation-customs.ec.europa.eu

MALTA

Supplies of food products for human consumption, except for supplies of pre-cooked dishes and certain highly processed products, such as ice-cream, chocolates, manufactured beverages or beverages subject to excise duty, and pet foods Supplies of seeds or other means of propagation of plants classified under the above item Supplies of live animals

FINLAND

Printing services for membership publications of non-profit making organisations. taxation-customs.ec.europa.eu

VII.

Geographical features of the application of VAT in the EU taxation-customs.ec.europa.eu

DENMARK

The Faeroe Islands and Greenland are not part of the European Union; consequently, no VAT is applied in these territories. taxation-customs.ec.europa.eu

GERMANY

For VAT purposes, the country does not include the island of Heligoland and the territory of Büsingen. taxation-customs.ec.europa.eu

SPAIN

For VAT purposes, the country does not include the Canary Islands, Ceuta and Menilla. taxation-customs.ec.europa.eu

ITALY

The following territories are excluded from the scope of VAT: Livigno, Campione d’Italia and the territorial waters of Lake Lugano. taxation-customs.ec.europa.eu

CYPRUS

Transactions originating in, or intended for, the United Kingdom Sovereign Base Areas of Akrotiri and Dhekelia are treated as transactions originating in, or intended for, the Republic of Cyprus. The application of the acquis is suspended in those areas of the Republic of Cyprus in which the government of the Republic of Cyprus does not exercise ef

FINLAND

The Åland Islands are excluded from the scope of VAT. taxation-customs.ec.europa.eu

The parking rate of 12% applies to:

Certain energy products such as: -coal and solid fuel obtained from coal -lignite and agglomerated lignite (except for jet) - coke and semi‐coke from coal, lignite and peat -uncharred petroleum coke used as fuel. taxation-customs.ec.europa.eu

The zero rate applies to:

Certain recuperation substances and recuperation products. Raw furskins of rabbits and hares. taxation-customs.ec.europa.eu

The zero rate applies to:

Newspapers, including newspapers delivered electronically, which is usually published at least once a month. taxation-customs.ec.europa.eu

Geographical features of the application of VAT in the EU:

The Faeroe Islands and Greenland are not part of the European Union; consequently, no VAT is applied in these territories. taxation-customs.ec.europa.eu

GERMANY

For VAT purposes, the country does not include the island of Heligoland and the territory of Büsingen. taxation-customs.ec.europa.eu

The parking rate of 13.5% applies to:

Fuel for power and heating, coal, peat, timber, electricity, gas (for heating and lighting, not including auto LPG), heating oil. Νοn-residential property. Βuilding services related to non-residential property, including installation where material is not a significant part part of the value of the service. Routine cleaning of non-residential pro

The super-reduced rate of 4.8% applies to:

Livestock and horses normally intended for use in the preparation of foodstuffs or in agricultural production. taxation-customs.ec.europa.eu

The zero rate applies to:

Supplies of printed books and booklets, including atlases, but excluding: newspapers, periodicals, brochures, catalogues, directories and books of stationery, cheque books and similar products, diaries, organisers, yearbooks, planners and similar products the albums and similar products, and books of stamps, tickets or coupons. (excl Supplies ding

The super-reduced rate of 4% applies to:

Basic foodstuffs such as bread, milk, cheese, eggs, fruit and vegetables Certain medicines Certain books (including free supplement), newspapers and periodicals Books on other physical means of support Subsidised housing under certain conditions Certain social services Domestic care services such as home help and care of the young, elderly, sick or

Geographical features of the application of VAT in the EU:

Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu Certain services with regard to production (basically printing services) of periodicals issued by non-profit organisations. Medicines supplied on prescription or sold to hospitals or imported into the country to be supplied on prescription or sold to hospitals. taxation-customs.ec.europa.eu

|

Tunisie - Loi de finances pour 2015 (www.droit-afrique.com)

26 déc. 2014 1- Est ajouté à l'article 15 du code de la taxe sur la valeur ajoutée un paragraphe III bis ainsi libellé : III bis : Le crédit de TVA est ... |

|

Untitled

par le tableau « B » nouveau annexé au code de la TVA. articles 31 et 75 de la loi n° 2015-53 du 25 décembre 2015 portant loi de finances pour l'année ... |

|

Code de la taxe sur la valeur ajoutee loi relative au droit de

Textes de mise en application du code de la TVA : La loi n°2015-53 du 25 décembre 2015 portant loi de finances pour l'année. |

|

Code de commerce.pdf

1 oct. 2022 Ces codes ne contiennent que du droit positif les ... relevant du règlement (UE) n° 2015/848 du 20 mai 2015 relatif aux procédures. |

|

Tunisie: Consultations de 2015 Au Titre de Larticle Iv Sixième

14 oct. 2015 code de l'investissement et le régime d'insolvabilité. ... recouvrement de la TVA en Tunisie (efficience C) — qui compare le rendement ... |

|

Loi n° 2015-53 du 25 décembre 2015 portant loi de finances pour l

Journal Officiel de la République Tunisienne — 29 décembre 2015 prévus par le code de l'impôt sur le revenu des personnes physiques et de l'impôt sur ... |

|

Tunisie - Loi n°2015-30 du 18 août 2015 portant loi de finances

18 août 2015 Journal Officiel de la République Tunisienne — 21 août 2015 ... du tableau « B bis » annexé au code de la taxe sur la valeur ajoutée. |

|

CODE TVA 2017 FR.pdf

présent code la taxe sur la valeur ajoutée due au titre de chaque taux sera liquidée: 1 Cette mesure entre en vigueur à compter du 1er janvier 2015. |

|

Règlement dexécution (UE) 2015/ de la Commission du 24

24 nov. 2015 vu le règlement (UE) no 952/2013 du Parlement européen et du Conseil du 9 octobre 2013 établissant le code des douanes de l'Union (1) ... |

|

Untitled

I. Législation fiscale en vigueur jusqu'au 31 décembre 2015 a) Pour les exonérations prévues par le code de la TVA il s'agit :. |

|

Code général des Impôts 2020

d'impôt sur le revenu (I R ), de taxe sur la valeur ajoutée (T V A ), des droits d'enregistrement (D E ) |

|

Numéro didentification fiscale

07/09/2015 14:04:00 Fiche pays: France (FR) 1 2 Description du NIF Les autorités fiscales françaises délivrent un numéro code français de la propriété intellectuelle |

|

FISCALITÉ DES ENTREPRISES - ACCUEIL

également considérés comme ayant leur domicile fiscal en France les agents de l'Etat qui exercent |

|

Rapport-fiscalite-numerique pdf - Sénat

utur régime issu du « paquet TVA » applicable à partir de 2015 pour les France d'impôt sur les sociétés alors même que ces groupes utilisent les Article 302 bis KI du code général des impôts (abrogé) |

|

Les dépenses fiscales - budgetgouvfr

PLF 2015 Le concept de dépense fiscale Voies et Moyens II En France sont définis |

|

Code général des impôts - Codes Droitorg

Production de droit Ces codes ne contiennent que du droit positif, les perçue dans la région Ile-de-France (231 ter - 231 ter) 652 p 2 Code général des impôts |

|

La fiscalité française - Impotsgouv

2 – Autres revenus de source française faisant l'objet de Liste des conventions fiscales conclues par la France en vigueur au 1er code général des impôts ( CGI), le chiffre d'affaires est |

|

GUIDE DE LA TVA à lusage des collectivités locales

Annexe 1 : Taux de TVA applicables en France Il convient de se reporter aux articles 256 à 260 du code général 19 Cf Décret n° 2015-1763 du 24 décembre 2015 |

|

PRESTATIONS DE SERVICES : QUELLE TVA APPLIQUER ?

re mise à jour janvier 2015 de la micro entreprise et qui possède un numéro de TVA) si le preneur assujetti est établi en France Article 242 nonies A du code général des impôts, modifié par Décret |

![PDF] Apprendre la programmation Android avec Android studio par la PDF] Apprendre la programmation Android avec Android studio par la](https://0.academia-photos.com/attachment_thumbnails/38089944/mini_magick20180818-31352-c58zch.png?1534645792)