FATCA/CRS Erfahrungsaustausch 2015

|

FATCA/CRS Erfahrungsaustausch 2015

Account Tax Compliance Act (FATCA) werden die neuesten Entwicklungen zum automatischen steuerlichen Informa - tionsaustausch im Rahmen des Common Reporting Stan - dard (CRS) der OECD vorgestellt und mit den Teilnehmern diskutiert Der multinationale automatische Austausch von Steuerdaten hat in diesem Jahr rasante Entwicklungsschritte gemacht |

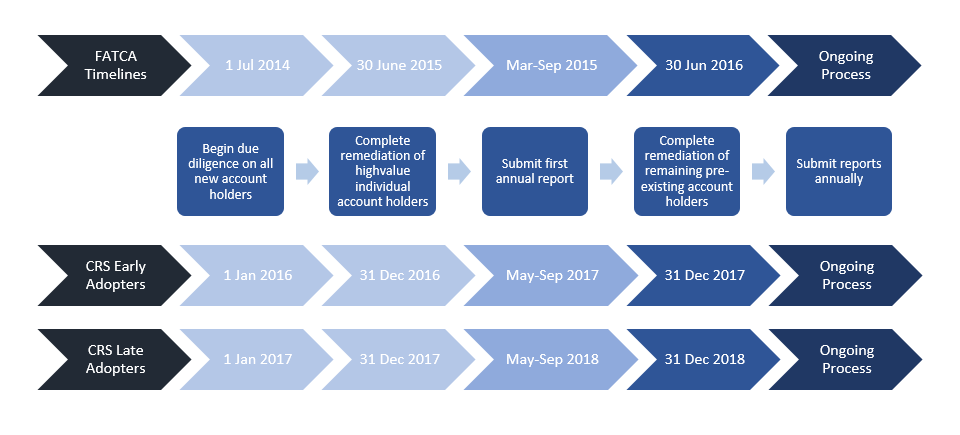

How does FATCA & CRS work?

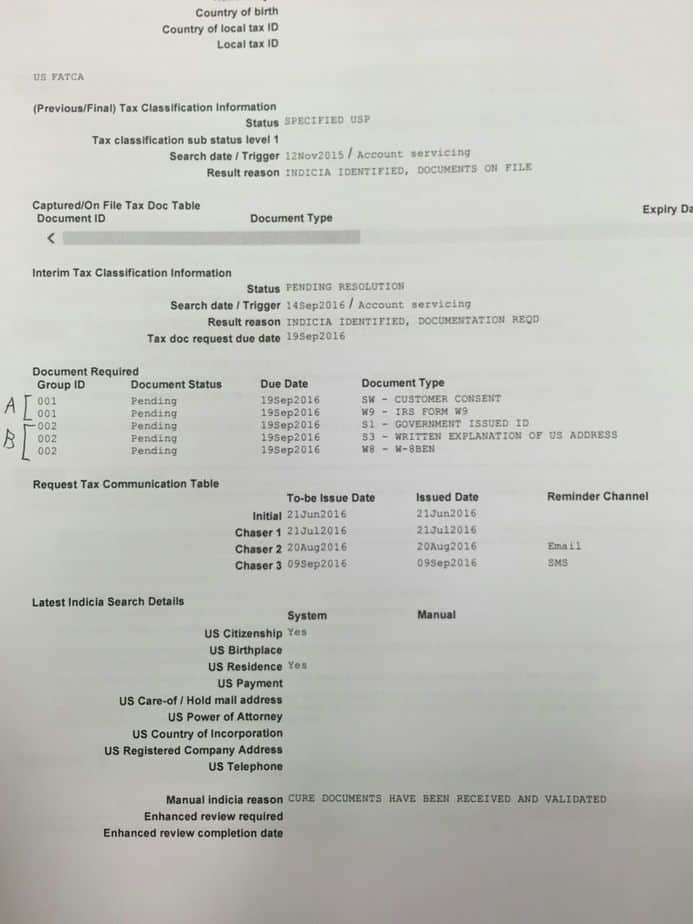

The exchange of taxpayer information under FATCA and CRS is effectively achieved through the imposition of obligations on Financial Institutions – such as banks, custodians, asset managers, certain types of funds and insurance companies – to collect, review and report information about their account holders/investors.

Does FATCA require foreign financial institutions to report financial accounts?

FATCA requires Foreign Financial Institutions (“FFIs”) outside the US to report information on financial accounts held by US persons. The UAE signed an Intergovernmental Agreement with the United States of America on 17 June 2015 with an effective (“go-live”) date of 1 July 2014 (“UAE-US IGA”).

What are FATCA & CRS requirements?

FATCA and CRS regimes require UAE Reporting Financial Institutions (“UAE RFIs”) to report information on certain financial accounts maintained by reportable account holders and/or controlling persons to the UAE Ministry of Finance (“UAE MoF”) on an annual basis.

What happens if you don't comply with FATCA?

This requires monitoring the information exchange agreements applicable in each jurisdiction. FATCA non-compliance leads to withholding implications, but the CRS is enforced through penalty schemes determined by each local governing authority. Some jurisdictions have approved penalties that may imply criminal prosecution.

Fundamentals of UAEs FATCA/CRS Compliances

What are the implications of FATCA and CRS on an individual investor?

Mastering CRS and FATCA: A Guide to Due Diligence Requirements

|

Merkblatt zur zwischenstaatlichen Amtshilfe durch

29 mai 2019 (EU) 2015/2378 in Bezug auf die Form und die Bedingungen ... sowie dem FATCA-Abkommen sind in dem BMF-Schreiben vom 1. Februar 2017. |

|

Tätigkeitsbericht zum Datenschutz für die Jahre 2015 und 2016

30 mai 2017 Tätigkeitsbericht 2015 und 2016 der Bundesbeauftragten ... Erfahrungsaustausch der BfDI mit den Datenschutzbeauftragten der Bundesgerichte . |

|

Bericht über internationale Finanz- und Steuerfragen 2015

1 févr. 2015 forderungen 2015 und in den kommenden Jahren noch zu meistern sind. ... und Wechsel zu einem FATCA-Abkommen ... in Form von Krediten sicher. |

|

Geldwäsche 2017

28 juin 2017 Intensiver Erfahrungsaustausch und Know-how-Transfer zu ... spannenden Erfahrungsaustausch. ... CRS & FATCA & StUmgBG. |

|

Aktivitäten 2015

Ergänzend zum Jahresbericht 2015 des Bundesverbandes ein intensiver Erfahrungsaustausch statt bei dem ... zum FATCA-Verfahren ähneln. |

|

Landtag Regierung und Gerichte 2015 2011 Landtag

Geschäftsordnung des Landtags in schriftlicher Form. 2015 die ersten FATCA-Meldungen an die amerikanische. Steuerbehörde IRS. |

|

Tätigkeitsbericht zum Datenschutz für die Jahre 2015 und 2016

30 mai 2017 BfDI 26. Tätigkeitsbericht 2015-2016 mit dem „EU-US Privacy Shield“ eine neue Rechtsgrundlage für Datenübermittlungen in die USA in Form. |

|

DER SCHWEIZER STIFTUNGSREPORT 10 JAHRE

Im Übrigen kennt selbst das FATCA-Abkommen mit den. USA das dem CRS gleichsam als Vorbild diente |

|

BVI 2015

24 juin 2015 zweiten Jahreshälfte 2015 von der Kommission ver- abschiedet. ... gesetzes FATCA und CRS |

|

Geschäftsbericht 2015

8 mars 2016 Bilanzmedienkonferenz Geschäftsergebnis 2015 ... Zu diesem Zweck ist die VP Bank in permanentem Erfahrungsaustausch mit anderen Banken |

![What is FATCA? [Infographic] What is FATCA? [Infographic]](https://image.slidesharecdn.com/f9002a35-8bf7-44c3-a36d-03b434945414-160916115545/95/clearstreamfatca-8-638.jpg?cb\u003d1474026990)

![What is FATCA? [Infographic] What is FATCA? [Infographic]](https://docplayer.org/docs-images/40/5950789/images/page_18.jpg)