Instructions for Form 1042-S - Internal Revenue Service

|

23 General Instructions

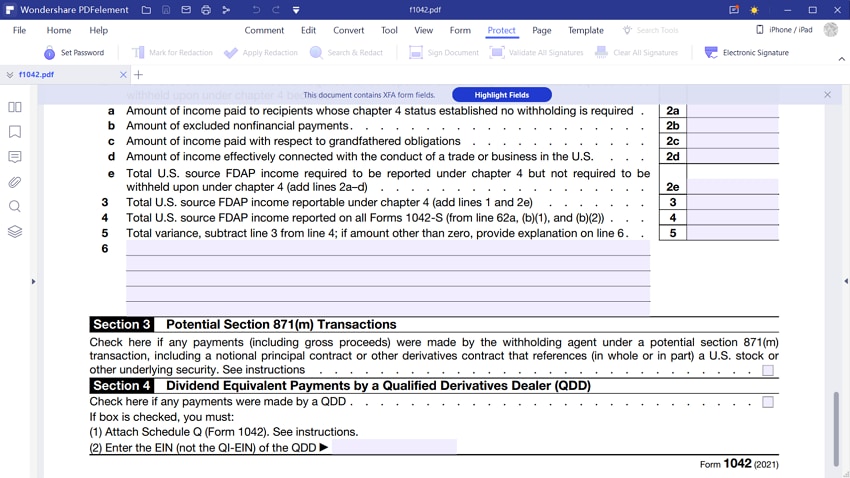

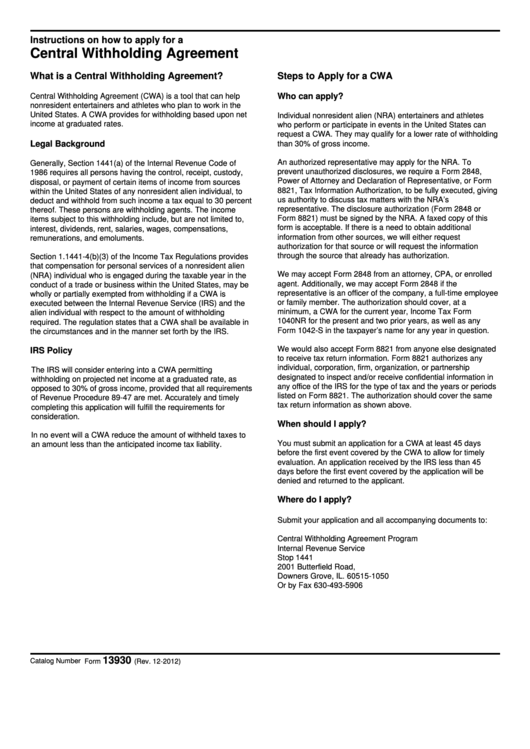

2022 Form 1042-S for use by brokers (starting for 2023) to report amounts realized and related withholding from transfers of PTP interests for purposes of section 1446(f) that are subject to reporting on Form 1042-S under Regulations section 1 1461-1(c)(2)(i) Brokers should use this code to report amounts realized paid to a recipient for |

|

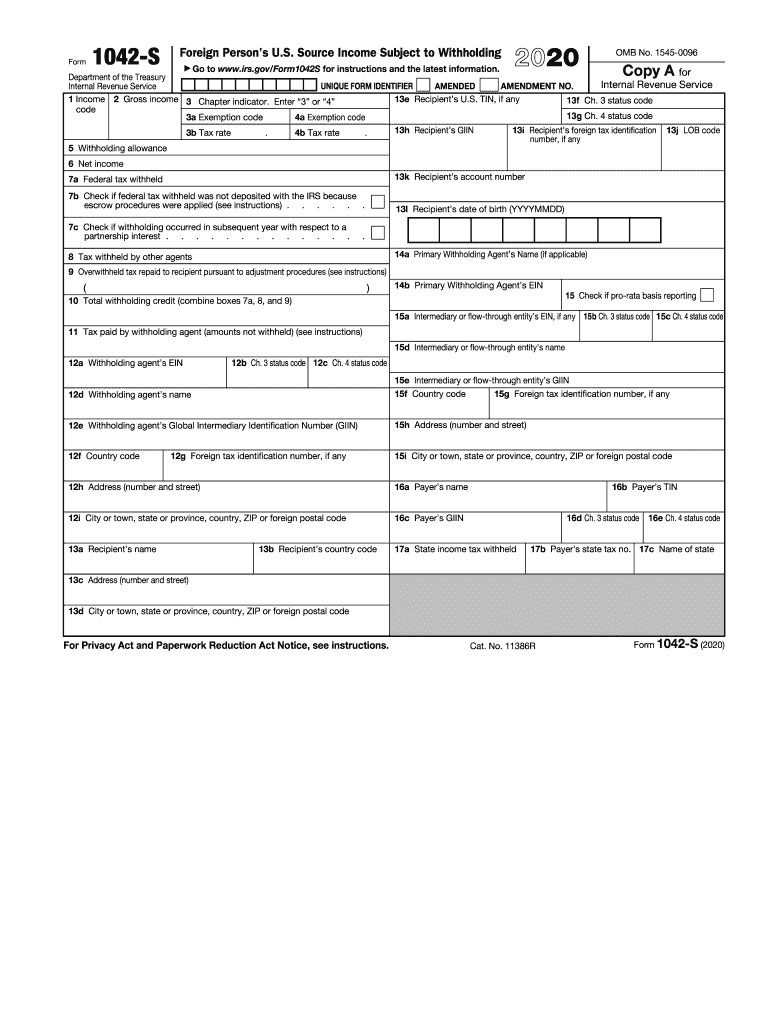

2024 Form 1042-S

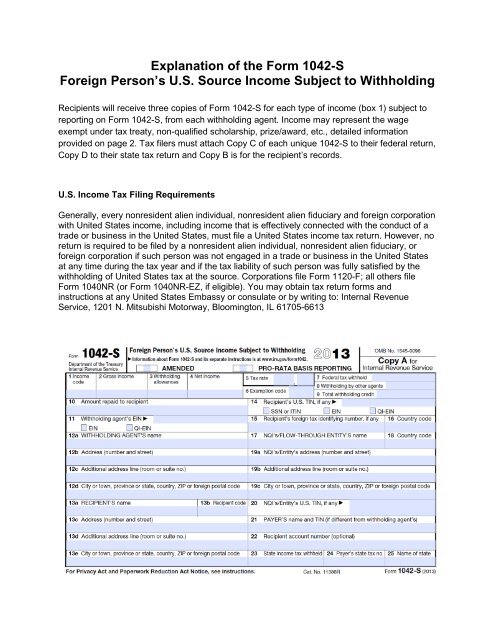

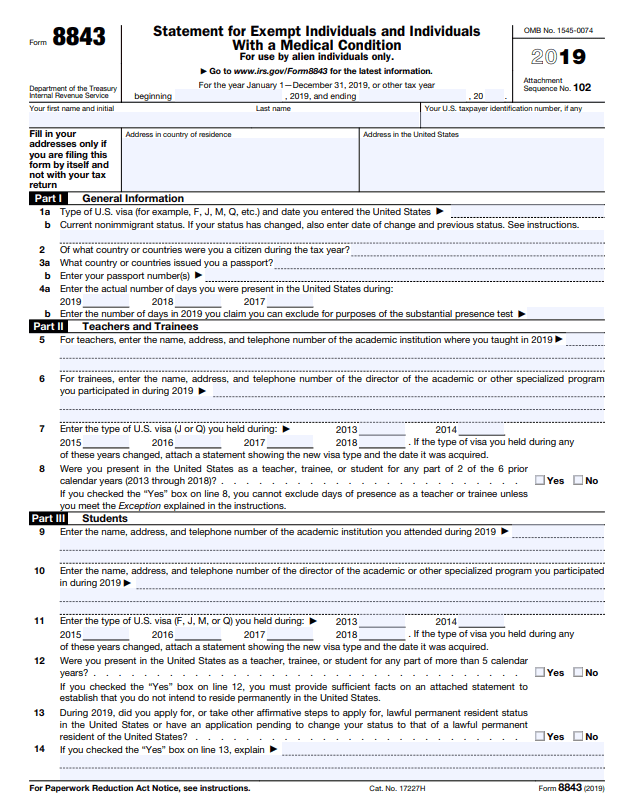

2024 Form 1042-S U S Income Tax Filing Requirements Generally every nonresident alien individual nonresident alien fiduciary and foreign corporation with U S income including income that is effectively connected with the conduct of a trade or business in the United States must file a U S income tax return |

|

1042-S 2022

Form 1042-S Department of the Treasury Internal Revenue Service Foreign Person’s U S Source Income Subject to Withholding aGo to www irs gov/Form1042S for instructions and the latest information 2022 UNIQUE FORM IDENTIFIER AMENDED AMENDMENT NO OMB No 1545-0096 Copy D for Recipient Attach to any state tax return you file 1 Income code |

|

Instructions for Form 1042-S

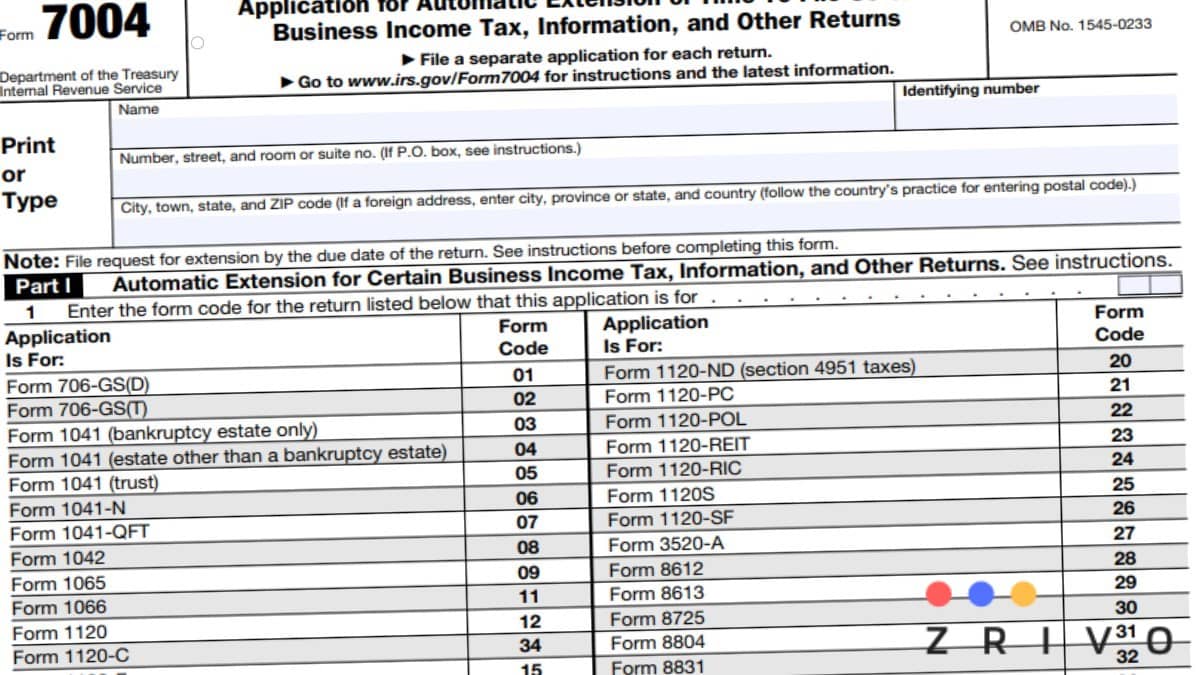

Also see Publicly Traded than the due date for filing Form 1042-S Also use Form 1042-S to report Partnerships (Section 1446 Withholding By filing Form 8809 you will get an distributions of effectively connected Tax) later automatic 30-day extension to file Form income by a publicly traded partnership or You must file a Form 1042-S even if |

|

Form 1042-S Department of the Treasury Internal Revenue Service

Recipient’s name address city state and ZIP code 13b Recipient’s country code Form 1042-S Department of the Treasury Internal Revenue Service Foreign Person’s U S Source Income Subject to Withholding ˜ Go to www irs gov/Form1042S for instructions and the latest information 2021 UNIQUE FORM IDENTIFIER AMENDED AMENDMENT |

Can You efile Form 1042?

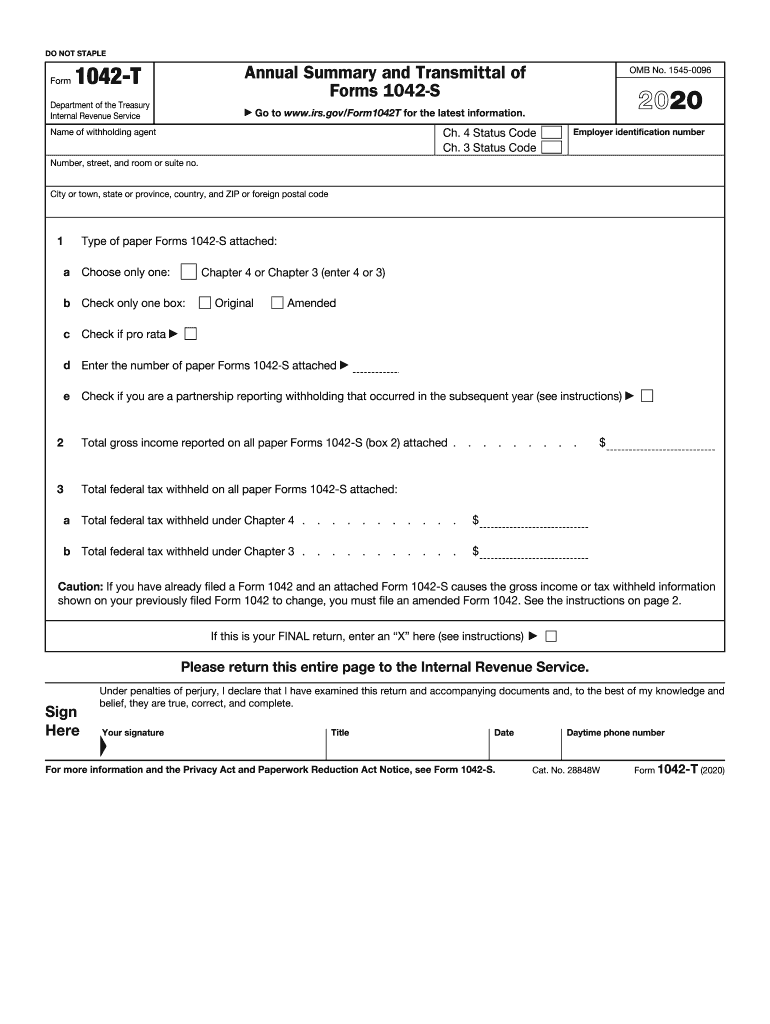

Withholding agents or their agents must use electronic media to file 250 or more Forms 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, with the IRS. Financial institutions are always required to file Forms 1042-S electronically.

Do I need to file Form 1042?

You are required to file or otherwise file Form (s) 1042-S for purposes of either chapter 3 or 4 (whether or not any tax was withheld or was required to be withheld to the extent reporting is required). File Form 1042 even if you file Form (s) 1042-S electronically.

Who needs to file a Form 1042?

If you are a US-based company and you hire non-US citizen workers, you are required to submit Form 1042-S to the IRS. The general goal of the form is to keep the IRS of the funds being sent outside of the country.

|

2022 Instructions for Form 1042-S

30 nov. 2020 2022. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue ... |

|

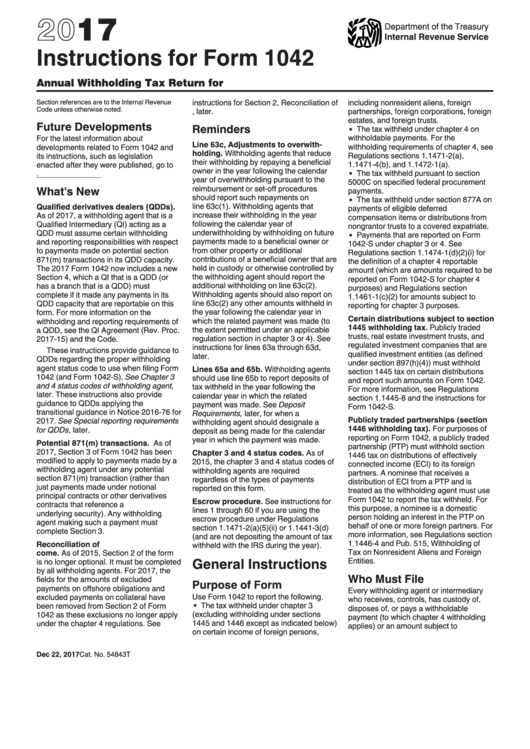

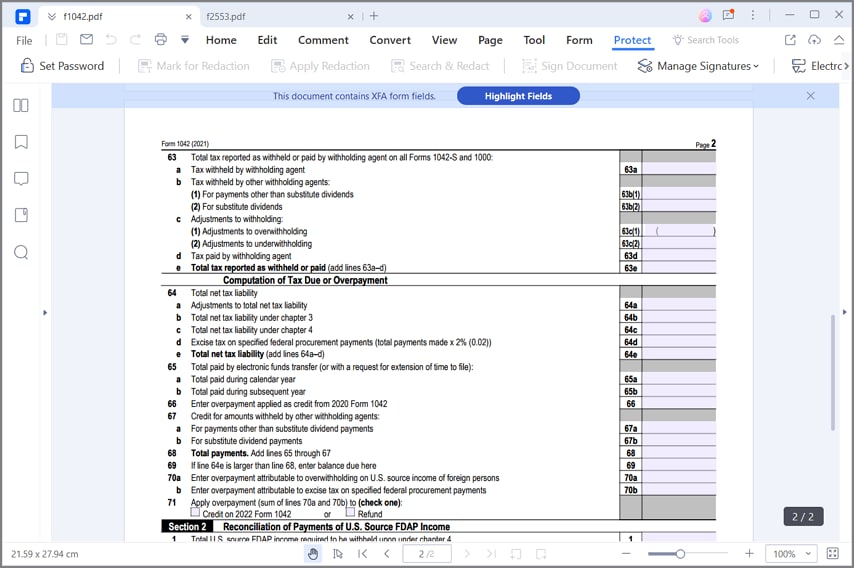

2021 Instructions for Form 1042

31 déc. 2021 chapter 3. On December 18 2018 |

|

2015 Instructions for Form 1042-S

2015. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue Service. |

|

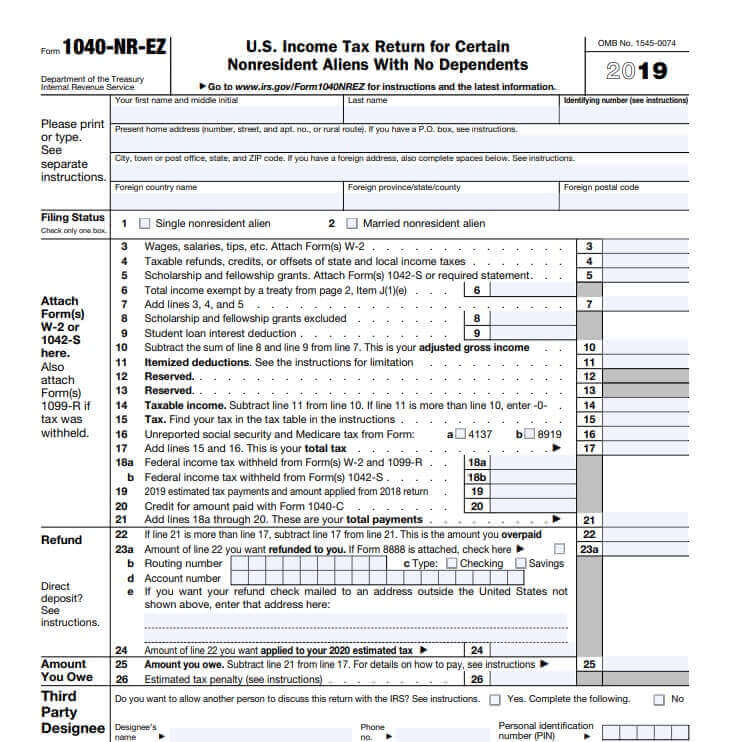

2021 Instructions for Form 1040-NR

18 janv. 2022 Department of the Treasury ... The Taxpayer Advocate Service (TAS) Is Here To Help You ... reported in box 10 of Form 1042-S is. |

|

2013 Instructions for Form 1042-S

22 oct. 2012 2013. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue ... |

|

2017 Instructions for Form 1042-S

2 févr. 2017 2017. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue ... |

|

2018 Instructions for Form 1042-S

7 mars 2018 2018. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue ... |

|

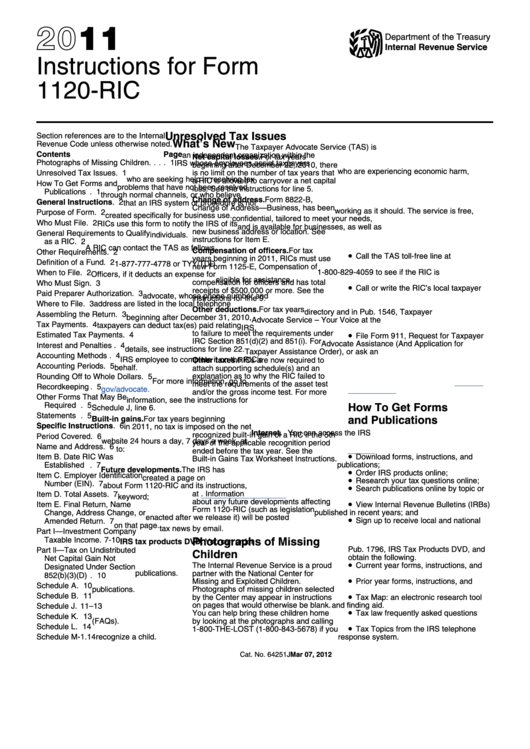

2012 - Instructions for Form 1042-S

8 nov. 2011 Department of the Treasury. Internal Revenue Service. 2012. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to ... |

|

2021 Instructions for Form 1042-S

19 févr. 2021 2021. Instructions for Form 1042-S. Foreign Person's U.S. Source Income Subject to Withholding. Department of the Treasury. Internal Revenue ... |

|

2021 Form 1042-T

Form 1042-T. Department of the Treasury. Internal Revenue Service. Annual Summary and Transmittal of. Forms 1042-S. ? Go to www.irs.gov/Form1042T for the |

| 2022 Instructions for Form 1042-S - IRS |

| 2021 Instructions for Form 1042 - IRS |

| Draft Instructions for Form 1042-S |

| Foreign Persons US Source Income Subject to Withholding |

| Explanation of Form 1042-S - UW-Shared Services |

| Form 1042-S |

| Miscellaneous Business Office Functions - FSA Partner Connect |

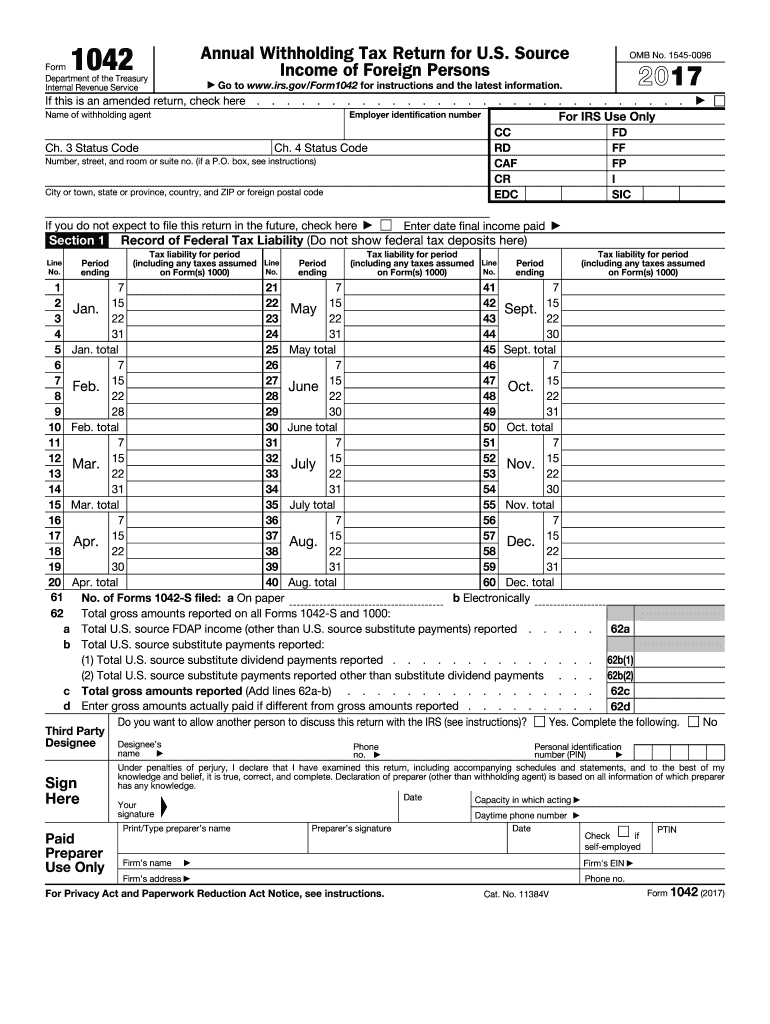

| Annual Withholding Tax Return for US Source Income - eFilecom |

|

2021 Instructions for Form 1042-S - IRS

19 fév 2021 · 2021 Instructions for Form 1042-S Foreign Person's U S Source Income Subject to Withholding Department of the Treasury Internal Revenue |

|

2020 Instructions for Form 1042 - IRS

Instructions for Form 1042 Annual Withholding Tax Return for U S Source Income of Foreign Persons Department of the Treasury Internal Revenue Service |

|

Continued Efforts Are Needed to Address Billions of - Treasury

17 jui 2020 · IRS received 6 3 million Forms 1042-S, Foreign This report presents the results of our review to determine whether the Internal Revenue Service In addition to the specific reporting requirements, withholding agents are |

|

Information Reporting on Form 1042-S, A New Challenge for

also the requirements for reporting income and taxes IRS copies of Form 1042- S may be requested on Form services to an entity as discussed below) II |

|

Copy A for Added new fields for the primary withholding - Deloitte

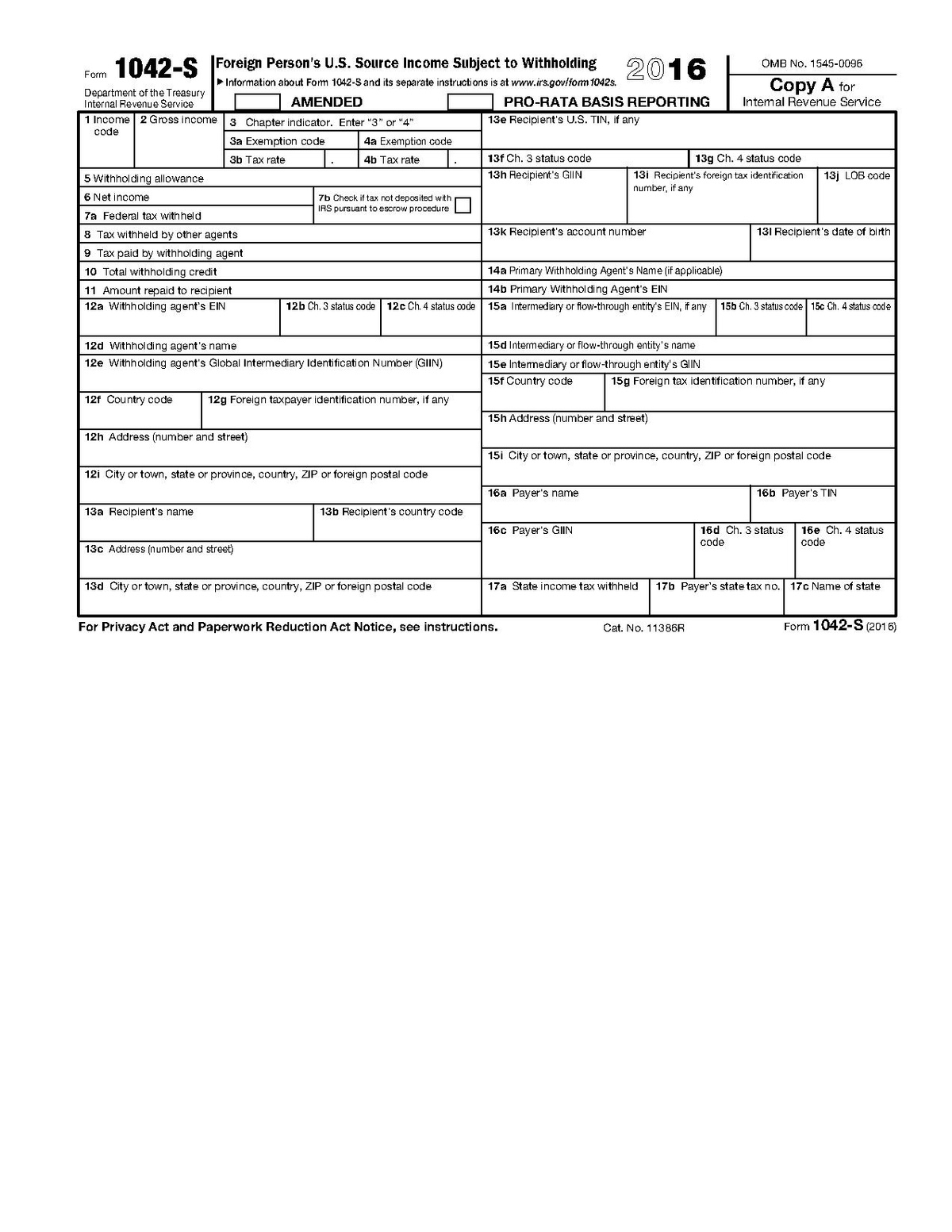

Internal Revenue Service Foreign Person's U S Information about Form 1042- S and its separate instructions is at www irs gov/form1042 2014 AMENDED |

|

Annual Withholding Tax Return for US Source Income of Foreign

Form 1042 Department of the Treasury Internal Revenue Service Information about Form 1042 and its separate instructions is at www irs gov/form1042 |

|

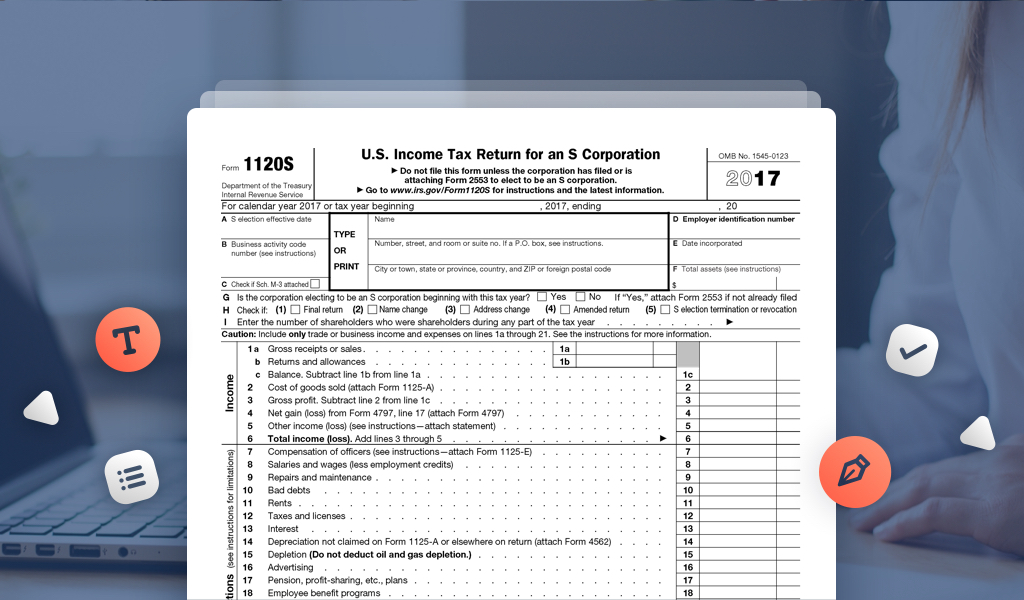

Form 1120 Instructions

Also see the instructions for Schedule J, Part III, line The Internal Revenue Service is a proud partner with 1042-S, Form 8805, or Form 8288-A showing the |

|

1042-S

Go to www irs gov/Form1042S for instructions and the latest information AMENDED Department of the Treasury Internal Revenue Service Form Payer's state |

|

Copy A for

Department of the Treasury Internal Revenue Service Foreign Information about Form 1042-S and its separate instructions is at www irs gov/form1042s 2016 |