Form 1099-MISC - Internal Revenue Service

|

Form 1099-MISC (Rev January 2024)

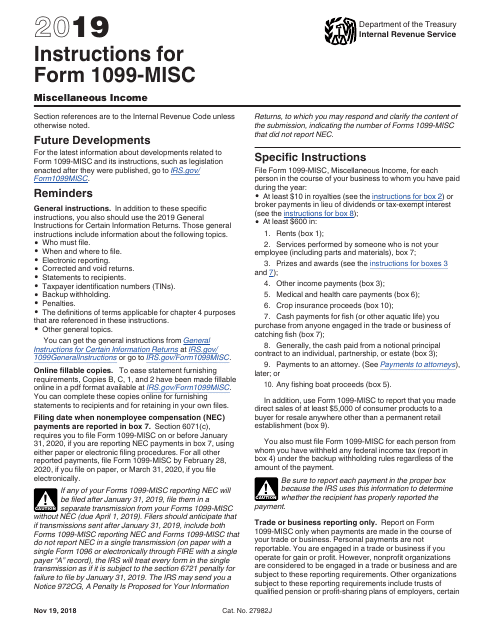

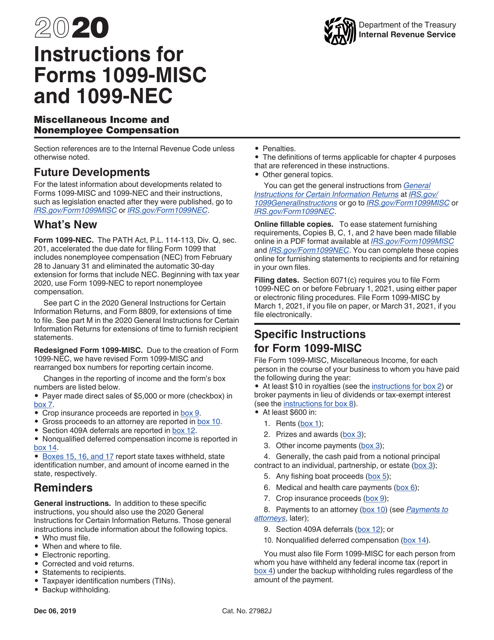

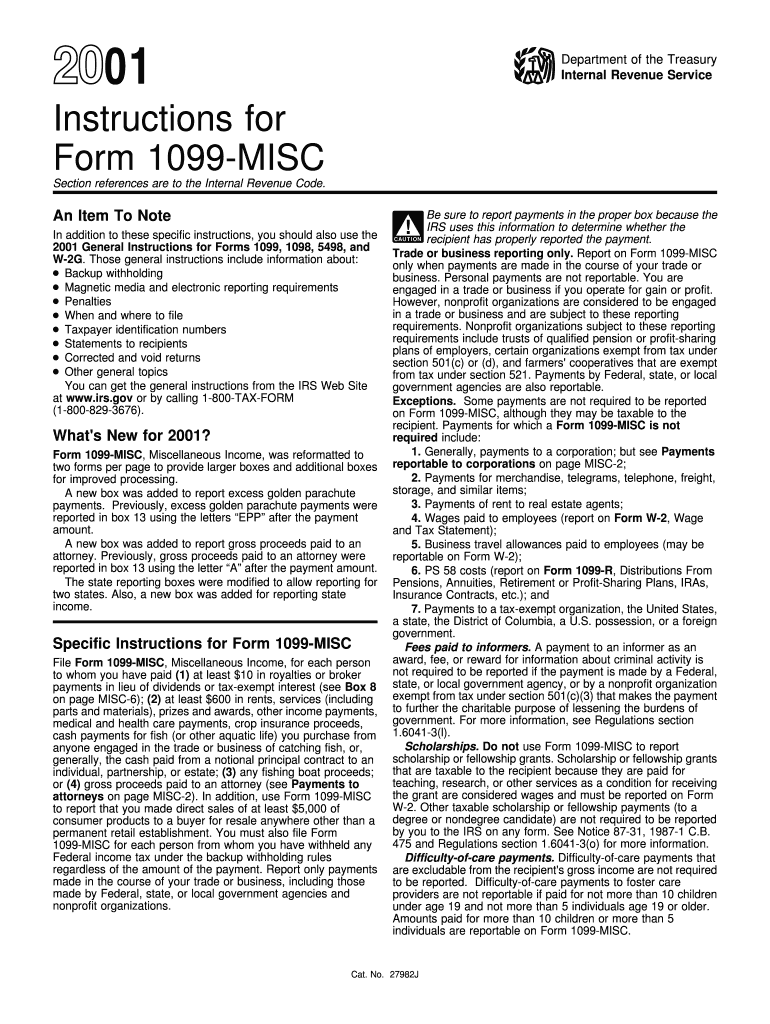

Form 1099-MISC and its instructions such as legislation enacted after they were published go to www irs gov/Form1099MISC Free File Program Go to www irs gov/FreeFile to see if you qualify for no-cost online federal tax preparation e-filing and direct deposit or payment options |

What are the filing requirements for 1099 MISC?

1099-MISC state filing requirements. The IRS due date for Form 1099-MISC is February 28 (paper) or March 31 (electronic) each year. And, you must give vendors their copies by January 31. If these dates fall on a weekend, your deadline for filing Form 1099-MISC is the next business day. State deadlines for the 1099-MISC work similarly.

What do I do with my 1099-MISC form?

if you received 1099-MISC forms from several payers, you will need to enter each one separately in your tax software . If you have just one business, all 1099-MISC forms are collected and added to your business tax schedule for that business. If you have several businesses, be sure each 1099 form is connected to the right business.

Who should issue 1099 MISC?

You must file a 1099-MISC for any nonemployee to whom your firm paid at least $600 during the year in: rent prizes and awards (e.g., to a customer who won your company’s raffle or won a prize at your firm’s grand opening), or trips (e.g., to honor a retiree)

What Is Form 1099-MISC: Miscellaneous Income?

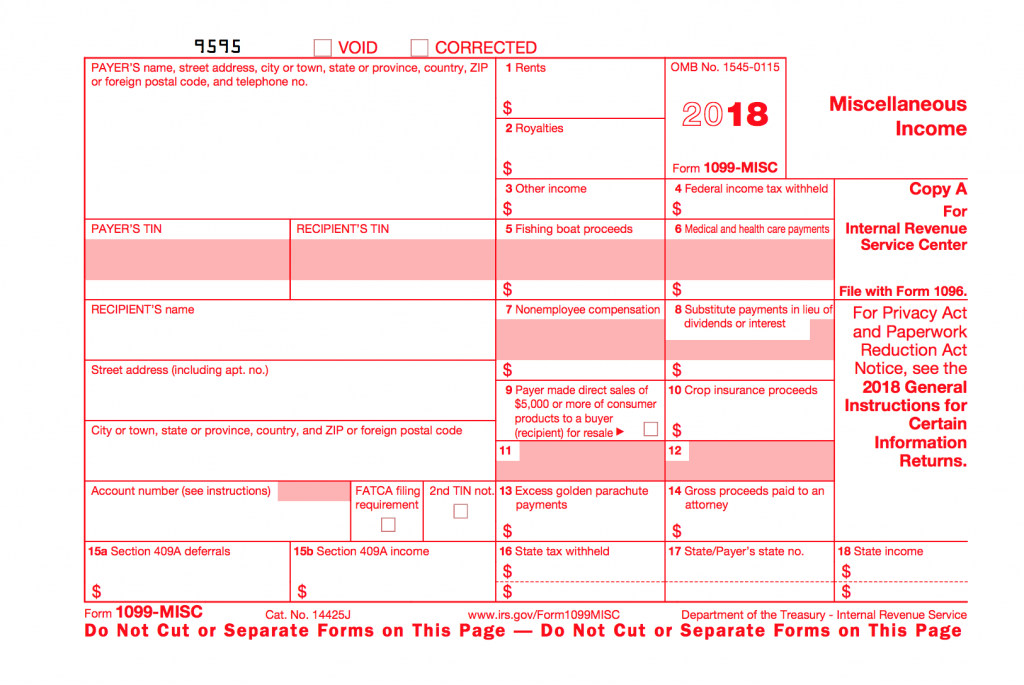

Form 1099-MISC: Miscellaneous Income (or Miscellaneous Information, as it’s now called) is an Internal Revenue Service (IRS)form used to report certain types of miscellaneous compensation, such as rents, prizes, and awards, healthcare payments, and payments to an attorney. Before the 2020 tax year, Form 1099-MISC was also used to report nonemployee

Who Files Form 1099-MISC: Miscellaneous Income?

Form 1099-MISC: Miscellaneous Income (aka Miscellaneous Information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person. It’s also sent to each person to whom you paid at least $600 during the calendar year in the following categories: 1. Rents

How to File Form 1099-MISC: Miscellaneous Income

A multipart fillable Form 1099-MISC is available on the IRS website. Copy A of Form 1099-MISC appears in red. This copy of the form is not intended for printing; it is for IRS use only. The black parts of the form can be completed, downloaded, and printed: 1. Copy 1 goes to the recipient’s state tax department 2. Copy B is sent to the recipient 3.

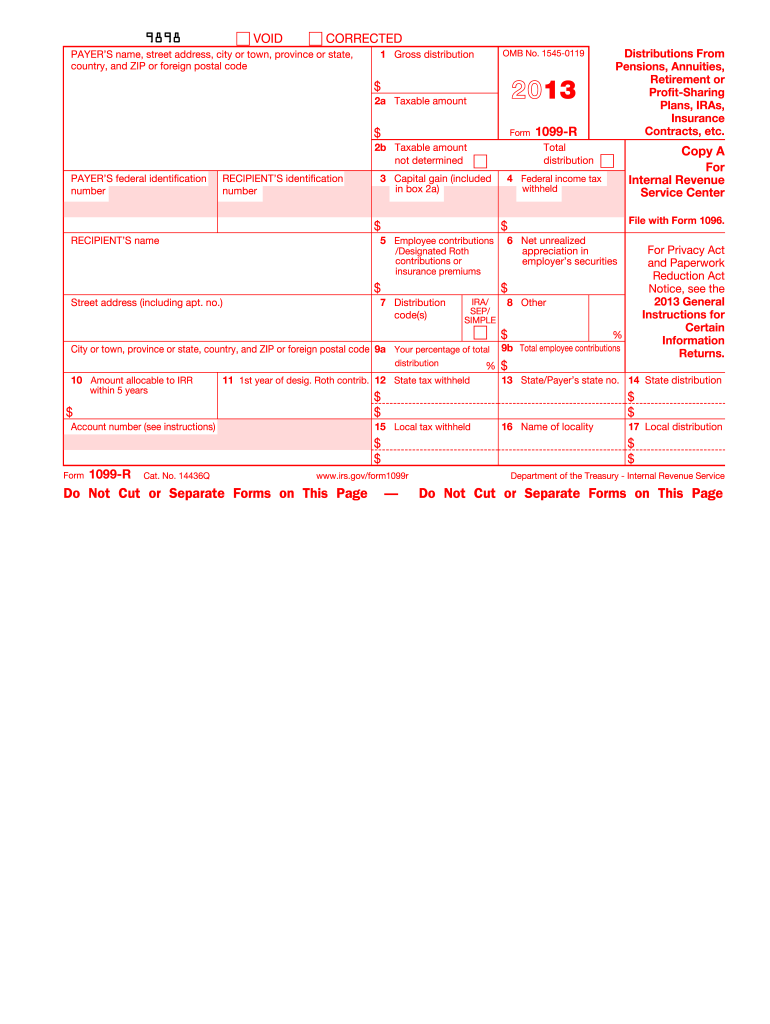

Other 1099 Forms

Here is a list of the specific 1099 forms and the purposeof each: 1. 1099-A: Acquisition or Abandonment of Secured Property 2. 1099-B: Proceeds from Broker and Barter Exchange Transactions 3. 1099-C:Cancellation of Debt 4. 1099-CAP: Changes in Corporate Control and Capital Structure 5. 1099-DIV: Dividends and Distributions 6. 1099-G: Certain Govern

The Bottom Line

Form 1099-MISC is used by business payers to report certain types of miscellaneous compensation, such as rents, prizes, and awards, healthcare payments, and payments to an attorney to the IRS and to the recipients of those payments. Recipients are required to report the payments as income on their tax returns. In a change from previous years, begin

Internal Revenue Service

🚨 Tax Form 1099-Misc Explained What Is IRS Form 1099-Misc

Internal Revenue Service

|

Form 1099-MISC (Rev. January 2022)

Form 1099-MISC. (Rev. January 2022). Miscellaneous. Information. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. |

|

2020 Form 1099-MISC

Form 1099-MISC. 2020. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2021 Form 1099-MISC

Form 1099-MISC. 2021. Miscellaneous. Information. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. |

|

2019 Form 1099-MISC

Form 1099-MISC. 2019. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2018 Form 1099-MISC

Form 1099-MISC. 2018. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2014 Form 1099-MISC

Form 1099-MISC. 2014. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2017 Form 1099-MISC

Form 1099-MISC. 2017. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2016 Form 1099-MISC

Form 1099-MISC. 2016. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

2013 Form 1099-MISC

Form 1099-MISC. 2013. Miscellaneous. Income. Copy 1. For State Tax. Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0115. |

|

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

31 Jan 2022 Electronic filing of returns. The Taxpayer First Act of. 2019 enacted July 1 |

| Form 1099-MISC (Rev January 2022) - IRS |

| 2021 Form 1099-MISC - IRS |

| Forms 1099-R 1099-MISC 1099-K 1099-NEC and W-2G - CTgov |

| Filing of Form 1099-MISC - City of Grand Rapids |

| Pub 172 - Annual W-2 1099-R 1099-MISC 1099-NEC 1099-K and |

| Master commissioner 1099 faq sheet |

| SECTION C: Tax Manual - I 1099-MISC - Ivy Tech |

| Office of the Controller - University of Missouri System |

| 1099s INFORMATION SHEET - University of Alaska System |

|

2021 Form 1099-MISC - IRS

Form 1099-MISC 2021 Miscellaneous Information Copy 1 For State Tax Department Department of the Treasury - Internal Revenue Service OMB No 1545- |

|

2020 Form 1099-MISC - IRS

Form 1099-MISC 2020 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury - Internal Revenue Service OMB No 1545- |

|

2019 Form 1099-MISC - IRS

Form 1099-MISC 2019 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury - Internal Revenue Service OMB No 1545- |

|

2017 Instructions for Form 1099-MISC, Miscellaneous Income

Form 1099-MISC Miscellaneous Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless |

|

How to Comply with 1099 Reporting Requirements - Region One ESC

Notifies the IRS of payments made to vendors - Provides notice to the services performed by someone who is not your employee (Box 7); • prizes and awards to corporations generally must be reported on Form 1099-MISC: - Medical and |

|

MASTER COMMISSIONER 1099 FAQ SHEET 1 What is the

The Internal Revenue Code Section 6041 requires the issuing of the Form 1099 their services, then a 1099-MISC would be required for that appraiser |

|

(IRS) 1099 Forms - Georgia Department of Education

13 jan 2021 · These instructions apply ONLY to school districts and systems filing FORM 1099- MISC and/or 1099- NEC statements for vendors If the Form |

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)