dividend withholding tax rates by country 2019

|

Global withholding taxes

Dividends 7 13 or 35 N/A A 7 withholding tax rate should apply for distributions on profits accrued from January 1 2018 through December 31 2019 |

|

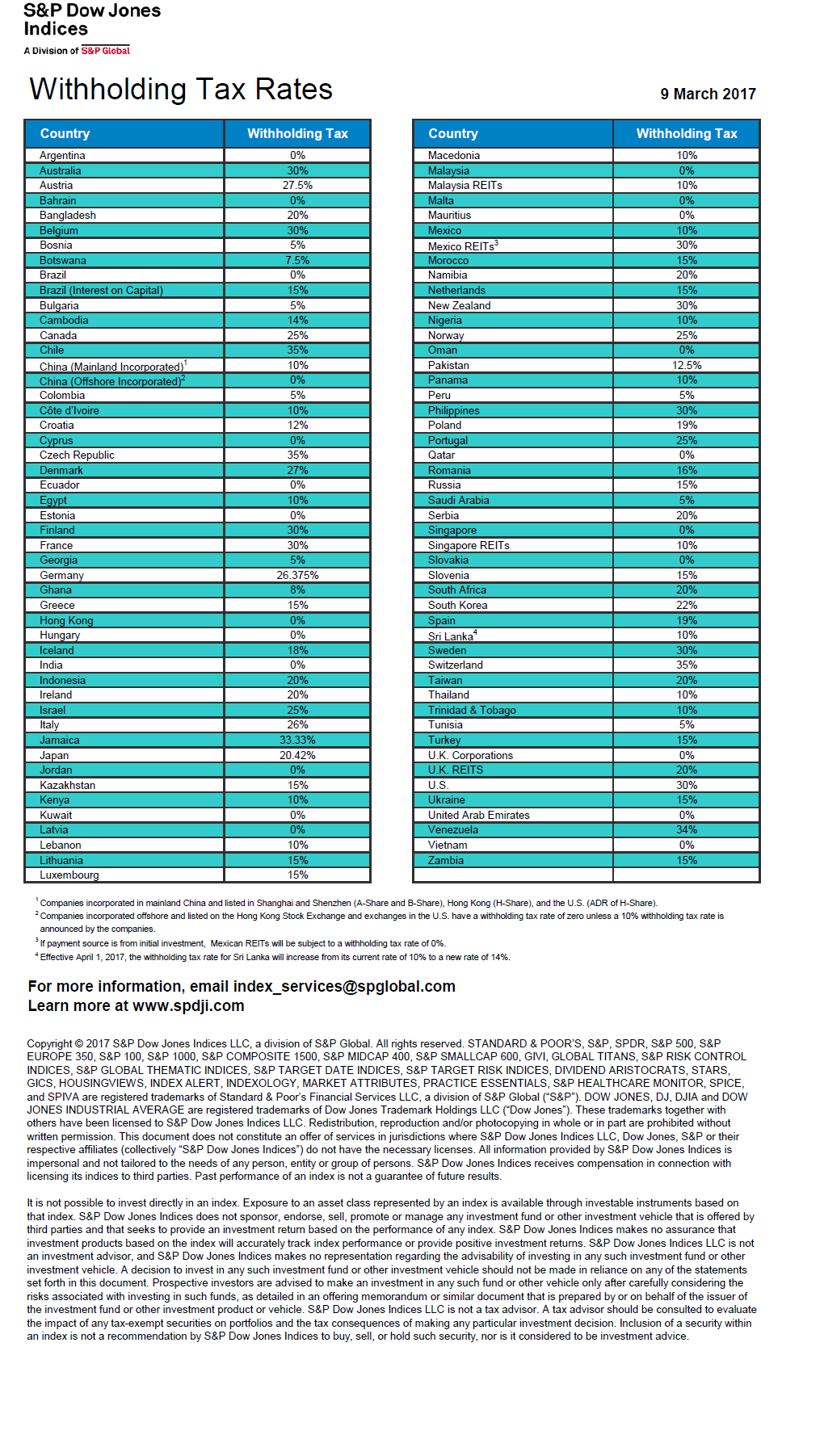

Withholding Tax Rates

5 jan 2024 · Argentina 7 Malta 0 0 Australia 30 Mauritius 0 Austria 27 5 Mexico 10 Bahrain 0 Mexico REITs3 30 Bangladesh |

|

Part 06-08A-01

Finance Act 2019 increased the rate of DWT to 25 effective from 1st of January 2020 It also provided that in respect of relevant distributions made from 1st |

What is the withholding tax rate in Morocco?

Effective 1 January 2023, Morocco introduced a phased reduction of the withholding tax rates on dividends over 4 tax years.

For 2024, tax is withheld at the rate of 12.50% (reduced from 13.75% effective 1 January 2024) on gross dividends distributed to non-residents.What do you pay? The U.S. withholding tax rate charged to foreign investors on U.S. dividends is 30%, but this amount is generally reduced to 15% for taxable Canadian investors by a tax treaty between the U.S. and Canada. 1 Source: MSCI, BlackRock, as of August 31, 2023.

Which EU country has the best dividend tax rate?

Dividends.

The lowest taxes on dividends in Europe in 2023 are set by the legislation of Greece, where the rate is 5%.

The highest tax is paid by residents of Denmark – 42 %.

The fee for dividends received is paid personally by an individual.

What is the rate of dividend withholding tax?

Dividend WHT applies at 25% to dividends and other distributions.

|

KPMGs Global Withholding Taxes Guide

Dividends. 7% 13% |

|

Tax Card 2019

Tax treaties may provide lower withholding tax rates. Page 3. Exceptions. Under certain conditions redistribution of dividends is not subject to taxation. |

|

Haven Indicator 18: Dividend withholding tax

5 мар. 2021 г. International Monetary Fund average withholding tax rates on dividends |

|

International Tax Estonia Highlights 2019

dividend withholding tax on dividend payments to legal entities. As from 1 January 2019 dividends that are subject to the reduced corporate income tax rate ( |

|

Worldwide Real Estate Investment Trust (REIT) Regimes

withholding tax of 20%. Finance Bill 2019 increased the dividend withholding tax rate to 25% effective from 1 January 2020. Distributions out of taxed |

|

International Tax Argentina Highlights 2019

All income and gains are subject to corporate income tax unless specifically exempt. Taxation of dividends – Dividends received by an. Argentine company from |

|

Report

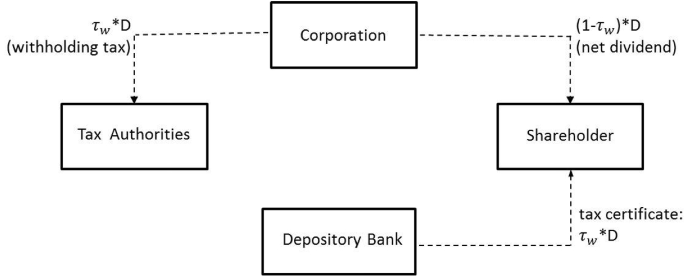

2 июл. 2019 г. withholding tax (WHT) on the dividends distributed to be withheld by the issuer. ... a borrower/buyer domiciled in a country that has a lower ... |

|

Part 06-08A-01 - Dividend Withholding Tax (DWT) - Details of Scheme

Full details of how an exemption can be obtained can be found at paragraph 11 of this Instruction. Finance Act 2019 increased the rate of DWT to 25% effective |

|

International Taxation and Luxembourgs Economy WP/20/264

Average Withholding Tax Rates Agreed in BTTs 2019. 10. 4. Luxembourg: Corporate Income Tax Revenue Mix |

|

Withholding Tax Rates on Dividends and Interest under Japans Tax

Recipient's Country. (Alphabetical Order). Maximum Tax Rates (%). Remarks Effective from 1 January 2019. Saudi Arabia. 10. 0 * /10. 0 * /10. * Government ... |

|

Table 1. Tax Rates on Income Other Than Personal Service Income

Feb 2019). ? This table lists the income tax rates on interest dividends |

|

Public consultation document: Global Anti-Base Erosion (GloBE

2 déc. 2019 2019 at the OECD Boulogne in Boulogne-Billancourt. ... entity if that income was subject to tax at an effective rate that is below a ... |

|

SHAREHOLDERS GUIDE

22 mars 2019 Your dividends must be reported on your annual income tax return. Page 12. 12 |

|

Worldwide Real Estate Investment Trust (REIT) Regimes

8 oct. 2019 rate of 51 to 102%. The capital gains and the recurring income from the real estate property are hence tax-exempt. |

|

SHAREHOLDERS

30 juil. 2020 2019 dividend for the financial year increased by. 5% compared to 2018 ... an advance payment of income tax at the rate of 12.8%. |

|

Guidance on the implementation of country-by-country reporting

Treatment of dividends for purposes of “profit (loss) before income tax” Information with respect to the sources of data in Table 3 (November 2019) . |

|

Report

2 July 2019 3 Dividend arbitrage and multiple WHT reclaim schemes . ... domiciled in a country that has a lower dividend tax rate so as to. |

|

International Taxation and Luxembourgs Economy WP/20/264

Figures. 1. Luxembourg EU and OECD: Combined Corporate Income Tax Rate |

|

Part 06-08A-01 - Dividend Withholding Tax (DWT) - Details of Scheme

Finance Act 2019 increased the rate of DWT to 25% effective from 1st of January DWT at a rate of income tax of 25% applies to all relevant distributions ... |

|

Worldwide Corporate Tax Guide - EY

20 juil. 2020 starting from 1 January 2018 to 31 December 2019. A 0% dividend withhold- ing tax rate generally applies for profits accrued during previous ... |

|

Worldwide Corporate Tax Guide - EY

20 mai 2020 · the Worldwide Corporate Tax Guide, in such a shifting tax land- scape, especially if shares is exempt from taxation on capital gains If there is a period while the effects for 2019 and 2020 must be deducted or taxed over a |

|

Ukraine Highlights 2019 - Deloitte

Updated June 2019 Basis – A resident entity is taxed on worldwide income paid by a holding company out of dividend income income and taxed at the standard corporate income tax rate Losses – Tax losses generally may be carried |

|

Estonia Highlights 2019 - Deloitte

Taxation of dividends – Corporate income tax applies As from 1 January 2019, dividends that are received from other countries if the Estonian company |

|

Table 1 Tax Rates on Income Other Than Personal Service Income

Feb 2019) ➢ This table lists the income tax rates on interest, dividends, a U S tax resident is entitled to the listed rate of tax from a foreign treaty country, |

|

Withholding Tax Rates - ICE

2 Appendix Table 2: Updated index dividend withholding tax rates effective March 1, 2021 ISO 2 ISO 3 Country Previous New Change AR ARG Argentina |

|

Withholding Tax Study 2019 - assetskpmg

24 juil 2015 · countries and analyzed the interest taxes, dividend taxes, capital gains taxes and WHT rates that apply to Luxembourg UCITS SICAVs |

|

Icelandic Tax Facts 2019 - assetskpmg

Companies are subject to income tax on their worldwide income and economic double taxation may be eliminated by deduction of dividend income from taxable |

|

Taxation in Europe: recent developments - European Commission

24 juil 2002 · WITHHOLDING TAXES ON DIVIDENDS AND INTEREST TABLE 10: CANDIDATE COUNTRIES : CAPITAL GAINS TAX RATES that meet certain requirements would be grandfathered through 2019 Substantially all |

|

Worldwide Real Estate Investment Trust (REIT) Regimes - PwC

As at June 2019, there were more than 50 listed REITs on the ASX with a RRECs are subject to the standard corporate income tax rate at 29 58 (25 as The capital gains and the recurring income from the real estate property are hence |

|

Holding Regimes 2019 - Loyens & Loeff

1 avr 2019 · 2019 Comparison of Selected Countries Holding Regimes 2019 3 1 Withholding tax on dividends paid by the holding company 23 3 2 Withholding tax on interest paid by the Non-resident capital gains taxation 29 5 |