and Capital Asset Pricing for Life Insurers

|

Estimating the Cost of Equity Capital for Insurance Firms

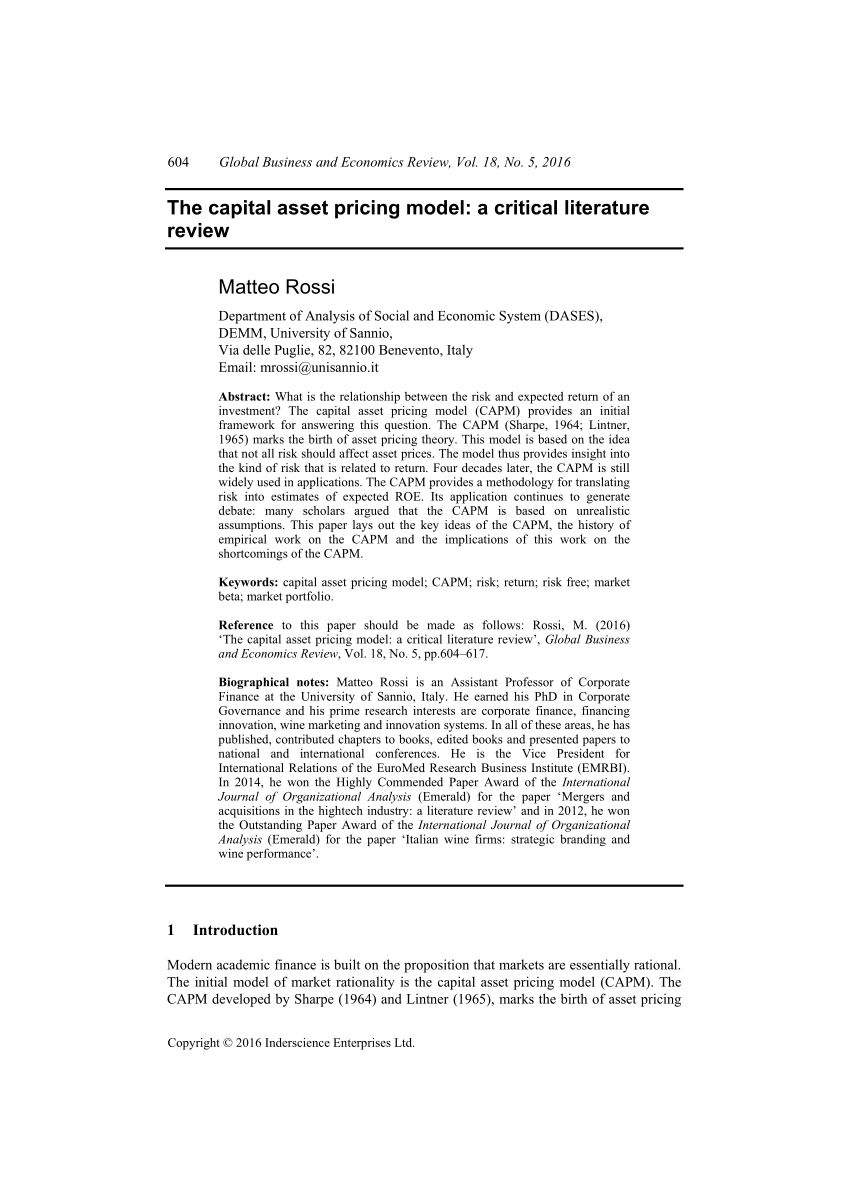

property-liability (P/L) insurers and life insurers using the CAPM FF3 CCAPM and ICAPM over an 11 year period As implied by the notion of time-varying risks on average the CCAPM and ICAPM generate higher COE estimates than the CAPM We also find that all four models consistently yield higher COE estimates for life insurers than P/L insurers |

|

Conning’s Strategic Asset Allocation Approach for Life

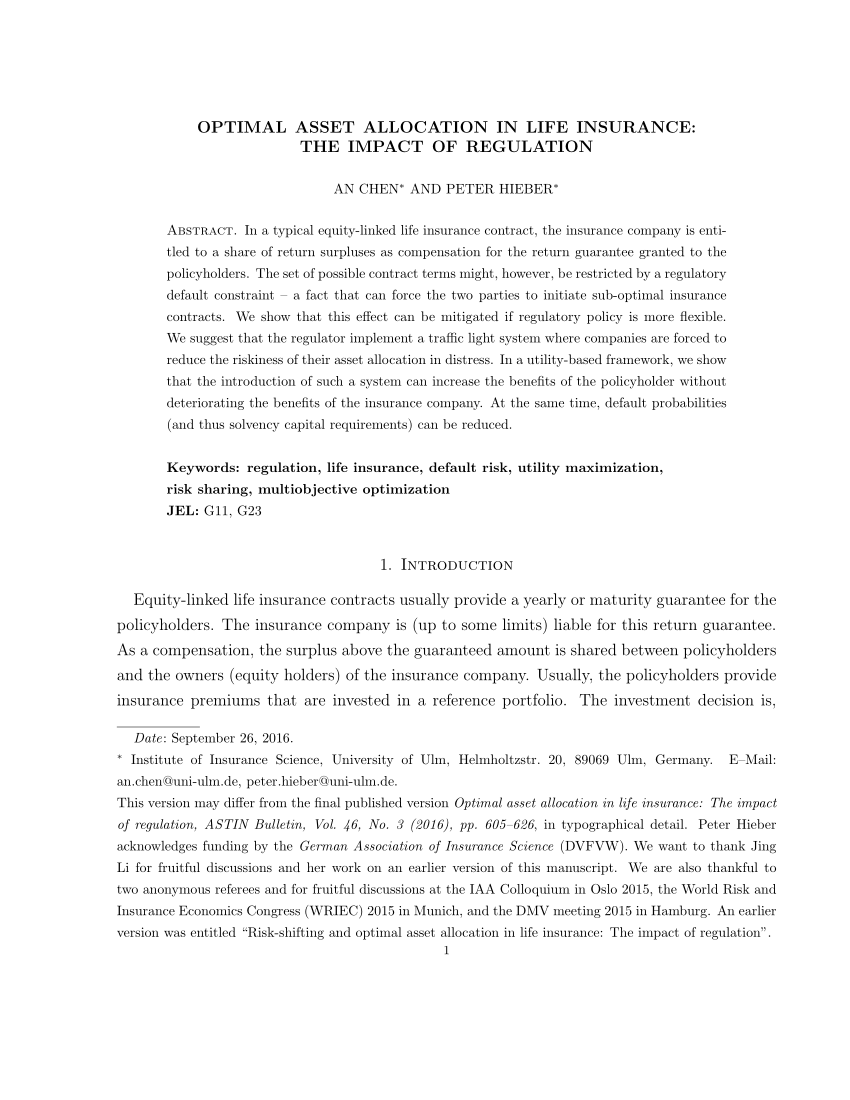

Life insurers are capital constrained entities that must constantly measure assess and plan allocations to the various risks they take These risks include balance sheet leverage capital adequacy product pricing in correlation with mortality and morbidity rates and setting investment strategy |

|

Estimating the Cost of Equity Capital for Insurance Firms

Estimating the Cost of Equity Capital for Insurance Firms with Multi-period Asset Pricing Models Abstract Previous research on insurer cost of equity (COE) focuses on single-period asset pricing models such as the CAPM and Fama-French three factor model (FF3) In reality however investment and |

|

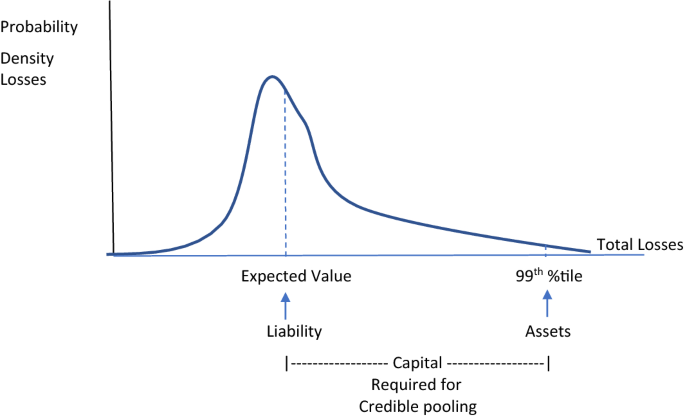

Economic Capital for Life Insurance Companies

This paper aims to address key questions on the calculation of economic capital for long-term life insurers It discusses the drivers of economic capital the development of an internal EC framework and the uses of EC within an insurance company It concentrates on the features that make long term life insurance business unique within the financial |

|

Risk Discount Ratesfor Actuarial Appraisal Values of Life

method of calculating and applying risk discount rates for life insurance appraisal values Capital Asset Pricing Model 1 9 When performing an actuarial appraisal value the choice of an appropriate discount rate to apply to the forecast earnings stream of a life insurance business is fundamentally a matter of judgement There is a body of |

|

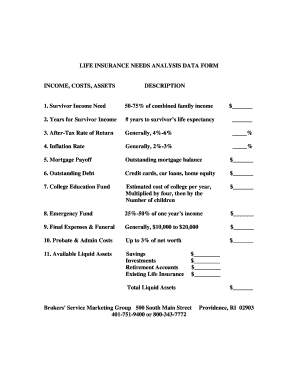

Regulatory Capital Requirements for US Life Insurers

Jul 11 2017 · C-1o Asset Risk - All Other 28 70 : C-2 Insurance Risk 9 68 : C-3a Interest Rate Risk 19 81 : C-3b Health Credit Risk 0 00 : C-3c Market Risk 0 29 : C-4a Business Risk 3 86 : C-4b Business Risk 0 05 : Total 100 00 * Source: http://naic org/documents/research_stats_rbc_results_life pdf |

How do asset managers design investment strategies for life insurance companies?

Many asset managers design investment strategies for life insurance companies around optimizing returns or managing duration risk. However, this fails to incorporate capital structure, opportunity costs, and appropriate measures of risks.

Do life insurance liabilities attract regulatory capital requirements?

Whatever the underlying theory, the mechanism of the adjustment is typically represented by an addition to the risk free rate for discounting liability cash flows. Conversely, holding life insurance liabilities attracts a regulatory (and economic) capital requirement.

What risks do life insurers take?

Life insurers are capital constrained entities that must constantly measure, assess, and plan allocations to the various risks they take. These risks include balance sheet leverage, capital adequacy, product pricing in correlation with mortality and morbidity rates, and setting investment strategy.

How do insurers value assets and liabilities?

These differing approaches are best illustrated by the valuation of assets and liabilities within the economic capital framework. Most insurers use a market value basis for assets with discounting of liabilities based on either treasuries or swap rates.

|

The Cost of Capital for Insurance Companies

Insurer capital comes from investors which means there is a cost associated Diversified insurance companiesà Non-life Life U S DCF CAPM Average cost |

|

Estimating the Cost of Equity Capital for Insurance Firms with Multi

property-liability (P/L) insurers, and life insurers using the CAPM, FF3, Previous research on insurer cost of equity focuses on single-period asset pricing |

|

ASSET PRICING MODELS AND INSURANCE RATEMAKING

in non-life insurance The first part of the paper presents a basic review of asset pricing models, including discrete and continuous time capital asset pricing |

|

Risk Discount Ratesfor Actuarial Appraisal Values of Life Insurance

faults, the capital asset pricing model (CAPM) can be used as a method of determining method of calculating and applying risk discount rates for life insurance |

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM2_2-b5f6378f74164191a5e589e307d88c51.png)