pricer swap excel

|

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

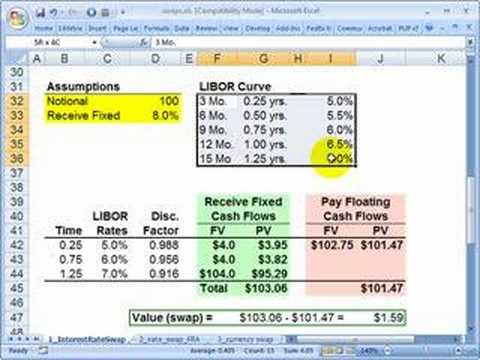

Three important calculations for interest rate swaps to be covered are: (1) pricing an at-market (or par) swap (2) valuing an off-market swap and (3) |

|

INTEREST RATE SWAP PRICING EXERCISE

The answers to this exercise are contained in sheet the Excel workbook In this sheet it is the product of the output of each Spline function on each date and |

|

Pricing variance swaps by using two methods: replication strategy

19 oct 2008 · Abstract In this paper we investigate pricing of variance swaps contracts The literature is mostly dedicated to the pricing using |

|

Understanding Interest Rate Swap Math & Pricing

The basic premise to an interest rate swap is that the coun- terparty choosing to pay the fixed rate and the counterpar- ty choosing to pay the floating rate |

How do you calculate swap price?

A swap is priced by solving for the par swap rate, a fixed rate that sets the present value of all future expected floating cash flows equal to the present value of all future fixed cash flows.

The value of a swap at inception is zero (ignoring transaction and counterparty credit costs).How do you value a swap contract?

The Swap Valuation Process

1Collect information on the swap contract.

2) Calculate the present value of the floating rate payments.

3) Calculate the present value of the notional principal of the swap.

4) Calculate the theoretical swap rate.

5) Calculate the swap spread.

6) Price the swap.

7) Find the termination value of the swap.What is the present value of a swap?

Interest rate swap terms typically are set so that the pres- ent value of the counterparty payments is at least equal to the present value of the payments to be received.

Present value is a way of comparing the value of cash flows now with the value of cash flows in the future.- Valuation of an Interest Rate Swap

The value of a fixed-rate swap at some future point in time, t , is determined as the sum of the present value of the difference in fixed swap rates times the notional amount.

Note that the above equation provides the value to the party receiving fixed.

|

Understanding Interest Rate Swap Math & Pricing

Municipal Swap Index. far the most common type of interest rate swaps. Index2 a spread over U.S. Treasury bonds of a similar maturity. |

|

Création dun outil de couverture de taux dintérêts en ligne

III Construction d'un pricer de swap. 35. 7 Cas général. 35. 8 Cas particulier Cette courbe se présente sous la forme d'un tableau Excel comprenant un. |

|

Chapitre 5. Swap de Taux et Asset-Swap Gov/Corp

Les taux zéro-coupon swap s'obtiennent directement à partir des taux au pair cotés et permettent le pricing de structures hors marchés et la valorisation de |

|

Pricing variance swaps by using two methods: replication strategy

19 oct. 2008 In this paper we investigate pricing of variance swaps contracts. The ... 5.2.1 Excel's solver . ... The formula for pricing variance swaps. |

|

Credit Default Swap –Pricing Theory Real Data Analysis and

Credit Default Swap –Pricing Theory Real Data Analysis and Classroom current date in the “Range” field and then click on “Export to Excel”. Figure 4. |

|

Bloomberg functions

Bloomberg Data & Calculations in Excel. IRSM. Interest Rate Swaps & Derivatives Functions Menu Defaults Menu -pricing sector |

|

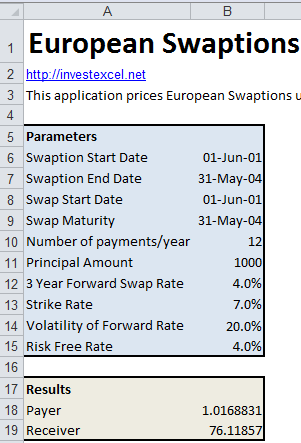

A commodity risk management system.

The main functionalities are available from the Excel API: • Price contribution and subscription. • Pricing of instrument (swap options). • Trade insertion. |

|

Cross Currency Swap Trading & Pricing Formulae - A PowerPoint

26 mars 2019 Cross Currency Swap Trading & Pricing. Formulae - A PowerPoint Overview with Excel. Pricing Examples. Nicholas Burgess nburgessx@gmail.com. |

|

A commodity risk management system.

The main functionalities are available from the Excel API: • Price contribution and subscription. • Pricing of instrument (swap options). • Trade insertion. |

|

ACTUAIRES

12 janv. 2021 2.3.4 Saisonnalité de l'inflation et pricing de produits dérivés . ... Ainsi pour un swap de taux de maturité TM |

|

Understanding Interest Rate Swap Math & Pricing

The basic premise to an interest rate swap is that the coun- terparty choosing to pay the fixed rate and the counterpar- ty choosing to pay the floating rate |

|

INTEREST RATE SWAP PRICING EXERCISE

The answers to this exercise are contained in sheet the Excel workbook ICMBCSE3 Answer xls The bond data and calculations are in sheet “Data” Note that there |

|

Excel Pricing Workbook: Cross Currency Swap Theory & Practice

26 mar 2019 · Excel Pricing Workbook: Cross Currency Swap Theory Practice - An Illustrated Step-by-Step Guide of How to Price Cross Currency Swaps and |

|

Cross Currency Swap Trading & Pricing Formulae

6 mai 2019 · Secondly we outline and give a breakdown of the cross currency swap pricing formula and provide Excel pricing examples |

|

Interest Rate Swap Valuation (Excel workbook (XLSX)) - Flevy

4500 $US |

|

Interest Rate and Currency Swaps: A Tutorial - CFA Institute

This tutorial provides more than a little knowledge about two particularly useful forms of derivatives-interest rate and currency swaps Both are widely used by |

|

Pricing Interest Rate Swaps and Interest Rate Options - Package

7900 $US En stock |

|

VaR for an illustrative portfolio of Interest Rate & Cross Currency

29900 $US En stock |

|

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

Three important calculations for interest rate swaps to be covered are: (1) pricing an at-market (or par) swap (2) valuing an off-market swap and (3) |

|

Swaps Options and Futures - Edward Bodmer

On this page you can review some excel files and analysis for valuing interest rate swaps exchange rate swaps and various different real options |

| Understanding Interest Rate Swap Math & Pricing |

| Understanding Interest Rate Swap Math & Pricing |

| Derivative Pricing within Microsoft Excel - nag |

| Credit Default Swap Pricing Theory Real Data Analysis and |

| Searches related to pricer swap excel filetype:pdf |

How are interest rate swaps valued?

- interest rates during the period of the swap contract.

. Because an interest rate swap is just a series of cash flows occurring at known future dates, it can be valued by sim ply summing the present value of each of these cash flows.

How are interest payments calculated for Xed leg of swap?

- For xed leg of swap, interest (coupon) payments are calculated as swap ratemultiplied by notional amount (principle); these interest payments are dis-counted by the discount factor and by the day count convention factor to getthe present values of the interest payments (recall the Day Count you haveleant in the previous section); then the presen

What curve do you use to project forward pricing?

- 3.

. In the middle of the screen, the Curve Data panel allows you to choose themarket curve used to discount cash ows and to project forward pricing.

. Inthis lab, we use 23- (USD Bloomberg Curve) for swaps.

How do I view swaps in a regional view?

- Left.

. The default setting for the yellow box at the left top of the screen shouldbe Regional, otherwise, you should select Regional in the drop-down list tohave a regional view for swaps.

|

Projet de Fin dEtudes N 4 - Actuarialab

1 14 Pricer d'un Swap suivant La valeur du swap donnée par notre Pricer est : 58 402 74$ FIGURE du marché est un fichier Excel relié avec Bloomberg |

|

Modélisation de la courbe des taux et valorisation des - Actuarialab

couverture risque de taux; - produits dérivés; - pricing; - FRA; - swap de taux; - Cap Figure 6: résultats du programme d'interpolation linéaire sur VBA-Excel |

|

Sarah ILIASS - Ecole Mohammadia dingénieurs

Elaboration d'un pricer d'obligations sous VBA/Excel Etudes et évaluations des produits dérivés de taux fermés : Swap de taux, Swap de bases, Swap de |

|

Pricing and Valuation of Interest Rate Swap Lab - Bloomberg LP

swap pricing methods and the corresponding Bloomberg functions The lab guide is about EUR and USD plain vanilla swaps and cross currency basis swap |

|

Modeling Derivatives Applications in Matlab, C++, and Excel

8 sept 2006 · Bootstrapping in Excel 30 1 10 General Swap Pricing in Matlab 33 Description 43 1 11 Swap Pricing in Matlab Using Term Structure |

|

Understanding Interest Rate Swap Math & Pricing - State Treasurers

Municipal Swap Index far the most common type of interest rate swaps Index2 a spread over U S Treasury bonds of a similar maturity |

|

Eikon

15 juil 2016 · How to use Eikon Answers on Excel Save the curve and use it in different applications, e g Swap Pricer, Swaption, Credit Default |

|

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

Starting with the LIBOR forward curve, pricing an at-market swap entails “ monetizing” each forward rate by multiplying by the notional principal and day- count |

![Bloomberg CDS Guide - [PDF Document] Bloomberg CDS Guide - [PDF Document]](https://blog.deriscope.com/images/easyblog_articles/88/CcySwap1PriceSimpleSheet.png)

![PDF]Financial Modelling in Pythonpdf PDF]Financial Modelling in Pythonpdf](http://faculty.trinity.edu/rjensen/acct5341/speakers/Table7.gif)