European Corporate Bond Sustainable and Responsible Investment

What is corporate sustainability due diligence?

On 23 February 2022, the Commission adopted a proposal for a Directive on corporate sustainability due diligence. The aim of this Directive is to foster sustainable and responsible corporate behaviour and to anchor human rights and environmental considerations in companies’ operations and corporate governance.

What is sustainable finance?

Sustainable finance refers to the process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects.

Why should you join the EU sustainable finance council?

It is actively contributing to the EU sustainable finance agenda, acting as a privileged interlocutor of Public Institutions, practitioners, and NGOs. Our broad constituency ensures that various sensitivities, points of views and expertise are reflected in our policy recommendations and positions.

What is the Corporate Sustainability Reporting Directive (CSRD)?

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force. This new directive modernises and strengthens the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, will now be required to report on sustainability.

What Is Sustainable Finance?

Sustainable finance refers to the process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects. Environmental considerations might include climate change mitigation and adaptatio

Why Is Sustainable Finance Important?

Sustainable finance has a key role to play in delivering on the policy objectives under the European green dealas well as the EU’s international commitments on climate and sustainability objectives. It does this by channelling private investment into the transition to a climate-neutral, climate-resilient, resource-efficient and fair economy, as a c

What Is Transition Finance?

Sustainable finance is about financing both what is already environment-friendly today (green finance) and what is transitioning to environment-friendly performance levels over time (transition finance). Transition finance is about financing private investments to reduce today’s high greenhouse gas emissions or other environmental impacts and trans

|

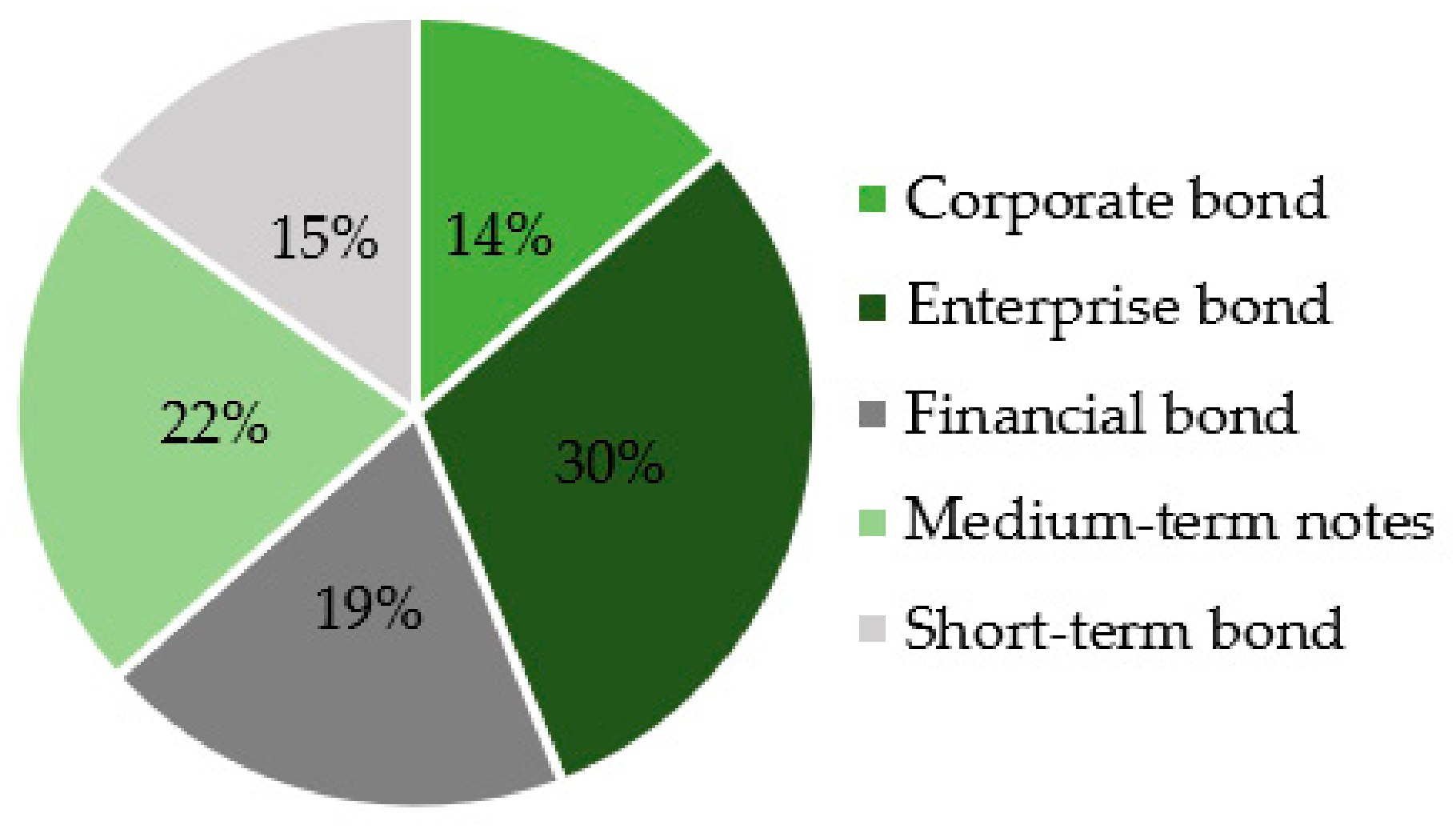

Global Corporate Bond Sustainable and Responsible Investment Fund

Non-euro denominated assets held in the fund will generally be hedged back to euros. Investment in all Debt and Debt-Related. Securities will follow abrdn's “ |

|

A sustainable and responsible investment guide for central banks

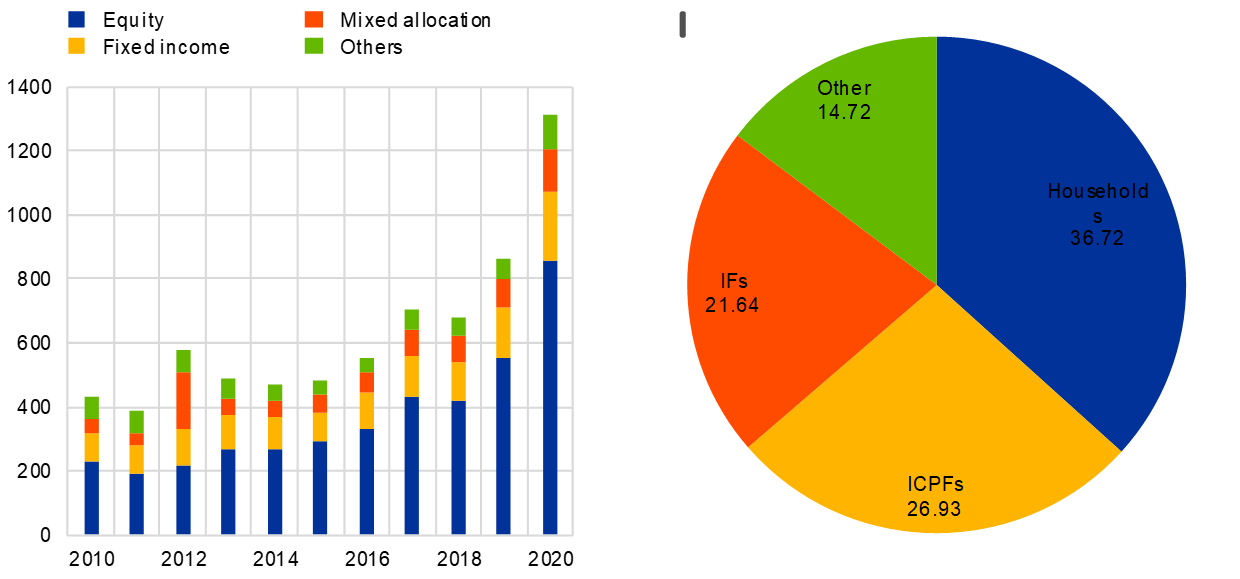

The asset mix of these portfolios is more diverse compared to the policy portfolios with holdings often including equities |

|

Sustainable and Responsible Investment Roadmap for The

the staff of the Corporate Affairs Corporate Bonds & Investment Products and International Affairs departments |

|

Aberdeen Standard SICAV II and SICAV III

Euro Corporate Bond Fund. D inc hedged. USD. LU1112015521. Euro Corporate Bond Sustainable and Responsible Investment Fund. A acc. EUR. LU1164462860. |

|

GLOBAL SUSTAINABLE INVESTMENT REVIEW 2020

2 Some of the definitions contained in the EU Sustainable Finance Disclosure Regulation (SFDR) ary screening ESG integration and corporate engagement. |

|

Of sustainable and responsible investment practices in central banks

8.2 European Central Bank: Low-carbon equity benchmarks in the pension portfolio green bond investing negative screening and ESG. |

|

Untitled

Standard Life Investments Global SICAV -European Corporate. Bond Sustainable and Responsible Investment Fund. FDC SICAV Obligations Monde - Actif 3. |

|

European Corporate Sustainable Bond Class I-sek h

Investment policy. The fund invests mainly in European corporate bonds. The fund follows Danske Invest's responsible investment policy. The. |

|

GLOBAL SUSTAINABLE INVESTMENT REVIEW

followed by ESG integration ($17.5 trillion) and corporate In Europe total assets committed to sustainable and responsible investment strategies grew ... |

|

LIJST VAN DE COMPARTIMENTEN VAN DE OPENBARE

Sustainable Global Equity. • Sustainable Multiasset. • Top European Research. ? Exclusive Solutions Funds. Compartimenten : • Bond Invest Emerging Markets. |

|

European Corporate Bond Sustainable and Responsible Investment

31 déc 2020 · Standard Life Investments Global SICAV - European Corporate Bond Sustainable and Responsible Investment Fund A Acc EUR Objectif |

|

Impact summary Responsible Euro Corporate Bond Fund

SDG9 links to several business lines including green buildings investments in the real estate sector, which support target 9 1 on sustainable infrastructure Around |

|

Global Corporate Bond Sustainable and Responsible Investment Fund

Non-euro denominated assets held in the fund will generally be hedged back to euros Investment in all Debt and Debt-Related Securities will follow Aberdeen |