form 1065 schedule d 2015 pdf

|

SCHEDULE D Capital Gains and Losses

Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1065 or Form 8865 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10 Information about Schedule D (Form 1065) and its separate instructions is at www irs gov/form1065 |

|

2015 Form 1065

Form 1065 Department of the Treasury Internal Revenue Service U S Return of Partnership Income For calendar year 2015 or tax year beginning 2015 ending 20 Information about Form 1065 and its separate instructions is at www irs gov/form1065 OMB No 1545-0123 2015 Type or Print Name of partnership Number street and room or suite no |

|

2015 Instructions for Form 1065

spouse filed a Form 1065 for the year prior to the election you don\'t need to amend that return or file a final Form 1065 for the year the election takes effect For more information on qualified joint ventures go to IRS gov and enter “Qualified Joint Venture” in the search box Foreign Partnership |

When are 1065 returns due?

In the case of a 1065, this is by the 15th day of the 3rd month after the end of the tax year for the return. For a calendar year filer, the deadline is March 15. We recommend that you e-file at least several hours before the deadline to ensure a timely filing. For more information, see Related Links below, and Publication 4163.

Is schedule L required in 1065?

When Schedule L is required: If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership’s books and records. In the event that there are any differences between the balance sheet contained in the books and records of partnership and balance sheet submitted on Schedule L, those differences should be explained in an attached statement with ...

When is schedule L required on 1065?

When Schedule L is required: If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership's books and records. In the event that there are any differences between the balance sheet contained in the books and records of partnership and balance sheet submitted on Schedule L, those differences should be explained in an attached statement with the ...

Where to mail IRS Form 1065?

Internal Revenue Service Ogden Submission Processing Center Attn: Form 1065 e-file Waiver Request Mail Stop 1057 Ogden, UT 84201. Waiver requests can also be faxed to 877-477-0575. Contact the e-Help Desk at 866-255-0654 for questions regarding the waiver procedures or process.

How to Fill Out Form 1065 or US Return of Partnership Income PDFRun

How To File Form 1065 Online (Multi-Member LLC & Partnership Tax Form)

How to Fill Out Form 1065 for 2021. Step-by-Step Instructions

|

2015 Schedule D (Form 1065)

Information about Schedule D (Form 1065) and its separate instructions is at www.irs.gov/form1065. OMB No. 1545-0123. 2015. Name of partnership. |

|

2015 Form 1065 (Schedule K-1)

Schedule K-1. (Form 1065). 2015. Department of the Treasury. Internal Revenue Service. For calendar year 2015 or tax year beginning. |

|

2015 Partners Instructions for Schedule K-1 (Form 1065)

7 janv. 2016 2015. Partner's Instructions for. Schedule K-1 (Form 1065). Partner's Share of Income Deductions |

|

2021 Partners Instructions for Schedule K-1 (Form 1065)

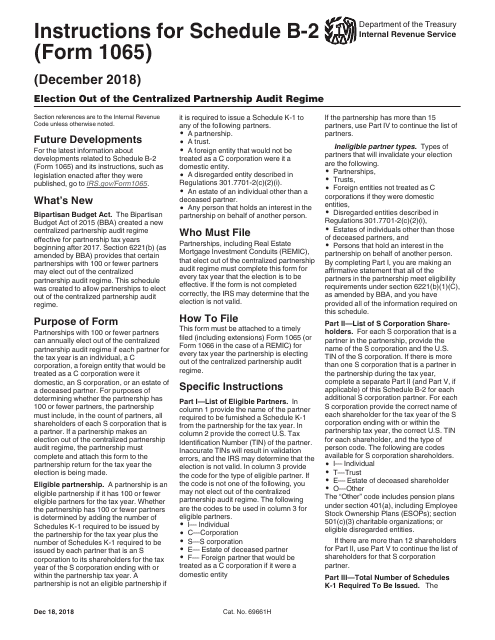

If you are a partner in a partnership that has not elected out of the centralized partnership audit regime enacted by the Bipartisan. Budget Act of 2015 (BBA) |

|

Form 1065 - U.S. Return of Partnership Income

of Partnership Income. For calendar year 2015 or tax year beginning ... d The partnership is not filing and is not required to file Schedule M-3 . |

|

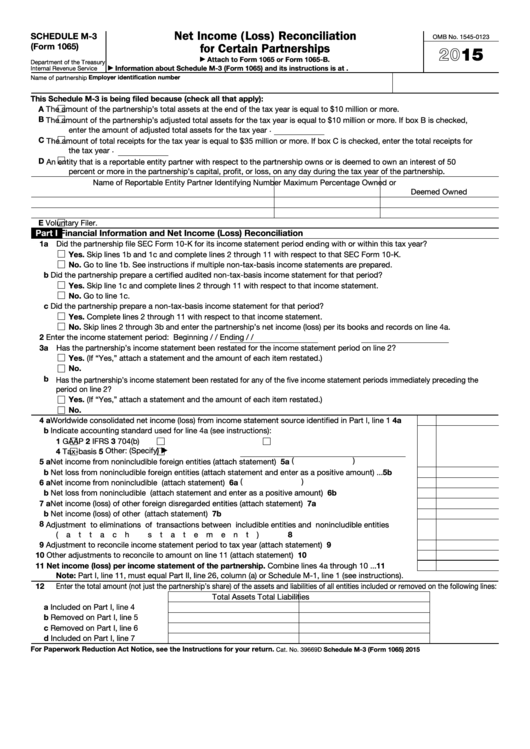

2015 Schedule M-3 (Form 1065)

the tax year . D. An entity that is a reportable entity partner with respect to the partnership owns or is deemed to own an interest of 50. |

|

2015 Form 8865 (Schedule K-1)

For detailed reporting and filing information see the Partner's Instructions for Schedule K-1 (Form 1065) and the instructions for your income tax return. 1. |

|

2021 Schedule K-1 (Form 1065)

OMB No. 1545-0123. Schedule K-1. (Form 1065). 2021. Department of the Treasury. Internal Revenue Service. For calendar year 2021 or tax year beginning. |

|

2015 Instructions for Form 1065

15 janv. 2016 501(d) must file Form 1065 to report its ... pro rata share in box 6a of Schedule K-1. Net ... pub/irs-irbs/irb12-10.pdf for the. |

|

2015 Partners Instructions for Schedule K-1 (Form 1065-B)

4 janv. 2016 2015. Partner's Instructions for. Schedule K-1 (Form 1065-B). Partner's Share of Income (Loss) From an Electing Large Partnership. |

|

2015 Schedule D (Form 1065) - IRS

ls for all short-term transactions reported on Form 1099-B for which basis was reported to the |

|

Form 1065 - Internal Revenue Service

f1065--2015PDF |

|

2015 Schedule D (565) -- Capital Gain or Loss - CAgov

ership's share of net short-term capital gain (loss), including gains (losses) from LLCs, |

|

Partners Share of Income, Deductions, Credits, etc 651113

for Form 1065 IRS gov/form1065 Cat No 11394R Schedule K-1 (Form 1065) 2014 |

|

Partners Instructions for Schedule K-1 (Form 1065) - RINA

The partnership files a copy of Schedule K-1 (Form 1065) with the IRS ¥ Box 13, Other |

|

Form MO-1065 - 2014 Partnership Return of Income - Missouri

MO-1065_2015PDF |

|

2015 Form 1040 (Schedule C) - Redleaf Press

assetsPDF |

|

2015 Instruction 1040 Schedule E

|

|

2019 Partners Instructions for Schedule K-1 (Form 1065)

irs-docsPDF |

|

2015 Tax Return - ElizabethWarrencom

2019/01PDF |