form 1116

|

Foreign Tax Credit

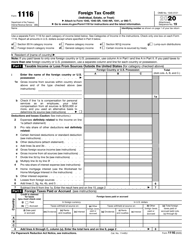

U S citizens and residents compute their U S taxes based on their worldwide income This sometimes results in U S citizens having to pay tax twice on the same income — first to the government of the foreign country where the income was earned and again to the U S government Taxpayers can choose whether to take the amount of any qualified forei |

|

Form 1116 – Foreign Tax Credit

Form 1116 – Foreign Tax Credit TaxSlayer Navigation: Federal Section>Deductions>Credits Menu>Foreign Tax Credit; or Keyword “1116” ONLY the Simplified Limitation Election for the foreign tax credit is in scope for Advanced certification To be eligible for this election qualified foreign taxes must be $300 ($600 if MFJ) or less all |

|

Attach to Form 1040 1040-SR 1040-NR 1041 or 990-T Go to

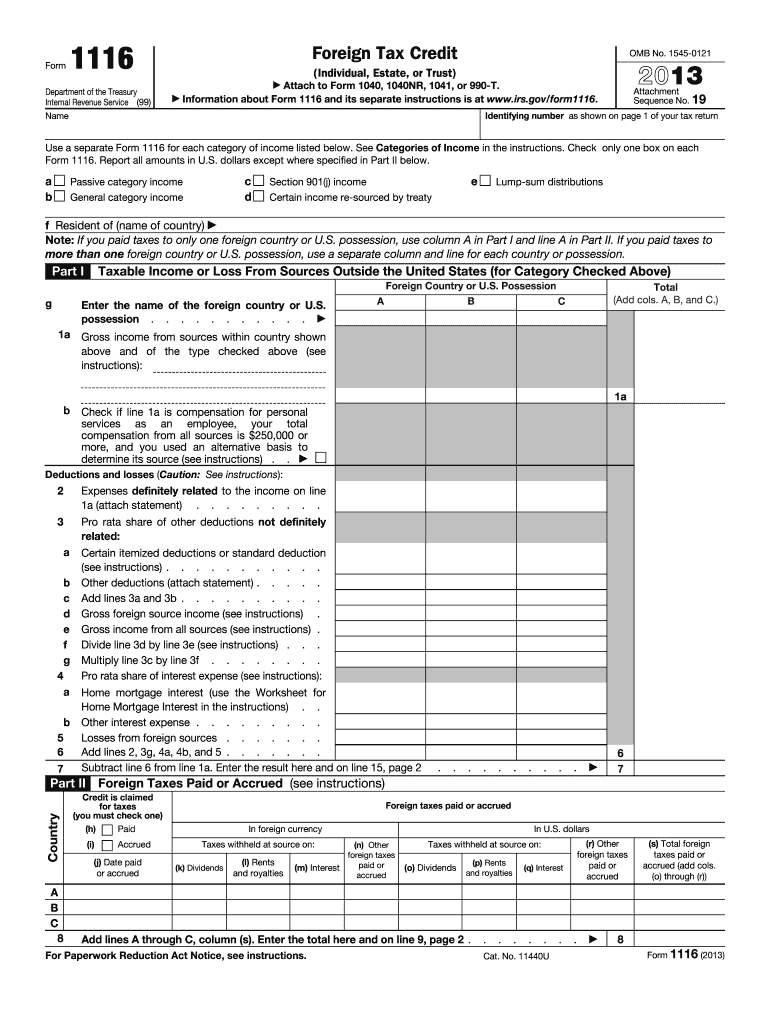

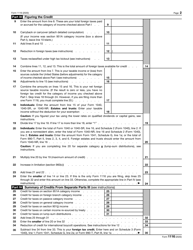

Attach to Form 1040 1040-SR 1040-NR 1041 or 990-T Go to www irs gov/Form1116 for instructions and the latest information OMB No 1545-0121 2023 Attachment Sequence No 19 Name Identifying number as shown on page 1 of your tax return Use a separate Form 1116 for each category of income listed below See Categories of Income |

|

2019 Form 1116

2019 Form 1116 Use a separate Form 1116 for each category of income listed below See Categories of Income in the instructions Check only one box on each Form 1116 Report all amounts in U S dollars except where specified in Part II below Section 951A category income c Passive category income e Section 901(j) income g Lump-sum distributions |

What are the criteria for filing Form 1116?

Before completing Form 1116 on your taxes, you must meet the four following criteria: Note that taxes that are due to be refunded to you are not included in the amount of foreign taxes paid. Before completing Form 1116, all of the foreign taxes paid will need to be converted to US dollars.

Who is eligible to claim the Foreign Tax Credit using Form 1116?

File Form 1116 to claim the foreign tax credit if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Changes to the 2021 Instructions for Schedule B (Form 1116) -- 17-MAR-2022)

What is the purpose of Form 1116?

US citizens living abroad are required to pay US taxes regardless of income source. Form 1116 is used to avoid double taxation by providing the taxpayer a dollar-for-dollar credit to be applied against taxes owed.

How does Form 1116 help U.S. expats?

Form 1116 is one tax form every U.S. expat should learn to love, because it’s one of two ways Americans working overseas can lower their U.S. tax burden. You file it to claim the Foreign Tax Credit (FTC), which reimburses expats for taxes paid to a foreign country dollar-for-dollar.

What is the foreign tax credit?

U.S. citizens and residents compute their U.S. taxes based on their worldwide income. This sometimes results in U.S. citizens having to pay tax twice on the same income — first to the government of the foreign country where the income was earned and again to the U.S. government. Taxpayers can choose whether to take the amount of any qualified forei

What qualifies taxpayers for the credit?

To qualify for the credit, the following requirements must be met. A taxpayer must: Have income from a foreign country Have paid taxes on that income to the same foreign country Not have claimed the foreign earned income exclusion on the same income (see the foreign earned income exclusion section of the Income – Other Income lesson) In addition, t

EXERCISES (continued)

Question 4: Anne is a U.S. citizen living in Japan. She listed wages, interest income, and dividend income on her U.S. tax return. She paid taxes on each of these types of income to Japan. Anne can claim a foreign tax credit for taxes paid on which of the following sources of income? Wages from her job in the U.S. Interest income from a U.S. bank I

What is “economic benefit”?

As mentioned earlier, the foreign tax paid cannot provide a specific economic benefit for the taxpayer and be included in the foreign tax credit computation. This means that the tax cannot be a payment that results in an individual receiving: Goods Services Fees or other payments The right to use, acquire, or extract resources, patents, or other pr

EXERCISES (continued)

Question 6: Adele lived and worked in a sanctioned country until August of this tax year, when she was transferred to Italy. She paid taxes to each country on the income earned in that country. Can Adele take a foreign tax credit on her U.S. tax return for the taxes paid on income she earned in the sanc-tioned country? □ Yes □ No Question 7:

Tax Law Application

There are several factors to consider when determining if taxes paid to a foreign government are eligible for the foreign tax credit. Ask the taxpayer: Was the income foreign-sourced? What type of tax was paid to the foreign government? Will the taxpayer receive some kind of specific economic benefit from the payment of this tax? apps.irs.gov

TAX LAW APPLICATION

To gain a better understanding of the tax law, complete the practice return(s) for your course of study using the Practice Lab on L<. apps.irs.gov

IRS Form 1116 walkthrough (Foreign Tax Credit)

How to File IRS Form 1116 (Foreign Tax Credit) for Non-U.S. Income & Taxes

How to File IRS Form 1116 for a Foreign Tax Credit on Compensation

|

Form 1116 - IRS.gov

Form 1116. Department of the Treasury. Internal Revenue Service (99). Foreign Tax Credit. (Individual Estate |

|

2021 Instructions for Form 1116

You may be able to claim the foreign tax credit without filing Form 1116. By making this election the foreign tax credit limitation (lines 15 through 23 of the |

|

Instructions for Schedule B (Form 1116) (Rev. December 2021)

With respect to each separate category of income if you are filing Form 1116 that has a foreign tax carryover in the prior tax year |

|

2017 Instructions for Form 1116

5 janv. 2018 You may be able to claim the foreign tax credit without filing Form 1116. By making this election the foreign tax credit limitation (lines 15 ... |

|

Schedule B (Form 1116) (December 2021)

? Attach to Form 1116. ? Go to www.irs.gov/Form1116 for instructions and the latest information. OMB No. 1545-0121. |

|

2019 Instructions for Form 1116

18 févr. 2020 Don't use Form 1116 to figure a credit for taxes paid to the U.S. Virgin. Islands. Instead use Form 8689 |

|

2020 Instructions for Form 1116

3 déc. 2020 Form 1116. See the instructions for. Line 12 later. To make the election |

|

Foreign Tax Credit

Go to www.irs.gov/Form1116 for instructions and the latest information. Use a separate Form 1116 for each category of income listed below. |

|

2018 Instructions for Form 1116

23 avr. 2019 You may be able to claim the foreign tax credit without filing Form 1116. By making this election the foreign tax credit limitation (lines 15 ... |

|

F1116--2019.pdf

Form 1116. Department of the Treasury. Internal Revenue Service (99). Foreign Tax Credit. (Individual Estate |

|

Form 1116 - Internal Revenue Service

ach to Form 1040, 1040-SR, 1040-NR, 1041, or 990-T ▷ Go to www irs gov /Form1116 for |

|

2020 Instructions for Form 1116 - Internal Revenue Service

pub › irs-priorPDF |

|

Instructions for Form 1116 - GlobeTax

be able to claim the foreign tax credit without filing Form 1116 By making this election, the |

|

Instructions for Form 1116 - GlobeTax

2019/04PDF |

|

Download the Obamas tax returns here - whitehousegov

Form 1116 if required 427 Married filing 49 Credit for child and dependent care expenses |

|

Tax Information for Individuals About Foreign Tax Paid - Fidelity

mpleting Form 1116, you may be required to report your share of foreign taxes paid by each fund |

|

Foreign Tax Credit for Individuals - IRS Nationwide Tax Forums

ftc16PDF |

|

Alternative Minimum Tax - Client Handout

uploadsPDF |

![Form 1116-Foreign Tax Credit - [PDF Document] Form 1116-Foreign Tax Credit - [PDF Document]](https://handypdf.com/resources/formfile/images/10000/foreign-tax-credit-page1.png)

![PDF] Assam Gramin Vikash Bank ATM Application Form PDF Download PDF] Assam Gramin Vikash Bank ATM Application Form PDF Download](https://data.templateroller.com/pdf_docs_html/2030/20306/2030633/form-1116-mec-division-of-welfare-and-supportive-services-direct-deposit-information-and-authorization-agreement-nevada_big.png)