form 1120 schedule g 2015

|

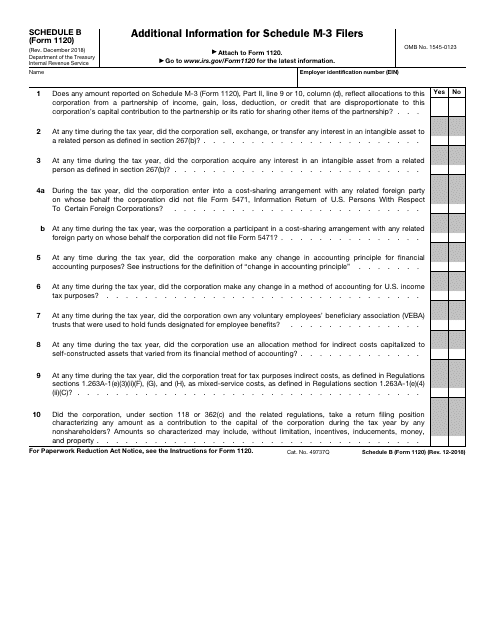

Schedule G (Form 1120) (Rev December 2011)

General Instructions Purpose of Form Use Schedule G (Form 1120) to provide information applicable to certain entities individuals and estates that own directly 20 or more or own directly or indirectly 50 or more of the total voting power of all classes of the corporation’s stock entitled to vote Who Must File |

|

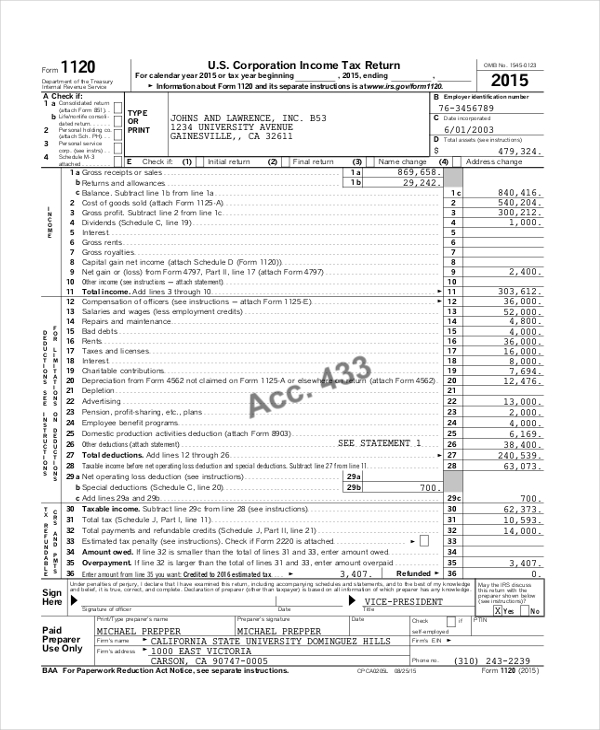

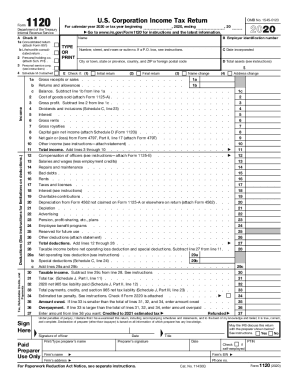

2015 Form 1120

For calendar year 2015 or tax year beginning 2015 ending 20 Information about Form 1120 and its separate instructions is at www irs gov/form1120 OMB No 1545-0123 2015 TYPE OR PRINT Name Number street and room or suite no If a P O box see instructions City or town state or province country and ZIP or foreign postal code |

|

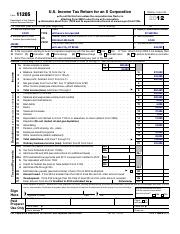

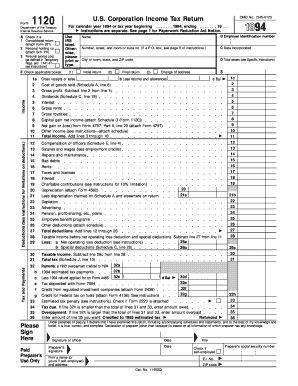

1120 US Corporation Income Tax Return G 2013 wwwirsgov

Form 1120 For calendar year 2013 or tax year beginning 2013 ending Department of the Treasury 2013 Internal Revenue Service G Information about Form 1120 and its separate instructions is at www irs gov/form1120 A Check if: B Employer identification number 1 a Consolidated return (attach Form 851) TYPE b Life/nonlife consoli-C Date |

|

1120 US Corporation Income Tax Return

Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20 Go to www irs gov/Form1120 for instructions and the latest information |

What is the due date for filing Form 1120?

Generally, an S Corporation must file Form 1120-S U.S. Income Tax Return for an S Corporation by the 15th day of the third month after the end of its tax year. For calendar year corporations, the due date is March 15. A corporation that has dissolved must generally file by the 15th day of the third month after the date it dissolved.

What is 1120 form Schedule G?

What is Schedule G form 1120? Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the corporation's stock entitled to vote.

When is the deadline for 1120?

Then you will have till September 15th, 2022 to file your form 1120S. If you didn’t file request for extension form 7004, you need to file your 1120S as soon as possible as the penalties for late filing will continue to accrue. Penalty for Late Filing S Corp Tax Return

When is the filing deadline for 1120?

The deadline is midnight on the date the return is due. Forms 1120, 1120-C, 1120-H are considered corporate returns. Returns are due the 15th day of the 4th month following the close of the entity’s year. A calendar year corporate return is due on April 15 (unless this falls on a weekend or holiday).

|

Schedule G (Form 1120) (Rev. December 2011)

Part I. Certain Entities Owning the Corporation's Voting Stock. (Form 1120 Schedule K |

|

U.S. Corporation Income Tax Return

If "Yes" complete Part II of Schedule G (Form 1120) (attach Schedule G) . Form 1120 (2015). Page 4. Form 1120 (2015). Page 4. Schedule K. Other Information |

|

2022 Instructions for Form 1120-REIT

For information on the relief provisions under sections 856(c)(7) and 856(g)(5) see the instructions for Schedule J |

|

2022 Instructions for Form 1120

If the corporation checked “Yes” to question. 4a or 4b complete and attach Schedule G. (Form 1120) |

|

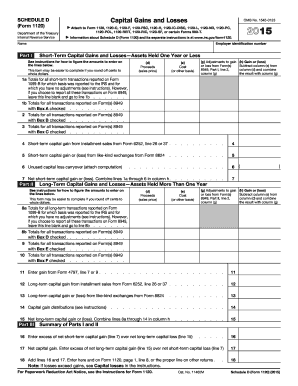

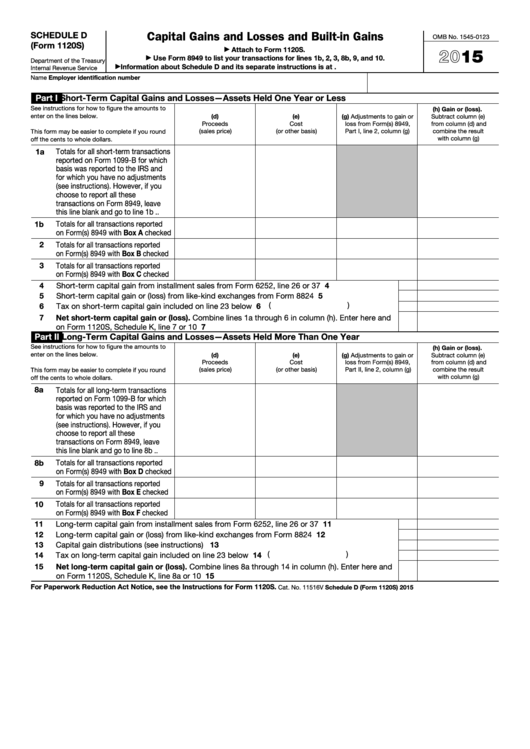

2015 Form 1120 (Schedule D)

This form may be easier to complete if you round off cents to whole dollars. (d). Proceeds. (sales price). (e). Cost. (or other basis). (g) Adjustments to gain. |

|

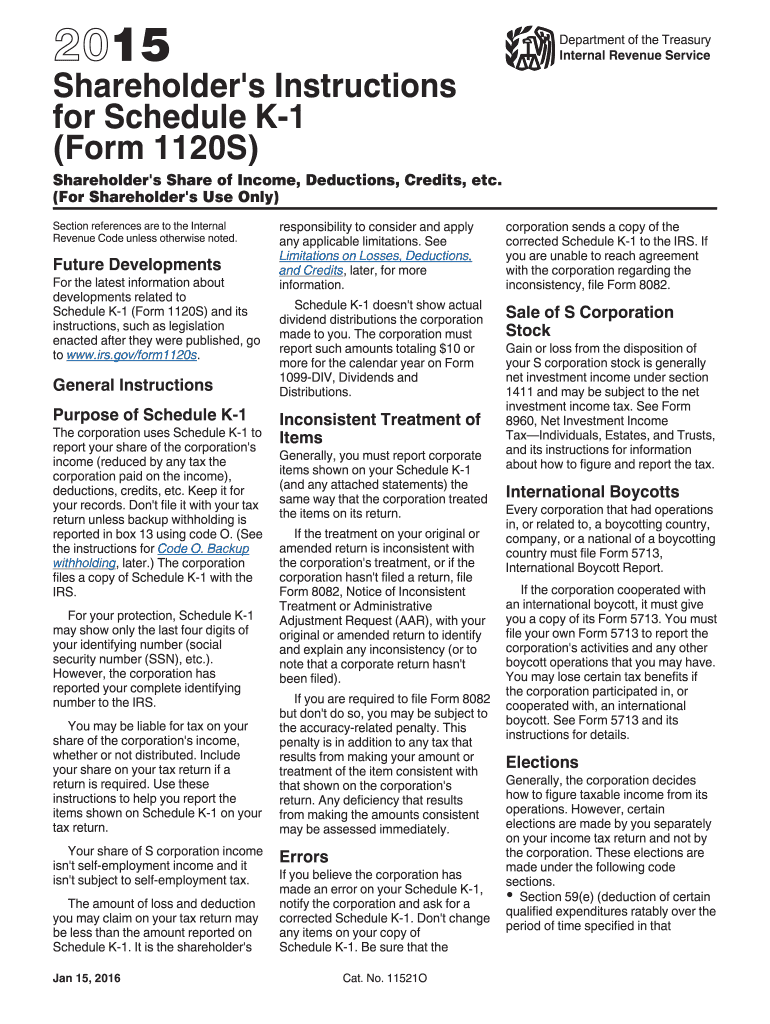

2015 Form 1120 S (Schedule K-1)

Schedule E line 28 |

|

2015 Form 1120-F

g Credit for federal tax paid on fuels (attach Form 4136). See instructions Schedule O (Form 1120)) . . . ▷. 2. Income tax. Check if a qualified personal ... |

|

2022 Instructions for Form 1120-S

reported on Schedule K-1 using codes E F |

|

Untitled

Nov 4 1993 If "Yes |

|

2015 Form 1120 S (Schedule D)

(g) Adjustments to gain or loss from Form(s) 8949. Part I |

|

Schedule G (Form 1120) (Rev. December 2011)

Part I. Certain Entities Owning the Corporation's Voting Stock. (Form 1120 Schedule K |

|

F1120--2015.pdf

For calendar year 2015 or tax year beginning. 2015 |

|

2015 Form 1120-C

Form 1120-C (2015). Page 3. Schedule G. Allocation of Patronage and Nonpatronage Income and Deductions. Before completing see Schedule K |

|

2015 Instructions for Form 1120-PC

12 févr. 2016 Instructions for Form 1120-PC (2015) ... not file a Schedule M-3 (Form 1120-PC) ... Regulations section 1.1503-2(g)(2). |

|

2015 Form 1120 (Schedule D)

? Information about Schedule D (Form 1120) and its separate instructions is at www.irs.gov/form1120. OMB No. 1545-0123. 2015. Name. Employer identification |

|

U.S. Corporation Income Tax Return

If “Yes” complete Part II of Schedule G (Form 1120) (attach Schedule G) . 5. At the end of the tax year |

|

2015 Form 1120 S (Schedule D)

Use Form 8949 to list your transactions for lines 1b 2 |

|

2015 Form 1120 S (Schedule K-1)

(Form 1120S). Department of the Treasury. Internal Revenue Service. 2015 No. 11520D. Schedule K-1 (Form 1120S) 2015 ... Schedule E line 28 |

|

2015 Schedule UTP (Form 1120)

Part I. Uncertain Tax Positions for the Current Tax Year. See instructions for how to complete columns (a) through (g). Enter in Part III |

|

2021 Instructions for Form 1120-REIT

7 févr. 2022 Use Form 1120-REIT U.S. Income Tax ... (according to section 856(g)(2)) revokes ... 6 |

|

Form 1120 - Internal Revenue Service

f1120--2015PDF |

|

Document_4pdf - SECgov

edgar › dataPDF |

|

January21201515pdfpdf - CTgov

NotificationsPDF |

|

Form 1120 - The CSUDH

rnal Revenue Service Information about Form 1120 and its separate Capital gain net income (attach Schedule D (Form 1120)) 2015 overpayment credited to 2016 |

|

Instructions for C and S Corporation Income Tax Returns

Taxpayers filing a federal 1120-F, 1120-H, 1120-POL, The references to form numbers and line descriptions on federal Corporate After allocation and apportionment, complete Schedule G to |

|

Form 1120 Instructions

e Form 1120, Schedule K, Question 25 Credit for paid Public Debt, Department G, P O Box 2188, Parkersburg, WV December 31, 2015, domestic corporations that are |

|

BENTON HARBOR CORPORATION INCOME TAX FORM AND

federal Form 1120S and Schedule K SCHEDULE S1 – S Revised 07/24/2015 Schedule G, line 1, 2019 Form CF-1120 Explanation for Sch G EXPLANATION FOR |