form 16 pdf

|

FORM NO 16

Mar 31 2022 · FORM NO 16 [See rule 31(1)(a)] Certificate under Section 203 of the Income-tax Act 1961 for tax deducted at source on salary paid to an employee under section 192 or pension/interest income of specified senior citizen under section 194P Name and address of the Employer/Specified Bank DELOITTE SUPPORT SERVICES INDIA PRIVATE LIMITED |

What is the process for downloading Form 16 PDF?

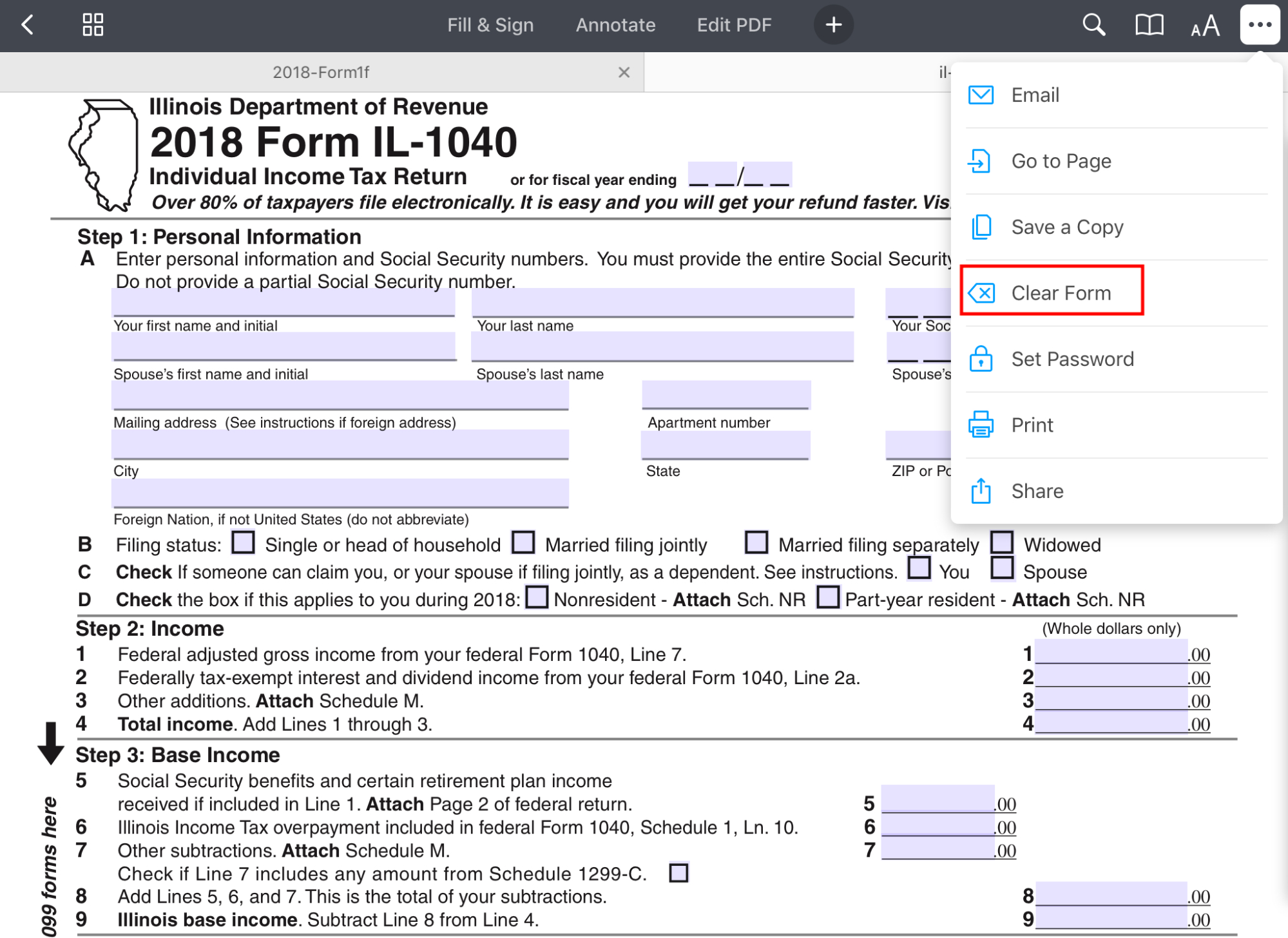

You will find the ‘PDF’ option and ‘Fillable Form’ options available under ‘Form 16’. You have to select the relevant option at your convenience. You will be able to download the form on the next page. You can download the Form16 from UBS HR Toolkit.

What is the purpose of Form 16 PDF?

Form 16 works as proof that the company has deducted tax from your salary and deposited it with the government. Form 16 is an important document that helps in the income tax returns filing process. Form 16 is usually requested by banks and financial institutions when you approach them for loans.

How do I fill out Form 16 pdf?

You will find the ‘Income Tax Forms’ option, under the ‘Forms/Download’ section, just click on it. You will find the ‘PDF’ option and ‘Fillable Form’ options available under ‘Form 16’. You have to select the relevant option at your convenience.

Where can I find Form 16 pdf for free?

Visit the official Income Tax Department website: https://www.incometaxindia.gov.in/Pages/default.aspx. You will find the ‘Income Tax Forms’ option, under the ‘Forms/Download’ section, just click on it. You will find the ‘PDF’ option and ‘Fillable Form’ options available under ‘Form 16’.

What Is Form 16?

Form 16 is an annual tax document issued to salaried individuals by employers. This document contains details of income earned by an employee, the tax-saving investments and deductions that were availed as well as any tax deducted at source (TDS) for the applicable Financial Year. These are the key details that the employee needs to file their inco

When Will Form 16 Be Available For 2022-23

As per the income tax rules, the deadline to issue Form 16 is 15 June every year. If you are a salaried individual and your employer has deducted TDS from your salaryin the financial year 2022-2023, then the due date for issuing Form 16 was 15 June 2023. Form 16 is an annual tax document that contains the details of the TDS deducted from the salary

Parts of Form 16

Since Form 16 is an income tax document, it has a format. The Income Tax Department of India has a pre-decided Form 16 format. Form no. 16 has two parts – Part A and Part B. Form 16 Part A contains details about the TDS deducted directly from your salary and paid to the government. Part A typically includes details like: 1. The employee, i.e. your

Tax Return Filing Through Form 16

When considering how to get Form 16, the thing to know is that it has to be provided by your employer. You cannot download Form 16 from anywhere. If you have moved on from a previous role, you can get in touch with the HR or finance department of your previous organization and request them to provide you with income tax Form 16. The information pro

Details Required from Form 16 While Filing Your Income Tax Return

Form 16 has two parts. Part A contains the amount of tax your employer has deducted from your salary every month and paid to the government. Part B shows how the employer calculated your tax based on the deduction and exemption you have claimed. Hence, Form 16 can be extremely helpful while filing income tax returns. Here are key details available

How to Download Form 16

As already mentioned before online Form 16 download is impossible for an employee. ITR Form 16 has to be issued by an employer. Employers can generate and download Form 16 from the TRACES portal. Here are steps that employers can follow for Form 16 download: 1. Go to tdscpc.gov.in/app/login.xhtml 2. Log in using employer login ID and password 3. Go

Types of Form 16

Remember how we mentioned earlier that you shouldn’t confuse Form 16 Part A and Part B with Form 16A and Form 16B? This is because there is a difference between these. 1. Form 16A:Form 16A is an income tax document that provides TDS details for income other than on salary. For instance, TDS on freelance income, TDS deducted for interest income on F

Eligibility For Form 16

According to the rules of the Income Tax Act, 1961, all salaried individuals who fall in the taxable bracket have to be issued Form 16 by their employers. This means that any individual who is employed by another person and earns more than Rs. 2,50,000 per year has to be given Form 16. You can request this from your current and previous employers w

Importance of Form 16

Form 16 is a key document for salaried individuals filing taxes. 1. Form 16 provides a detailed account of your salary and the tax paid. It is proof that tax has been paid to the government on your behalf. When filing taxes, you need this to provide an accurate account of your income. 2. Apart from filing taxes, Form 16 can also be used as proof of

Important Points to Cross-Check from Form 16 For Filing Taxes

Once you get the income tax Form 16 from your employer, it is essential that you check whether all the details are correct. Here are the most important components of Form 16 to verify: 1. Ensure your PAN details and personal information is correct. 2. Verify the PAN, TAN, and details of your employer. 3. Compare the TDS mentioned with the TDS deduc

|

1[FORM NO. 16 [See rule 31(1)(a)] PART A Certificate under section

2 sept. 2021 1[FORM NO. 16. [See rule 31(1)(a)]. PART A. Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source on salary ... |

|

FORM NO. 16A [See rule 31(1)(b)] Certificate under section 203 of

FORM NO. 16A. [See rule 31(1)(b)]. Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source. Certificate No. Last updated on. |

|

FORM 16 [See Rule 34(1)] FORM OF APPLICATION FOR GRANT

FORM 16. [See Rule 34(1)]. FORM OF APPLICATION FOR GRANT OR RENEWAL OF TRADE CERTIFICATE. To. The Registering Authority ……………………………. … |

|

FORM – 16 [rule 14] FOR STUDENTS EDUCATION EDUCATION

FORM – 16. [rule 14]. FOR STUDENTS. EDUCATION. EDUCATION. Application Form for verification of Scheduled Caste/Schedule Caste convert to Buddhism/. |

|

FORM 16 [See Rule 34(1)] FORM OF APPLICATION FOR GRANT

FORM 16. [See Rule 34(1)]. FORM OF APPLICATION FOR GRANT OR RENEWAL OF TRADE CERTIFICATE. To. The Registering Authority ……………………………. … |

|

FORM NO. 16

FORM NO. 16. [See rule 31(1)(a)]. Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source from income chargeable under the head |

|

Form 16 Inspection certificate

Building Regulation 2021 • Section 53 • Form 16 • Version 1 • September 2021 This form is to be used for the purposes of section 10 of the Building Act ... |

|

Form VA-16 - Employers Quarterly Reconciliation Return of Virginia

Detach at dotted line below. DO NOT SEND ENTIRE PAGE. Employer's Quarterly Reconciliation and. Return of Virginia Income Tax Withheld. Form VA-16. |

|

Mental Health Act Form 16 Notification to a Near Relative

FORM 16. MENTAL HEALTH ACT. [ Section 34.2 R.S.B.C. 1996 |

|

Ninth Circuit Form 16

Form 16. Circuit Rule 27-3 Certificate for Emergency Motion. Instructions for this form: http://www.ca9.uscourts.gov/forms/form16instructions.pdf. 9th Cir. |

|

Form 16 - Income Tax Department

FORM NO 16 [See rule 31(1)(a)] PART A Certificate under section 203 of the Inc |

|

FORM NO 16A - Income Tax Department

|

|

Form 16 - Webtel

16 [See rule 31(1)(a)] PART A Certificate under section 203 of the Inc ome-tax Act, 1961 for |

|

FORM NO16 [See Rule 31(1) (a) ]

16 [See Rule 31(1) (a) ] CERTIFICATE UNDER SECTION 203 OF THE INCOME-TAX ACT, |

|

E-Tutorial Download Form 16A - SureTDS

A downloaded from TRACES are considered as valid TDS certificates, as per Download T'ACE“ PDF Generation Utility from the website and install it on your desktop |

|

Cleartax form 16 generator - Squarespace

a text file or pdf file with form-16 Part-A in 1 Part-A Details and Excel or PDF (if already |

|

FORM NO 16 [See rule 31(1)(a)] PART A Certificate under

16 [See rule 31(1)(a)] PART A Certificate under section 203 of the Income-tax Act, 1961 for |

|

E-Tutorial - Download Form 16 - TaxGuru

d request for Form 16 for a particular FY can be submitted only after ZIP File into PDF |